Serodus ASA - Norne Securities

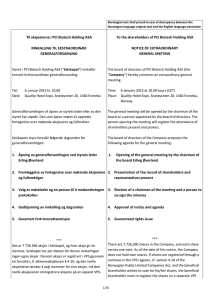

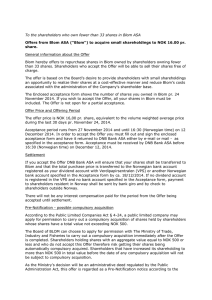

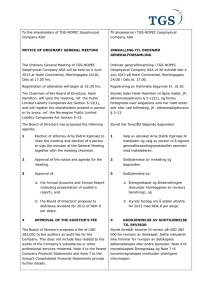

advertisement