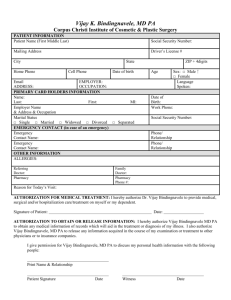

HIGHLIGHTS OF DVAT (4th Amendment)Act,2012

CA VIJAY KUMAR GUPTA vijayguptaca104@yahoo.com

Passed by the Delhi assembly on 13-12-

2012

Received assent of LG on 24-12-2012

Applicable wef 16-01-2013

By CA Vijay Kumar Gupta

2

Amendment in the defination of sale price(Sec.2(1) clause zd(vii)

Retail sale price of petrol and diesel will be treated as sale price

By CA Vijay Kumar Gupta

3

Amendment in Sec.36A

Rate of TDS increase from 2% to 4% for payment made by any person(excluding Individual or HUF)

to any contractor

Uniform rate of TDS to all dealers whether registered or unregistered

Rate of TDS on the payment by contractor to subcontractor increased from 2% to 4%

Uniform rate of TDS to all dealers whether registered or unregistered

By CA Vijay Kumar Gupta

5

Amendment to Sec.58A

Requirement of proceedings under

DVAT-04 has been removed. Now,

Commissioner can order Audit u/s 58A at his own will keeping in mind the nature and complexity of the business of the dealer

Section 58(2) substituted.

Fees of audit shall be determined and paid by the commissioner and his determination shall be final.

By CA Vijay Kumar Gupta

7

Amendment to Sec.95

For New dealers ,intimation of IEC compulsory at the time of Registration

Every dealer has to intimate his existing

IEC number to the Department with in 2 months i.e. 15-03-2013

If obtained subsequently, intimation with in 15 days of obtaining IEC

Failure to intimate IEC leads to penalty of 1000 per week subject to a maximum of 50000/-Sec.95(4)

By CA Vijay Kumar Gupta

9