Rodda, Issacs, Rogers & Bhargava

advertisement

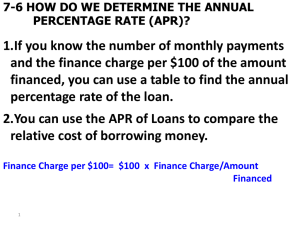

NCVTS County Financial Reports September 26, 2013 Objectives • Gain information regarding the following NCVTS Reports: – – – – County Finance Report County Reconciliation Report Net Distribution Report Pending Refund Report NCVTS Reports Background Reports Background • General Rules for NCVTS Reports – Financial reports should include vehicle values, taxes and interest paid by jurisdiction. – The financial report will initially be provided by month of collection. A subsequent version will provide collections by registration month. Both reports will include a year-to-date summary page. – DOT will show gross collections, billing, credit card and debit card costs, and net revenue. • Costs will be extracted. Reports Background • General Rules for NCVTS Reports – The levy consists of “bills for registrations/property taxes actually paid in full through the renewal/issuance process or created through the LRP process. – 5% first month interest remains in effect after July 1, 2013. – DOT Fiscal will provide a monthly Remittance Advice showing: • Overall collections for your county • Billing and collection costs • Credit card and debit card costs • Net collections after expenses are deducted County Finance Report County Finance Report • Primary purpose is balancing with DOT Remittance Advice • Secondary role is cost allocation • Obtained from VTS on a monthly basis • May be imported as a .csv or .xls file or keyed manually into your financial system • County or municipal finance personnel should contact the County Assessor for direct access to this report County Finance Report • Report shows financial data in 13 tables – One table for each month of the Fiscal year, starting in July and ending with June – One final table giving a “Year to Date” summary. – The amounts in each table are based on payments made in that Fiscal month. – Each table breaks out financial data by Tax Jurisdiction. County Finance Report • The financial data for each table is divided into four areas: – Billing Information – provides data for Levies (as originally billed or adjusted prior to payment) and number of vehicles as well as LRP (Limited Registration Plates) – Collections – shows amounts actually paid (after adjustments, if any) • This is the levy – Credit /Debit Card Cost Allocation – shows payment data made by Credit or Debit card – Total Collected and Total Uncollected – shows data about amounts paid and amounts unpaid (LRP) County Finance Report Billing Information Jurisdiction CB1 CH1 KB1 NH1 NH2 WB1 WM1 Totals Nbr Vehicles 69 0 38 1,918 883 48 880 Renewal/LRP Renew/Issue Levy /Issue Net Values $467,622 $1,098.90 $424,330 $0.00 $373,930 $977.83 $16,751,835 $92,825.42 $7,454,207 $5,889.06 $431,559 $574.05 $8,024,517 $39,892.97 $141,258.23 LRP Levy $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Net Levy $1,098.90 $0.00 $977.83 $92,825.42 $5,889.06 $574.05 $39,892.97 $141,258.23 • Valuations and Levy • The number of vehicles with renewals, issuances or LRPs. • The net value of registered vehicles (after adjustments made before payment), issuances and LRPs • The taxes and fees billed/collected through renewals, issuances and LRPs. • The taxes billed on vehicles issued an LRP County Finance Report • Collections – The total value of taxes paid through renewals and issuances – The total value of taxes collected through the LRP process – The aggregate collection rate for LRP and Renewal collections Collections Renew/Issue Collections LRP Collections Total Collections % Collected $1,098.90 $0.00 $0.00 $0.00 $977.83 $0.00 $92,335.68 $0.00 $92,335.68 99.47% $5,874.41 $0.00 $5,874.41 99.75% $574.05 $0.00 $39,558.59 $0.00 $140,419.46 $1,098.90 100.00% $0.00 0.00% $977.83 100.00% $574.05 100.00% $39,558.59 99.16% $0.00 $140,419.46 99.41% County Finance Report • Cost Allocation • 3 Categories of costs – Billing Costs – Credit Card Costs – Debit Card Costs (future) • Counties should allocate the lump sum costs across their taxing jurisdictions Credit/Debit Card Cost Allocation Billing Cost Collections By % Credit Card 0.78% 0.00% 0.69% 65.75% 4.18% 0.40% 28.17% 99.97% $332.24 $0.00 $316.64 $33,685.90 $2,324.74 $212.88 $13,444.61 $50,317.01 Cost % 0.66% 0.00% 0.62% 66.94% 4.62% 0.42% 26.71% 99.97% Collection by Debit Card $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Cost % 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% County Finance Report • Total Collections/Uncollected – Provides • Interest collected for each jurisdiction • Total collections (Levy + Interest) per jurisdiction • Total LRP uncollected Total Collections/ Uncollected Interest Collected Total Collected LRP Uncollected $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1,098.90 $0.00 $977.83 $92,335.68 $5,874.41 $574.05 $39,558.59 $140,419.46 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 County Finance Report • Cost allocation percentages are based on the contribution of each individual levy to the total of all levies. – Counties/municipalities may choose other methods for cost allocation – Counties no longer have the statutory authority to charge municipalities and other jurisdictions up to 1.5% of collections to offset collection costs for vehicles billed under the Tag and Tax Together program County Finance Report • DOT Fiscal will provide a monthly Remittance Report showing: – Overall collections for your county – Billing and collection costs – Credit card and debit card costs – Net collections after expenses are deducted County Finance Report County Finance Report County Finance Report County Finance Report County Reconciliation Report County Reconciliation Report • This report provides detailed county payment and reversal data in VTS for the purpose of reconciling against distribution reports from STARS for a given date range. – Originally intended for testing purposes – Only looks at payments • The parameters for this report are: – Start date (inclusive) – End date (inclusive) County Reconciliation Report County Reconciliation Report Dataset: Reconciliation by “Year For” and Tax District Pos 1 2 3 Field Name Year_for Tax_District Vehicle_Taxes Length 4 20 19 Type int Char money 4 Vehicle_Fees 19 money 5 6 7 8 9 10 11 12 13 14 Taxes_and_Fees Interest Holds_Plus Total_Payments Reversed_Taxes Reversed_Fees Total_Reversed_Taxes_and_Fees Reversed_Interest Holds_Minus Total_Reversals 19 19 19 19 19 19 19 19 19 19 money money money money money money money money money money 15 Credit_Card 19 money Description Tax district – using county financial import data Payments where Levy_type = tax, excluding reversals and interest Payments where levy type = vehicle fee, excludes reversals and interest Sum of Vehicle taxes and vehicle fees All interest on vehicle fees and taxes, excluding reversals Funds not assigned (usually seen as an overpayment) Sum of Taxes and Fees plus interest plus Holds_plus Reversals of levy type taxes, excludes reversals of interest Reversals of levy type vehicle fees excludes interest Sum of reversed vehicle fees and reversed vehicle taxes All reversed interest Reversed holds (reversal of overpayment refunds) Sum of Total reversed taxes and fees plus reversed interest plus Holds_minus Payments associated to a credit card – includes all taxes, fees, reversals, Holds Plus, Holds_minus and interest County Reconciliation Report Dataset: Reconciliation by “Year For” and Tax District cont. Pos Field Name Length Type Description 16 Debit_Card 19 money Sum_Vehicle_Taxes Sum_Vehicle_Fees Sum_Taxes_and_Fees Sum_Interest Sum_Holds_plus 19 19 19 19 19 money money money money money Payments associated to a debit card – includes all taxes, fees, reversals, Holds Plus, Holds_minus and interest Sum of all Vehicle taxes in report Sum of all Vehicle_Fees in report Sum of all Taxes_and_Fees in report Sum of all Interest in report Sum of all Holds_plus in report 17 18 19 20 21 22 Sum_Total_Payments 19 money Sum of all Total_Payments in report 23 Sum_Reversed_Taxes 19 money Sum of all Reversed_Taxes in report 24 Sum_Reversed_Fees 19 money Sum of all Reversed_Fees in report 25 Sum_Total_Reversed_Taxes_and_Fees 19 money Sum of all Total_Reversed_Taxes_and_Fees in report 26 Sum_Reversed_Interest 19 money Sum of all Reversed_Interest in report 27 Sum_Holds_Minus 19 money Sum of all Holds_Minus in report 28 Sum_Total_Reversals 19 money Sum of all Total_Reversals in report 29 Sum_Credit_Card 19 money Sum of all Credit_Card in report 30 Sum_Debit_Card 19 money Sum of all Debit_Card in report Net Distribution Report Net Distribution Report • The Net Distribution Report is a modification of the Daily Distribution Report and includes total levies collected by tax district and net adjustments including releases and refunds. Net Distribution Report Net Distribution Report • Recent updates: – Levy column only includes transactions from STARS • This will match County Finance Report and County Reconciliation Report – Net Adjustment column added • Includes changes to levy amounts due to adjustments and prorations that occur after the payment is made – Net Adjustment Interest column added • Includes changes to interest amounts due to adjustments and prorations after the payment is made – Total column renamed to Net Levy Pending Refund Report Pending Refund Report • This report shows prorated refund data by: – Tax District – Levy Type • Vehicle fee – only prorated in the case of full release or bill voidance • Tax – Interest for a given time period Pending Refund Report • The parameters for the Report are: – Fiscal Year – in the form “2013-14”. – Time Period – a specific Month, Quarter or Year – Refund Types: • Proration • Adjustment >=100 • Adjustment <100” • Over payments are excluded from the report – Refund Status: • Approved • Pending Pending Refund Report • This report pulls from three datasets: – Dataset 1 shows a breakdown by tax district and levy type – Dataset 2 is a summary of refunds by tax district (prorated) – Dataset 3 is a list of the parameters used to filter the data and the run date of the report. Pending Refund Report Pending Refund Report • Dataset 1: Refunds w/ Tax District and Levy Types Prorated Pos 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Field Name Name Adddress_1 Address_2 Address_3 Refund_Type Bill_Num Status Transaction_Num Refund_Description Refund_Reason Create_Date Tax_District Levy_Type Refund_Amt Length 100 50 50 50 20 10 20 10 200 20 10 20 10 14 Type Char Char Char Char Char Char Char int Char Char Date Char Char money 15 Subtotal_Refund_Amt 19 money 16 Total_Refund_Amt 19 money Description Tax payer name Taxpayer Address Additional Tax Payer address Taxpayer City, state, zip Proration or adjustment Bill Base number Pending or Authorizied Refund Number Generic description Reason for refund Date Refund created Relevant tax district Tax , Vehicle Fee, or Interest Amount to be refunded by Tax district and Levy Type Amount to be refunded to a taxpayer in a single refund transaction Total amount of refunds in the report Pending Refund Report • Dataset 2: Summary of Refunds by Tax District Pos 1 2 3 Field Name Tax_District_Summary District_Type_Summary Refund_Amt_Summary 4 Sum_refund_Amt_Summary Length 20 20 19 19 Type Char Char money money Description Tax district District type – City, County,Fire,Special Amount refunded to tax district (prorated) Total refund amount • Dataset 3: Report Parameters Pos 1 2 3 4 5 6 Field Name County Refund_Time_Period Refund_Fiscal_Year Refund_Types Refund_Status Report_Run_Date Length 50 15 11 100 100 21 Type char Char Char Char Char Datetime Description Name of County report is for Name of Month, Quarter or Year Fiscal year of data List of Refund Types in report List of statuses contained in report Date and Time that the Report was created – mm/dd/yyyy hr:min Report Matching Report Matching The following three reports should match with each other (some adjustments may be necessary for reversals) County Reconciliation County Finance Net Distribution (STARS Payment) Report Matching The following two reports should match with each other Net Distribution (Non STARS Payment) Pending Refund