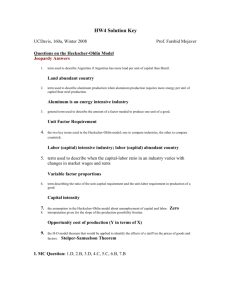

Trade theory 4 - Heckscher-Olin

advertisement

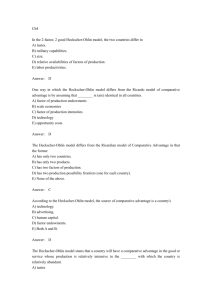

Trade Theories: #4 … Heckscher-Olin Introduction: The Determinants of Comparative Advantage • There are many factors that determine comparative advantage between countries • The reasons why one country might be more productive than another in a particular line of production should be analyzed Modern Trade Theory • Adam Smith and David Ricardo assumed that each country would have its own technology, climate, and resources, and that these differences would give rise to productivity differences (and thus differences in comparative advantage) • In the 20th century, several economists developed more detailed explanations of trade in which comparative advantage of a country depends on it’s endowments of inputs (factors of production) to produce goods Heckscher-Ohlin (HO) Model • Eli Heckscher and Bertil Ohlin, Swedish economists • Model based on two concepts: 1. Factor endowments—the quantities of productive resources possessed by a country 2. Factor intensity—the amount of labor per unit of capital used in production of a product Heckscher-Ohlin (HO) Trade Model • A country’s factors of production (a country’s endowments of inputs) are used to make each good give rise to productivity differences between countries • Factor endowments: – Factor abundance versus factor scarcity: When a country enjoys a relative abundance of a factor, the factor’s relative cost is less than in countries where the factor is relatively scarce – A country’s comparative advantage lies in the production of goods that use relatively abundant factors Heckscher-Ohlin (HO) Trade Model Factors? • Labor • Capital Heckscher-Ohlin (HO) Trade Model • Export goods that intensively use factor endowments which are locally abundant • So … A country that is relatively labor abundant (capital abundant) should specialize in the production and export of that product which is relatively labor intensive (capital intensive) • Corollary: import goods made from locally scarce factors • Patterns of trade are determined by differences in factor endowments - not productivity Country Factor Abundance • Country A is relatively capital-abundant if: KA / LA > KB / LB Obviously, County B would be labor-abundant : LB / KB > LA / KA Example • Two countries (EU and India) and two factors (labor and capital) • EU is capital-abundant compared to India (and India is labor-abundant compared to EU) if and only if the ratio of the total amount of capital to the total amount of labor (K/L) available in EU is greater than that in India An Example of Factor Abundance EU India Capital 50 machines 2 machines Labor 150 workers 10 workers • Indian capital-labor ratio: KInd / L Ind is 2/10 or 1/5 • EU capital-labor ratio: Kus / L us is 50/150 or 1/3 • Since the EU’s capital-labor ratio is higher, it is the relatively capital abundant country: (KEU / L EU > KInd. / LInd. or 1/3 > 1/5 ) Factor Intensity • Labor (capital)-intensive GOOD – a good is labor (capital)-intensive relative to another, if its production requires more (less) labor per machine than the other good requires in its production. – So if production of good x is more labor intensive than production of good z Lx / K x > Lz / Kz Factor Intensity • So assume that the production of… Cloth requires 3 units of labor per 1 units of capital Machines require 2 units of capital per 1 unit labor Obvious … Cloth is Labor intensive and Machines are Capital Intensive Factor Intensity • What about this… Cloth requires 3 units of labor per 1 units of capital Machines require 2 units of labor per 1 unit capital Since we are looking at “relative” values … Still the same … Cloth is Labor intensive and Machines are Capital Intensive Heckscher-Ohlin (HO) Trade Model • Assumptions of the Heckscher-Ohlin Model – There are two countries and two goods … (2x2) model – Production and consumption conducted under perfect competition • Firms are price takers • Prices of factors are determined by supply and demand in each market • In long run, prices of goods are equal to their respective costs of production Heckscher-Ohlin (HO) Assumptions, continued • No transportation costs, taxes, or other obstructions to trade • International trade does not cause complete specialization • Consumers in both countries have equal tastes and preferences • Both countries are endowed with homogeneous factors of production, capital (K) and labor (L), and both are used in production Heckscher-Ohlin (HO) Trade Model Assumptions, continued • Technology for production is the same in both countries and produced under constant returns to scale • Capital and labor are mobile domestically • Labor and capital cannot move between countries Heckscher-Ohlin (HO) Trade Model • The EU is richly endowed with a wide variety of factors: natural resources, skilled labor, and physical capital – Expectation: The EU will export agricultural products (particularly those requiring skilled labor and physical capital) and machinery and industrial goods (requiring physical capital and scientific and engineering skills) – Result: Major EU exports include grain products made with small labor and large capital inputs; and commercial aircraft made with physical capital and skilled labor Gains from Trade in the HO Model • Ricardian (Comparative Advantage) model assumed that each country faced a constant set of tradeoffs because of only one homogeneous input: labor • The HO model assumes: (1) multiple inputs—labor capital, land, etc.—and (2) variations in the quality of inputs • Thus, the PPC cannot be assumed to have constant costs. Under the HO model, each country has a rising opportunity cost for each type of production Production Possibility Frontier • Because EU is capital-abundant and Machines are capital-intensive, IEU’s PPF will lie primarily along (or biased toward) the Machine axis • Because India is labor-abundant and Cloth is labor-intensive, India’s PPF will lie primarily along (or biased toward) the Cloth axis Production Possibility Frontiers Machines .. EU Slope still equals opp. cost …. But since the PPC is curved, the tradeoff between machines and cloth is different at each point of production A India .. Cloth Production Possibility Frontiers Machines .. A – can be the “no-trade” Autarky position for the countries Aeu Aind .. Cloth • Domestics of India will see that relative price of machines in EU is lower than at home • Domestics of EU will see that relative price of cloth in India is cheaper than at home • Producers see the change in consumer patterns and will increase production of abundant factor. • Results in an equalization of price ratios in both countries Production Possibility Frontiers Machines .. Qeu EU will exploit their comparative advantage and increase production of Machines Aeu p Aind Qind p .. Cloth H-O Model FACTOR-PROPORTIONS THEORY Capital Stock per Worker of Selected Countries in 1992 (in 1985 international dollar prices) High-Income Country Switzerland Capital-to-Labor Ratio Middle & Low Income Country Capital-to-Labor Ratio $76,733 Mexico $11,697 Canada 44,970 Poland 11,811 Japan 41,286 Chile 11,306 Australia 38,729 Turkey 7,626 France 37,560 Thailand 5,853 United States 35,993 Philippines 3,598 Netherlands 34,084 India 1,997 Italy 33,775 Kenya 822 Spain 30,888 Nigeria 735 United Kingdom 22,509 Trade and Income Distribution • The HO model provides a more sophisticated way to analyze gains and losses from trade because it drops unrealistic assumptions – Labor can be divided into categories of different skill levels – Other types of inputs can be included – Industries can require different mixes of various inputs • There is a systematic relationship between the factor endowments of a country and the winners and losers from trade • Let’s analyze this claim further…