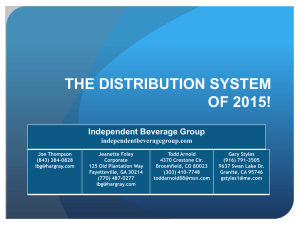

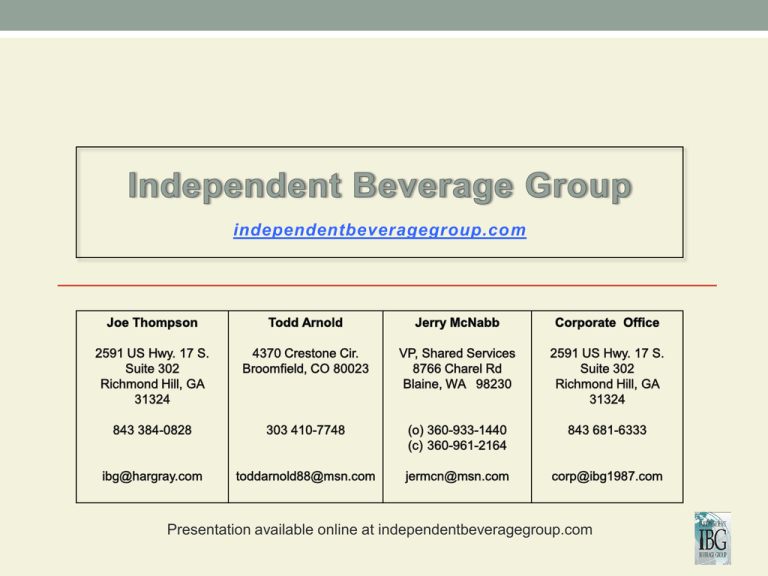

Power Point - Independent Beverage Group

advertisement

independentbeveragegroup.com Presentation available online at independentbeveragegroup.com 2 Volume • Moving Forward • Industry volume will be down (-1.0% through 2020). • ABI and MC will each be down. • All Others will be up. 3 ABI & MC vs. All Others Forecast 160.0 148.5 143.3 140.0 138.1 132.6 127.1 121.4 120.0 115.5 100.0 70.7 61.1 64.1 67.3 74.2 2014 2015 2016 2017 2018 80.0 78.0 81.9 2019 2020 60.0 40.0 20.0 0.0 Assumes overall industry will be down 1.0% during each of the forecast years. 4 % of Absolute Alcohol 70.0% 60.0% 59.6% 58.5% 57.0% 56.3% 55.2% 53.2% 52.0% 50.9% 31.8% 32.5% 33.3% 50.0% Spirits 40.0% 30.0% 20.0% 27.6% 27.9% 29.0% 29.5% 30.4% Wine 12.8% 13.6% 14.0% 14.2% 14.4% 15.0% 15.5% 15.8% 2001 2003 2005 2007 2009 2011 2013 2015 (est.) 10.0% 0.0% Distilled Spirits Council 5 Per Capita Consumption - Beer In Gallons 31.0 30.5 30.6 30.3 30.0 29.5 29.5 29.0 28.5 28.2 28.0 27.6 27.5 27.0 26.5 26.0 2005 2007 2009 2011 2013 6 Distributors Declining – Craft Brewers Increasing 4,500 4,000 4,000 3,500 3,200 2,975 3,000 2,615 2,500 2,267 Brewers 2020 ??????????? 1,905 2,000 1,500 950 1,000 500 900 650 42 0 1970 • 1990 1995 2000 2005 2010 IBG estimates: • 2010 – 950 = 90% of volume. • 2020 – 650 = 85% of industry volume. • Self distribution, sort drink, specialty = 1,000 – 2,500. 2013 2020 7 Beer Brands by Segment -TUS Multi Outlet + Convenience As of mid-year, craft brands and cider brands have already surpassed their numbers in 2013 (based on brands selling more than 1 case). Total Brands 4,577 Total Brands 4,031 Total Brands 4,975 Total Brands 4,948 3451 3493 3109 2669 801 748 57 116 125 215 101 60 113 2011 Premium 801 220 144 130 231 63 102 2012 Sub Premium Import 765 134 216 193 63 92 2013 Craft 122 YTD Super Premium PAB Cider Source: Bump Williams Consulting 197 8 Beer SKUs by Segment 2010-2013 TUS Multi Outlet + Convenience + RMA Sum of Total Liquor Stores The net number of beer SKUs increased by 4,031 or 62.8% over these four years (based on SKUs selling more than 1 case). Total SKUs 9,447 Total SKUs 8,287 Total SKUs 7,256 Total SKUs 5,416 5156 4421 3772 3229 469 501 314 264 499 519 116 2010 Premium 347 365 528 535 Import 399 447 128 2011 Sub Prem 1891 1781 1626 1523 551 555 2012 Craft Sup Prem 460 519 176 2013 PAB Cider Source: Bump Williams Consulting 315 9 Avg Items Carried Per Store - 2008 – 2012 Time Series by Channel 2008 – 2012 Increase In Avg Item Per Store 224 or +22% Avg. Items Per Store 1,234 Avg. Items Per Store 1,202 Avg. Items Per Store 1,124 900 800 700 Avg. Items Per Store 1,080 Avg. Items Per Store 1,010 767 760 693 647 586 600 500 400 300 200 100 113 94 115 89 271 254 239 228 217 117 76 126 120 69 67 0 2008 TOTAL U.S. FOOD 2009 TOTAL U.S. CONV 2010 TOTAL U.S. DRUG 2011 YTD 2012 Sum of Total Liquor Stores Source: Bump Williams Consulting 10 Volume • Distributors and retailers are very focused on above premium category. • Industry is losing heavy beer drinkers due to aggressive pricing. Millennials enjoy craft, FMB’s and cider and drink less than past consumers. • Is our industry spending enough time and attention on premium, premium light and sub premiums? • Currently All Others sell 61M bbls while ABI and MC combined sell over 148M bbls. • Are you spending twice as much time on premium, premium light and sub premium as you spend on All Others? • How many presales people did you have in 2008? How many do you have now? • Is retail taking space from ABI / MC and giving it to specialty, craft, FMB’s, etc.? • We are not saying to diminish effort on All Others, only increase effort on premium, premium light and sub premiums. 11 Margin • Margins will be up but will increase slower. • Return to normal at CPI– 2.5% to 3.0%. 12 Distributor Gross Profit Slowing 9.0% 8.1% 8.0% 7.0% 5.9% 6.0% 5.0% 4.5% 4.5% 4.0% 3.0% 2.3% 2.0% 1.1% 1.0% 0.0% 2005 2007 2009 2011 2013 2014 (est.) 13 Cost • Labor costs will increase. • Number of people. • Particularly ABI/MC sales people. • Wages per person. • Capital expenditures will increase faster than before. • Many distributors have used up excess capacity. • Size matters. • Mega distributors. • 16% cost / 26% margin / $1.75 ++ profit per c/e. • 30 distributors = 30% of volume. • Traditional distributors. • 21 % cost / 25% margin / less than $1.00 profit. • 920 = 60% of volume. • “All Other” distributors will increase but will be more expensive to operate. • 1,000 to 2,500 = 10% of volume. • Plenty of access to market. 14 Profitability 15 Distributor Gross Profit Per Case $5.05 $4.91 $4.85 $4.60 $4.65 $4.45 $4.51 $4.15 $4.25 $4.25 $4.05 $3.75 $3.85 $3.94 $3.65 $3.55 $3.45 $3.55 $3.71 $3.25 2005 2007 2009 NBWA Productivity Report 2011 IBG 2013 16 Distributor Operating Profit Per Case $1.30 $1.25 $1.20 $1.10 $1.10 $1.00 $1.00 $0.90 $0.75 $0.80 $0.80 $0.75 $0.70 $0.60 $0.50 $0.60 $0.67 $0.59 $0.53 $0.40 2005 2007 2009 2011 2013 17 Consolidation • Pace of consolidation will increase. • Value will depend on location, portfolio depth and diversity, strategic potential, number of people interested. • Access to market will be expanded. • Self distribution, Specialty Distributors, Wine / Spirits, Distributors, Soft Drink Bottlers. • Industry will be less stable. • Legislative changes escalating. • On-going violations of 3-tier principles. • Supplier self distribution. • Distributors with more diverse portfolios makes it harder to defend beer’s protection. • Mega distributors, supplier distribution and specialty distributors will grow while traditional distributors will get squeezed from both ends. • Value of distributorships has grown significantly. • Less desirable markets will be difficult to sell. • Growth markets with good portfolios can name their price. 18 WA ABI MT ME ND VT MN OR ID X WI SD X NE Keith & MI Don UT KS AZ Hensley Dobbs NM X OH IN IL CA RI CT PA Hand CO ABI ABI X IA ABI Stokes MO TN X WV VA Jefferies NC Hand OK AR SC TX Nau MS X AL GA Dormity LA FL Lamantia ABI Mega Distributors NJ ABI DE KY ABI Ben E. Keith MA ABI NY WY NV NH MD 19 WA CoHo MT ME ND Taylor VT MN OR NH MA ID Clay WY Ingram WI SD Reyes Clay CO X IL MC KS AZ OK X Clay NM Andrews OH Monarch X X Keg 1 Glazer Andrew s Reyes VA KY NC X TN AR SC Glazer Reyes MS LA Goldring / Moffat AL X RI CT NJ DE IN MO TX MC Mega Distributors PA WV CA Goldring / Moffat ? MI North Coast IA NE NV UT Reyes NY GA X Taylor Reyes FL Gold Coast MD 20 ClickWA MT ME ND Sheehan Maletis VT MN OR NH Sheehan MA ID WI NY Sheehan SD WY RI MI Sheehan PA IA Saccani OH CO SW&S Wirtz UT X X Sheehan Stone NJ NE NV CA CT KS Self AZ Nackard Clement IL Major Brands Rucker IN Sheehan MO X MD WV Sheehan VA KY X DE NC TN OK X AR NM X Ben E. Keith TX Lamantia MS AL SC SW&S GA Young LA FL Brown Craft Mega Distributors X – W/S with significant beer. 21 Positives • Craft category’s creativity, intellect and entrepreneurial spirit creates excitement in industry. • Beer distributors retail penetration is superior to wine and spirits / specialty and self-distribution (structural advantage). • Soft drink? • ABI distributors Monster performance vs. Coke Bottlers. • Marketing potential. • Import / craft marketing is fabulous. • Major brewers marketing potential. • Growing Hispanic demographic. • Potential to expand consumer base with sweeter, flavored products to women and young adults. • Increasing competition. • Gold system (Crown) is a 3rd competitor to ABI / MC. 22 Major Points • IBG believes volume will be negative for several years. • We get a new generation of consumers in 2020 to 2025. • Wine and spirits will try to take share of stomach and will not stop until someone stops them. • Beer distributors will become beverage distributors. • Beer distributors make less per case but sell more cases and could make more money. • Beer distributors will have less franchise protection in some states. • Beer Distributors will need to allocate more resources to mega brands. • Mega brands will not continue to pay the freight for others. MODEL 2020 INDEPENDENT BEVERAGE GROUP 24 Model - 2020 • Challenge: • How to add complexity, contain costs and provide “brand building” benefits. 25 Model – 2020 • “Gigantic” attitude adjustment. • ABI’s Impact Selling System was fantastic push system. • Distributors need to focus on marketing to consumers at retail (pull, not push). • Do you believe beer distributors can significantly influence consumer purchase at retail? • Account managers should be responsible for creating a dynamic purchase environment that emphasizes brand development – “pull” marketing. • More time to sell at store level. • More presales people. • More E-commerce. • Transition replenishment from presales person to retailers through technology. • More inside selling in a professional manner. 26 Model - 2020 • Volume. • Need to be beverage / DSD distributors. • Will have a larger geographical footprint. • Will have different territorial descriptions for different categories. • Will have unique accounts. • Operating Costs. • 12% - 30% average Operating Cost as a % of sales depending on scale and performance requirements. • Mega – 12%, traditional – 18%, others – 30%. • ABI / MC and many distributors have recently cut costs and raised prices but have been ineffective at marketing. • Many brewers are slowly taking margin from distributors and we expect this to escalate. 27 Model - 2020 • Margin. • 18% to 35%. • Average will tend to be lower than today. • Profit. • More total profitability but less per case. 3 THINGS TO REMEMBER INDEPENDENT BEVERAGE GROUP 29 3 Things To Remember • Distribution system needs to focus more time, people and money at improving retail performance (pull, not push). • Distribution system will be more complex and less protected in the future. • Consolidation will be much more difficult and time consuming due to the number of suppliers and categories involved.