Placement Research - 2014 Monaco Symposium on Luxury

advertisement

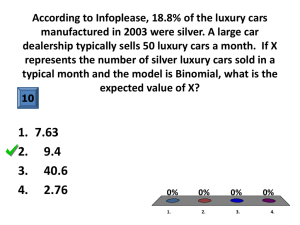

Top Ten Future Research Topics & The CHANCE®-Criterion: Forecasting Success of New Luxury Products 2014 Luxury Conference, Monaco Oliver Heil (*) Armin Münch (**) www.luxury-research.org www.markenwechsel.org (*) Univ.-Prof. Dr. Oliver Heil (Ph.D.) Johannes Gutenberg Universität Mainz Chaired Professor of Marketing (**) Armin Münch CEO, Target Group Frankfurt, Germany A „Top Ten“ of Luxury-Research Challenges & Opportunities • When are luxury brands to successful for their own good (e.g. Porsche, LV, USM and why not Rolex(?)), i.e. resisting the temptation to expand. • Brick & mortar vs internet: The previous enemy became a friend and collaborateur. • Consumption-experience in the luxury segment: What is unique, special and luxurious? • Luxury failures: How to prevent them, to manage them and what is their impact on the brand (e.g. was is right to cut Maybach, is the Bentley GT a failure?) • Social acceptance of luxury—evolution of brands (LV used to be „old“, Rolex „is“ old, exotic skins are out again, footprints of luxorious brands matter more & more) A „Top Ten“ of Luxury-Research Challenges & Opportunities • The power of less: Limited Editions everywhere and no end in sight (enormous wtp but much brand damage if number of LE is wrong) • Global luxury no longer European luxury: Threats due to the advent of Asian luxury brands. • Evolution of luxury: future meanings beyond p,q,x, etc.—e.g. enhance quality of life instead of „luxury is when price does not matter“ (Lagerfeld) • Luxury as front-runner, e.g. new retail formats, new synergetic product-forms & designs e.g. Porsche/Burmester, Hermes/Bugatti, Chopard/Aghili or Wally yacht (design). • Down to business: Predicting the successin and size and growth of luxury segments. 4 I Introduction I High FMCG Flop Rates • Europe: according to GfK, flop rate of all new brands about 70% • USA: only 10-20% of new products and services succeed • Subset of luxury products: seemingly slightly fewer failures but * definition of luxury (e.g. vs. premium) tricky * “missing” data as producers destroy failures • Prediction of Luxury-Failures more important than, e.g. FMCGs * producers feel forced to destroy failures (see above) * brand images more vulnerable (e.g. broken Rolls more delicate than with a broken FIAT) 5 I The CHANCE CRITERION® I Insight * measure market potential for a product (or service) * criterion to predict for each and every single test person * selection: whether or not he/she would switch to a new product for regular use. The CHANCE CRITERION®: switching occurs iff “the new product is viewed to be better along at least one attribute and at least of equal appeal in all, other (n-1) attributes.” Note: no trade-offs, current product as reference, status-quo as driver. Precisoin CHANCE®-Criterium in Reality Premium and luxury products Reality Product Prediction A 600.000 625.000 B 96.000 105.000 C 540.000 545.000 D 760.000 825.000 E 450.000 460.000 F 240.000 280.000 G 540.000 580.000 Note: CC typically underpredicts and, thus, which leads to a less costly error. Conceptual Assessment • Challenge in luxury markets: Predicting Purchase/Switch or Not –since many luxury consumers already have a Rolex, Bentley, Hermes,… • Luxury consumption correlates with cognitive and emotional involvement, (e.g. Luce et al. 1999, Kapferer 2006, 2009, Langer and Heil 2013) making new product sales difficult to predict • Loss aversion – Prospect Theory (e.g. losses more important than gains (Kahneman und Tversky 1979, Hardie 1993)), endowment Effect (subjective price exceeds market price, e.g. Thaler 1980), Regret theory (regret for negative descision/purchase, e.g. Landman 1987, Sudgen 1985) • Norm-Theory (preference for maintaining status quo, esp. as status quo is viewed as normal (Kahneman & Miller 1986)) , Trade-Off avoidance (Kahneman & Tversky 1983, 1990, Payne et al 1993), value fct sketchy 8 I The CHANCE-CRITERION® Model of Brand Choice I With the CHANCE method: Always individually, checking on fulfillment of the CHANCE-CRITERION® PERSON 1 PERSON 2 PERSON 3 … PERSON n Q 1: e.g. Disposition to buy Q 2: e.g. Likes Q3: e.g. Dislikes Q 4: … Q5: … CHANCE Criterion Fulfilled Not fulfilled Fulfilled Fulfilled Not fulfilled Using the CHANCE®-Criterion is Surprisingly easy, fast and cost-efficient Ask simple questions 1. What brand(s) do you own or use most often? 2. Presentation of new product and, also, naming of a possible/probably price, followed by the next question: How would you describe this product to a friend of your, who does not really know this new product? 3. What do you like better about the new product? 4. What do you like less? 5. What would be a price that you deem appropirate and at which you would be likely to purchase the product? Note 1: Simple questions robust and reliable data. Note2: Promising new development Neuro Chance to measure electrical activity in brain (electroencephalogram, EEG) for different luxury products. 10 I The CHANCE CRITERION® and Statistics I Statistical Significance Visual The Significance Visual is ‚borrowed’ from Sequential Analysis. It is the visualization of the standard formula of statistical significance for small numbers of respondents. In reality it is augment using measures of distribution and awareness. Every test person is registered in one of the little squares. The entry is to right if she/he has fulfilled the CHANCE Criterion. If the CHANCE Criterion is not fulfilled, the entry is in vertical direction. The area to the upper left thus is where entries end if the tested brand/ product has little or no consumer potential. The area with the dark lined little squares is the area of statistical uncertainty, doing more interviews might let the entries end in a light area to the right or left. Reaching the light area in the middle means that about half of all respondents are potential regular users. If the entries end in the light area to the right, large consumer potential is indicated. NOTE: CHANCE has been validated in a variety of industries and for 11 I CHANCE CRITERION® -- Consistency Check I 25 25 20 15 23 24 25 20 21 22 30 25 20 24 25 23 15 21 22 19 20 18 18 19 17 17 16 10 16 24 25 23 22 21 20 15 18 19 17 16 15 14 10 15 12 13 11 14 13 14 12 13 12 11 09 08 09 10 06 07 08 10 07 5 05 06 06 04 04 05 04 05 03 5 07 02 03 03 01 02 0 0 5 10 11 # # P O T E N T I A L 11 20 15 08 09 10 11 5 0 K E I N P O T E N T I A L 30 K E I N P O T E N T I A L K E I N P O T E N T I A L 30 10 LUXURY SIDE-BY-SIDE HERO out of 25 = 44% fulfill the CHANCE-CRITERION ® # # 02 01 0 01 0 5 8 # # # # # 8 out of 25 = 32% fulfill the CHANCE-CRITERION 0 5 # # # # P O T E N T I A L P O T E N T I A L ® A few examples of responses to • a new product • an ad campaign . 5 out of 25 = 20% fulfill the CHANCE-CRITERION ® # In Short • Extremely High Precision of Forecast • Nice Error Structure • Sound Theory • Surprisingly Small Sample Sizes Needed • Very Good Efficiencies – Time – Cost • Nicely Suited Research-Instrument for Luxury Research