Swap-Presentation

advertisement

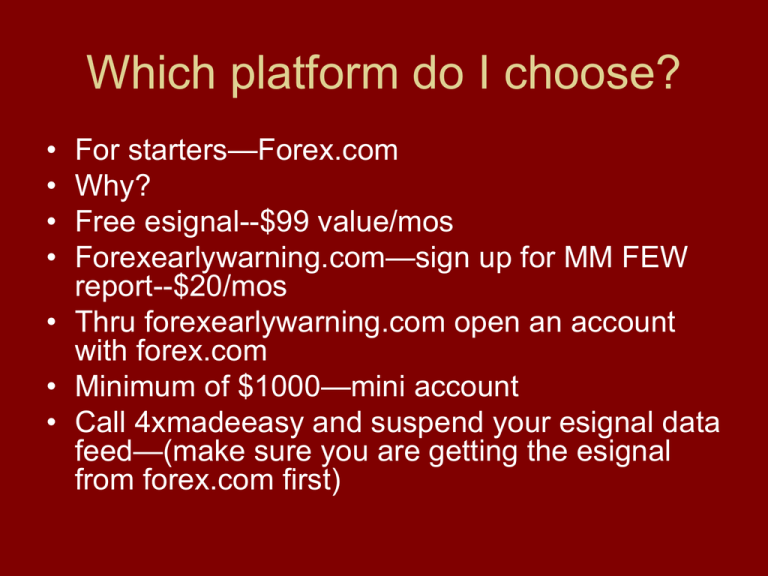

Which platform do I choose? • • • • For starters—Forex.com Why? Free esignal--$99 value/mos Forexearlywarning.com—sign up for MM FEW report--$20/mos • Thru forexearlywarning.com open an account with forex.com • Minimum of $1000—mini account • Call 4xmadeeasy and suspend your esignal data feed—(make sure you are getting the esignal from forex.com first) • Make 10 mini round trip trades (10 in, 10 out) in forex.com account each calander month—if you don’t you will lose your esignal • Forex.com will credit your account each month with $20 to pay for the FEW reports • Worse case scenerio—trade 10 mini lots of eur/usd @ 3 pip spread—get in then out immediately during quiet time—it will cost you $30 --still a net savings of $70 on the esignal and $20 for the FEW. Then what? • FXCM –no dealing desk option, very easy to learn and use, hedge on same account, pay swaps on mini accounts • Interbankfx—no dealing desk, micro/mini/standard accounts, pay swaps on all accounts, great charting, EA compatible (THT) What is a SWAP? • Swap (rollovers) is a debit or credit paid or earned as a reflection of the varying interest rates applicable to currency pairs. When trading the USD/JPY for example, swap interest rates will be determined based on the interest rates of the countries being represented by this pair. Depending on whether you are long or short and which country has higher interest rates, you may be charged or credited interest. Essentially, when a trader holds a position over night they are subject to the interest rates applicable to the currency pair they are trading. • To earn a positive rollover, you must be long the currency paying the higher interest rate. • USD/JPY—US rate is 5.25% and JPY rate is .5% • NZD/USD—NZD rate is 7.25% • If you are short the currency paying the higher interest rate, you will have a negative rollover—you pay. When are swap rates calculated? • Swap rates are calculated daily at 4:59 EST. Trades that have been opened before 4:59 EST and held open past this time will be subject to swap rates. Swap rates are tripled on Wednesday at 4:59 EST. Why are swap rates tripled on Wednesday? • When placing a trade in the spot Forex market, the actual value date is two days forward. A deal done on Thursday is for value Monday. A deal done on Friday is for value Tuesday, and so on. On Wednesday the amount of swap is tripled in order to compensate for the following weekend (during which time swap is not charged because trading is stopped for the weekend). What does MM think? • Tip 9 – Carry trades are great, these are trades where your objective is a combination of high interest income and some capital appreciation. If you buy a pair the high interest payout country must be on the left. For example if you buy the AUD/JPY you are paid the interest differential daily and it is quite large. These are buy and hold trades and more like investing rather than trading where interest accumulation gives you daily and weekly income. Start following interest rates of the various countries and regions if you are interested in this type of investing. You can also papertrade to witness how the interest accumulates. This an excellent trading style for persons who have less time to trade in their schedule. Also consider using a broker with leverage of 200:1 or higher on these types of trades. Swap/spread comparisons • Mini account swap rates for Interbankfx • • • • • • • • • • • • • • • • • • • • • Symbol EUR/USD USD/JPY GBP/USD USD/CHF USD/CAD AUD/USD NZD/USD EUR/GBP EUR/JPY EUR/CHF GBP/CHF GBP/JPY AUD/JPY CHF/JPY EUR/CAD EUR/AUD AUD/CAD AUD/NZD NZD/JPY Buy $-0.60 $1.35 $-0.04 $0.89 $0.22 $0.11 $0.32 $-0.70 $0.85 $0.50 $1.66 $2.05 $1.05 $0.14 $-0.38 $-1.07 $0.29 $-0.26 $1.05 Sell $0.54 $-1.43 $0.03 $-0.94 $-0.35 $-0.24 $-0.37 $0.49 $-1.12 $-0.67 $-2.06 $-2.65 $-1.31 $-0.33 $0.28 $0.91 $-0.39 $0.20 $-1.35 spread 3 pips 3 pips 4 pips 4 pips 5 pips 5 pips 5 pips 4 pips 4 pips 4 pips 7 pips 8 pips 8 pips 7 pips 8 pips 8 pips 8 pips 11 pips 8 pips • • • • • • • • • • • • • • • • • • • • • • • FXCM—hedging, no dealing desk platform Receive swap regardless of margin level Symbol Buy Sell spread EUR/USD $0.59 2-3 pips USD/JPY $1.35 3 pips GBP/USD $0.04 4 pips USD/CHF $0.89 3 pips USD/CAD $0.29 4 pips AUD/USD $0.17 3 pips NZD/USD $0.39 4 pips EUR/GBP $0.52 2 pips EUR/JPY $1.14 2-3 pips EUR/CHF $0.56 2 pips GBP/CHF $1.70 5-6 pips GBP/JPY $2.61 4-13 pips AUD/JPY $1.24 5 pips CHF/JPY $0.34 5 pips EUR/CAD $0.19 6 pips EUR/AUD $0.91 7 pips AUD/CAD $0.40 7 pips AUD/NZD NZD/JPY $1.30 8 pips CAD/JPY $0.89 5 pips Interesting? • • • • • • • • • • • • • • • • • • • • • Forex.com EUR/USD USD/JPY GBP/USD USD/CHF USD/CAD AUD/USD NZD/USD EUR/GBP EUR/JPY EUR/CHF GBP/CHF GBP/JPY AUD/JPY CHF/JPY EUR/CAD EUR/AUD AUD/CAD AUD/NZD NZD/JPY CAD/JPY BUY -$1.20 $0.68 -$0.60 $0.33 -$0.26 -$0.40 -$0.20 -$1.77 $0.51 $0.08 $1.16 $1.78 $0.68 -$0.25 SELL -$0.20 -$1.86 -$0.80 -$1.49 -$0.95 -$1.00 -$1.20 -$0.98 -$1.70 -$1.24 -$2.31 -$2.97 -$1.86 -$0.93 -$1.45 $0.32 $1.35 -$1.45 SPREAD 3 pips 4 pips 5 pips 5 pips 5 pips 4 pips 4 pips 3 pips 4 pips 5 pips 9 pips 9 pips 7 pips 6 pips 8 pips 8 pips 8 pips 6 pips • Personally, I don’t think you are going to get rich with swaps. But it is good to be aware of the swap rates when you are deciding whether to hold or close a trade before the update. • On Wed., I have traded the GBP/JPY just before the update—long position when charts look good, I close it right after the update and earn a few pips and triple positive swap of $2.61 X 3=$7.83 per mini lot. Just make sure the charts look decent.