Factoring

advertisement

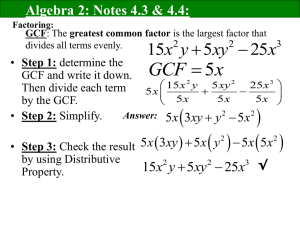

MFS Chapter – 6 M. Y. KHAN Factoring and Forfaiting Factoring: The Concept… • “Factor is a financial intermediary which assumes the responsibility of collection of receivables arising out of credit sales of their clients and in return charges commission for its services”. • So, a Factor is… A Financial Intermediary/Institute/Company That buys invoices of a manufacturer or a trader, at a discount, and Takes responsibility for collection of payments. Factoring: The Concept… • “Factoring is the Sale of Book Debts by a firm (Client) to a financial institution (Factor) on the understanding that the Factor will pay for the Book Debts as and when they are collected or on a guaranteed payment date. Normally, the Factor makes a part payment (usually upto 80%) immediately after the debts are purchased thereby providing immediate liquidity to the Client”. Factoring Services - Concept Deliver of goods Client Order placed Customer Client submits invoice Customer pays Factor-Prepayment Monthly statements Factor 4/13/2015 4 Process of Factoring: • Client makes a credit sale with a customer. • Client sells the customer’s account to the Factor and notifies the customer. • Factor makes partly payment (advance) against account purchased, after adjusting for commission and interest on the advance. • Factor maintains the customer’s account and follows up for payment. • Customer remits the amount due to the Factor. • Factor makes the final payment to the Client when the account is collected or on the guaranteed payment date. Charges for Factoring Services: • Factor charges Commission (as a flat percentage of value of Debts purchased) (0.50% to 1.50%) • Commission is charged up-front. • For making immediate partly payment, interest charged. Interest is higher than rate of interest charged on Working Capital Finance by Banks. • If interest is charged up-front, it is called Discount. Functions of a Factor: 1. Administration of sales ledger - Maintains the client’s sales ledger - Gives periodic reports - Current status of his receivables - Receipts of payments from customers - Customer-wise record of payments - Change in payment pattern 2. Provision of collection facility - Undertakes to collect receivables on behalf of the client - Relieving the clients from problems involved in collection - Enables the clients to reduce cost of collection Functions of a Factor: CONT… 3. Financing Trade Debts: 4. Credit Control And Credit Protection: - This service is provided where debts are factored without recourse. Factor assumes the risk of default. 5. Advisory Services: - Specialized knowledge and experience - Customers’ perception - Change in marketing strategies - Emerging trends Types / Forms of Factoring: 1. Recourse Factoring: Factor does not assume credit risks associated with receivables. Credit Risk is borne by the Client. In India, Factoring is done with recourse. 2. Non-Recourse Factoring: Factor assumes credit risks associated with receivables. Charges a higher commission Credit risk is assumed by Factor In USA/UK, Factoring is commonly done without recourse. Types / Forms of Factoring: 3. Advance Factoring: Factor pays a specified portion (75% to 90%) in advance. Balance being paid upon collection from the customer. The client has to pay interest on advance payment. Example of Advance Factoring Mechanism: 2 Client Assigns invoice 4 monthly statement of accounts Factor 5 payment to factor 1 Credit sale Customer Types / Forms of Factoring: CONT… 4. Maturity Factoring / Collection Factoring: Factor does not make any advance payment to the Client. Factor Pays on date of collection/agreed future date. Less RISK for Factor and charges nominal commission. 5. Full Factoring / Old Line Factoring: Features of almost all the factoring services. Entire spectrum of services; collection, credit protection, sales ledger administration, short-term finance. Types / Forms of Factoring: CONT… 6. Disclosed Factoring: Name of factor is disclosed in sales invoice. 7. Undisclosed Factoring: Name of factor is NOT disclosed in sales invoice. 8. Domestic Factoring: Buyer, Seller, Factor domiciled in the same country. Types / Forms of Factoring: CONT… 9. Export / Cross Border / International Factoring: Usually Four Parties Involved Viz. the Exporter, Importer, Export Factor, Import Factor. Two Agreements. Import Factor Provides Link Between Export Factor and Importer. Import factor underwrites customer trade credit risk, collects receivables and transfers fund to export factor. International Factoring Transactions: Receives order Credit limit request Approval Delivers goods Submits documents P repayment Documents Collection P ayment remittance Balance payment 1 Exporter 3 4 Importer 6 8 7 2 5 10 Export Factor 9 Import Factor International Factoring Transactions Advantages of Factoring: 1. Off-balance Sheet Finance 2. Reduction of Current Liabilities 3. Improvement in Current Ratio 4. Higher Credit Standing: 5. More time for Planning and Production 6. Reduction of Cost and Expenses 7. Additional Source of Finance WHY FACTORING HAS NOT BECOME POPULAR IN INDIA? • Banks’ unwillingness to provide factoring services • Problems in recovery. • Factoring requires assignment of debt which attracts Stamp Duty. • Cost of transaction becomes high. • Lack of awareness. Factoring in INDIA: Major Players • • • • • • • • • SBI Factors and Commercial Services Pvt. Ltd. Canbank Factors Limited Global Trade Finance Limited Foremost Factors Limited HSBC Bank CITI Bank NA, India Standard Chartered Bank SIDBI ECGC Ltd. FORFAITING: THE CONCEPT - “Forfeiting refers to financing of receivables pertaining to international trade”. - Forfaiting is a mechanism by which the right for export receivables of an exporter (Client) is purchased by a Financial Intermediary (Forfaiter) without recourse to him. - Converts exporter’s credit sale into cash sale. - Discounting the documents covering the entire risk of nonpayment in collection. - Credit period can range from 3 to 5 years. 2 Exporter 1 6 7 Importer 3 5 Forfaiting Transactions 4 9 8 Forfaiter 1. 2. 3. 4. 5. 10 Committed to purchase debt Commercial contact Delivery of goods Gives guarantee Hands over documents Avalling Bank 6. Delivers documents 7. Makes payment 8. Presents document for payment 9. Repays at maturity 10.Payment to the forfaiter Characteristics of Forfaiting: • Converts Deferred Payment Exports into cash transactions, providing liquidity and cash flow to Exporter. • Discharge Exporter from Cross-border Political OR Exchange Risk associated with Export Receivables. • Finance available upto 100% (as against 75 - 80% under conventional credit) without recourse. • Acts as additional source of funding and hence does not have impact on Exporter’s borrowing limits. It does not reflect as debt in Exporter’s Balance Sheet. • Provides Fixed Rate Finance and hence risk of interest rate fluctuation does not arise. Characteristics of Forfaiting: Cont… • Exporter is freed from credit administration. • Simple Documentation as finance is available against bills. • Forfait financer is responsible for each of the Exporter’s trade transactions. Hence, Export business can be done more efficiently. • Forfait transactions are confidential. FORFAITER’S CHARGES • The DISCOUNT charged by the Forfaiter depends upon: Cost of Forfaiting Margin to cover risk Management charges Fees for delayed payment Period of Forfaiting contract Credit rating of Avalling Bank Country/Currency Risk of the importer Export Factoring V/s Forfeiting: Sr. No. Export Factoring Forfaiting 1 75 to 90% Financing 100% Financing 2 Financing, Collection, Sales Ledger Administration Pure Financing 3 Short Term Financing 3 To 5 Years 4 Does not guard against Exchange Rate Fluctuation Forfaiter guards. FACTORING vs. FORFAITING POINTS OF DIFFERENCE Extent of Finance FACTORING Usually 75 – 80% of the value of the invoice Credit Worthiness Factor does the credit rating in case of nonrecourse factoring transaction FORFAITING 100% of Invoice value The Forfaiting Bank relies on the creditability of the Availing Bank Services provided Day-to-day No services are administration of sales provided and other allied/advisory services FACTORING vs. FORFAITING – CONT… POINTS OF DIFFERENCE FACTORING FORFAITING Recourse With or without recourse Always without recourse Size of transaction Usually no restriction on minimum size of transactions that can be covered by factoring. Scope of service Service is available for domestic and export receivables. Transactions should be of a minimum value of USD 250,000. Usually available for export receivables only denominated in any freely convertible foreign currency. WHY FORFAITING HAS NOT DEVELOPED… • Relatively new concept in India. • High Rupee Fluctuation • High cost of funds • High minimum cost of transactions (USD 250,000/-) • RBI Guidelines are unclear. • Very few institutions offer such services in India. Exim Bank is one of the major player and very few other co’s involved. • Lack of awareness. List of some Forfaiters: • Standard Bank, London • Hong Kong Bank • ABN AMRO Bank • Meghraj Financial Services • Triumph International Finance India Ltd., • Natwest Bank • Meridian Finance Group 4/13/2015 28