PowerPoint - ABN AMRO Private Banking Jersey

advertisement

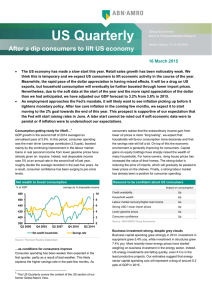

Rebuilding confidence Han de Jong Group Economics March 2012 Six months ago: pessimism • Contagion in euro crisis • Sharp drop in economic activity & business confidence Fear for another sharp downturn like ‘Lehman’ 2 Why did the global economy not ‘collapse’? • Financial system did not dry up • European leaders took positive steps 3 Business confidence: PMI and ISM index 65 60 55 50 45 40 35 30 05 06 07 08 Eurozone PMI 09 10 11 12 US ISM 4 Source: Bloomberg Business confidence: PMI Index 65 60 55 50 45 40 35 2006 2007 2008 Brazil 2009 China 2010 2011 2012 India 5 Source : Bloomberg Divergence US and eurozone Unemployment, % 12 11 10 9 8 7 6 5 4 06 07 08 09 US 10 11 12 Eurozone 6 Source: Bloomberg Money growth % yoy 14 12 10 8 6 4 2 0 -2 04 05 06 07 08 Eurozone M3 09 10 US M2 11 12 7 Source: Bloomberg Divergence Europe: car sales % yoy, February 2012 Portugal -48.8 Greece -45.2 Ireland -8.6 France -20.2 Italy -18.9 Netherlands -10.0 UK Germany -2.5 0.0 Estonia +29.7 Iceland +148.5 8 Source: Bloomberg US: self sustaining growth NFIB index NAHB index 100 40 95 30 90 20 85 10 80 0 07 08 09 10 Source: Bloomberg 11 12 Small businesses' confidence 07 08 09 10 Source: Bloomberg Car sales, millions 11 12 Home builders' confidence Consumer confidence, index 18 100 16 90 14 80 12 70 10 60 8 50 07 Source: Bloomberg 08 09 10 11 12 07 Source: Bloomberg 08 09 10 11 12 Univ.of Michigan 9 China hard landing or soft landing: Car sales millions 25 20 15 10 5 0 05 06 07 08 09 10 11 12 10 Source: Bloomberg Economic situation • US moving to self-reinforcing recovery • Europe improving gradually • Emerging economies taking advantage of industrial recovery – and room to stimulate 11 Euro crisis • LTROs have eased pressure • Greek tragedy no longer problem for financial markets – now purely political • New Compact • Likely increase bail-out funds • Calm has returned to markets 12 2yr government bond yields % 8 7 6 5 4 3 2 1 Jan-10 Jul-10 Jan-11 Italy Jul-11 Jan-12 Spain 13 Source: Bloomberg European banks tightening lending criteria until Q4 Net-tightening (%) 80 60 tightening 40 20 0 easing -20 03 04 05 06 Corporates 07 08 Consumers 09 10 11 12 Housing 14 Source: Thomson Reuters Datastream Risks to the ECB’s approach • ECB balance sheet riskier • Inflation • Phenomenal distortion in markets, will lead to misallocation • Reduced urgency other policymakers - Public finances - Structural reform 15 Structural improvements? • Deleverging continues • Eurozone public finances much improved • Structural reform 16 Spain Exports Exports to emerging Asia 120 200 110 180 100 160 90 140 80 120 70 100 08 09 10 Germany Source: Thomson Reuters Datastream 11 12 07 EUR bn, 3mma, index Jan08=100 Current account 09 UK Source: Thomson Reuters Datastream 10 Spain 11 12 GBP/EUR bn, 12mma, index Jan07=100 General government net borrowing 20 4 0 2 -20 0 -40 -2 -60 -4 -80 -6 -100 -8 -120 -10 -140 -12 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Source: Thomson Reuters Datastream 08 Spain EUR bn, 12 mm total 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Source: OECD, estimates 2011 en 2012 OECD % GDP 17 Italy Exports Imports 120 120 110 110 100 100 90 90 80 80 70 70 60 08 09 10 Germany Source: Thomson Reuters Datastream 11 12 08 09 Italy EUR bn, 3mma, index Jan08=100 Primary budget balance 10 Germany Source: Thomson Reuters Datastream 11 12 Italy EUR bn, 3mma, index Jan08=100 General government net borrowing 7 0 -1 -2 -3 -4 -5 -6 -7 -8 -9 -10 6 5 4 3 2 1 0 -1 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Source: OECD, estimates 2011 en 2012 OECD % GDP 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Source: OECD, estimates 2011 en 2012 OECD % GDP 18 Unemployment Unemployment, % Unemployment, % 25 16 14 20 12 10 15 8 10 6 4 5 2 0 0 05 06 07 Greece Source: Bloomberg 08 09 Spain 10 11 12 Portugal 05 06 07 Ireland 08 09 Italy 10 11 12 Germany Source: Bloomberg 19 Source: Bloomberg US: Debt deleveraging households % GDP 120 100 80 60 40 20 0 55 60 65 70 Households 75 80 85 Business 90 95 00 05 10 Government 20 Source: Thomson Reuters Datastream Risks • Escalation euro crisis - Austerity fatigue - Loss of patience • Oil prices • Rising interest rates • China hard landing • Too much austerity • Too little austerity 21 Price earning ratio S&P 500 35 30 25 20 15 10 5 0 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 22 Source: Bloomberg Investment portfolios – adding risk • Equities: raised to neutral • Equities: - more cyclical exposure - overweight Emerging Markets • Bond: 23 High yields, corporates, Emerging Markets 23 Equities 24 Bonds % 10 10 30 10 10 30 Government bonds Corporate bonds High yield (funds) Inflation-linked bonds Covered bonds EM bonds (funds) 25 Important information ABN AMRO Group Economics on the internet abnamro.nl/economischbureau - Dutch publications abnamro.nl/groupeconomics – English publications This material is provided to you for information purposes only. Before investing in any product of ABN AMRO Bank NV, you should inform yourself about various consequences that you may encounter under the laws of your country. ABN AMRO Bank NV. has taken all reasonable care to ensure that the information contained in this document is correct but does not accept liability for any misprints. ABN AMRO Bank NV reserves the right to make amendments to this material. This material which is subject to change without notice is provided for informational purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments. While ABN AMRO makes reasonable efforts to obtain information from sources, which it believes to be reliable, ABN AMRO makes no representation or warranty of any kind, either express or implied as to the accuracy, reliability, up-to-dateness or completeness of the information contained herein. Nothing herein constitutes an investment, legal, tax or other advice nor is it to be relied on in any investment or decision. Certain services and products are subject to legal restrictions and therefore may not be available for residents of certain countries. You should obtain relevant and specific professional advice before making any investment decision. The past performance is not necessarily a guide to the future result of an investment. The value of investments may go up or down due to various factors including but not limited to changes in rates of foreign exchange and investors may not get back the amount invested. ABN AMRO disclaims any responsibility and liability whatsoever in this respect. 26