Chapter 13: Sales Contract - Mrs. Ingram`s Class Website

advertisement

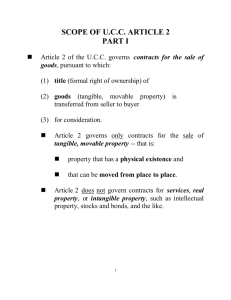

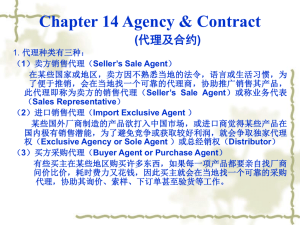

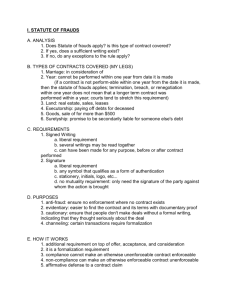

CHAPTER 13: SALES CONTRACT LAW IN SOCIETY~MRS. INGRAM~2013-2014 OBJECTIVES: • Define sale and explain how the UCC governs the sale of goods. • Explain how the UCC treats unconscionable contracts and contracts of adhesion. • Compare the status of a casual seller with a merchant. • Explain how the Statute of Frauds is applied to sales. SECTION 13-1: SALES • Key Terms: • • • • • • • • • • • • Sale pg. 229 Ownership pg. 229 Contract to Sell pg. 229 Goods pg. 229 Price pg. 229 Barter pg. 229 Vendor pg. 230 Vendee pg. 230 Payment pg. 230 Delivery pg. 230 Receipt of Goods pg. 230 Bill of Sale pg. 231 FOCUS QUESTION: • What distinguishes a sale from other contractually based transfer of goods? • The transfer of the goods from seller to buyer occurs immediately. WHAT IS A SALE? • Sale: a contract in which ownership of goods transfers immediately from the seller to the buyer for a price. • Ownership: entails a collection of rights that allow the use and enjoyment of property. • Contract to Sell: ownership is to take place in the future. WHAT IS A SALE? • Goods: tangible (touchable), moveable personal property (items other than land or buildings), such as airplanes, books, clothing, and dogs. • Price: the consideration for a sale or contract to sell goods. • Barter: exchange goods for goods. WHAT IS A SALE? • Not Included in the Definition of Goods: • Money (except rare currency or rare coins) • Intangible (not touchable) personal property, such as legal rights to performance under a contract. Such rights are transferred by assignment rather than by sale. • Patents and copyrights, which are exclusive rights granted by the federal government in the intellectual products of inventors and writers. • Real property (generally land, buildings, and legal rights therein), the transfer of which is subject to special rules. • Under the UCC a sales contract may be made in any manner sufficient to show agreement. DISCUSSION QUESTIONS • You bought blue jeans and a shirt from the store at the mall. You paid by credit card. Is this considered a sale or barter? • Sale. The purchase of goods on credit as with a credit card is not the same as the loan of money to buy the goods. The interest feature in the credit card transition is a misnomer. The percentage is just a way of computing using the sales price as a basis, the actual purchase price when the good is paid for completely. • You had your hair cut at the local hair salon. Is this a sale? If not, why isn’t it considered a sale? • No. The contract was for personal services CONTRACTS THAT ARE NOT SALES • What’s Your Verdict? pg. 229 • Note- if you provide a service, as a watch or automobile repair shop would do, the transfer of ownership of goods incident to the providing of the service does not make the overall transaction of sale. However, sales tax in most states will be applied to the transfer of ownership for the repair parts. CONTRACTS THAT ARE NOT SALES • Vendor: the seller • Vendee: the buyer or purchaser • Bill of Sale:-receipt that serves as written evidence of the transfer of ownership of goods. (usually required in automobile sales) • Makes resale of property easier because it provides the owner with written evidence of ownership. • If goods are lost, stolen, o destroyed, as in a fire, the document can help prove value. CONTRACTS THAT ARE NOT SALES • Use of Credit • Used to encourage business. • Buyer may get both title and possession before payment. • Acceptance of Goods • The buyer has agreed by words or by conduct, that the goods received are satisfactory. • Acceptance is shown when the goods are used, resold, or otherwise treated as if the buyer owned them. • Buyer fails to reject the goods within a reasonable time. CONTRACTS THAT ARE NOTE SALES • Other Ways to Contract • • • • Telephone Fax Mail Seller may ship the goods and notify the buyer of this action. UNCONSCIONABLE SALES CONTRACTS • Unconscionable- grossly unfair • Contracts of Adhesion- in such contracts one of the parties dictates all the important terms. The weaker party must generally accept the terms as offered or not contract at all. • A court that decides whether a clause of a contract is unconscionable may do any of the following: • Refuse to enforce the contract • Enforce the contract without the unconscionable clause • Limit the clause’s application so that the contract is no longer unfair UNCONSCIONABLE SALES CONTRACTS • What’s Your Verdict? pg. 232 • Is there evidence to believe that the actual terms of the contract were unconscionable other than the fact that it was in English? • Yes. The disparity in the cost versus the purchase price indicates such an additional basis. SECTION 13-2: SPECIAL RULES FOR SALES CONTRACTS • Key Terms: • Merchant pg. 234 • Casual Seller pg. 234 SPECIAL RULES FOR MERCHANTS • Merchant: someone who deals regularly in the type of goods being exchanged or claims special knowledge or skill in the type of sales transaction being conducted. • Holds higher standard of conduct. • May be required to have a license • Subjected to special taxation and closer regulation by the government. • Casual Seller: a person who does not deal regularly with types of goods being sold. Ex: You sold your private automobile. SPECIAL RULES FOR MERCHANTS • What’s Your Verdict? pg. 234 • How would you distinguish between a merchant and a casual seller? If Adonis claimed that he was just doing it as a pastime and proved that he was not making any money as a result of his activities, would the city still have a right to claim he owed sales tax as a merchant? • Yes. Even “hobbyists” must pay sales tax under these circumstances MERCHANT STATUS IN SALES CONTRACTS • An offeror may state the offer to buy or to sell goods must be accepted exactly as made or not at all. • Otherwise, the offeree may accept and still change some terms of the contract or add new ones. This would be a counteroffer, but the new term would now be called proposal for addition to the contract. • When both parties are merchants, a new term is inserted by the offeree automatically becomes part of the contract if the offeror fails to object within a reasonable time. The new term must not materially alter the offer. • If the new term is a material (important) alteration, it is included in the contract only if the original offeror expressly shows an intention to be bound by it. HOW DOES THE STATUTE OF FRAUDS APPLY TO SALES? • Statute of Frauds- sales contracts for goods valued at $500 or more must be evidenced by a writing to be enforceable in court. • Both parties should sign a written sales contract and each party gets a copy. Provides usual legal records, and it reinforces mutual good faith. • If either party decides to breach the contract, the injured party can sue. The written contract goes a long way towards proving the existence and terms of the agreement. • All that is required is a writing, signed by the party being sued, which satisfies the court that a contract to sell, or a sale, has been made. HOW DOES THE STATUTE OF FRAUDS APPLY TO SALES? • The number or quantity of goods involved in the transaction must be contained in the writing. The contract is not enforceable beyond the stated quantity. • Credit, Warranty Terms, Price are not necessary in the writing, but can be provided in oral testimony in court. EXCEPTIONS TO THE STATUTE OF FRAUDS FOR SALES CONTRACTS • Oral contracts for the sale of goods valued at $500 or more may be valid and enforceable. These exceptions to the requirements include the following: • GOODS RECEIVED AND ACCEPTED BY THE BUYER • Both receipt and acceptance are necessary • Under the UCC a buyer can accept goods in three ways: • After a reasonable opportunity to inspect the goods, the buyer signifies to the seller that the goods conform to the contract or will be retained in spite of their nonconformity. • The buyer acts inconsistently with the seller’s ownership (uses, consumes, or resells the goods) • The buyer fails to make an effective rejection after having a reasonable opportunity to inspect the goods. EXCEPTIONS TO THE STATUTE OF FRAUDS FOR SALES CONTRACTS • BUYER PAYS FOR GOODS AND SELLER ACCEPTS PAYMENT • When payment in full has been accepted by the seller, the oral contract is enforceable in full. • GOODS SPECIALLY MADE NOT SUITABLE FOR SALE TO OTHERS • A seller can enforce an oral contract for non-resalable goods if • The seller has substantially begun to manufacture them or • The seller has made contracts to obtain the goods from third parties. EXCEPTIONS TO THE STATUTE OF FRAUDS FOR SALES CONTRACTS • PARTY AGAINST WHOM ENFORCEMENT SOUGHT ADMITS ORAL CONTRACT MADE • A party against whom enforcement of an oral contract is sought may admit in legal pleadings or testimony that he or she agreed to part or all of a contract. • Writing is not necessary. EXCEPTIONS TO THE STATUTE OF FRAUDS FOR SALES CONTRACTS • What’s Your Verdict? pg. 235 • Is Chilton liable to Open Shutter for breach of contract? Why or why not? • Not unless she admits to the terms of the contract during legal proceedings or under oath in court. • If Open Shutter broke the contract, would they be liable? Why or why not? • Yes, based upon the contract signed by them • Would the result be the same if the contract is between two merchants? What is the difference if the contract is between two merchants? • The signature of the party suing may suffice to prove a contract was made; also, a written confirmation of an oral contract within a reasonable time binds both parties. • What is the exception? (If the second merchant sends a written objection within ten days, the confirmation is not binding