Build-A-Bear - Mark

advertisement

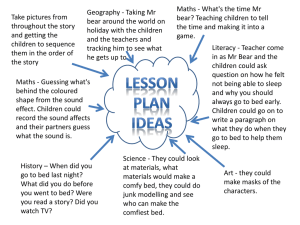

Strategic Management Amazing Robert Julian Robert Grove Mike Reid Kate Willett Strategic Management Class Project 1 Looking to purchase Build-A-Bear Profitability of new acquisition Potential for growth Return on investment 2 Mission At Build-A-Bear Workshop®, our mission is to bring the Teddy Bear to life. An American icon, the Teddy Bear brings to mind warm thoughts about our childhood, about friendship, about trust and comfort, and also about love. Build-A-Bear Workshop embodies those thoughts in how we run our business everyday. 2010 Objectives Increase Store & Online Traffic Add Revenue From Experiential Product Ranges Zhu Zhu Pets to All Company Owned Stores Increase Membership in BuildaBearville.com Improve Product Offerings Across the Board Help to Engage Guests w/ Brand Influence Additional Purchases Focus On Strategic Cost Reductions Open 1 New-Format Store Relocate 1 Store in North America & Open 2 New Locations in Europe 3 Since 1997 Over 30 Million Donated Huggable Heroes World Wildlife Fund A Champion Fur Kids 4 Founded – 1997 – Maxine Clark 1st Location – St. Louis - 1997 $400,000 in Sales in 4 Months 1999 Retail Success Attracts Venture Capitalists Began Operating its Flagship Store in London 2007 50 Million Bears Sold 400 Stores Mainly in Malls 5 in MLB Stadiums Entered Video Game Market – Nintendo DS Tie-In Stuffed Animals Happy Meals at McDonald’s 10 New Stores Open 2001 - “Retail Innovator of the Year” 2003 – International Expansion 2006 – Acquire “The Bear Factory” Shrek, The Cat in the Hat, Happy Feet, ect. 2010 Zhu Zhu Pets Electronic Hamsters Similar to Webkinz Forbes 100 Best Companies To Work For 5 Specialty Teddy Bear Business Observations Highly customizable products Highly interactive experience High end market Majority of stores in high end malls 6 Not in great shape Negative operating income in fiscal 2010 and 1st quarter 2011 Price per share declined by $24/share in past 3 years Failure to profit from Ridemakerz, LLC. Investment “Major restructuring of operations” Also closed Friends 2B Made line (dolls) However, expanding vertically Zhu Zhu pets, Bearville.com 7 1: Product innovation Larger merchandise stores and limited edition products 2: Individual product integration and marketing Each new product launch has unique marketing campaign and promotions/special offers 3: Compel customers to return to store Increase incremental purchases 4: Grow e-commerce sales Increase engagement in virtual world 5: Continue to develop new opportunities and revenue streams outside current store base 8 9 Performance Metrics Debt to Equity Ratio = 0 Return on Average Equity (4th qt. 2010) = 5.52% 0.06% in fiscal 2010 Return on Average Equity (1st qt. 2011) = 21.59% Observations Operates under no debt Allows them to stay alive in poor performance Ridemakerz, LCC. failure had huge impact 10 Consumer Services Industry Sells products directly to the consumer, as opposed to the “capital goods” industry, which manufactures goods for sale Ex. Not un-processed wheat Consumer Services Retail General Retailers Specialty Retailers 11 Applause LLC The Boyds Collection LTD. Enesco Group, Inc. Maine Bear Factory Russ Berrie & Company Ty, Inc. Vermont Teddy Bear Company 12 Product Customizable teddy bear Customizable stuffed animals Zhu Zhu Pets Services Experience based shopping Group parties Online interactive games/services 13 Build-A-Bear Board of directors Board of Directors: 14 Insiders Names Age Since Current Position Maxine Clark 62 2004 Chairman of the Board, Chief Executive Bear John Haugh 48 2010 President Bear Tina Klocke 51 2009 Chief Operations and Financial Bear, Treasurer, Secretary David Finnegan 48 Tereas Kroll 56 2010 Chief Entertainment and Digital Marketing Bear Peter Coleman 62 2009 Lead Independent Director James Gould 62 2000 Director William Reisler 54 2000 Director Mary Fiala 59 2005 Director Louis Mucci 69 2004 Director Katherine Savitt 47 2009 Director Virginia Kent 56 2010 Director Braden Leonard 40 2011 Director Chief Bearrister, General Counsel and International Franchising Outsiders 14 Strengths Account of Directors Degree of Independence Varying Backgrounds Weakness Chairman is also the CEO Age Variance 15 External Factors Weighted Weight Rating Score Comments Opportunities Children aged 8 to 11 spend 1-2 hours online daily International customized teddy bear market 0.10 3.2 0.32 0.20 4.1 0.82 Partnerships with companies such as Disney 0.25 4.5 1.125 More Bearville.com users Great opportunity for company growth Partnerships allow for the creation of trademarked products 0.35 Well positioned due to branding Threats "Make you own" teddy bear mall kiosks 0.10 3.5 Several other online virtual worlds (i.e. Webkinz.com) 0.05 2 0.1 Compete with huge toy retailers (i.e. Toys R' Us) 0.30 3.9 1.17 Total Scores 1.00 Many other online competitors Customers may elect to purchase a ready made product 3.885 16 Internal Factors Weighted Weight Rating Score Comments Strengths "Limited Edition" animals released monthly 0.20 4.5 0.9 238 U.S. trademark registrations 0.15 3.2 0.48 All store locations are leased 0.10 3.5 0.35 Extensive training for all associates 0.15 4.0 0.6 Customers have a reason to keep coming back Creates a very unique customer experience Some contain minimum annual sales termination provisions Well-tuned bear-building process and great guest experience Weaknesses All international locations are franchised 80% of inventory is purchased by 3 vendors 0.12 2.5 0.3 0.18 2.0 0.36 Expensive specialty product 0.10 3.0 0.3 Total Scores 1 Possibility of a different customer experience Vendors' prices have a large impact on annual profits Some consumers could be unable to purchase products 3.29 17 S O Strengths • • • • "Limited Edition" animals released monthly 238 U.S. trademark registrations All store locations are leased Extensive training for all associates W T Weaknesses • • • All international locations are franchised 80% of inventory is purchased by 3 vendors Expensive specialty product Opportunities Threats • • • • Children aged 8 to 11 spend 1-2 hours online daily International customized teddy bear market Partnerships with companies such as Disney • • "Make you own" teddy bear mall kiosks Several other online virtual worlds (i.e. Webkinz.com) Compete with huge toy retailers (i.e. Toys R' Us) 18 Strategic Factors S1 "Limited Edition" animals released monthly S2 Extensive training for all associates W2 80% of inventory is purchased by 3 vendors O1 Partnerships with companies such as Disney Weighted Weight Rating Score Short Intermediate Long 0.2 4.5 0.90 0.15 4.0 0.60 0.25 2.0 0.50 0.15 4.5 0.68 X X X X X T1 Compete with huge toy retailers (i.e. Toys R' Us) 0.25 Total Score 1 3.9 0.98 X X Comment Keeps customers coming back Best customer experience Possible issue with cost of materials More options for consumers Cheaper, faster alternative available 3.65 19 Economic recession Product relevance Public vs. private ownership International presence in growing economies Focus on core competencies Reduced mall traffic 20 Core Competencies Children’s Hospital Mobile party units Additional sales strategies Host parties Additional trademarked bears/animals Expand Bearville virtual world 21 Mobile Units $80,000 Initial Investment $300 Profit Margin Per Party 2 Parties per Week Pay-Off Period – 2.56 Years Annual Profitability - $31,200 per unit 5 Year ROI – 87.5% 10 Year ROI – 275% Mobile Units Add revenue Create brand awareness Expand party aspect of the company Control Average 2 parties per week Employees are educated & interactive Product quality is comparable to in-store product 22 Implementation 5,000,000 Investment Goal of 20% Conversion rate 2,000,000 Visitors per month Average ticket: $40.00 Pay-Off Period – 1 year Annual Profitability - $2,576,000 Evaluation and Control Projected 50 Million hours of brand engagement More educational games to gain Parental Approval Introduce different levels of Membership User information can be registered and tracked 23 Initial Investment $ 750,000.00 Furry Friends Sold Since Inception 90,000,000 Operating Expenses Franchise Fee $ 48,301.59 Years in Operation Average Number Sold Annually Rent (Annual) $ 24,000.00 Total Number of Stores (C.O.&F) 407 SG&A $ 402,727.27 Average Number Sold Per Store 17,010 Store Preopening Costs $ 177,000.00 Average Price Per Friend Annual Salary for Employees $ 80,000.00 Total Operating Expenses Total Investment Investment Gain Total Investment ROI 13 6,923,077 $40 Total Average Sales from Friends $ $ 732,028.86 $ 1,482,028.86 Total Investment $ 1,482,028.86 $ 5 Years 10 Years Total Average Sales from Friends Children's' '07-08 Inpatients $ 963,971.14 $ 1,482,028.86 $ 3,409,971.14 $ 1,482,028.86 Average Price Per Friend Selling Average (Assumption) $ 40 50% Average Annual Sales from Friends Years to Break Even $ 489,200 3.03 -35% 130% 680,400.68 680,400.68 24,460 24 Not to buy. Fad company Minimal firm assets Nothing to liquidate Leased locations Already peaked Minimal potential to grow 1 year negative net income 2 year negative operating income Declining stock price – 3 years 25 26