WithinOurGrasp_Oct29 - West Virginia Center on Budget & Policy

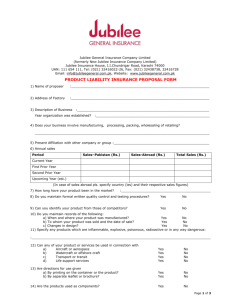

advertisement

Source. Bureau of Labor Statistics. Data from the Consumer Price Index - All Urban Consumers, South Urban region. Source. Institute on Taxation and Economic Policy. (2009). Who Pays? A Distributional Analysis of the Tax System in all 50 States. 10% State EITC Family Tax Credit Yes No Est. 151,000 75,938 Maximum income eligibility 244% FPL 125% FPL Cost $28 million $17 million Refundable Number of Tax Filers Married, Two Children 1200 1000 State Tax Without Any Credit 800 Tax Liability with FTC Tax Liability with 10% EITC 600 State Income Tax Liability ($) 400 200 0 50 3,400 6,750 10,100 13,450 16,800 20,150 23,500 26,850 30,200 33,550 36,900 40,250 -200 -400 Income ($) 160 140 120 34.4 (state) 100 (in millions of dollars) 80 60 110 (federal) 126 40 20 18.4 0 Total TANF Funds WV TANF Expenditures Unspent Funds The West Virginia Center on Budget and Policy encourages you to reproduce and distribute these slides, which were developed for use in making public presentations. If you reproduce these slides, please give appropriate credit to WVCBP. The data presented here may become outdated. For the most recent information or to sign up for our free E-Mail Updates, visit www.wvpolicy.org West Virginia Center on Budget and Policy 723 Kanawha Blvd, Suite 300 Charleston, WV 25301 (P) 304.720.8682 (F) 304.720.9696