Example 1

advertisement

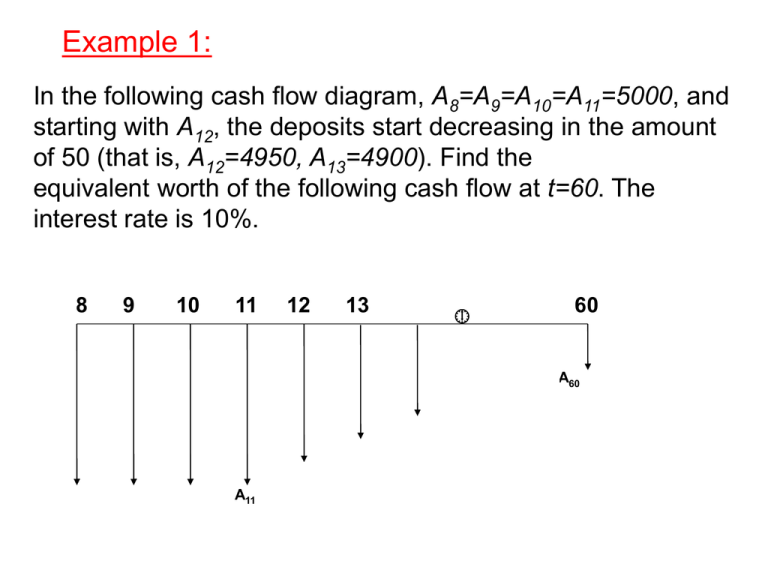

Example 1: In the following cash flow diagram, A8=A9=A10=A11=5000, and starting with A12, the deposits start decreasing in the amount of 50 (that is, A12=4950, A13=4900). Find the equivalent worth of the following cash flow at t=60. The interest rate is 10%. 8 9 10 11 12 13 60 A60 A11 Example 1: F60 5000( F | A,10%, 53) 50( P | G,10%, 50) ( F | P,10%, 50) 7205406.83 Example 2: Set up an equation to find the value of Z on the left-hand cash-flow diagram that establishes equivalence with the right-hand cash-flow diagram. Both diagrams are drawn on a yearly scale. The interest rate is 12% compounded quarterly. Note that you are only asked to set up an equation, not to find the actual value of Z. 1000 0 1 Z Z 2 Z 3 Z 4 Z 5 6 years 0 1 2 3 4 5 6 5000 Example 2: 4 0.12 Effectiveannualrate 1 1 12.55% 4 Z Z ( P | A,12.55%, 4) 5000( P | F ,12.55%, 6) 1000( P | F ,12.55%, 2) Example 3: Find the equivalent worth of the following cash-flow at t=0 assuming an inflation rate of 2% per month. a)if the market interest rate is 12% compounding monthly b)if the market interest rate is 12% compounding continuously Note the timings of cash flows and that the cash flows are shown on a monthly scale. Also all amounts are in actual dollars. 0 1 2 9 10 13 16 37 40 45 50 75 A1=1000 A2=2000 A3=3000 80 months Example 3: (1 0.01) 3 1 3.03% (a) Effective rate for three months: (1 0.01) 5 1 5.10% Effective rate for five months: P 1000( P | A,1%,10) 2000( P | A, 3.03%,10) ( P | F ,1%,10) 3000( P | A, 5.10%, 8) ( P | F ,1%, 40) (b) Effective rate for one month: e Effective rate for three months: 0.12 12 1 1.01% 0.12 1 3.05% e 0.12 Effective rate for five months: e 4 12 5 1 5.13% P 1000( P | A,1.01%,10) 2000( P | A, 3.05%,10) ( P | F ,1.01%,10) 3000( P | A, 5.13%, 8) ( P | F ,1.01%, 40) Example 4: Suppose that a bank is paying 8% nominal interest, compounded semiannually. a) What is the semiannual effective rate? b) What is the effective rate per year? c) What is the effective rate per month? d) Find the equivalent nominal interest rate, compounding continuously. Example 4: 0.08 4% 2 2 0.08 1 1 8.16% 2 1 0.08 6 1 1 0.656% 2 e r 1 0.0816 r 7.84% Example 5: Suppose that some years ago your grandfather has created an account which will provide you with a certain amount of cash over a 20 year period. He arranged such that you will receive your first payment one year from now in the amount of 3000. Also suppose that you will receive 6% net increase every year over the next 20 years. That is, your first payment will be 3000, second will be 3000(1.06), third will be 3000(1.06)2, and so on in terms of constant dollars. Suppose that over the next 20 years, the inflation rate will be 5% per year and the inflation-free interest rate will be 3% per year. a)How much will be your last payment (20th year) in terms of constant dollars? b)How much will be your last payment (20th year) in terms of actual dollars? c)Using constant dollar analysis and the geometric gradient formula, find the present worth of your total earnings over 20 years. d)Using actual dollar analysis and the geometric gradient formula, find the present worth of your total earnings over 20 years. Example 6: The following equation describes the conversion of a cash flow into an equivalent equal payment series of amount A for 8 years with an interest rate of 10% compounded annually. Draw the original cash flow diagram. A = [-1000 - 1000(P / F, 10%, 1) - 200(P / A1, 5%, 10%, 3) (P / F, 10%, 2)] (A / P, 10%, 8) + [3000+500(A / G, 10%, 4)] (P / A, 10%, 4) (P / F, 10%, 1) (A / P, 10%, 8) +750(F / A, 10%, 2) (A / F, 10%, 8) Example 6: The following equation describes the conversion of a cash flow into an equivalent equal payment series of amount A for 8 years with an interest rate of 10% compounded annually. Draw the original cash flow diagram. A = [-1000 - 1000(P / F, 10%, 1) - 200(P / A1, 5%, 10%, 3) (P / F, 10%, 2)] (A / P, 10%, 8) + [3000+500(A / G, 10%, 4)] (P / A, 10%, 4) (P / F, 10%, 1) (A / P, 10%, 8) +750(F / A, 10%, 2) (A / F, 10%, 8) 3000 3500 4000 4500 750 750 0 1 1000 1000 2 3 4 200 210 5 220.5 6 7 8 Example 7: A man borrows a loan of $50,000 from a bank. According to the agreement between the bank and the man, the man will pay nothing for two years and starting at year 3, he will pay equal amounts of A in every 3 months for the next 5 years. If the interest rate is 10% compounded monthly and the inflation rate is 8%, a) Find the payment amount A b) Find the interest payment and principal payment for the 10th payment. c) Find the total interest paid to the bank d) Suppose you want to pay off the remaining loan in lump sum right after making the 15th payment. How much would this lump be? How much would this decrease your total interest payment to the bank? e) Now, assume that, instead of paying equal amounts of A in actual dollars, you want to pay equal amounts of B in constant dollars. Find this constant dollar payment amount B. Example 7: a) i3 = (1 +0.1/12)3 – 1 A = 50000 (F | P, i3, 8) * (A | P, i3, 20) b) P9 = A(P | A, i3, 11) Interest = P9* i3 Principal Payment = A – Interest c) 20A-50000 d) P = A(P | A, i3, 5) Decrease in total interest: 5A - P e) f3 = (1 +0.08)˄1/4 - 1 i3’ = (i3 - f3) / (1 + f3) B = 50000 (F | P, i3’, 8) * (A | P, i3’, 20) Example 8: Assume that you have the following two options for a new machine. Assuming that the salvage value of each option is constant at any time after the machine is bought and MARR is 10%, answer the following using PW, AE and IRR analysis. a) b) c) d) OPTION 1 OPTION 2 Initial Cost $20,000 $40,000 Annual Savings 12,000 25,000 Salvage Value 10,000 20,000 Life 3 yrs. 2 yrs. Assuming that you will only operate the facility for 2 years, which option will you choose? Assuming that you will close the facility after 5 years, which option will you choose? Which option will you choose if you plan to operate your facility for an indefinite period and each option will be available forever. Assume that you are planning to operate your facility for an indefinite period and option 1 is available forever. However, option 2 is available only now and if you choose option 2 now, you will have to replace it by option 1 at the end of its service life. Which option will you choose now? Example 9: Referring to the accompanying cash-flow diagram, answer the following questions: 2000 1000 0 1 2 3 4 5 6 1000 3000 a)If i = 0, what is the PW? b)What is the PW if i ∞? c)If MARR is 10%, what is the discounted payback period?