RFM

advertisement

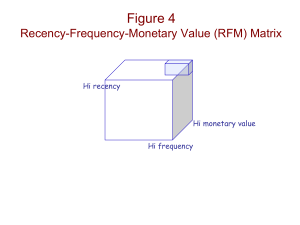

Business Intelligence/ Decision Models RFM Analysis Outline Explain how RFM works, and how you can use it to improve response rates and reduce costs SPSS RFM With transaction files With customer files Use of RFM with Target Variable 2 Recency, Frequency, and Monetary (RFM) Analysis According to Hughes! Always improves response and profits Better than any demographic model The most powerful segmentation method for predicting response Old-fashioned RFM? Never assume a CHAID program or even a regression model will outperform an old-fashioned RFM… (David Shepard) Respon se Rate Response by Recency Quintile 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 3.49% 1.25% 1.08% 0.63% 0.26% 5 4 3 Recency Quintile 2 1 Response by Frequency Quintile 2.50% 2.00% 1.99% Response Rate 1.56% 1.50% 1.31% 1.00% 0.92% 0.93% 2 1 0.50% 0.00% 5 4 3 Frequency Quintile Response by Monetary Quintile 1.80% 1.61% 1.60% 1.45% 1.46% 1.40% 1.22% 1.23% 2 1 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00% 5 4 3 Big Ticket: Response to $5,000 CD Offer by Monetary Percentage of households promoted who purchased 2 1.68 1.5 1.17 1 0.88 0.66 0.5 0.32 0 5 4 3 Monetary Quintile 2 1 RFM Code Construction R 5 F 35 4 34 3 33 2 32 31 1 Database One Sort Five Sorts 1 M 335 334 333 332 331 Twentyfive sorts RFM Code Construction R DB F 2 M 5 5 5 4 4 4 3 3 3 2 2 2 1 1 1 1st Sort DB 2nd Sort DB 3rd Sort RFM Code Construction 3 Predefined subjective breaks: R = < 2 wks, 2-6 wks, 7-8 wks, and > 12 wks F = 10, 8, 6, 3, 1 M = > $500, $300-500, $200-300, $100-200, < $200, 11 RFM Code Construction R = 5, 4, 3, 2, 1 @ weight = 10 F = 5, 4, 3, 2, 1 @ weight = 5 M =5, 4, 3, 2, 1 @ weight = 1 Weighted sum Score = xiwi Ex. RFM 421 = Score 51 4 Let’s stick with this one! R 5 F 35 4 34 3 33 2 32 31 1 Database One Sort Five Sorts M 335 334 333 332 331 Twentyfive sorts Break Even Response Rate BE = Unit Cost / Unit Profit Example: • Unit cost = .55 • Unit profit = $33 • Thus $.55 / $33 = 0.0167 or 1.67% Number of Cells 5 x 5 x 5 = 125 cells How many individuals per cell so that response is significant? Minimum 4 / BE Ex. 4 / .0167 = 240 individuals per cell # of customers +/- 30,000 Use Common sense: 5x4x4, or 5x4x3, or 5x2x2, or 4x2x3 15 Systematic Sampling: Selecting every Nth case Customer Database 300,000 Records For Nth by 10, select every tenth record. Nth 30,000 Records Result will be a statistical replica of the database Result of Test for 30,000 # 1 2 3 4 5 RFM 555 554 553 552 551 Reach 240 240 240 240 240 Response 20 16 13 10 11 Rate 8.15% 6.56% 5.62% 4.33% 4.51% 6 7 8 9 10 545 544 543 542 541 240 240 240 240 240 9 12 6 10 7 3.78% 4.98% 2.88% 4.26% 3.10% 11 12 13 14 535 534 533 532 240 240 240 240 10 9 8 6 4.13% 3.83% 3.35% 2.70% Case Study # of customers 2,100,000 Test with 30,000 Left with 2,070,000 If 555 RFM 125 cells 16,560 customers per cell 18 Test Response Rate by RFM Cell Index of Response 0 = Break Even 500 400 300 200 100 0 -100 34/125 cells above BE -200 555 455 355 255 111 Break Even Index (BEI) BE: .0167 set to 0 or 100 as a reference point Ex. Assume Response = .025 for a given cell If BEI set to 0 BEI = [(Resp – BE)/BE] * 100 Ex. [(.025 - .0167)/.0167]*100 Ex. 49.7 rounded 50 If BEI set to 100 BEI = [Resp/BE] * 100 Ex. [.025/.0167] * 100 = 150 Profit from Test Program Quantity Rate Amount Gross Profit 402 $40.00 $16,080 Fixed Costs 30,000 $0.55 $16,500 Profits (Loss) ($420) Test, Full File & RFM Selects Compared Test Response Rate Responses Net Revenue Quantities Fixed Costs Profits Full File RFM Select 1.34% 1.17% 2.76% 402 23,412 15,540 $16,080 $936,480 $621,596 30,000 2,001,585 563,040 $16,500 $1,100,581 $309,672 -$420 -$164,101 $311,924 RFM Procedure Transaction file • Run RFM on transaction file • Create an new RFM dataset • Merge with customer file Customer file • File is already prepared • Run RFM on time since last purchase, number of purchases, and money spent 24 SPSS Means Procedure Compare Means Means DV Response Variable (0/1) IV RFM (Means and N) Copy output table to Excel Sort all columns by mean response Descending order Determine BE and economics 25 Selected RFM RFM score 515 Mean Cost N Income .46 547 $ 410 $ 1,008 512 .42 1097 $ 823 $ 1,860 514 .42 530 $ 398 $ 892 513 .41 185 $ 139 $ 304 511 .38 318 $ 239 $ 488 411 .34 302 $ 227 $ 416 415 .34 565 $ 424 $ 760 414 .32 561 $ 421 $ 708 412 .31 1205 $ 904 $ 1,516 413 .30 185 $ 139 $ 224 312 .28 1543 $ 1,157 $ 1,704 311 .27 527 $ 395 $ 576 314 .27 724 $ 543 $ 768 315 .25 749 $ 562 $ 744 313 .24 132 $ 99 $ 128 211 .21 1053 $ 790 $ 904 213 .18 1318 $ 7,667 $ $ 62,162 $ Total .07 82882 U. Cost 0.75 U. Profit 4 BE 0.1875 13,000 $ 5,333 21,920 -$ 40,242 26 Bits and Pieces Recency with continuity: Frequency? Change in buying decisions Purchases in year or # of items Transactions in a year # of visits, # of calls Tests and Rollouts Caution about RFM Customer reach File fatigue Use RFM for testing Use it to identify your best customers Objectives? Profit, ROI, Reach RFM Customer File RFM Customer File RFM Customer File RFM Customer File RFM Customer File RFM Customer File RFM Sort Analyze Compare Means Means RFM Sort, Import into Excel RFM 111 112 113 114 115 121 122 123 124 125 131 Mean N .1975 319 .1937 320 .1531 320 .1438 320 .1531 320 .0562 320 .0281 320 .0438 320 .0438 320 .0344 320 .0094 320 ………..… 535 541 542 543 544 545 551 552 553 554 555 Total .1219 .0719 .0688 .0594 .0656 .0500 .0219 .0188 .0281 .0250 .0281 .1484 320 320 320 320 320 320 320 320 320 320 320 39999 36 RFM Economics Ex. Catalogue Fixed Cost $4.00 Gross Profit $20.00 BE $4 / $20 = .20 Sent to all 39,999 Cost $159,996 Resp .1484 5,936 Gross $118,720 Sent to > .20 10,240 Cost $40,960 Buyers 4,367 Gross $87,340 - $41,276 $46,380 37 RFM Economics Email Fixed Cost $0.02 Unsub. .025 Gross Profit $20.00 Worst Case .050 BE .02/20 = .001 CLV $100 Sent to all 39,999 Cost Resp .1484 5,936 Gross Cust. Loss 20,000 Sent to > .20 10,240 Cost Buyers 4,367 Gross Cust. Loss 256 $800 $118,720 $2,000,000 - $1,882,100 $205 $87,340 $25,600 $61,535 38