3.4

advertisement

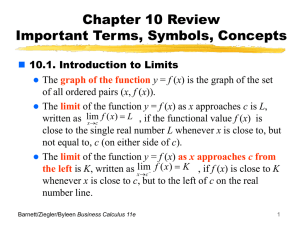

Chapter 3 Mathematics of Finance Section 4 Present Value of an Annuity; Amortization Learning Objectives for Section 3.4 Present Value of an Annuity; Amortization The student will be able to calculate the present value of an annuity. The student will be able to construct amortization schedules. The student will be able to calculate the payment for a loan. The student will have developed a strategy for solving mathematics of finance problems. Barnett/Ziegler/Byleen Finite Mathematics 12e 2 Present Value of an Annuity In this section, we will address the problem of determining the amount that should be deposited into an account now at a given interest rate in order to be able to withdraw equal amounts from the account in the future until no money remains in the account. Here is an example: How much money must you deposit now at 6% interest compounded quarterly in order to be able to withdraw $3,000 at the end of each quarter year for two years? Barnett/Ziegler/Byleen Finite Mathematics 12e 3 Derivation of Formula We begin by solving for P in the compound interest formula: A P 1 i n P A(1 i ) n Barnett/Ziegler/Byleen Finite Mathematics 12e 4 Present Value of the Eight Payments Interest rate each period is 0.06/4=0.015 0.06 P1 3000 1 4 1 P2 3000 1.015 3 P3 3000(1.015) P4 3000(1.015) 4 2 5 Derivation of Short Cut Formula We proceed to calculate the eight payments. We could simply find the total of the 8 payments. There are 8 payments since there will be 8 total withdrawals: (2 years) (four withdrawals per year) = 8 withdrawals. This method is tedious and time consuming so we seek a short cut method. Barnett/Ziegler/Byleen Finite Mathematics 12e 6 Barnett/Ziegler/Byleen Finite Mathematics 12e 7 Barnett/Ziegler/Byleen Finite Mathematics 12e 8 Present Value of an Ordinary Annuity 1 (1 i) n PV PMT i i PMT PV n 1 (1 i) PV = present value of all payments PMT = periodic payment i = rate per period n = number of periods Note: Payments are made at the end of each period. Barnett/Ziegler/Byleen Finite Mathematics 12e 9 Understanding the Concept of Present Value Interest Rates, Compounding, and Present Value In economics, an interest rate is known as the yield to maturity. Compounding is the process that gives us the value of a sum invested over time at a positive rate of interest. Present value is the process that tells us how much an expected future payment is worth today. 11 Compounding Assume you have $1 which you place in an account paying 10% annually. How much will you have in one year, two years, etc? An amount of $1 at 10% interest Year 1 2 3 n o $1.10 $1.21 $1.33 $1(1 + i)n Formula: FV = PV(1 + i) 12 Compounding over Time Extending the formula over 2 years FV = PV(1 + i) (1 + i) or FV = PV(1 + i)2 3 years FV = PV(1 + i) (1 + i) (1 + i) = PV(1 + i)3 n years FV = PV(1 + i)n 13 Present Value Present value tells us how much an expected future payment is worth today. Alternatively, it tells us how much we should be willing to pay today to receive some amount in the future. • For example, if the present value of $1.10 at an interest rate of 10% is $1, we should be willing to spend $1 today to get $1.10 next year. 14 Present Value Formula The formula for present value can be found by rearranging the compounding formula. FV = PV(1 + i) solve for PV o FV/(1 + i) = PV 15 Present Value over Time Extending the formula over 2 years FV = PV(1 + i)2 PV = FV/(1 + i)2 3 years FV = PV(1 + i)3 PV = FV/(1 + i)3 n years FV = PV(1 + i)n PV = FV/(1 + i)n 16 Things to Notice An increase in the interest rate causes present value to fall. Higher rates of interest mean smaller amounts can grow to equal some fixed amount during a specified period of time. A decrease in the interest rate causes present value to rise. Lower rates of interest mean larger amounts are needed to reach some fixed amount during a specified period of time. 17 Example: How much must I invest today to get $10,000 in five years if interest rates are 10%? PV = FV/(1 + i)n PV = $10,000/(1 + .10)5 = $10,000/1.6105 = $6,209.2 How much must I invest today to get $10,000 in five years if interest rates are 5%? PV = FV/(1 + i)n PV = $10,000/(1 + .05)5 = $10,000/1.2763 $7,835.15 18 More Things to Notice Present value is always less than future value. (1 + i)n is positive so FV/(1 + i)n < FV In addition, PV4 < PV3 < PV2 < PV1 (1 + i)1 < (1 + i)2 o The longer an amount has to grow to some fixed future amount, the smaller the initial amount needs to be. 19 Time Value of Money The longer the time to maturity, the less we need to set aside today. This is the principal lesson of present value. It is often referred to as the “time value of money.” 20 Example: If I want to receive $10,000 in 5 years, how much do I have to invest now if interest rates are 10%? $10,000 = PV(1 + .10)5 $10,000/1.5105 = $6209.25 If I want to receive $10,000 in 20 years, how much do I have to invest now if interest rates are 10%? $10,000 = PV(1 + .10)20 $10,000/6.7275= $1486.44 21 Back to Our Original Problem How much money must you deposit now at 6% interest compounded quarterly in order to be able to withdraw $3,000 at the end of each quarter year for two years? Barnett/Ziegler/Byleen Finite Mathematics 12e 22 Back to Our Original Problem How much money must you deposit now at 6% interest compounded quarterly in order to be able to withdraw $3,000 at the end of each quarter year for two years? Solution: R = 3000, i = 0.06/4 = 0.015, n = 8 1 (1 i ) n P R i 1 (1.015) 8 P 3000 22, 457.78 0.015 Barnett/Ziegler/Byleen Finite Mathematics 12e 23 Interest Earned The present value of all payments is $22,457.78. The total amount of money withdrawn over two years is 3000(4)(2)=24,000. Thus, the accrued interest is the difference between the two amounts: $24,000 – $22,457.78 =$1,542.22. Barnett/Ziegler/Byleen Finite Mathematics 12e 24 Amortization Problem Problem: A bank loans a customer $50,000 at 4.5% interest per year to purchase a house. The customer agrees to make monthly payments for the next 15 years for a total of 180 payments. How much should the monthly payment be if the debt is to be retired in 15 years? Barnett/Ziegler/Byleen Finite Mathematics 12e 25 Amortization Problem Solution Problem: A bank loans a customer $50,000 at 4.5% interest per year to purchase a house. The customer agrees to make monthly payments for the next 15 years for a total of 180 payments. How much should the monthly payment be if the debt is to be retired in 15 years? Solution: The bank has bought an annuity from the customer. This annuity pays the bank a $PMT per month at 4.5% interest compounded monthly for 180 months. Barnett/Ziegler/Byleen Finite Mathematics 12e 26 Solution (continued) We use the previous formula for present value of an annuity and solve for PMT: 1 (1 i) PV PMT i i PMT PV n 1 (1 i) n Barnett/Ziegler/Byleen Finite Mathematics 12e 27 Solution (continued) Care must be taken to perform the correct order of operations. 1. enter 0.045 divided by 12 2. 1 + step 1 result 3. Raise answer to -180 power. 4. 1 – step 3 result 5. Take reciprocal (1/x) of step 4 result. Multiply by 0.045 and divide by 12. 5. Finally, multiply that result by 50,000 to obtain 382.50 i PMT PV n 1 (1 i ) 0.045 12 382.50 PMT 50, 000 180 0.045 1 1 12 Barnett/Ziegler/Byleen Finite Mathematics 12e 28 Solution (continued) If the customer makes a monthly payment of $382.50 to the bank for 180 payments, then the total amount paid to the bank is the product of $382.50 and 180 = $68,850. Thus, the interest earned by the bank is the difference between $68,850 and $50,000 (original loan) = $18,850. Barnett/Ziegler/Byleen Finite Mathematics 12e 29 Constructing an Amortization Schedule If you borrow $500 that you agree to repay in six equal monthly payments at 1% interest per month on the unpaid balance, how much of each monthly payment is used for interest and how much is used to reduce the unpaid balance? Barnett/Ziegler/Byleen Finite Mathematics 12e 30 Amortization Schedule Solution If you borrow $500 that you agree to repay in six equal monthly payments at 1% interest per month on the unpaid balance, how much of each monthly payment is used for interest and how much is used to reduce the unpaid balance? Solution: First, we compute the required monthly payment using the formula i PMT PV 1 (1 i) n 0.01 500 1 (1.01) 6 $86.27 Barnett/Ziegler/Byleen Finite Mathematics 12e 31 Solution (continued) At the end of the first month, the interest due is $500(0.01) = $5.00. The amortization payment is divided into two parts, payment of the interest due and reduction of the unpaid balance. Monthly Payment $86.27 Interest Due = $5.00 Unpaid Balance Reduction + $81.27 The unpaid balance for the next month is Previous Unpaid Bal $500.00 Unpaid Bal Reduction – $81.27 Barnett/Ziegler/Byleen Finite Mathematics 12e New Unpaid Bal = $418.73 32 Solution (continued) This process continues until all payments have been made and the unpaid balance is reduced to zero. The calculations for each month are listed in the following table, which was done on a spreadsheet. Payment Payment Interest Inpaid Bal Unpaid Number Reduction Balance 0 $500.00 1 86.27 $5.00 $81.27 $418.73 2 86.27 $4.19 $82.08 $336.65 3 86.27 $3.37 $82.90 $253.74 4 86.27 $2.54 $83.73 $170.01 5 86.27 $1.70 $84.57 $85.44 6 86.27 $0.85 $85.42 $0.03 Barnett/Ziegler/Byleen Finite Mathematics 12e In reality, the last payment would be increased by $0.03, so that the balance is zero. 33 Strategy for Solving Mathematics of Finance Problems Step 1. Determine whether the problem involves a single payment or a sequence of equal periodic payments. • Simple and compound interest problems involve a single present value and a single future value. • Ordinary annuities may be concerned with a present value or a future value but always involve a sequence of equal periodic payments. Barnett/Ziegler/Byleen Finite Mathematics 12e 34 Strategy (continued) Step 2. If a single payment is involved, determine whether simple or compound interest is used. Simple interest is usually used for durations of a year or less and compound interest for longer periods. Step 3. If a sequence of periodic payments is involved, determine whether the payments are being made into an account that is increasing in value -a future value problem - or the payments are being made out of an account that is decreasing in value - a present value problem. Remember that amortization problems always involve the present value of an ordinary annuity. Barnett/Ziegler/Byleen Finite Mathematics 12e 35 Barnett/Ziegler/Byleen Finite Mathematics 12e 36 Barnett/Ziegler/Byleen Finite Mathematics 12e 37 Barnett/Ziegler/Byleen Finite Mathematics 12e 38 Barnett/Ziegler/Byleen Finite Mathematics 12e 39 Barnett/Ziegler/Byleen Finite Mathematics 12e 40 Amount that can be paid off in 20 years, or present value of $917.18 for 20 years at 7.75%. Barnett/Ziegler/Byleen Finite Mathematics 12e 41 Barnett/Ziegler/Byleen Finite Mathematics 12e 42