An Analysis of Horizontal & Vertical Restraints

advertisement

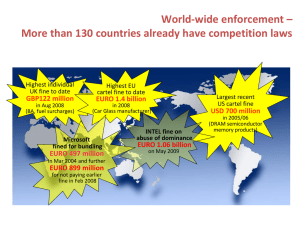

Agreements I Barbados Fair Trading Commission Program in Competition Law and Policy Barbados – March 30 – 31, 2011 Sean Dillon Bureau of Competition United States Federal Trade Commission These views are those of the author and do not necessarily represent the position of the Federal Trade Commission or any individual Commissioner. Goals of this session: Types of Agreements (horizontal, vertical, cartel) Harms of collaboration Benefits of collaboration Per se vs. Rule of Reason Elements of a Case Proof of an Agreement Justifications for the Agreement Harm to consumers/anticompetitive effects 2 Horizontal Agreements Barbados Law Fair Competition Act, Section 13(2) Prevents agreements between businesses that have or are likely to have the effect of preventing, restricting or distorting competition in a market. 3 Comparison with U.S. Law Under Section 1 of the U.S. Sherman Antitrust Act: “Every contract, combination … or conspiracy, in restraint of trade … is declared to be illegal ....” Prohibits only those contracts or agreements that restrain trade unreasonably (as determined by the courts). FTC Act, 15 U.S.C § 45(a): “(1) Unfair methods of competition in or affecting commerce … are hereby declared unlawful.” 4 Agreements Between Competitors U.S. law divides anticompetitive agreements between competitors into two groups: Illegal “per se” Purpose and effect are irrelevant Strict liability These include cartels and other agreements that by nature almost always injure competition Judged by “rule of reason” May or may not be illegal depending on all of the facts and circumstances, including its purpose, any anticompetitive effects, any benefits from the agreement Careful analysis needed to know which applies 5 Collusion: Offense Illegal Per Se Per se offenses are naked agreements among competitors to: No justifications are permitted Fix prices Divide markets Reduce output Rig bids These always injure competition No benefits to consumers Hard core cartels punishable by prison, fines 6 Agreements Subject to Rule of Reason Other agreements among competitors are analyzed according to their purpose and competitive effects Some are beneficial, but Others simply reduce output, reduce choice and increase cost In such cases, agreements are illegal only if it is shown that harm outweighs benefits Agreements found illegal under the Rule of Reason are typically remedied through injunction and damages 7 VERTICAL The Chain of Production Supplier Supplier Supplier Manufacturer Manufacturer Manufacturer Distributor Distributor Distributor Retailer Retailer Retailer HORIZONTAL 8 HORIZONTAL AGREEMENTS & CARTELS 9 Distinction Between Cartels and Other Types of Horizontal Agreements Cartel agreements typically include one or more of the following: Agreements Agreements Agreements Agreements markets Agreements on what price to charge to limit their output to allocate customers to divide territories or to rig the bidding process 10 Distinction Between Cartels and Other Types of Horizontal Agreement Cartel agreements are illegal per se Competitive harm is presumed Experience shows these agreements almost always lead to higher prices & reduced output No justifications or defenses considered Preventing destructive or “cut-throat” competition Enhancing service and quality competition Preventing “unsafe” competition The agreed upon prices are reasonable Subject to criminal prosecution in U.S. Leniency Programs – Eliminate or reduce criminal penalties against those that report cartels first. U.S. Government’s primary way of detecting cartels. 11 Distinction Between Cartels and Other Types of Horizontal Agreements Other types of horizontal agreements may or may not harm competition May benefit competition when they create efficiencies: Lower costs Reduce risks Create new or improved products or manufacturing or distribution methods Improve the flow of information May harm competition when they create or facilitate the exercise of market power 12 Types of Horizontal Agreements Agreements on Price Facilitating Practices Agreements Quiet Life Agreements Group Boycotts Joint Venture Agreements Agreements to Improve Functioning of the Market Trade Associations 13 Horizontal Agreements on Price: Price Fixing Agreements These are the most serious because price often is the principal way that firms compete. It is the agreement that is illegal, regardless of whether the parties to the agreement ever charge the agreed upon price. These agreements can take many forms, but do not require an agreement on the ultimate price that will be charged. 14 Different Forms of Price Fixing Agreements To raise or stabilize the price On a standard formula by which to compute prices To eliminate discounts or to establish uniform discounts On credit terms that will be extended to customers To use a uniform price as a starting point for negotiations with potential customers To discontinue free services To impose a mandatory surcharge To use a common sales agent to set prices To restrict price advertising 15 Example: The Lysine Conspiracy Lysine is a feed additive used by farmers in livestock feeds – a worldwide $600 million industry. Members of the lysine cartel reached agreements to carve up the world market by allocating sales volumes among themselves and agreeing on what prices would be charged to customers worldwide. As a result, prices went up about 70 percent in the first three months of the conspiracy. Impermissible naked price fixing – resulted in multi-million dollar fines for cartel members and criminal convictions. Naked Versus Ancillary Horizontal Agreements on Price Not all are illegal per se Distinguish between “naked” price fixing agreements and “ancillary” price fixing agreements Naked price fixing: the agreement on price is Per se illegal Ancillary price fixing: literal agreement on the principal agreement. price, but subordinate to some other principal agreement involving economic integration Rule of reason analysis (a balancing test) Permitted where reasonably related to/necessary for the principal agreement 17 Example: The Case of the Lithotripsy Joint Venture Competing urologists formed a joint venture to purchase and operate a lithotripsy machine Urologist investors agreed to charge a uniform “machine fee” for each use Investors included 35 of 200 urologists in the market Investors pooled their capital to purchase and operate the machine Investors shared financial risk of profit or loss Literal price fix, but ancillary to the principal agreement and reasonably related to the principal agreement Benefits > harms = legal Urologist investors also agreed to charge a uniform “professional fee” for the physician services No sharing of financial risk Price agreement not reasonably related to the principal agreement Illegal 18 Proof of Agreement Requirement of an “agreement” Two or more economic actors Does not have to be express or written Direct Evidence of an agreement: Copy of the actual agreement Statement by a person who attended a meeting where the agreement was reached Internal company memorandum written to report a meeting where the agreement was reached Notes of a telephone conversation that discussed the agreement Statement by a person who was approached by the cartel to join the agreement 19 Proof of Agreement Circumstantial evidence – inferring an agreement Look for evidence of behavior that makes sense only if there is an agreement Evidence that tends to exclude the possibility of independent conduct Evidence that is against an actor’s economic interest absent an agreement 20 Example: Parallel Pricing Behavior All competitors in a market announce at the same time that their prices will increase by the same amount. Suspicious behavior? Yes Conclusive evidence of an agreement? No Further investigation needed to eliminate other non-cartel explanations for the price increase sudden increase in costs that affect all competitors at the same time sudden change in the demand for the product sudden change in the price of a substitute product 21 Facilitating Practices Agreements Agreements that make it easier for competitors to collectively exercise market power and to avoid competing with each other May include agreements to share information, adopt a product standard, or adopt a particular contracting or pricing practice These practices may not directly restrain competition, their use makes it easier for industry participants to reach or maintain tacit or explicit agreements on price or output Difficulty with facilitating practices agreements is that they are not always anticompetitive 22 Example: Facilitating Practices Agreement Price protection clauses: Seller agrees to either meet any price the buyer is able to obtain from another supplier or release the buyer to purchase from the other seller Looks pro-competitive in that they can offer customers lower prices But can serve as a “policing” mechanism to detect cheating on cartels and reduces the incentives of sellers to offer lower prices 23 Quiet Life Agreements Agreements that restrict competition by freeing competitors from some significant aspect of competition that does not directly involve price or output Example: Agreements not to advertise Example: Agreements to limit business hours Example: A large group of auto dealers agreed to restrict their showroom hours, including closing on Saturdays. The agreement reduced a service that dealers normally provide – convenient hours – and made it difficult for consumers to comparison shop. (Detroit Auto Dealers) 24 Quiet Life Agreements, con’t Things to consider in analyzing “quiet life” agreements: What competition is being eliminated? How important is that competition to consumers? Does the agreement accomplish anything other than the elimination of competition? (Any benefits?) Could the same benefits be achieved without eliminating this competition? 25 Group Boycotts Agreements among competitors not to deal with other competitors, suppliers, or customers Some agreements that look like group boycotts can create efficiencies and make a market more competitive. Example: A group of small competitors form a joint purchasing arrangement for the purchasing and warehousing of product, enabling them to compete more effectively with larger companies 26 Group Boycotts, con’t Other agreements may harm competition. Example: A new retailer enters offering very low prices compared to others. The incumbent retailers collectively threaten to refuse to deal with any supplier that does business with the new low-price retailer. The boycott could prevent the new entrant from obtaining sufficient supplies needed to compete, thereby protecting existing retailers from the low-price competition and harming consumers. 27 Evaluating Group Boycotts What portion of the companies in the market are part of the agreement? To what extent is a competitor excluded or disadvantaged? Are alternatives available? What is the purpose of the agreement, and what are the purported benefits? If the excluded competitor has alternative ways of obtaining the same or similar benefits, the exclusion will not likely be harmful If the parties claim a purpose other than to exclude or disadvantage competition, determine whether the facts support the stated purpose Could the same benefits be achieved without excluding or disadvantaging a competitor? Are less anticompetitive but reasonable alternatives available for achieving the same benefits? 28 Joint Venture Agreements Cooperation may produce a better competitor (a more efficient and effective competitor) Joint ventures may include terms that unreasonably restrict competition among the venture’s participants General guidance on joint ventures Is the purpose to make the participants more efficient/effective? Is the agreement necessary to achieve the asserted competitive benefits? Is sufficient competition left to compete with the newly formed venture? 29 Agreements to Improve the Functioning of the Market Standard setting agreements among competitors generally are beneficial to competition. Example: an agreement among plumbing pipe manufacturers to standardize the sizes, shapes, and material composition so that builders and consumers can use pipes interchangeably no matter which manufacturer made them. Although adoption of standards may exclude nonconforming products and thus harm the company (competitor) that makes them, this alone is rarely a sufficient basis for condemning the practice as anticompetitive. Before standard setting can harm competition, one factor must be present: control over market access. 30 Trade Associations Trade associations carry out many legitimate, positive functions: Educating members about technology and other advances in the industry Identifying potential problems with products Facilitating training on legal & other administrative issues Acting as an advocate or lobbyist before the government Trade associations also can serve as a forum for cartel activities, and trade associations can be used as vehicles for cartels to engage in “facilitating practices” and “quiet life” agreements Example: farm equipment trade association and its members agreed not to advertise prices for new farm equipment and to boycott a trade publication in furtherance of the agreement Example: chiropractic trade association and its members conspired to fix prices and to boycott third-party payers to obtain higher reimbursement levels 31 Which agreements should be illegal? An agreement between two competitors setting the price to be charged for their goods/services An agreement between competitors to limit production in order to save scarce resources An agreement setting the price to be charged for goods competitors jointly develop, produce, and sell as part of a business venture between them An agreement between competitors to close their stores on Saturdays and Sundays in order to spend time with their families An agreement between competitors not to do business with a supplier that has been supplying a new entrant 32 VERTICAL AGREEMENTS (Vertical Restraints) 33 Overview of Vertical Restraints VRs involve restrictive agreements between firms that are not direct competitors. They are very different in kind from restrictions among competing sellers, such as price fixing. VRs, which involve complements in production, may have both procompetitive and anticompetitive features 34 Possible VR Structure Manufacturer (supplier) Distributor 1 Distributor 2 Distributor 3 35 Types of Vertical Restraints Vertical Price Restraints Resale price maintenance – Agreement between manufacturer and distributor not to sell manufacturer’s product at or above a price floor, or at or below a price ceiling. Vertical Non-Price Restraints Vertical Territorial Division Location Clauses Vertical Customer Division Others 36 Why Vertical Restraints? Could be profitable for 2 reasons: 1)Because they increase efficiency of the distribution system and thus help lower supplier costs; 2)Because they increase the supplier’s market power and enable it to earn monopoly profits. Competition policy that attempts to maximize the welfare of consumers would try to approve restrictions that have the first effect, and condemn those that had the second effect. 37 Procompetitive Features of VRs Higher retail margins induce more service by retailers. Prevents “free riding” by discount houses. Stimulates interbrand competition by reducing intrabrand competition. May induce distributors of products to provide optimal level of promotional display or advertising services, increasing demand and benefitting consumers. 38 Anticompetitive Features of VRs RPM – Keeps prices higher than they might otherwise be. Territorial division may facilitate tacit or explicit collusion by suppliers, particularly if engaged in horizontal territorial division. May foreclose competition, as exclusive supply agreements may cut off key inputs to competitive suppliers. Raising Barriers to Entry – May require entry at two levels in chain of production, or raise the cost of new entry. Toys ‘R’ Us case (2000) – Chain toy store used VRs under which toy manufacturers agreed not to supply popular toys to retail discount clubs. Court held VR facilitated collusion among manufacturers. 39 U.S. Legal Analysis of VRs Non-price VRs analyzed under a rule of reason analysis. RPM – For nearly 100 years, minimum resale price maintenance was per se illegal in the United States. In 2007, U.S. Supreme Court in Leegin case held minimum RPM subject to rule of reason analysis rather than per se prohibition – essentially permitting it in the United States (but may violate State law). 40 Legal Analysis of VRs As VRs may have either procompetitive or anticompetitive explanations, facts are key. Assessing “Market Power” is important: Market power is the ability of a company (or companies) to raise prices above competitive levels without losing sales so rapidly as to make the price increase unprofitable. The risk of an anticompetitive outcome is greater when the firm or firms using VRs have market power Dominant firm may exclude rivals Non-dominant firms with market power may use VRs to facilitate collusion. Degree of market power may be important. When VRs are used by firms that lack market power, efficiency explanations, such as inducing promotional activities, likely to hold sway. 41