Document

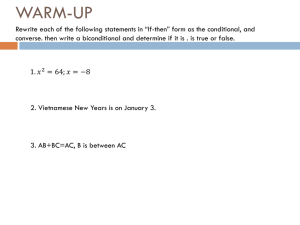

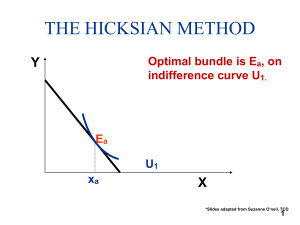

advertisement

Income and Substitution Effects The Law of Demand: Slope of budget line from px/py to steeper px’/py y x p x px/py U1 U2 px’/py px/py xb xa Qd falls from xa to xb x x*=x(px,py,M) xb xa Qd falls from xa to xb x x p x Decompose into Income and Substitution effects. • Substitution Effect: Change in Qd caused by change in px/py , but holding utility constant. • Income Effect: Change in Qd caused by change in purchasing power resulting from price change, but holding px/py. Substitution Effect y px/py U1 px’/py px/py xb xc xa x x*=x(px,py,M) xb xc xa Substitution effect: How Qd changes as a result of the price change, even when utility can be held constant (Qd from xa to xc) x Substitution Effect • Utility maximization requires a tangency (MRS = px/py) be maintained. • Because of diminishing MRS, an increase in px/py means the tangency will be where x* is lower and a decrease in px/py means the tangency will be where x* is higher. • Substitution effect is consistent with the law of demand. Income Effect y px/py U1 px’/py px/py xb xc x x*=x(px,py,M) xb xc xa Income effect: How Qd changes as a result ONLY of the change in purchasing power resulting from a price change -- holding the price ratio at the new level, px’/py – (Qd from xc to xb) x Income Effect • By isolating the change in purchasing power (but leaving the price ratio unchanged), the income effect looks exactly like the change resulting from a change in income. • Normal goods, increase in price means decrease in purchasing power, so income effect is negative – reinforces the law of demand. • Inferior goods, increase in price means decrease in purchasing power, so income effect is positive – runs counter to the law of demand. Substitution and Income Effects (Inferior Good) y px/py U1 px’/py px/py xc xb xa x x*=x(px,py,M) xc xb xa Income effect: After a substitution effect from xa to xc the individual feels poorer and because it is an inferior good, the income effect is positive (Qd from xc to xb) Overall the change in consumption conforms to the law of demand unless the good is inferior and the income effect so large that it overwhelms the substitution effect. Goods for which this occurs are called Giffen goods. x Giffen Good • Case where x 0 p x • Why so rare? • To be Giffen – Inferior – Large income effect (to overwhelm the substitution effect) – meaning expenditure must be a substantial portion of income • Goods that we spend a lot on tend to be normal. Ordinary or Compensated Steeper? px/py increases to px’/py px/py Normal Good Compensated steeper px/py Inferior Good Ordinary Steeper x*=x(px,py,M) xc*=xc(px,py,Ū) px’/py px’/py x*=x(px,py,M) px/py xb xc xa px/py x xc*=xc(px,py, Ū) xc xb xa SE SE IE IE x Typical Inferior vs Giffen px/py increases to px’/py px/py Inferior Good Ordinary Steeper Giffen Good Positive slope px/py x*=x(px,py,M) x*=x(px,py,M) px’/py px’/py px/py xc*=xc(px,py, Ū) px/py xc xb xa x xc*=xc(px,py, Ū) xa xb xc SE SE IE IE x Elasticity – Substitution Effect • Demand will be more inelastic if the elasticity of substitution, σ, is smaller – smaller substitution effect. y Ub Ua x Elasticity – Income Effect • But holding σ constant, a normal good will have the more elastic demand as the income effect reinforces the substitution effect. For an inferior good, the income effect works against the substitution effect. • Goods that are small portions of budget will tend to have very small income effects. Slutsky Equation • What happens to purchases of good x change when px changes? x p x • Ideally we want to decompose the change into x into the two components: – Substitution effect: the curvature of the utility function -- substitutability between goods – Income effect: the magnitude and direction of the effect of a change in purchasing power. Slutsky Equation • The equation that decomposes the substitution and income effects: x x p x p x x x M UU Slutsky Derivation (Modern) • At the optimal bundle we are at the intersection of the Marshallian and Hicksian demand curves: x c (p x , p y , U) x * x(p x , p y , M) Where income = M is the minimum income required to acheive utility = U. So if: M E* E* p x , p y , U ,we can define M M* p x , p y , U Then: x* x p x , p y , M* p x , p y , U And we can set up the following identity: x c (p x , p y , U) x p x , p y , M * p x , p y , U Start with that identity x (p , p , U) x p , p , M p , p , U c * x y x y x y And we can differentiate each side w.r.t. p x : x c (p x , p y , U) p x And since x(p x , p y , M) p x M* p x , p y , U E* p x , p y , U x (p x , p y , U) c p x M x(p x , p y , M) p x * x(p x , p y , M) M p x , p y , U p x * E px , py , U x(p x , p y , M) M p x By Shepard's Lemma, x c (p x , p y , U) p x x(p x , p y , M) p x x(p x , p y , M ) M x c (p x , p y , U) At the Optimal Bundle • Rearrange to get: x(p x , p y , M) p x x c (p x , p y , U) p x x (p x , p y , U) c x(p x , p y , M) M And since we are at an optimum where M and U such that: x c (p x , p y , U) x(p x , p y , M) Yielding: x(p x , p y , M) p x x c (p x , p y , U) p x x(p x , p y , M) x(p x , p y , M) M One last troubling variable • We have: x p x , p y , M p x x (p , p , U) x c x y p x p , p , M x y • But we need x(p x , p y , M) p x instead of UU x c (p x , p y , U) p x x p x , p y , M M At the Optimal Bundle Substitute: U V p x , p y , M into * x c p x , p y , U p x So: x p x , p y , M p x x c p x , p y , U p x x c p x , p y , V* p x , p y , M p x x c p x , p y , U p x x p , p , M x y p x x p , p , M x UU x p x , p y , M I y Becomes by substituting the indirect utility function in for U : x p x , p y , M p x x p , p , M x p x y x px , py , M UU x p x , p y , M M Slutsky Equation Substitution Effect x p x , p y , M p x x p x , p y , M p x x px , py , M x p x , p y , M M UU Always negative because of convexity of preferences. Income Effect x p x , p y , M p x x p x , p y , M p x x(p x , p y , M ) UU x Positive if good is inferior 0 M x Negative if good is normal 0 M x p x , p y , M M Own-Price Slutsky • Decomposition: partial derivative of the ordinary demand for x w.r.t. px x(p x , p y , M) p x x(p x , p y , M) p x x Take , then substitute in p x x p x UU Ordinary demand for x c U V(p x , p y , M) to get x(p x , p y , M) UU x(p x , p y , M) M partial derivative of the ordinary demand for x w.r.t. M A Slutsky Decomposition Example • We can demonstrate the decomposition of a price effect using the Cobb-Douglas example studied earlier U xy .5 • The Marshallian demand function for good x was 2M x px , py , M 3p x • With a total effect of a change in px x p x , p y , M 2M p x 3p 2x Substitution Effect Hicksian demand: x px , py , U c U 2/3 2p 1/3 y , and 1/3 x p x p x , p y , U c p x U Indirect utility: U V px , py , M 2M 3 2 3p x 3p y 1 2 Substitution effect: x p x , p y , M p x UU 3 2 2M 1 2 3p 3p x y 4 3 3p x 2/3 2p 1/3 y 2M 9p 2x 2/3 2p 1/3 y 3p 4/3 x Income Effect x p x , p y , M 2M 2 x(p x , p y , M) and 3p x M 3p x The product is x px , py , M x p x , p y , M M 2M 2 4M 2 3p x 3p x 9p x Slutsky Equation x p x , p y , M p x 2M 3p 2x p x Effect 2M 9p 2x Effect 2M 9p 2x x px , py , M UU Substitution Total 6M 9p 2x x p x , p y , M 4M 9p 2x Income Effect 4M 9p 2x x p x , p y , M M If you only have Marshallian demand equations… • You can get the total and income effects from them, and then add them to get the substitution effect. x p x , p y , M p x 6M 9p 2x Total Effect + + x px , py , M 4M 9p 2x Income Effect x p x , p y , M I 2M 9p 2x = Substitution Effect x p x , p y , M p x UU Cobb-Douglas Slutsky IE x x 4M 2 M 9p x TE= SE x 2M p x 3p 2x x p UU 2M 9p2x Cross Price Effects, x p y • Out analysis of cross-price effects in a twogood world is limited as spending more on x, necessarily means spending less on y and viceversa. • Yet, we can use the two good world to define terms and gain an intuitive understanding. Net Substitutes • Net effect, limit analysis to the substitution effect: – py rises, (px/py falls), Qd of x rises y SE x p y 0 UU y1 y2 U1 SE x1 x2 x Net Compliments • Net effect, limit analysis to the substitution effect: – py rises, (px/py falls), Qd of x falls y ! x p y 0 UU Cannot be represented in a two good world!!! With only two goods, they must be net substitutes. In a multi-good world, it is possible for x to be a net substitute for y, but a net compliment of z. y1 U1 x1 x Substitutability with Many Goods • Demand for Bacon, Eggs, Cereal, etc. p bacon rises bacon 0 p bacon eggs 0, net compliments p bacon cereal 0, net substitutes p bacon Gross Compliments • Gross effect, both income and substitution effect: – py rises, x* falls, both goods normal. – When the price of y rises, the substitution effect is to consume less y and more x – Because of the larger income effect, individuals buy less of both x and y. y SE IE x 0 p y y1 yc y2 U1 SE I E x2 x1 xc U2 x Gross Substitutes • Gross effect, both income and substitution effect: – py rises, Qd of x falls, y normal, x inferior. – When the price of y rises, the substitution effect is to consume less y and more x. – Because x is inferior, the income effect reinforces the substitution. y x 0 p y SE y1 yc IE U1 y2 SE U2 IE x1 xc x2 x Gross Effects • Is the status (normal vs. inferior) the determining feature? • No. You can have gross substitutes even if x is inferior, so long as the income effect is small. Gross Substitutes • Gross effect, both income and substitution effect: – py rises, Qd of x rises, both x and y normal. – When the price of y rises, the substitution effect is to consume less y and more x. – While x is normal, the magnitude of the income effect is smaller than the substitution effect. y x 0 p y SE y1 yc IE U1 y2 SE U2 IE x1x2 xc x Asymmetry of the Gross Definitions • The gross definitions of substitutes and complements are not symmetric – it is possible for x to be a gross substitute for y (when the price of y changes) and at the same time for y to be a gross complement of x (when the price of x changes). Asymmetry of the Gross Definitions • Suppose that the utility function for two goods is given by U(x,y) = ln x + y • Setting up the Lagrangian L = ln x + y + (M – pxx – pyy) Asymmetry of the Gross Definitions • We get the following FOCs: Lx = 1/x - px = 0 Ly = 1 - py = 0 Lλ = M - pxx - pyy = 0 • Manipulating the first two equations, we get pxx = py Asymmetry of the Gross Definitions •Inserting this into the budget constraint, we can find the Marshallian demand for x and y x py px ; y M py py •The cross price effects are not symmetric x 1 ; p y px y 0 px Cross-Price Slutsky • We’ll skip the derivation, but here it is: x x p y p y UU substitution effect (+) x y M income effect (-) if x is normal combined effect (ambiguous) Cross-Price Slutsky • Cross Slutsky decomposition: partial derivative of the ordinary demand for x w.r.t. py x x p y p y UU x , then substitute in p y U V p x , p y , M to get x p y partial derivative of the ordinary demand for x w.r.t. M Ordinary demand for y c Take x y M UU A Slutsky Decomposition Example • We can demonstrate the decomposition of a price effect using the Cobb-Douglas example studied earlier 0.5 U xy • The Marshallian demand function for good x was 2M x(p x , p y , M) 3p x • With a total cross price effect of a change in px x(p x , p y , M) 0 p y Remember this Graph? Qd for y was unaffected by the change in px y 0 p x IE x x 4M 2 M 9p x TE= SE x 2M p x 3p 2x x p UU 2M 9p2x And the effect on x of a change in py y TE= p y SE x p IE y y M UU x 0 p y Qd for x was unaffected by the change in py Substitution Effect Hicksian demand: 1 2p y x px , py , U U , and px 2 c 3 3 x c p x , p y , U p y 1 U V px , py , M 2M 2 3 px py 3 1 2 2 Substitution effect: 3 2 1 2M 2 3 3 1 2 2 3 p p x y x p x , p y , M p y 1 UU 3 2 3p x p y 3 2 3 2 U 1 2M 9p x p y 3 2 3 2 3p x p y 3 Indirect utility: 3 3 Income Effect x p x , p y , M M 2 y px , py , M and 3p y M 3p x The product is y px , py , M x p x , p y , M M M 2 2M 3p y 3p x 9p y p x Cross-Price Slutsky Decomposition x p x , p y , M p y 0 x p x , p y , M UU p y 2M 9p x p y Total Substitution Effect Effect y px , py , M 2M 9p x p y Income Effect x p x , p y , M M Slutsky Equation Via Comparative Statics • Using Utility Maximization and Expenditure Minimization • Yes, Rockin’ it Old School Comparative Statics: Differentials of U-max FOC w.r.t. px • Remember 0 p x p y p x U xx U yx • Using cofactors 0 x p y p x U xy p p y x x x U xy p x 0 U yy y p x Substitution effect < 0 0 p y p x U xy p y 0 U yy p y U yy p y U yy x x p x H H H Income effect Assume SOC hold and H 2U x U y U xy U x 2 U yy U y 2 U xx 0 Comparative Statics: Differentials of U-max FOC w.r.t. px • Simplify Substitution effect < 0 0 x p y p x U xy 0 p y p x U xy p y 0 U yy p y U yy p y U yy x x p x H H H Assume H 0 • To get this p y 2 p x U yy p y U xy x x p x H H Income effect Building the Income Effect: Differentials of U-max FOC w.r.t. M • Remember 0 p x p y p x U xx U yx p y M 1 x U xy • 0 M U yy y 0 M • Using cofactors 0 1 p y p x 0 U xy x p y M 0 U yy H Assuming H 0 p x U xy p y U yy 1 H p x p y H p x U xx U xy p y U yx U yy 0 Look Familiar? p x U yy p y U xy H Combine • Start with x p x and add in x M p y 2 p x U yy p y U xy x x p x H H x M • Yielding p y x x x p x M H 2 Save this for later!!! Comparative Statics: Differential of E-Min FOC w.r.t px • Remember 0 U x U y p U y x 0 x c U xy 1 p x 0 U yy c y p x U x U xx U yx U x U y H min U x U xx U xy U y U yx U yy 0 • By cofactors 0 U x U y 0 1 U xy U y 0 x p x H U yy c U y 0 1 U y H min Assuming SOC hold and H min U yy min 1 U y H min 2 U y2 H 0 min 2U x U y U xy U x 2 U yy U y 2 U xx 0 Small Adjustment • Note that H 2U x U y U xy U x 2 U yy U y 2 U xx 0 H min • Now take 2U x U y U xy U x 2 U yy U y 2 U xx 0 0 U x 1 U xy x c U y 0 p x H Multiply by • Yielding U yy min U y2 H 0 min 1 , now H min H 0 1 x c U y 0 p x H 2 U y 0 Another Small Adjustment • Start with x c U y 0 p x H 2 • Recall that = Uy py , and therefore, U y py • By substitution x c* p y p x H • All green 2 x c* p y p x H 2 SLUTSKY!!! • Go back to this x p y x x p x M H 2 • Substitute x c p y p x H 2 • To get x x c x x p x p x M • As before, we need to substitute in to get x x p x p x x x M UU