PowerPoint-presentatie

advertisement

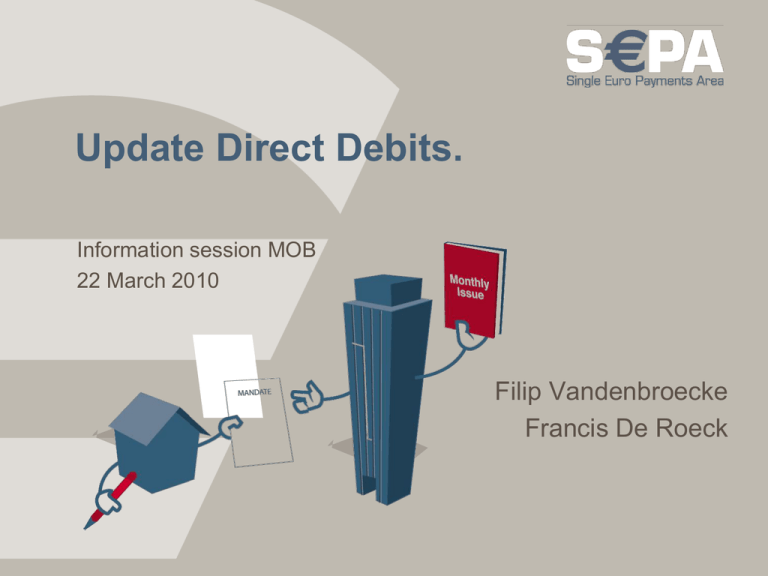

Update Direct Debits.

Information session MOB

22 March 2010

Filip Vandenbroecke

Francis De Roeck

Agenda

1.

Core scheme

2.

Continuity/migration of DOM80 mandates for SDD

3.

B2B scheme

4.

Questions ?

Appendixes

5.

Possible future developments

Information session Febelfin - 11/5/2009

2

1. SDD Core scheme :

Comparison with DOM 80(Post 1/4/2010)

Use

Creditor ID

Format

Mandate

Storage of the

mandate

Mandate reference

Type of DD

Pre-notification

cut-off times

Unpaids

Refunds

DOM 80- PSD

compliant

local

given by the NBB

CIRI

yes

Debtor Bank

Creditor ( DOM 70)

given by the Debtor

bank

recurrents

yes

D-1

D+3

8 weeks

13 months

SEPA Direct Debits

local & cross-border

given by the Creditor bank

XML format

yes

Creditor

given by the creditor

one-off’s and recurrents

yes

D-5 / D-2

D+5

8 weeks (authorised trx)

13 months (unauthorised)

Information session Febelfin - 11/5/2009

3

1. Core scheme :

Consequences for the Debtor

• Mandate managed by the Creditor

• The debtor will send his mandate to the creditor (and not to his bank)

• The debtor bank can offer specific services to the debtor (visualization of

mandates, controls…)

• Transparency

• The debtor is well informed by the creditor about the collection

• Good information about the product, rights, … from his bank

• Good protection

• Easy process for refund

• Belgian end European invoices

• Recurrent and one-off invoices

Information session Febelfin - 11/5/2009

4

1. Core scheme :

Consequences for the Creditor

• Mandate managed by the creditor

• The debtor will send his mandate to the creditor

• The creditor is responsible for dematerialisation & archiving

• New process and timelines

• New roles & responsibilities

• New contracts

• Same refund period as for DOM80(post PSD).

• New formats between the customer and the bank :

• IBAN/BIC

• XML Standard for Collections & Reversals (will be published in April)

• Full automated processing :

• End-to-end carrying of customer remittance data with a unique reference

• Ability to automate exceptions handlings like rejects, refunds, …

• Ultimate debtor and creditor

• Belgian and European invoices

• Recurrent and one-off collections

• Later extension to : E-signature & Business-to-Business

Information session Febelfin - 11/5/2009

5

1. Core scheme :

first experiences

• Some creditors started

• Only with new mandates

• No major issue

• new elements for Belgian Creditors

• Mandate management

• XML formats

• Limited volumes so far

• As from 1/4/2010 : possibility to issue SDD(core) collections based on

‘migrated’ DOM80 mandates.

• Migration to Isabel 6.

Information session Febelfin - 11/5/2009

6

2. Migration of 'old' BE mandates

Debtor

Debtor

bank

By Nov 1st, 2009

monthly upload

individual

notification of

enriched mandates

data

Active mandates + BIC + IBAN

download request

data of Creditor X

Creditor

bank

Creditor X

request for migration

Information session Febelfin - 11/5/2009

7

Direct Debits

Migration of existing Belgian mandates

• Belgian banks decided to limit the impact (for creditors &

debtors) by enabling the continuity of the 30 millions existing

mandates

• Procedure :

–

–

–

–

–

Debtor Bank will upload to the NBB the electronic datas about the

DOM80 mandates of their customers (debtors) with IBAN/BIC

The NBB will store all mandate information in a central database

The Creditor can ask to his bank a file will all mandates in his

favor

The Creditor Bank will then ask the download to the NBB which

will send the file to the Creditor

Debtor Banks have to keep the archived mandates

• Mandates migrated are only Core scheme mandates, for B2B

mandates, a new signature is needed

Information session Febelfin - 11/5/2009

8

3. B2B (Business to Business) scheme

• Major differences versus the core scheme:

- Specific mandate.

- No refund

- Eligible debtors :

- only ‘business’.

- Concrete criteria left to debtor banks

- Confirmation of consent by debtor to his bank required.

- Shorter timelines

- D-1 for presentations

- D+2 for returns

– No Migration of DOM80 mandates into B2B mandates.

– Only new mandates

- The B2B scheme is optional for Banks

- (for the Core scheme, each bank must participate as debtor bank).

- but 12 banks are already operational in Belgium

Information session Febelfin - 11/5/2009

9

10

3. B2B scheme :

first experiences

• Some creditors started

• Major attention points

• Too many collections returned due to lack of consent

available at the level of the debtor’s bank

– Ask your debtor to confirm to his bank about his consent (f.i.

copy of the mandate)

• Eligibility of debtors

– This can not be imposed to debtor banks (optional scheme).

Ask your debtor to contact his bank

Information session Febelfin - 11/5/2009

11

more info ?

Following information is available on the site www.Sepabelgium.be

• Rule books

–

Core & B2B

• Implementation guidelines

–

–

–

–

Core & B2B

bank to bank

Customer to bank (Unifi 20022)

Bank to Customer (CODA 2)

• Brochure SEPA DD (Febelfin)

• Migration of DOM80 mandates to core scheme mandates

–

–

Migration procedure for banks (debtor banks & creditor banks)

Migration contract for banks (debtor banks & creditor banks) (soon

available)

Information session Febelfin - 11/5/2009

12

Good to know : Average number of direct

debits per citizens (2006)

Information session Febelfin - 11/5/2009

13

Questions

?

?

?

Information session Febelfin - 11/5/2009

14

Update Direct Debits.

full version

Information session MOB

22 March 2010

Filip Vandenbroecke

Francis De Roeck

Agenda

0. PSD & impact on DOM80

1. Core scheme

2. Continuity/migration of DOM80 mandates for

SDD

3. B2B scheme

4. Questions ?

Appendixes

5. E-mandate

6. Possible future developments

Information session Febelfin - 11/5/2009

16

0. PSD versus SEPA

•Scope of PSD

– Covers all forms of electronic

payments, including:

• Cash to bank (deposits)

– Out of scope:

• Pure cash payments (cash to cash)

• Cheques, bills of exchange etc.

•Scope of SEPA

– Applies to limited number of

payments:

• credit transfers

• cards

• direct debits

– Geographic area is

• EU – 27 countries

• EEA – 3 countries

– Covers transactions in all EU

currencies – 15 currencies (incl.

EEA currencies)

– Bank to customer

– Law, hence: Mandatory

– Geographic area is EU 27 + EEA +

CH

– Covers only transactions in Euro!

– Interbank area

– Voluntary adherence

Information session Febelfin - 11/5/2009

17

0.Comparison DOM 80/ DOM 80 PSD compliant

DOM 80

Use

local

Creditor ID

given by the NBB

Format

CIRI

Mandate

yes

Storage of the

Debtor Bank

mandate

Creditor ( DOM 70)

Mandate reference

given by the Debtor

bank

Type of DD

recurrents

Pre-notification

yes (in practice ?)

cut-off times

D-1

Unpaids

D+4

Refunds

4 days

DOM 80- PSD compliant

idem

idem

idem

idem

idem

idem

idem

yes

idem

D+3

8 weeks (authorised tr)

13 months (Dom70)

(unauthorised)

Information session Febelfin - 11/5/2009

18

0. Impact of the PSD on DOM 80

1. Refund period needs to be integrated

•

- 8 weeks for authorised transactions: unconditional

refund (DOM 70/80)

•

- 13 months for unauthorised transactions (DOM 70)

2. Value date = Book date

3. New contract to be PSD compliant

4. The existing mandate forms can still be used but need to

give an explicit reference to the underlying contract

5. The pre-notification ( the debtor has to be advised before

the debit)

6. The execution time: D+3 (instead of D+4)

Application 01/04/2010

Information session Febelfin - 11/5/2009

19

1. SDD Core scheme :

Comparison with DOM 80(Post 1/4/2010)

Use

Creditor ID

Format

Mandate

Storage of the

mandate

Mandate reference

Type of DD

Pre-notification

cut-off times

Unpaids

Refunds

DOM 80- PSD

compliant

local

given by the NBB

CIRI

yes

Debtor Bank

Creditor ( DOM 70)

given by the Debtor

bank

recurrents

yes

D-1

D+3

8 weeks

13 months

SEPA Direct Debits

local & cross-border

given by the Creditor bank

XML format

yes

Creditor

given by the creditor

one-off’s and recurrents

yes

D-5 / D-2

D+5

8 weeks (authorised trx)

13 months (unauthorised)

Information session Febelfin - 11/5/2009

20

1. Core scheme :

Process for the mandate

The provider

The seller

The creditor

1. The customer buys a service

/ a good from the provider

The customer

The buyer

The debtor

3. If the debtor chooses

the European Direct Debit

as payment instrument,

he fills & signs the

mandate form

4. He sends it to the

creditor

2. The customer receives a contract / an invoice and

a mandate form from his provider

5. The creditor

updates his

administration and

archives the

mandate.

Contract / Invoice

Reference : 123456789

Provider’s name :

subscription Magazine ABC

Amount : 57,23 €

Payment by :

European Direct Debit

Mandate

SEPA Direct Debit Mandate

CREDITOR'S

NAME & LOGO

Mandate reference - to be completed by the creditor

By signing this mandate form, you authorise (A) {NAME OF CREDITOR} to send instructions to your bank to debit your

account and (B) your bank to debit your account in accordance with the instructions from {NAME OF CREDITOR}.

As part of your rights, you ar

Your name

+

*

1

Your name

Name of the debtor(s)

Name of the debtor(s)

Your address

*

Your address

2

Street name and number

Street name and number

*

3

Postal code

Postal code

City

City

*

4

Country

Country

Debtor identification code

5

Debtor identification code

Creditor's name

For business users: w rite any code number here w hich you w ish to have quoted by your bank.

For business users: write any code number here which you wish to have quoted by your bank.

**

Creditor's name

6

Creditor name

Creditor name

**

7

Creditor Identifier

Creditor Identifier

**

8

Sreet name and number

Street name and number

**

9

Postal code

Postal code

City

City

**

10

Country

Country

11

Creditor reference party: Creditor must complete this section if collecting payment on behalf of another party .

Creditor reference party: Creditor must complete this section if collecting payment on behalf of another party .

Your account number

*

Your account number

12

Account number - IBAN

Account number - IBAN

*

13

SWIFT BIC

Person on whose behalf

payment is made

14

Debtor Reference Party: If you are making a payment in respect of an arrangement betw een {NAME OF CREDITOR} and another

person (e.g. w here you are paying the other person's bill) please w rite the other person's name here.

If you are paying on your ow n behalf, leave blank.

Debtor Reference Party: If you are making a payment in respect of an arrangement between {NAME OF CREDITOR} and another

person (e.g. where you are paying the other person's bill) please write the other person's name here.

If you are paying on your own behalf, leave blank.

Person on whose behalf

payment is made

In respect of the contract

**

In respect of the contract:

15

Identification number of the underlying contract

Identification number of the underlying contract

**

16

Description of contract

Description of contract

Type of payment

*

Type of payment

City or town in which you are

signing

City or town in which you are

signing

Recurrent payment

Recurrent payment

or

or

One-off payment

One-off payment

17

Date *

Location

Location

D

D

M

M

Y

Y 18

Date

Signature(s)

Signatures

Please sign here

*

Information session Febelfin - 11/5/2009

21

1. Core scheme :

Process for the payment (1)

1. The provider sends to the

debtor a pre advice at least 14

days before the due date.

Pre-notification

The creditor can send the pre-notification

separately or can join it to a statement or

an invoice.

Mandate reference : 123456789

Name of the supplier : Subscription Magazine ABC

Amount : 57,23 euros

Payment date : every year 15th of January

First payment : 15th of January 2009

An overview or a plan for several

collections is also acceptable

The creditor & the debtor can agree about

another timing for the pre-notification

Information session Febelfin - 11/5/2009

22

1. Core scheme :

Process for the payment (2)

Creditor

Debtor

2. The creditor sends the

collections with the Mandate

Related Information (MRI) to his

bank

6. The creditor’s

account is credited

4. The debtor’s bank

debits the account of

the debtor

Debtor’s

bank

Creditor’s

bank

3. The creditor’s bank sends the

collections + MRI to the debtor’s bank

Clearing

Settlement

5. The debtor’s bank pays the creditor’s bank

Information session Febelfin - 11/5/2009

23

1. Core scheme :

Exception handling & The R messages (1)

Information session Febelfin - 11/5/2009

24

1. Core scheme :

Exception handling & The R messages

• Reject: is DD collection that is diverted from normal execution

prior to inter-bank settlement by the Creditor Bank, CSM or

Debtor Bank (invalid format, wrong IBAN, check digit, refusal

by the debtor, …)

• Refusal: is a claim initiated by the Debtor before settlement

for any reason, requesting the Debtor Bank not to pay a DD

collection (the Debtor bank will then generate a reject)

• Return: is DD collection that is diverted from normal

execution after inter-bank settlement and is initiated by the

Debtor Bank within 5 target days. (insufficient balance on the

account, …)

• Refund: is a claim by the Debtor for a reimbursement of an

already settled DD

Information session Febelfin - 11/5/2009

25

1. Core scheme :

Exception handling & The R messages

• Revocation: is requested by the Creditor to recall the

instruction for a DD collection prior to the acceptance by the

Creditor Bank.

• Request for cancellation: is requested by the Creditor Bank to

recall the instruction for a DD collection prior to acceptance

by the CSM

• Reversal: when the Creditor concludes that a DD collection

should not have been processed after the Clearing and

Settlement and reimburses the Debtor with the full amount of

the erroneous collection within 2 days after settlement.

Can be initiated by Creditor Bank for the same reasons.

Information session Febelfin - 11/5/2009

26

1. Core scheme :

Consequences for the Debtor

• Mandate managed by the Creditor

• The debtor will send his mandate to the creditor (and not to his bank)

• The debtor bank can offer specific services to the debtor (visualization of

mandates, controls…)

• Transparency

• The debtor is well informed by the creditor about the collection

• Good information about the product, rights, … from his bank

• Good protection

• Easy process for refund

• Belgian end European invoices

• Recurrent and one-off invoices

Information session Febelfin - 11/5/2009

27

1. Core scheme :

Consequences for the Creditor

• Mandate managed by the creditor

• The debtor will send his mandate to the creditor

• The creditor is responsible for dematerialisation & archiving

• New process and timelines

• New roles & responsibilities

• New contracts

• Same refund period as for DOM80(post PSD).

• New formats between the customer and the bank :

• IBAN/BIC

• XML Standard for Collections & Reversals (will be published in April)

• Full automated processing :

• End-to-end carrying of customer remittance data with a unique reference

• Ability to automate exceptions handlings like rejects, refunds, …

• Ultimate debtor and creditor

• Belgian and European invoices

• Recurrent and one-off collections

• Later extension to : E-signature & Business-to-Business

Information session Febelfin - 11/5/2009

28

Creditor Identifier in Belgium

1. When Creditor has an Enterprise nb:

–

–

8 17 : Enterprise number (10 pos.)

This ID remains the same, whatever bank is that delivers it

2. When Creditor has no Enterprise nb:

–

–

–

•

BE 98 001 0456810810

BE 98 ZZZ 300 D 000000008

8 10 : Creditor Bank Code (3 pos.) ING=300

11

: “D”

12 20: Sequential Number (9 pos.)

Remark: The dom80 IDs that begin with 4 or more zeros may not be

used

BE 98 001 0000012345

•

Creditor Bank obligations:

–

–

–

Issue the Creditor Identifier (AT-02)

Issue the unique sequential nb when no enterprise nb exists

Deliver Creditor Identification issuance certificates when requested

Information session Febelfin - 11/5/2009

29

Informing creditors of the reason of

an R-transaction via CODA (4)

The bank of the creditor

–

–

Maps the SDD reason codes received into CODA reason codes

Differentiates between 4 code groups

• CODA reason 1 : maps codes indicating technical problems

–

Codes MD02, MD03, AG02, RC01, AM05

• CODA reason 2 : maps codes indicating other/unknown reason

–

–

Codes AM04, MS03

CODA reason 3 : maps codes indicating explicit disagreement by the debtor

–

Codes MD01,MD06 and MS02

• CODA reason 4 :maps codes indicating account problems

–

Codes AC01, AC04,AC06, AG01,BE01,MD07, RR01,SL01

Information session Febelfin - 11/5/2009

30

Collection initiation files

• One set of signatures

• Each DD batch:

– Same due date

– Can not mix Sequence Type:

•

•

•

•

First

Recurrent

Final

One-off

(D-5)

(D-2)

(D-2)

(D-5)

– Can not mix core with B2B

– Can mix different timelines in same Seq Type

• Recurrent normal (D-2) with Bank Changed (D-5) = when Debtor

goes to another bank & decides to keep the same mandate

– Individual procuration check (for NL)

• Different batch in file when

– Different due date

– Different scheme (core vs B2B)

– Different sequence type

rule

Information session Febelfin - 11/5/2009

31

1. Core scheme :

first experiences

• Some creditors started

• Only with new mandates

• No major issue

• new elements for Belgian Creditors

• Mandate management

• XML formats

• Limited volumes so far

• As from 1/4/2010 : possibility to issue SDD(core) collections based on

‘migrated’ DOM80 mandates.

• Migration to Isabel 6.

Information session Febelfin - 11/5/2009

32

2. Migration of 'old' BE mandates

Debtor

Debtor

bank

By Nov 1st, 2009

monthly upload

individual

notification of

enriched mandates

data

Active mandates + BIC + IBAN

download request

data of Creditor X

Creditor

bank

Creditor X

request for migration

Information session Febelfin - 11/5/2009

33

Direct Debits

Migration of existing Belgian mandates

• Belgian banks decided to limit the impact (for creditors &

debtors) by enabling the continuity of the 30 millions existing

mandates

• Procedure :

–

–

–

–

–

Debtor Bank will upload to the NBB the electronic datas about the

DOM80 mandates of their customers (debtors) with IBAN/BIC

The NBB will store all mandate information in a central database

The Creditor can ask to his bank a file will all mandates in his

favor

The Creditor Bank will then ask the download to the NBB which

will send the file to the Creditor

Debtor Banks have to keep the archived mandates

• Mandates migrated are only Core scheme mandates, for B2B

mandates, a new signature is needed

Information session Febelfin - 11/5/2009

34

3. B2B (Business to Business) scheme

• Major differences versus the core scheme:

- Specific mandate.

- No refund

- Eligible debtors :

- only ‘business’.

- Concrete criteria left to debtor banks

- Confirmation of consent by debtor to his bank required.

- Shorter timelines

- D-1 for presentations

- D+2 for returns

– No Migration of DOM80 mandates into B2B mandates.

– Only new mandates

- The B2B scheme is optional for Banks

- (for the Core scheme, each bank must participate as debtor bank).

- but 12 banks are already operational in Belgium

Information session Febelfin - 11/5/2009

35

3. B2B : Process for the mandate

1. The customer and the provider

negotiate a commercial transaction

The customer

The buyer

The debtor

3. If the

debtor

chooses the

European

Direct Debit

as payment

instrument,

the mandate

form is to be

filled & signed

The provider

The seller

The creditor

4A. The debtor sends the filled

and signed mandate to the

creditor

5. The

creditor

updates his

administrat

ion and

archives

the

mandate.

2. The customer receives a contract / an

invoice and a mandate form from his provider

Additional step for B2B :

4B. The debtor informs his Bank

about the signed mandate

Debtor’s

bank

Contract / Invoice

Reference : 123456789

Provider’s name : subscription

Magazine ABC

Amount : 57,23 €

Payment by :

European Direct Debit

Mandate

SEPA Direct Debit Mandate

CREDITOR'S

NAME & LOGO

Mandate reference - to be completed by the creditor

By signing this mandate form, you authorise (A) {NAME OF CREDITOR} to send instructions to your bank to debit your

account and (B) your bank to debit your account in accordance with the instructions from {NAME OF CREDITOR}.

As part of your rights, you ar

Your name

+

*

1

Your name

Name of the debtor(s)

Name of the debtor(s)

Your address

*

Your address

2

Street name and number

Street name and number

*

3

Postal code

Postal code

City

City

*

4

Country

Country

Debtor identification code

5

Debtor identification code

Creditor's name

For business users: w rite any code number here w hich you w ish to have quoted by your bank.

For business users: write any code number here which you wish to have quoted by your bank.

**

Creditor's name

6

Creditor name

Creditor name

**

7

Creditor Identifier

Creditor Identifier

**

8

Sreet name and number

Street name and number

**

9

Postal code

Postal code

City

City

**

10

Country

Country

11

Creditor reference party: Creditor must complete this section if collecting payment on behalf of another party .

Creditor reference party: Creditor must complete this section if collecting payment on behalf of another party .

Your account number

*

Your account number

12

Account number - IBAN

Account number - IBAN

*

13

SWIFT BIC

Person on whose behalf

payment is made

14

Debtor Reference Party: If you are making a payment in respect of an arrangement betw een {NAME OF CREDITOR} and another

person (e.g. w here you are paying the other person's bill) please w rite the other person's name here.

If you are paying on your ow n behalf, leave blank.

Debtor Reference Party: If you are making a payment in respect of an arrangement between {NAME OF CREDITOR} and another

person (e.g. where you are paying the other person's bill) please write the other person's name here.

If you are paying on your own behalf, leave blank.

Person on whose behalf

payment is made

In respect of the contract

**

In respect of the contract:

15

Identification number of the underlying contract

Identification number of the underlying contract

**

16

Description of contract

Description of contract

Type of payment

*

Type of payment

City or town in which you are

signing

City or town in which you are

signing

Recurrent payment

Recurrent payment

or

or

One-off payment

One-off payment

17

Date *

Location

Location

D

D

M

M

Y

Y 18

Date

Signature(s)

Signatures

Please sign here

*

Information session Febelfin - 11/5/2009

36

3. B2B : Process for the payment

Debtor

Creditor

1. The provider sends to

the debtor a pre advice at

least 14 days before the

due date.

2. The creditor sends the

collections with the Mandate

Related Information (MRI) to his

bank

6. The creditor’s

account is credited

4B. The debtor’s bank

debits the account of

the debtor

Debtor’s

bank

Creditor’s

bank

5. The debtor’s bank pays the creditor’s bank

Settlement

Additional step for

B2B : 4A. The debtor’s

bank checks the

agreement of the debtor

Clearing

3. The creditor’s bank sends the collections

+ MRI to the debtor’s bank

Information session Febelfin - 11/5/2009

37

3. Exception handling & The R

messages – B2B

Time line for the B2B scheme :

D-14

Creditor Presends

notification

Collection

to his bank

D-1

collection

sent

1) to CSM

2) to Deb bank

D

D+2

D+5

Limit to send Due date

collection

Settlement date

1) to CSM

Debit date

2) to Deb bank

Refusal (Debitor)

Return

reject

(Deb Bk)

Specific for B2B :

- Shorter timelines

- No Refund

Information session Febelfin - 11/5/2009

38

3. B2B scheme :

first experiences

• Some creditors started

• Major attention points

• Too many collections returned due to lack of consent

available at the level of the debtor’s bank

– Ask your debtor to confirm to his bank about his consent (f.i.

copy of the mandate)

• Eligibility of debtors

– This can not be imposed to debtor banks (optional scheme).

Ask your debtor to contact his bank

Information session Febelfin - 11/5/2009

39

more info ?

Following information is available on the site www.Sepabelgium.be

• Rule books

–

Core & B2B

• Implementation guidelines

–

–

–

–

Core & B2B

bank to bank

Customer to bank (Unifi 20022)

Bank to Customer (CODA 2)

• Brochure SEPA DD (Febelfin)

• Migration of DOM80 mandates to core scheme mandates

–

–

Migration procedure for banks (debtor banks & creditor banks)

Migration contract for banks (debtor banks & creditor banks) (soon

available)

Information session Febelfin - 11/5/2009

40

Good to know : Average number of direct

debits per citizens (2006)

Information session Febelfin - 11/5/2009

41

Questions

?

?

?

Information session Febelfin - 11/5/2009

42

4. In the pipeline :

E mandates : objectives

• Higher security : Validation by the debtor bank of :

• the correctness of the account and openness for SDD collections

• the access to the account based on the used identification mean.

less refunds for unauthorized collections.

• Paperless : Faster & easier process

• Fully automated E2E STP mandate processing

• One integrated process with the ordering / signing of the contract.

• The Debtor bank can store the MRI at that time

• Instead of based on the MRI sent with the first collection

• To improve its offering for visualisation / additional controls

• Dependencies :

• Documentation & standardisation (ISO)

• Offering of routing & validation services

• Facultative; no impact on the collections.

• Available for both schemes : core & B2B (later)

• No commitment yet on Belgian level. (analysis to be done)

Information session Febelfin - 11/5/2009

43

4. SDD e-Mandate

Service Description

Successive steps of the issuing process:

• Step 1: Debtor initiates e-Mandate on Creditor’s Web-Site;

checking by Creditor

• Step 2: Creditor submits e-Mandate proposal through routing service

• Step 3: to validation service of Debtor Bank

• Step 4: Debtor Bank invites Debtor to enter authentication means

• Step 5: Debtor Bank validates Debtor’s means of authentication and

confirms to Debtor

• Step 6: Debtor Bank confirms validation result through the original

routing service

• Step 7: to the Creditor

• Step 8: Creditor confirms final acceptance to Debtor and stores

e-Mandate

The collection is processed via the normal standard SDD procedure

Information session Febelfin - 11/5/2009

44

4. SDD e-Mandate

Diagram of the 4 party model

1.

Initiation

2 &3 Mandate request

Authorisation

4.

Confirmation

6 &7 E-Mandate

8

Confirmation

Information session Febelfin - 11/5/2009

45

5. Other possible developments

• Scheme ‘fixed amount’ – (no refund)

• Mandates via Zoomit

• MRI before first collection

Information session Febelfin - 11/5/2009

46

5.1. Other possible developments

scheme ‘fixed amount’ – no refund

• Major characteristics :

– Specific mandate : the mandate contains the amount of the

future collection(s).

– The debtor renounces explicitly his refund right

– The periodicity (f.i. one collection per month) is also an option in

this scheme

• Target

– No eligibility limitations at debtor side.

– Eligibility at creditor / business side not yet clear. There may be

a code of conduct reserving this scheme to the payment of goods

& services that by their nature cannot be returned.

– This scheme will be optional

• Status

– Status at EPC level : for validation in the Plenary of 24/3/2010.

– The Belgian banking community will support this scheme. The

timing is not yet discussed nor defined.

Information session Febelfin - 11/5/2009

47

5.2. Other possible developments :

mandates via Zoomit

• Major characteristics :

– Possibility for the creditor to submit mandates to the

debtor via zoomit

– Possibility for the debtor to sign the mandate electronically

– Possibility for the creditor to be sure that the mandate is

signed by the owner of the account or his representative

– Pure Belgian idea – no European solution

• Status

– Presented in last MOB; some positive reactions, but limited

interest expressed.

– To be analysed in the context of a joint action plan for the

migration

Information session Febelfin - 11/5/2009

48

5.2. Other possible developments :

Mandates via Zoomit.

IBAN

Dr bk 1

Connector

Connector

Sender

Mandate Requests

Dr Bk 2

Connector

Mandate Requests

Encrypted

URL to

DSP

Dr Bk 3

Connector

Send signed e-Mandate request

Sign eCheck

eAccount

X

Mandate

request

Document

Service Platform

DSP

Internet

Banking

Connector

Browser window 2

49

Mandates

Availability

Browser window 1

Information session Febelfin - 11/5/2009

49

5.3. Other possible developments :

MRI before first collection

• Major characteristics :

–

–

–

–

–

Possibility for the creditor to send the Mandate Related Information (MRI)

to the debtor bank as soon as the mandate has been signed by the debtor.

The debtor bank checks the eligibility : i.e. that the account number is

correct, open, and not blocked for Sepa Direct Debits.

Possibility for the debtor bank to inform the owner of the account about

this MRI; in this case : possibility for the debtor to react if required.

(for B2B : Possibility for the debtor bank to submit to the owner of the

account this MRI in order to get confirmation of his consent).

This Belgian idea has been submitted (once again) to the EPC :

• Support from major stakeholders (consummers; EACT)

• Limited support from major banking community.

• Status

–

–

–

Presented in last MOB; some positive reactions.

We monitor the development at European level : The belgian banking

community is not in favor of local flavours.

To be analysed in the context of a joint action plan for the migration

Information session Febelfin - 11/5/2009

50

5.3. MRI before first collection :

same first steps in the process for the mandate …

The provider

The seller

The creditor

1. The customer buys a service

/ a good from the provider

The customer

The buyer

The debtor

3. If the debtor chooses

the European Direct Debit

as payment instrument,

he fills & signs the

mandate form

4. He sends it to the

creditor

2. The customer receives a contract / an invoice and

a mandate form from his provider

Contract / Invoice

Reference : 123456789

Provider’s name :

Mandate

subscription Magazine ABC

Amount : 57,23 €

+

Payment by :

European Direct Debit

SEPA Direct Debit Mandate

5. The creditor

updates his

administration and

archives the

mandate.

CREDITOR'S

NAME & LOGO

Mandate reference - to be completed by the creditor

By signing this mandate form, you authorise (A) {NAME OF CREDITOR} to send instructions to your bank to debit your

account and (B) your bank to debit your account in accordance with the instructions from {NAME OF CREDITOR}.

As part of your rights, you ar

Your name

*

Your name

1

Name of the debtor(s)

Name of the debtor(s)

Your address

*

Your address

2

Street name and number

Street name and number

*

Postal code

Postal code

3

City

City

*

4

Country

Country

Debtor identification code

Debtor identification code

Creditor's name

5

For business users: w rite any code number here w hich you w ish to have quoted by your bank.

For business users: write any code number here which you wish to have quoted by your bank.

**

Creditor's name

6

Creditor name

Creditor name

**

7

Creditor Identifier

Creditor Identifier

**

8

Sreet name and number

Street name and number

**

9

Postal code

Postal code

City

City

**

10

Country

Country

11

Creditor reference party: Creditor must complete this section if collecting payment on behalf of another party .

Creditor reference party: Creditor must complete this section if collecting payment on behalf of another party .

Your account number

*

Your account number

12

Account number - IBAN

Account number - IBAN

*

13

SWIFT BIC

Person on whose behalf

payment is made

14

Debtor Reference Party: If you are making a payment in respect of an arrangement betw een {NAME OF CREDITOR} and another

person (e.g. w here you are paying the other person's bill) please w rite the other person's name here.

If you are paying on your ow n behalf, leave blank.

Debtor Reference Party: If you are making a payment in respect of an arrangement between {NAME OF CREDITOR} and another

person (e.g. where you are paying the other person's bill) please write the other person's name here.

If you are paying on your own behalf, leave blank.

Person on whose behalf

payment is made

In respect of the contract

**

In respect of the contract:

15

Identification number of the underlying contract

Identification number of the underlying contract

**

16

Description of contract

Description of contract

Type of payment

*

Type of payment

City or town in which you are

signing

City or town in which you are

signing

Recurrent payment

Recurrent payment

or

or

One-off payment

One-off payment

17

Date *

Location

Location

D

D

M

M

Y

Y 18

Date

Signature(s)

Signatures

Please sign here

*

Information session Febelfin - 11/5/2009

51

5.3. MRI before first collection :

additional steps before the first collection.

Creditor

Debtor

6. The creditor sends the

Mandate Related Information

(MRI) to his bank

11. The creditor

10. The debtor’s bank

can inform the debtor,

can propose additional

controls, etc.

Debtor’s

bank

receives the R

messages

Creditor’s

bank

9. The debtor’s bank sends a R message

if relevant

CSM

8. The debtor’s bank

checks that the account

is eligible (account valid;

open and not blocked

for SDD’s

7. The creditor’s bank sends the MRI

to the debtor’s bank

Information session Febelfin - 11/5/2009

52