utility billing best practices - Florida Government Finance Officers

advertisement

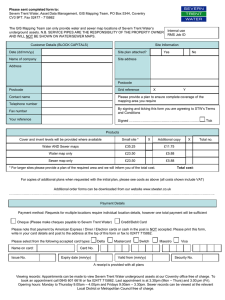

“UTILITY BILLING BEST PRACTICES” The trials and tribulations of dealing with water/sewer customers and their bills Florida Government Finance Officers Association (FGFOA) School of Government Finance – November 18-22, 2013 “UTILITY BILLING BEST PRACTICES” Presentation by Ingrid Gaskin-Friar November 21, 2013 – 10:00 a.m. – 11:40 a.m. I Introduction II Overview – Hierarchy and Responsibilities of Staff III City Code – Chapter 32 IV Bill Samples and Billing Rates V Bad Debt VI Refunds VII Mandatory Hook-up VIII Application Process IX Collections X Cut-Off Policy XI Opportunity to Increase Payment XII Questions and Answers XIII Appendix Material City of Melbourne Website Section I Introduction LEADERSHIP A) Wren, J.T. (Ed.). (1995). The Leader’s Companion: Insights on Leadership Through the Ages. New York: Free Press, p.70. Water: “The wise leader is like water. Consider Water: Water cleanses and refreshes all creatures without distinction and without judgment; Water freely and fearlessly goes deep beneath the surface of things; Water is fluid and responsive; Water follows the law freely. Consider the Leader: The Leader works in any setting without complaint, with any person or issue that comes on the floor; the Leader acts so that all will benefit and served well regardless of the rate of pay; the Leader speaks simply and honestly and intervenes in order to shed light and create harmony. From watching the movements of Water, the Leader has learned that in action, timing is everything. Like Water, the Leader is yielding. Because the Leader does not push, the group does not resent or resist.” B) The City of Melbourne bills approximately 58,000 utility customers monthly. Staff address 8,000 to 10,000 calls monthly. The City utilizes Tyler, MUNIS CIS-software for its utility billing. Water and Sewer rates increased by an average of 7% in this fiscal year, in accordance with a five-year rate plan approved by Melbourne City Council in May 2012. The water and sewer system budget is proposed to increase by $1,897,846 from this past year. Total water sales: $24,000,000 Sewer charges: $18,000,000 Note: The City of West Melbourne utilizes the City’s bulk water sales at the inside City rate. The City of West Melbourne utilizes 9% of the City of Melbourne’s water sales. Section II Overview – Hierarchy & Responsibilities Of Staff Financial Systems Administrator Utility Billing Special Chief Accounts Clerks (3) Financial Services Director of Finance Customer Service Manager Sr. Accounts Clerks (5) Accounts Clerks (5) Accounts Clerks – Part Time (2) – AARP Switchboard Operator STAFFING RESPONSIBILITIES RELATING TO CUSTOMER SERVICE CALLS: Four (4) Accounts Clerks provide cashiering function in conjunction with Customer Service at the front office. Chief Accounts Clerks and Senior Accounts Clerks assist with Customer Telephone calls in conjunction with other daily assignments. Utility Billing Specialist addresses customer complaints transferred from staff, prior to forwarding to the Customer Service Manager. Financial Systems Administrator is responsible for all technological improvements/upgrades and month end closing. Customer Service Manager addresses customer complaints that are forwarded from the Utility Billing Specialist, Director of Finance, and City Manager/Council. Finance Director assumes the customer complaint, if the customer refuses to speak with the Customer Service Manager. City Manager delegates customer complaints to Director of Finance and/or Customer Service Manager for resolution. 99 % OF CUSTOMER ISSUES ARE ADDRESSED AT THE STAFFING LEVEL Section III City Code – Chapter 32 City of Melbourne Utility Billing City Code City Manager: (Reference City Code Sections below) MELBOURNE CITY CODE Sec. 32-11 Administrative Adjustments to Utility Bills MELBOURNE CITY CODE Sec. 32-79 Authorized to provide adjustments to Water Bills MELBOURNE CITY CODE Sec. 32-308 Sewer Service Rate Section IV Bill Samples and Billing Rates Residential Customers’ Water and Sewer Security Deposit ¾ inch meter - $120.00 * Water and Sewer Security Deposits vary by size of meter or number of units for multi-family establishments and by city ** Commercial customers -2 ½ times the average monthly bill at same location METER SIZE WATER COST SEWER COST ¾” $43.00 $77.00 1” $107.50 $192.50 1 ½” $215.00 $385.00 2” $344.00 $616.00 3” $791.00 $1,416.80 4” $1,075.00 $1,925.00 6” $2,150.00 $3,850.00 8” or larger To be negotiated City Code Sec. 32-78 Construction Meter Water Sales: A customer may tap a fire hydrant for construction use only with permission from the City and after placing a meter deposit and payment for the water used based on volume registered by the meter. METER SIZE DEPOSIT AMOUNT ¾ inch $150.00 1 inch $300.00 2 inch $1,000.00 Deposit is refunded when the meter is returned. 1. View a Typical Bill Charges: Water Sewer Garbage Recycling Yard Trash 2. Advisory Notes on back of utility bill: City of Melbourne water, sewer, garbage, recycling and yard trash, reclaim water City of Melbourne water, Brevard County sewer, garbage, recycling, yard trash, and utility tax City of Melbourne water, City of Cocoa Beach sewer City of Melbourne water, City of Palm Bay sewer (Lakes of Melbourne) City of Melbourne water, City of West Melbourne sewer* Late Fee, Shut Off Fee, Lien Fee are also included on the bill Bills include a Shut Off date where applicable *The City of West Melbourne utilizes the City of Melbourne’s bulk water sales at the inside City of Melbourne rate. TWO TYPES OF BILLING Regular paper bills via U.S. Mail E-Bills Billing Functions are outsourced with AXIS Bill due date: 25th day of the cycle Late Fee Applied: 26th day of the cycle ACH Bills with bank draw: 25th day of the cycle Final Bills: Security deposit credit refunded SAMPLE RESIDENTIAL ACCOUNT COMPUTATION Each week of month is a regular billing period for 12,000 to 16,000 Bill Accounts. Approximately 700 – 800 accounts are finaled monthly. * Waste Management Contract ** Funds utilized to manage Recycling Division AMOUNT RATE Water Base Charge (inside) Water Consumption TOTAL $7.58 8,000 Gallons $4.66 Sewer Base Charge (inside) Sewer Consumption CALC. +37.28 $ 44.86 $11.21 8,000 Gallons $6.49 $51.92 $63.13 Utility Tax (none) Garbage * $6.50 Recycling/Yard Trash * $4.07 Sanitation Service Charge ** Shut Off Charge Late Fee 1.5% $.27 Minimum $30.00 $5.00 SAMPLE COMMERCIAL ACCOUNT COMPUTATION *Waste Management Contract ** Funds utilized to manage Recycling Division Shut Off Charge $30.00 Late Fee 1.5% , Minimum $5.00 AMOUNT RATE CALC. Water Base Charge (inside) 14 ERCs $7.58 $106.12 Water Consumption 112,000 Gallons $4.66 +521.92 Sewer Base Charge (inside) 14 ERCs $11.21 $156.94 Sewer Consumption 112,000 Gallons $6.49 $726.88 Utility Tax TOTAL $628.04 $883.82 None Garbage * 89 units $6.50 $578.50 Recycling/Yard Trash * 89 units $4.07 $362.23 Sanitation Service Charge ** 89 units $.27 $24.03 Shut off Charge*** Late Fee 1.5% Min. $5.00 Total Bill *** Call Commercial Customers or use Door Knocker $2,476.62 The City of Melbourne provides billing services for the following cities at “outside” City rates for city water and Brevard County sewer charges: City of Melbourne Beach Town of Palm Shores City of Indialantic The City of Melbourne City of Satellite Beach City of Indian Harbour Beach The City of Melbourne provides billing services for Utility Taxes - charges each City a billing service fee: Indian Harbour Beach 6% Tax West Melbourne 8% Tax Indialantic 10% Tax The City of Melbourne Palm Shores 10% Tax Melbourne Beach 9.5% Tax Melbourne Village 6% Tax Notably absent: City of Melbourne customers have no Utility Tax The City of Melbourne bills sanitation services for the following companies under contract: Waste Management Waste Pro (Back door, curbside, multi-family) for garbage, recycling and yard trash (Back door, curbside, multi-family) for garbage, recycling and yard trash Customer Contacts: Letter Telephone Outside Drop Box Lobby Drop Box Email Fax Customer Walk Ins Section V Bad Debt A) Write off/bad debt 1) 3 years history of write offs 2) write off as a percentage of water sales WATER SALES 2011 2012 2013 • $26,291,280 • $27,694,566 • $27,579,821 BAD DEBT 2011 2012 2013 • $207,959.11 011 • $228,473.46 • $128,143.18 PERCENTAGE OF BAD DEBT TO WATER SALES 2011 2012 2013 • 008% less than 1% • .008% less than 1% • .005% less than 1% B) 2011 2012 2013 SEWER CHARGES • $17,536,902 • $17,928,518 • $18,220,110 RECONNECTION CHARGE $30.00 SHUT OFF FOR NON PAYMENT 2011 2012 2013 • $309,767 • $315,000 • $267,000 3% UTILITY TAX BILLING FEE 2011 2012 2013 • $8,803 • $8,600 • $8,991 SERVICE INITIATION FEE SERVICE FEE BROKEN METER OR CURBSTOP 2011 2012 2013 • $21,119 • $28,000 • $20,062 2011 2012 2013 • $165,295 • $170,000 • $164,319 WASTE MANGEMENT BILLING FEE $.79 PER BILL 2011 2012 2013 • $300,453 • $306,000 • $285,119 WASTE PRO BILLING FEE $.79 PER BILL 2011 2012 2013 • $13,274 • $12,600 • $14,787 BILLING FEES MELBOURNE VILLAGE 3% UTILITY TAX REVENUE 2011 2012 2013 • $2,812 • $3,000 • $2,925 PALM BAY (SEWER) $1.59 PER BILL 2011 2012 2013 • $7,660 • $7,700 • $7,710 BILLING FEES BREVARD COUNTY (SEWER) $1.59 PER BILL 2011 2012 2013 • $382,256 COCOA BEACH (SEWER) $3.00 PER BILL 2011 • $384,500 2012 • $366,819 2013 • $12,885 • $12,650 • $13,401 RECLAIMED WATER SALES 2011 2012 2013 • $167,519 • $175,000 • $177,689 LATE FEES 1.5% $5.00 MINIMUM 2011 2012 2013 • $526,433 • $550,000 • $509,505 RECORDING FEES Administrative Fee $25.00 Recording Fee $25.00 2011 2012 2013 • $27,700 • $35,000 • $21,973 Section VI Refunds A) History of water and sewer adjustments B) Approval process C) Melbourne City Code Sec. 32.308(d) LEAK ADJUSTMENTS: Pool Fill Pool Refill Slab Leaks Special City Manager Request SEWER CREDITS WILL NOT BE GRANTED FOR: Broken or leaky water lines where the water enters the sanitary sewer system (leaky toilets or inside faucets) Water used for irrigation Negligent use of water Undetermined use of water SEWER ADJUSTMENTS YEAR NUMBER OF ACCOUNTS GALLONS IN THOUSANDTHS DOLLAR AMOUNT 2011 436 15,036.1 $91,953.47 2012 466 22,031.5 $140,102.79 2013 424 26,571.8 $113,108.70 WATER ADJUSTMENTS YEAR NUMBER OF ACCOUNTS GALLONS IN THOUSANDTHS DOLLAR AMOUNT 2011 130 12,243.5 $52,183.58 2012 117 13,338.4 $57,376.08 2013 101 11,178.2 $49,869.64 Section VII Mandatory Hook-up WATER AND SEWER IMPACT FEES WATER AND SEPTIC SYSTEM WATER ONLY ANNEXATION – BILL GARBAGE ONLY (TEMPORARY) MAY BILL BASED ON A FIVE-YEAR LINE EXTENSION PAYMENT PLAN – INTEREST INCLUDED Section VIII Application Process A) B) C) D) E) F) G) H) I) Refundable Security Deposit – Residential ¾” Meter $43.00 Water and $77.00 Sewer Non-refundable Initiation Fee Rental Lease Picture Identification – Driver’s License/Passport Ownership Documentation or HUD Statement Annual Water and Sewer Rates ERC Where Applicable ERC Computation for Multi-family & Commercial Accounts Exemption from Security Deposit: Twelve Consecutive Months of Good Pay History at a Prior Address Note: May Relinquish Capacity in Writing or After 12 Months, Pay Impact Fees or Pay Water and Sewer Base Charges Section IX Collections BANKRUPTCY A) Bankruptcy Court Documentation – Bankruptcy Date B) Compute Bankruptcy Amount – Amount Written Off C) New Account Established – Post Bankruptcy Date D) Type of Bankruptcy – Chapter 7, Chapter 11, etc. E) Receivership – Receiver Pays Utility Bills (legal document) Required to Change Name LIENS AND COLLECTION AGENCIES A) $100.00 Minimum Balance to Place a Lien B) Lien on Owner Account C) Probate Documentation/New Owner to Establish Service LIENS Following Lien Schedule for Liens and Lien Releases 2008 – 2011 Liens Gradually Increased LIENS FILED Year No. of Liens 2011 LIENS RELEASED Revenue Year No. of Liens 237 $68,661.80 2011 215 $57,871.09 2012 455 $149,482.55 2012 333 $97,981.32 2013 303 $91,479.97 2013 403 $137,667.36 Revenue Section X Cut-off Policy Automatic Meter Reader (AMR) Meter ADE Meter with AMR Data Profile Capability: Hourly Water Consumption Program – Graph Downloaded and Formatted into Word Format Manual Meters are Converted to AMRs Remote Meter Commercial/Multi-Family Units 5 Days Before – Notice Posted on Premise at Individual Units Certified Letter Sent to Owner - $250 Connection Fee BILLING ERRORS A) B) C) D) Billing Adjustments for Incorrect Reads Utilize the High and Low Report Estimated Bills – Flooding, etc. Utilize Skipped Bill Report THEFT OF WATER A) B) C) D) Fraudulent Lease Squatters – Residence Former Owners Renting Their Foreclosed Property Account in a Different Customer’s Name – to Avoid Existing Balance E) Accounts Left in Owner’s Name COORDINATION WITH CHARITIES A) Vouchers B) Shut Off for Delinquent Bills C) Utility Bill Balance – No Security Deposit CUT OFF POLICIES AND PROCEDURES A) B) C) D) E) Threshold Balance–Equal to or Greater than $75 Monday, Tuesday, Wednesday, Thursday Melbourne, Beaches, Eau Gallie (Schedule) Shut Off Date is Noted on Bill Shut Off a Week After date Stated on Bill; i.e., Shut Off Date 9/16/13; Shut Off 9/23/13 Approximately 900 Accounts Shut Off Monthly PROCESS Check Special Condition Notes Date Generated Work Orders EFT Text Account Inquiry 900 Metered Accounts Shut Off per Month # OF ACCTS ON SONP LIST C1 611-650 C1 110-119 C1 120-124 C1 205-221 MAY 35 44 24 39 C2 655-745 C2 127-139 C2 140-150 C2 222-250 JUNE 53 42 22 43 JULY 50 45 38 55 65 40 58 43 34 68 75 79 AUG 49 44 28 53 SEPT 31 37 26 45 59 26 34 47 C3 817-870 C3 151-155 C3 156-162 C3 254-337 34 21 70 52 37 23 54 68 43 32 30 28 57 40 81 58 44 26 62 74 C4 912-957 C4 170-181 C4 182-191 C4 341-411 14 72 37 14 28 85 28 10 27 83 40 16 37 85 43 24 20 62 27 15 MINIMUM $$$ ON SONP LIST MAY $75.00 $75.00 $75.00 $75.00 JUNE $75.00 $75.00 $75.00 $75.00 JULY $75.00 $75.00 $75.00 $85.00 $75.00 $75.00 $75.00 $75.00 $115.00 $75.00 $75.00 $75.00 AUG $75.00 $75.00 $75.00 $75.00 SEPT $100.00 $75.00 $75.00 $75.00 C1 C1 C1 C1 611-650 110-119 120-124 205-221 C2 C2 C2 C2 655-745 127-139 140-150 222-250 C3 C3 C3 C3 817-870 151-155 156-162 254-337 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $100.00 $125.00 $75.00 $75.00 $75.00 $115.00 $75.00 $75.00 $75.00 $75.00 C4 C4 C4 C4 912-957 170-181 182-191 341-411 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $115.00 $115.00 $85.00 Section XI Opportunity To Increase Payment OPPORTUNITY TO INCREASE EASE OF PAYMENT BY: Drop Box Outside City Hall Drop Box in the Lobby of City Hall ACH – Checking, Savings (Requires ACH Form) Online Payment Access - Website PAYMENT VIA PAYMENT PROCESSOR: Visa Mastercard Discover American Express ($2.50 FEE FOR INCREMENTS OF $100.00) PAYMENT VIA E-CHECK: Checking Account Savings Account ($2.70 FEE FOR E-CHECK) Section XII Questions & Answers Section XIII Appendix Material Ingrid Gaskin-Friar City of Melbourne Customer Service Manager 321-608-7160 igaskin@melbourneflorida.org Ms. Ingrid Gaskin-Friar joined the City of Melbourne in 1989. Ms. Gaskin-Friar has been the City of Melbourne Customer Service Manager for the past 15 years, where she manages Utility Billing and Collections and the Revenue Division, supported by a staff of 21 employees. Prior to serving as the City’s Customer Service Manager, Ingrid worked as the City of Melbourne Grants Administrator for 9 years, where she prepared grant applications and managed thousands of dollars in grant projects. Ingrid worked as a Tax Auditor with the State of Florida Department of Revenue in 1988, after holding several positions as staff accountant in the private sector and banking institutions. Ingrid received a MBA in 1993 from Florida Institute of Technology, Melbourne, FL and a BS in Public Accounting from Fordham University, Bronx, NY. Ingrid served as President of the Space Coast FGFOA Chapter from 2011-2013, is a 2013 Chairperson on Treasury/Debt Section Subcommittee of FGFOA School of Government Finance, and since 2005 has served as Treasurer of the Laurelwood Home Owners’ Association.