PURE COMPETITION

advertisement

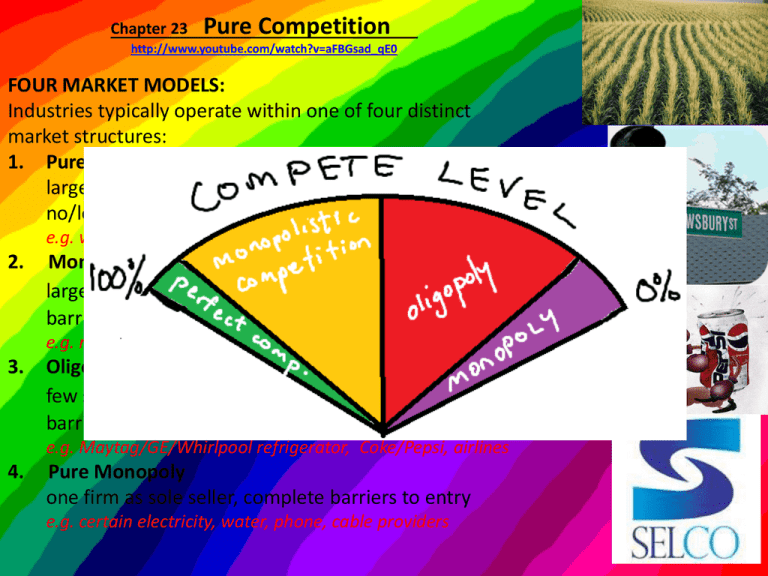

Chapter 23 Pure Competition http://www.youtube.com/watch?v=aFBGsad_qE0 FOUR MARKET MODELS: Industries typically operate within one of four distinct market structures: 1. Pure Competition large number of sellers, standardized product, no/low barriers to entry e.g. wheat, corn, gold, foreign currency, NYSE 2. Monopolistic Competition larger # of sellers, differentiated product, low entry barriers, non-price competition e.g. restaurants, casual clothing, some retail stores 3. Oligopoly few sellers of similar products, significant entry barriers, price competition e.g. Maytag/GE/Whirlpool refrigerator, Coke/Pepsi, airlines 4. Pure Monopoly one firm as sole seller, complete barriers to entry e.g. certain electricity, water, phone, cable providers the Four Market Models A firms control over Price? • • • • Pure Competition (e.g. wheat) – none; market sets the price; “price takers” Monopolistic Competition (e.g. restauraunts) – some but within limits … market forces apply Oligopoly (automobiles or airlines) – significant but limited by mutual interdependence Pure Monopoly (a town’s cable TV or electricity provider) – considerable (… but must consider demand & elasticity of demand) the Four Market Models An industry’s non-price competition? (e.g. advertising, product differentiation) • • • Pure Competition (e.g. corn for ethanol production) – none Monopolistic Competition (e.g. fiction books) – considerable; emphasis on “branding”, trademarks, advertising Oligopoly (automobiles or airlines) – considerable; to differentiate relatively standard product (FF miles) • Pure Monopoly (a town’s electricity provider) – an attempt to increase demand (consumer tastes/preferences) – enough to create/maintain barriers to entry p460 #1. Briefly indicate the basic characteristics of pure competition, pure monopoly, monopolistic competition, and oligopoly. Under which of these market classifications does each of the following most accurately fit? In each case justify your classification. (a) a supermarket in your home town; Oligopoly - few in number, relatively standard products, price is interdependent w/ competition (b) the steel industry; Oligopoly - few in number, relatively standard products, significant obstacles to entry (c) a Kansas wheat farm; Pure Competition - Large number of firms, standardized product, no control over price (d) the commercial bank in which you or your family has an account; Monopolistic Competition (or maybe Oligopoly) - Monopolistic: Relatively large #, some control over price (fees, interest, etc.), branding - Oligopoly: Products fairly standardized, price interdependent, branding/advertising (e) the automobile industry. Oligopoly - few in number, relatively standard products, attempts to differentiate, high entry barriers Introduction to Pure Competition • • • • Very large numbers Standardized Product “Price Takers” -- the competitive firm cannot set market price, but will adjust to it Free entry and exit (i.e. low barriers to entry) Relevance of Pure Competition • a benchmark for evaluating the efficiency of the real-world economy • pure competition would result in long-run productive efficiency, where price equals minimum LRATC • pure competition would result in long-run allocative efficiency, where price equals MC PURE COMPETITION Questions to answer when analyzing pure competition: 1. What is demand from the seller’s viewpoint? 2. How does a competitive firm respond to market price (in the short run)? 3. In the long run, what adjustments are made in a competitive industry? Why? 4. How efficient are perfectly competitive industries? Why/how? 1. Demand in aofcompetitive industry downward sloping. (Law When of demand.) 3. Entry/exit firms. When profitsisexist, new firms will enter. losses occur, The demand curve for an individual firm is perfectly elastic. (Price-taker.) some firms will exit. 2. ItPerfectly “accepts”competitive the price (but will change quantity response to aand change in price). 4. markets are the mostsupplied efficientin(productive allocative efficiency) and preferred whenever possible by economists. p460 #3. Use the following demand schedule to determine total and marginal revenues for each possible level of sales: a. What can you conclude about the structure of the industry in which this firm is operating? Explain. Purely competitive market; the firm is a price-taker; as the “quantity demanded” of the supplier increases, there is no change in price paid by the buyer. Product Quantity Total Price ($) Demanded Revenue ($) 2 2 2 2 2 2 0 1 2 3 4 5 Marginal Revenue ($) $ 0 2 4 6 8 10 -2 2 2 2 2 b. Graph the demand, total revenue, and marginal revenue curves for this firm. c. Why do the demand and marginal revenue curves coincide? Demand is perfectly elastic; MR is constant and equals Price. MR = P d. “Marginal revenue is the change in total revenue.” Explain verbally and graphically, using the data in the table. Given a price & the short-run cost structure: a. will this firm produce in the short run? b. Why, or why not? c. If it does produce, what will be the output? d. What will be the economic profit or loss? To solve: • Is price greater than at least one level of AVC? • If no, shut down. (zero production; loss = TFC) • If yes, apply MR “=“ MC rule to find output. • Find the difference between price and ATC to determine per unit profit or loss. • Multiply per unit profit or loss by output to determine total profit/loss. Potential prices: 1. 2. 3. 4. product price of $38 product price of $45 product price of $50 product price of $68 TP 0 1 2 3 4 5 6 7 8 9 10 AFC x 50.00 25.00 16.67 12.50 10.00 8.33 7.14 6.25 5.56 5.00 AVC x 48.00 46.00 42.67 40.50 40.40 41.67 44.29 46.88 50.00 54.00 ATC x 98.00 71.00 59.33 53.00 50.40 50.00 51.43 53.13 55.56 59.00 MC x 48 44 36 34 40 48 60 65 75 90 Short Run Profit Maximization 1. Total Revenue minus Total Cost Approach 2. MR = MC. Marginal Revenue equals Marginal Cost Approach • Law of DR explains first decreasing then increasing marginal costs • In lower stages of output, MR > MC; in higher stages of output, MC > MR • To maximize profit, a firm will produce output at the point where MR = MC (this allows a firm to earn the cumulative profit of all output where MR > MC) The MR = MC rule: • only applies when producing is preferred to shutting down (a firm will shut down when its loss at all levels of output exceeds fixed costs) • applies to pure competition (and oligopoly, monopoly, & monopolistic comp.) Four scenarios after applying MR = MC: 1. Shut Down (P < AVC) 2. Minimize Losses (AVC < P < ATC) 3. Break Even (P = ATC) 4. Maximize Profits (P > ATC) iii. If it does produce, what will be the profit maximizing or loss minimizing output? iv. Explain. v. What economic profit or loss will the firm realize per unit of output. p460 #4. i. will this firm produce in the short run? ii. Why, or why not? a. product price of $56 P > AVC (not shutdown) at $56, MR “=” MC at 8 units MR > ATC (earning profit) Profit per unit is ≈ $7.87 ($56.00 – $48.13) (x 8 ≈ $63 total profit) b. product price of $41 P > AVC (not shutdown) at $41, MR “=” MC at 2 and 6 units AC @ 2 units > AC @ 6 units MR < ATC (loss minimization) Loss per unit is ≈ $6.50 ($41.00 – $47.50) (x 6 ≈ $39 total loss… < $60 fixed costs) c. product price of $32 P < AVC at all levels of output (shutdown!!!) Loss equal to total fixed costs: loss of $60 incurred P460 #4 d – g. Part d. Part f. g. is $46; e. The The equilibrium firm will notprice produce if P < AVC. equilibrium output = 10,500. When P > AVC, the firm will produce in the short run at the quantity where P = MC. Each firmcurve will produce units. The MC – above 7the AVC curve – shows the quantity of output the firm will supply at Loss per unit = $1.14, or $8 per firm. each price level. (That schedule is the short run supply curve.) The industry will contract in the long run. LONG RUN PROFIT MAXIMIZATION Assumptions (remember: Perfect Competition): • The only long run change is the entry and exit of firms • The “representative” firm; identical costs for all firms Entry Eliminates Profits • When short run economic profits are earned, new firms enter (long run) increase in supply Exit Eliminates Losses • When short run economic losses exist, firms exit the market (long run) decrease in supply Long run equilibrium established by entry/exit of firms. PURE COMPETITION AND EFFICIENCY Productive Efficiency: P = Minimum ATC -- market forces this behavior in the long run -- entry eliminates profit; loss eliminates firms (i.e. causes exit) Productive Efficiency is reached when price is equal to minimum average total costs. Allocative Efficiency : P = MC P = MB…why? when P > MC, resources have been underallocated and more resources should be used to produce that good when P < MC, resources have been overallocated and fewer resources should be used to produce that good Allocative Efficiency is reached when price is equal to marginal cost.