Business Intelligence - Datamonitor Healthcare

advertisement

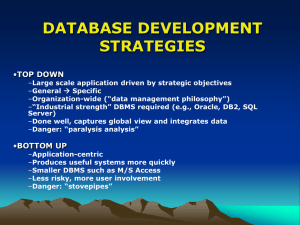

quality data expert analysis intuitive delivery the home of Business Intelligence © Datamonitor PharmaVitae: Daiichi Sankyo Pharmaceutical Co., Ltd HC00068-029 Slidepack 01/12 the home of Business Intelligence quality data expert analysis intuitive delivery 15,000 14,250 13,500 12,750 12,000 11,250 10,500 9,750 9,000 8,250 7,500 6,750 6,000 5,250 4,500 3,750 3,000 2,250 1,500 750 0 -750 100% 95% 90% 85% 80% 75% 70% 65% 60% 55% 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% 04 05 06 07 08 09 10 Growth rate 11 12 Sales ($m) 13 14 15 16 Year-on-year growth rate (%) Sales ($m) Daiichi Sankyo prescription pharmaceutical performance, sales ($m) and growth rate (%), 2004–16 Daiichi Sankyo financial performance ($m), 2004–16 25,000 20,000 15,000 10,000 5,000 0 -5,000 -10,000 -15,000 -20,000 04 05 06 07 08 09 10 11 12 13 14 15 16 Rx pharma Other revenues COGS S,G&A R&D Other operating expense Operating profit Daiichi Sankyo launch, core and expiry configuration vs peer set, sales ($m), 2010–16 +4,000 +2,000 +0 -2,000 -4,000 Launch Net EIS OTS TAK Expiry Average Core DNS MITS SHI AST -6,000 DAI Prescription pharma sales ($m) +6,000 SWOT analysis of Daiichi Sankyo Strengths • Lucrative cardiovascular portfolio spearheaded by the blockbuster olmesartan antihypertensive franchise. • High levels of industrial collaboration highlighted by inlicensing with companies spanning Big Pharma and beyond. Weaknesses • Over exposure to the cardiovascular market, deriving half of its total prescription pharma revenues from CV drugs, leaving Daiichi open to threats from a number of angles. • Domestic growth could be hampered by growing use of generics and reforms impacting price. • Impressive year for new drug approvals/launches in 2011, most notably gaining green lights for Memary, Zelboraf, Nexium and Lixiana, all of which have now launched. • Daiichi forced to write down an almost $4bn loss after Ranbaxy manufacturing processes came under scrutiny from FDA, more than two thirds of the original purchase price paid by Daiichi for a controlling stake in Ranbaxy. • Operating profits have shown signs of recovery after declines in 2008 and 2009. • Limited capital available for further deals after acquisitions of Ranbaxy and Plexxikon. Threats Opportunities • Two new launches for thrombosis market, Effient and Lixiana, could help drive Daiichi’s market share in this lucrative CV segment and broaden its focus away from hypertension. • 2016 patent expiry of olmesartan will have significant impact on Daiichi but not within the time constraints of this analysis. Indirect generic competition from elsewhere in the ARB class could hamper olmesartan sales. • Expansion opportunity in the US market through established products and recent/forthcoming launches. • • Emerging market growth strategy strengthened by acquisition of Ranbaxy, particularly in India. Weaker than hoped uptake of newly launched pipeline drugs, one example being Effient (prasugrel), which remains a key growth driver for Daiichi despite initially showing weak sales growth. • Generic version of Lipitor could propel Ranbaxy generics business in US, though competing authorized generics may limit the commercial potential of this venture. Daiichi Sankyo’s key product sales ($m), 2004–16 16,000 14,000 Sales ($m) 12,000 10,000 8,000 6,000 4,000 2,000 0 04 05 06 Rest of portfolio Loxonin Mevalotin Cravit 07 08 Ranbaxy Zelboraf ARQ 197 Venofer 09 10 11 12 13 Benicar/Benicar HCT Memary Azor Welchol 14 Effient Artist Lixiana 15 16 Daiichi Sankyo’s key product growth drivers and resistors ($m), 2004–10 12,000 10,000 6,000 4,000 2,000 Start / end year Positive growth Negative growth 2010 Rest of portfolio Mevalotin Azor Welchol Artist Loxonin Cravit Ranbaxy Benicar/Benicar HCT 0 2004 Sales ($m) 8,000 Daiichi Sankyo’s key product growth drivers and resistors ($m), 2010–16 16,000 14,000 10,000 8,000 6,000 4,000 2,000 Start / end year Positive growth Negative growth 2016 Rest of portfolio Cravit Welchol Gracevit Lixiana ARQ 197 Memary Zelboraf Effient Ranbaxy 0 2010 Sales ($m) 12,000 Daiichi Sankyo prescription pharmaceutical sales by therapy area ($m), 2004–16 16,000 14,000 12,000 Sales ($m) 10,000 8,000 6,000 4,000 2,000 0 04 05 CV 06 07 Other Onco 08 ID 09 I&I CNS 10 Uro 11 Hema 12 13 14 15 Resp GE Musco Endo 16 Daiichi Sankyo prescription pharmaceutical sales by geographic region ($m), 2004– 16 16,000 14,000 12,000 Sales ($m) 10,000 8,000 6,000 4,000 2,000 0 04 05 06 07 08 09 Japan 10 US 11 RoW 12 5EU 13 14 15 16 Daiichi Sankyo launch, core and expiry configuration, sales ($m), 2010–16 14,000 +1,039 14,067 2016 +1,048 Generic 16,000 +2,399 -930 12,000 10,509 8,000 6,000 4,000 2,000 Start / end year Expiry Core Launch 0 2010 Sales ($m) 10,000 Positive growth Negative growth Daiichi Sankyo prescription pharmaceutical sales by molecule type ($m), 2004–16 16,000 14,000 12,000 Sales ($m) 10,000 8,000 6,000 4,000 2,000 0 04 05 06 07 Small molecule 08 09 10 Monoclonal antibody 11 Vaccine 12 13 14 Therapeutic protein 15 16 Daiichi Sankyo prescription pharmaceutical sales by source of product ($m), 2004– 16 16,000 14,000 12,000 Sales ($m) 10,000 8,000 6,000 4,000 2,000 0 04 05 06 07 08 M&A 09 Internal 10 11 Co-developed 12 13 In-licensed 14 15 16 Daiichi Sankyo operating revenue/cost analysis ($m), 2004–16 20,000 15,000 10,000 5,000 0 -5,000 -10,000 -15,000 04 05 06 07 08 09 10 11 12 13 14 15 16 Rx pharma Other revenues COGS S,G&A R&D Other operating expense Operating profit Benicar/Benicar HCT sales by geography and analyst consensus ($m), 2004–16 4,000 3,500 3,000 Sales ($m) 2,500 2,000 1,500 1,000 500 0 04 05 06 US 07 5EU 08 09 JAPAN 10 11 ROW 12 13 14 15 Analyst consensus Global 16 Effient sales by geography and analyst consensus ($m), 2004–16 900 800 700 Sales ($m) 600 500 400 300 200 100 0 04 05 06 US 07 08 5EU 09 JAPAN 10 11 ROW 12 13 14 15 Analyst consensus Global 16 Zelboraf sales by geography and analyst consensus ($m), 2004–16 700 600 Sales ($m) 500 400 300 200 100 0 04 05 06 US 07 08 5EU 09 JAPAN 10 11 ROW 12 13 14 15 Analyst consensus Global 16 Memary sales by geography and analyst consensus ($m), 2004–16 450 400 350 Sales ($m) 300 250 200 150 100 50 0 04 05 06 US 07 08 5EU 09 JAPAN 10 11 ROW 12 13 14 15 Analyst consensus Global 16 quality data expert analysis intuitive delivery the home of Business Intelligence © Datamonitor