Mosaic Report - Arts Victoria

advertisement

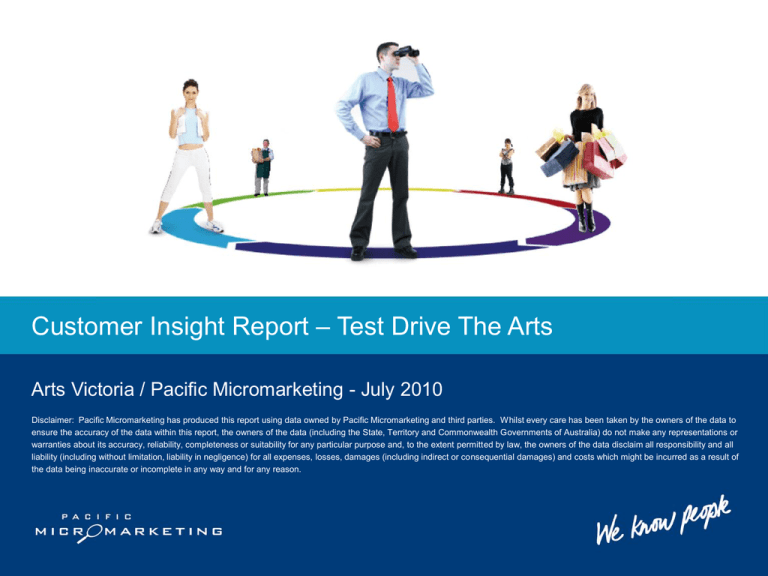

Customer Insight Report – Test Drive The Arts Arts Victoria / Pacific Micromarketing - July 2010 Disclaimer: Pacific Micromarketing has produced this report using data owned by Pacific Micromarketing and third parties. Whilst every care has been taken by the owners of the data to ensure the accuracy of the data within this report, the owners of the data (including the State, Territory and Commonwealth Governments of Australia) do not make any representations or warranties about its accuracy, reliability, completeness or suitability for any particular purpose and, to the extent permitted by law, the owners of the data disclaim all responsibility and all liability (including without limitation, liability in negligence) for all expenses, losses, damages (including indirect or consequential damages) and costs which might be incurred as a result of the data being inaccurate or incomplete in any way and for any reason. Contents • Background and Objectives • Methodology • Key Findings • Mosaic Group Profiles • Mosaic Type Profiles • Appendix – Mosaic Group Summary Descriptions • Appendix B – Explanation of Profile Importance Calculations IN STRICT COMMERCIAL CONFIDENCE Background and Objectives • Pacific Micromarketing and Arts Victoria worked together over 2010-2012 to assist the arts community in building a better understanding of their audiences using Mosaic, a geo-demographic segmentation tool, as the common currency • There is a wider need within the Victorian Arts community for audience benchmarking analysis and segmentation: • to enable arts and cultural organisations to better understand, diversify and grow audiences • to provide a more accurate total market view • to inform marketing activities • to identify opportunities for collaboration • to assist developing partner / sponsorship / philanthropic strategy IN STRICT COMMERCIAL CONFIDENCE Methodology • For this report, Pacific Micromarketing was engaged to produce an aggregated profile of audiences associated with Test Drive the Arts, a cohort of a self-identified new and returning (lapsed) arts audience who attended performances ranging from large, main-stage productions to small and experimental works through the Test Drive the Arts program. • Pacific Micromarketing’s full suite of segmentation data was appended to Test Drive the Arts audience data. Key Findings The key findings for Test Drive the Arts audience members show that: • They are likely to come from professional households living in inner city areas and outer city suburbs. They are socially aware, lead busy lifestyles, are active and culturally aware. • They are likely to come from more highly educated households where individuals keep up to date with news and current affairs from a range of mediums. • They are from mostly 1 to 2 person households – either home sharers or couples, share above average affluent lifestyles and spend some or much of their free time going out to different cultural and sporting events and socialising. IN STRICT COMMERCIAL CONFIDENCE Mosaic Group Customer Distribution • There are four main Mosaic Groups which make up in total 73.5% of the Test Drive the Arts audience. • Mosaic Group C – Young Ambition (25.5%), Mosaic Group F – Metro Multiculture (20.9%) Mosaic Group B – Academic Achievers (14.2%), Mosaic Group A – Privileged Prosperity (12.9%). IN STRICT COMMERCIAL CONFIDENCE Mosaic Group Profile Ranked by Index • Mosaic Group C – Young Ambition is the highest ranked Group. An index of 286 illustrates an over representation in Test Drive the Arts audience members at almost three times the VIC Metro average. • Mosaic Group G – Learners & Earners scores an index of 161 although only represents 7.9% of the audience • Mosaic Group B – Academic Achievers and Mosaic Group A – Privileged Prosperity are the next two highest ranking groups with an index of 138 and 121 respectively. • Although Mosaic Group F – Metro Multiculture makes up 20.9% of the Test Drive audience, due to the high number of households in the VIC Metro region it only has an index of 74. IN STRICT COMMERCIAL CONFIDENCE Mosaic Group Key Findings • There are four key Mosaic Groups that are over represented when compared to VIC Metro households. These Mosaic Groups are: • Mosaic Group C – Young Ambition (25.5% of visitors, index of 286) Educated and high-earning young singles and sharers that live in inner suburbs. • Mosaic Group G – Learners & Earners (7.9% of visitors, index of 161) Students and professionals living in high-density, lower cost suburbs. • Mosaic Group B – Academic Achievers (14.2% of visitors, index of 138) Wealthy areas of educated professional households. • Mosaic Group A – Privileged Prosperity(12.9% of visitors, index of 121) The most affluent families in the most desirable locations. • These four groups account for 60.6% of the Test Drive the Arts audience. • In VIC Metro there are 488,989 households that fall within these 4 Mosaic Groups totalling 34.8% of all households. IN STRICT COMMERCIAL CONFIDENCE Mosaic Type Customer Distribution • Mosaic Types C09 – Bright Futures (15.2%), B06 – Informed Affluence (7.7%), F20 – Intercontinental Connections (7%), C11 – Rising Wealth (6.8%) and F21 – New Wave (6.3%) represent the top five Mosaic Types of the Test Drive the Arts audience. IN STRICT COMMERCIAL CONFIDENCE Mosaic Type Profile Ranked by Index (Over 150) • There are six key Mosaic Types that are highly over-represented in the Test Drive the Arts audience. • All of the Mosaic Types which make up Mosaic Group C are within these 6. • Mosaic Type C09 – Bright Futures (Index of 312) and Mosaic Type C11 – Rising Wealth (Index of 290) are the highest of these six. IN STRICT COMMERCIAL CONFIDENCE Mosaic Types Key Findings • The six Mosaic Types that have indices more than 150 (greater than one and half times over-represented) are: • C09 – Bright Futures (15.2% of audience members, index of 312) Thriving students or professional renting flats and terraces. Very active, making the most of living in the city. • C11 – Rising Wealth (6.8% of audience members, index of 290). Educated and affluent young professional couples in inner city areas. Travel, sport and culture are keen interests. • G28 – Asian Studies (3.6% of audience members, index of 245). Campus and CBD-dwelling students, often from Asia, with low incomes. Make the most of city life despite low budgets. IN STRICT COMMERCIAL CONFIDENCE Mosaic Types Key Findings • C10 – Graduating Upwards (3.6% of audience members, index of 206) Young high-earning socialites in high-rise apartments, often close to water. Busy social lives include sport and going out with friends. • B06 – Informed Affluence (7.7% of audience members, index of 163). High income families and singles in the attractive middle suburbs. Socially aware, active lifestyles and frequent users of the internet. • A02 – Studied Wealth (4.3% of audience members, index of 154) Well educated, maturing families in prime suburbs. Often enjoy events, nights out or playing sport. • These six Mosaic Types account for 41.2% of Test Drive the Arts audience members and 18% of households in the VIC Metro region IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE IN STRICT COMMERCIAL CONFIDENCE How to Read a Mosaic Profile G ro u p A B C D E F G H I J K D e s c rip tio n 2 1 P riv ile g e d P ro s p e rity A c a d e m ic A c h ie v e rs Y o u n g A m b itio n P u s h in g th e B o u n d a rie s F a m ily C h a lle n g e M e tro M u ltic u ltu re L e a rn e rs & E a rn e rs P ro v in c ia l O p tim is m F a rm in g S to c k S u b u rb a n S u b s is te n c e C o m m u n ity D is c o n n e c t TO TALS T a rg e t % B ase % P e n e tra tio n % 3 2 4 ,0 1 6 1 ,8 0 4 1 ,3 0 7 2 ,6 3 2 3 ,9 2 7 2 ,9 9 9 698 1 ,7 7 9 1 ,1 6 4 1 ,3 2 9 1 ,4 3 6 1 7 .3 9 % 7 .8 1 % 5 .6 6 % 1 1 .4 0 % 1 7 .0 1 % 1 2 .9 9 % 3 .0 2 % 7 .7 0 % 5 .0 4 % 5 .7 6 % 6 .2 2 % 2 4 ,9 0 0 1 3 ,5 9 2 5 ,2 6 3 1 3 ,9 0 9 5 4 ,8 1 7 2 4 ,1 4 8 4 ,5 2 0 2 8 ,2 2 8 1 3 ,2 9 0 1 6 ,3 5 0 3 2 ,4 3 7 1 0 .7 6 % 5 .8 7 % 2 .2 7 % 6 .0 1 % 2 3 .6 8 % 1 0 .4 3 % 1 .9 5 % 1 2 .2 0 % 5 .7 4 % 7 .0 6 % 1 4 .0 1 % 1 6 .1 3 % 1 3 .2 7 % 2 4 .8 3 % 1 8 .9 2 % 7 .1 6 % 1 2 .4 2 % 1 5 .4 4 % 6 .3 0 % 8 .7 6 % 8 .1 3 % 4 .4 3 % 2 3 ,0 9 1 1 0 0 .0 0 % 2 3 1 ,4 5 4 1 0 0 .0 0 % 9 .9 8 % N o rm a lis e d In d e x 4 1 0 .5 4 2 .9 3 5 .0 4 8 .2 7 -1 0 .6 6 3 .9 6 1 .5 7 -6 .7 9 -1 .0 4 -1 .9 5 -1 1 .7 1 In d e x 5 162 133 249 190 72 124 155 63 88 81 44 100 1. 2. 3. 4. 5. The name given to each classification type Number of households/population/adults 18 and over within each classification type Penetration % is calculated based on the target volume divided by the base volume The Normalized index is similar to the index but takes volume into account. The Index compares the percentage of each type in the customer file against the percentage of each type in the base population. • The index is the means by which each type is determined to be over- or under-represented within the base profile. An index of 100 occurs where the target % is the same as the base % and therefore the proportion of customers in the profile within this type is said to be average. • For the Normalized Index, the average value is zero, so any indices above zero is over represented by the target group and any index less than zero is under represented by the target group IN STRICT COMMERCIAL CONFIDENCE