Maximising Protection Sales

Paul Walkinshaw

This document is directed at professional financial advisers only and should

not be distributed to, or relied upon by retail customers

The information is based on our interpretation of current HM Revenue & Customs

practise, which can change

Module Objectives

By the end of this training module you will:

Understand the importance of Knowing Your Customer;

Describe the sales process and sales cycle

Demonstrate an understanding of effective communication;

Demonstrate an understanding of the A to B questioning technique.

Demonstrate an understanding of 3 level questioning

Understand how to link products to client’s needs

2

2

Today's Agenda

Part 1 = Housekeeping, Introductions & Objectives;

Part 2 = Know Your Customer and the Sales Process

Part 3 = Effective Communication;

Part 4 = Questioning Techniques;

Part 5 = Presenting the solution

Close

3

3

Introductions

Full name

How long have you worked in Financial Services and

your role

Why are you here?

4

Know Your Customer

“Where advisers did not sufficiently assess customer needs, for

example by failing to adequately establish their customer's attitude to

risk or to explain the implications of limiting their advice to the

customer's objectives, the advice process was deemed to be

inadequate. This is because an inadequate assessment of client

needs poses a significant risk to the provision of a suitable

recommendation.”

Source: FSA:

Consumer Research 52 ‘Quality of advice process in firms offering financial advice: findings of mystery shopping research’

Aug 06

Link: http://www.fsa.gov.uk/pubs/consumer-research/crpr52.pdf

5

5

The sales process

7. AFTER

SALES

FOLLOWUP

1. PLAN

AND

PREPARE

6.

CONCLUDE

THE SALE

2. OPENING

and

OBJECTIVE

5.

OBJECTION

HANDLING

3. IDENTIFY

THE NEEDS

4. PRESENT

THE

SOLUTIONS

6

The sales process

7. AFTER

SALES

FOLLOWUP

1. PLAN

AND

PREPARE

6.

CONCLUDE

THE SALE

2. OPENING

and

OBJECTIVE

5.

OBJECTION

HANDLING

3. IDENTIFY

THE NEEDS

4. PRESENT

THE

SOLUTIONS

7

Life Protection

Critical Illness

Income Protection

Mortgage Protection

Behavioural Traits of customers

8

Major General - be brief be bright be gone

Socialiser

- involve me and make it fun

Carer

- show me you care, listen to me

Detective

- be right , be detailed, be patient

Collaborator - works with you to the right outcome

Selling the service/ full review

9

Building rapport

Moving to purpose

Stating process and benefit

Seeking customer confirmation to proceed

Sign-posting generally

Keeping the customer involved

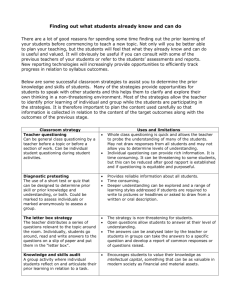

Factfinding Information

Hard Facts:

Name;

Date of Birth;

Marital Status;

Children;

Address;

Sex;

Etc.

10

Soft Facts:

Plans;

Feelings;

Thoughts;

Aspirations;

Preferences;

Dreams;

Etc.

10

The egg timer model

Clien

t

Views and

opinions

Current

Need

s

Feature

s

Solution

How it works

What are the benefits

11

Hearing or Listening?

Hear:

• verb (past and past part. heard) 1 perceive (a sound) with

the ear.

Listen:

• verb 1 give one’s attention to a sound. 2 make an effort to

hear something.

SOURCE: Compact Oxford English Dictionary

12

12

Active Listening

You can show that you are listening by:

SUMMARISING:

“So what you are saying is….”

“As I understand it….”

Benefits of summarising are:

Checks your understanding

Show’s you’ve been listening

Show’s interest

13

13

Active Listening

You can show that you are listening by:

REFLECTING:

“That must have really upset you”

“You felt that…”

“That must of been nice”

Benefits of reflecting are:

Brings out speakers feelings

Shows empathy

Shows you understand

14

14

Dealing with Objections

Six typical techniques used in dealing with objections:

1. Park it;

2. Answer it and confirm;

3. Accept it and balance it with a benefit;

4. Offer extra information;

5. Reduce it to zero

6. Question it through to agreement.

15

15

Handling Objective

Pace Technique

Probe the initial point raised by the customer;

Identify the REAL reason – often the first objection raised is a smoke screen!

“Apart from that, is there anything else that concerns you”

Acknowledge you understand their point of view;

Let the customer know that you have heard their concern!

“Yes, I can see that is an important issue”

Confirm that there is a solution;

Having identified one or more areas, you can now answer the objections!

“You will be pleased to know that I can offer you…”

Engage in conversation about the customers options

Now is the time to ensure the customer is happy with your answers!

“Are you happy with how this will work for you”

16

16

Handling Objectives

Feel, Felt, Found

FEEL;

Show empathy to the customers query & you understand their concern!

“I can understand how you feel”

FELT;

Next, reassure them that they are not alone!

“Many of my customers have felt the same. However”

FOUND;

Show the benefits. Customers often object if they haven’t seen them!

“They have found that…”

17

17

A to B Questioning Technique

SALES TIP: You need to know 3 things before moving on to the next stage:

Identify current standard of living / Annual Household Income / Term of Years Cover Required

A

What position

financially would

you want your

family to be in?

18

18

“A” Type Questioning

If you had died yesterday…………”

What position financially, would you want your

Spouse/Partner/Family to be in?

What impact would it have on the standard of living for

your family?

How long would you want your current level of income to

continue for?

19

19

A to B Questioning Technique

SALES TIP: Keep this high level, this is not flicking through each of their policies at

this stage, I mean getting a basic level of understanding as to what the customer has in place

A

What position

financially would

you want your

family to be in?

20

B

What cover do

you Currently

have in place?

20

“B” Type Questioning

What cover do you currently have in place and what will

they provide?

What cover is provided through your employer?

At this stage it often appears that the customer may not want their family to

face financial hardship in the event of loss of income or early demise but based

on what is currently in place it is quite obvious to them that this is what is

facing them in the event of anything happening!

21

21

A to B Questioning Technique

How big is the Gap?

“The Gap”

A

What position

financially would

you want your

family to be in?

22

B

What cover do

you Currently

have in place?

22

“The Gap” Type Questions

How do you feel about this?

How would this affect the family and your plans?

Does it concern you enough to want to talk about it

further today?

23

23

The onion model

Personality

Values

Attitudes

Personality

Behaviours

24

3 level questioning

Understanding the gap between the ideal and what

arrangements are already in place

Linking to currents arrangements ask why those

arrangements? ( list reasons)

Replay reasons and seek customer view as to the most

important

Replay most important and ask “ why” is this most

important to you.

25

Consequences

Reiterate what the client would want in the event of

death etc

Illustrate the gap

Ask client to explain consequences of taking no

action

Follow up with “is that what you want”

Repeat until client concludes what needs to be done

Then return to second need

26

Concept of Benefit Selling

“The concept of benefit selling is a straightforward one. It

is based on the fact that people buy your products and

services not so much for what they are, but for what they

do for them. Benefit selling is an approach which should

be the basis for any sales presentation. It is an approach

which concentrates on highlighting to potential buyers

the benefits to them of the product or service being sold”

27

27

Features, Advantage and Benefit

FEATURE

“Which means that….”

BENEFIT

28

28

The egg timer model

Clien

t

Views and

opinions

Current

Need

s

Feature

s

Solution

How it works

What are the benefits

29

What we have covered

Know Your Customer;

Sales Process /Sales Cycle

Effective Communication;

Questioning Techniques

Presenting solutions

close

30

30

Maximising Protection Sales

ANY QUESTIONS?

This document is directed at professional financial advisers only and should

not be distributed to, or relied upon by retail customers

The information is based on our interpretation of current HM Revenue & Customs

practise, which can change

Axa Sun Life Services plc distributes and administers financial products and services. It is authorised and regulated by the Financial

Services Authority and is a company limited by shares, registered in England No. 3424940, registered office: 5 Old Broad Street, London,

EC2N

1AD.

As

part

of

our

commitment

to

quality

service,

telephone

calls

may

be

recorded.

31

31