Slide 1 - The Palisades Consulting Group, Inc.

advertisement

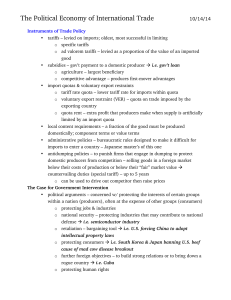

Investing in America, 2011 2011, 投资在美国 Eva Lerner-Lam, President Palisades China Group, LLC 磐石中国集团有限责任公司主席 林意华 Shenzhen/Tsinghua University/Beijing Research Institute of Innovative Entrepreneurship Training Center 深圳清华大学研究院北京创新创业培训中心 07/10/2011 磐石中国集团有限责任公司 Palisades China Group, LLC • 创立于2009年 --- 磐石咨询集团在美国开 始运营后的第20年 Established in 2009, 20 years after Palisades Consulting Group began operations in the US • 在中国和美国寻找投资机会 Entrepreneurs seeking investment opportunities in both China and the US • 自1988年起在中美两国投资于房地产、技 术交流、数字媒体和音乐教育等领域。 Since 1988, invested in real estate, technical exchange, digital media and music education in both countries 今天讨论的话题 Objectives of Today’s Session 1. 从中国指向美国的境外导向投资FDI趋势总 述 Overview of emerging trends in Foreign Direct Investment (FDI) from China to the US 2. 3. 4. 5. 如何开始 特别注意 独特机遇 开放讨论 How To Get Started Be Careful… Unique Opportunities Open Discussion 境外导向投资(FDI)趋势 Emerging Trends in Outward FDI • 中国计划在2020年之前向境外投资1-2万亿 美元 Chinese FDI Projected to Total $1-$2 trillion by 2020 中国向美国投资(FDI)趋势 Emerging Trends in Outward FDI to the US • 中国产业已经至少在美国50个州中的35个 州内创造了超过10000个岗位 Chinese businesses have already established operations and created more than 10,000 jobs in at least 35 of the 50 states in the US. 2003年中国向美国投资 China FDI in America 2003 2003-2004年中国向美国投资 China FDI in America 2003-2004 2003-2005年中国向美国投资 China FDI in America 2003-2005 2003-2006年中国向美国投资 China FDI in America 2003-2006 2003-2007年中国向美国投资 China FDI in America 2003-2007 2003-2008年中国向美国投资 China FDI in America 2003-2008 2003-2009年中国向美国投资 China FDI in America 2003-2009 2003-2010年中国向美国投资 China FDI in America 2003-2010 需要考虑的因素 -- 中国方面 Factors to Consider: China • 中产阶级新兴财富关注教育及创业投资 Growing middle class wealth for educational and entrepreneurial investments • 中国的计划生育政策 China’s one-child policy • 渴望理解西方创新文化并应用到中国未来发 展中 Desire to gain understanding of Western innovation and creativity and adapt to China’s future growth 需要考虑的因素 -- 美国方面 Factors to Consider: US • 世界第二大消费市场(中国为第一大) The US is the world’s second largest consumer market (China is #1) • 建立公司无最低投资额限制 No minimum investments required to start a US corporation • 透明法律制度及无歧视法律援助解决投资 相关争端 Transparent legal system with non-discriminatory legal recourse in investment-related disputes • 先进的实体和财政基础设施 Advanced physical and financial infrastructure 需要考虑的因素 --- 美国方面 Factors to Consider: US • 美国城市为竞争投资推出多项优惠税收政 策刺激 Many tax incentives as US cities compete for FDI • 强大的知识产权保护措施 Strong intellectual property protections • 资产及利润的免费自由流动 Free transferability of capital and profits • 独一无二的高等教育系统 Unparalleled higher education system 世界前十经济体比较(2008年) Comparison of Top 10 Global Economies (2008) 机遇 Opportunities • 中国资金+美国项目 – – – – – – – – – – – China Cash + US Projects 航空运输及自动运输 Aero, Auto & Transport 清洁能源 Clean Energy 消费品 Consumer Products 金融及商业服务 Finance & Bus. Services 化石能源及化学制品 Fossil Fuels & Chemicals 健康、生物及制药 Health, Bio & Pharma 接待服务及房地产 Hospitality & Real Estate 工业机械 Industrial Machinery 信息技术 Information Technology 后勤/物流 Logistics 金属及矿物 Metals & Minerals 成功的威胁 Threats to Success • 不确定的政治环境下的政治风险 Political risk in an uncertain political environment • 处于震荡中的消费环境下的投资回报(ROI) Return on Investment (ROI) in a shaken consumer market • 人民币-美金兑换政策 RMB-USD convertibility policies 缓和因素 Mitigating Factors • 政治风险:如今在2011年,美国更惧怕失 业而不是惧怕中国 Political Risk: Now, in 2011, America fears joblessness more than China • 投资回报风险:华盛顿特区和北京正在合 作达成美国向中国的出口政策 ROI Risk: US-to-China export policies being calibrated by Washington, DC and Beijing • 人民币-美金兑换风险:美国和中国的主 要银行正在建立可能的新机制 RMB-USD Risk: Major banks in US and China are making new mechanisms possible 如何开始 How to Get Started • 第一重要性: 公司管治透明化 #1 Priority: Clarify your corporate governance • 组建自己的美国商务、法律、会计、公共 关系团队 Assemble your own US business, legal, accounting and public relations team 如何开始 How to Get Started • 通过联邦、各州、当地商业发展办公室寻 找美国方面合作伙伴 Seek US partners through Federal, State and Local Business Development Offices • 在2012年至2015年专注于创造就业岗位 Focus on job creation in 2012-2015 特别注意 Be Careful… • 保护你的知识产权 Protect your intellectual property • 注意你的公共关系 Pay attention to public relations • 避免与高负债率或融资收买目标企业合作 Avoid partnering with firms with high debt-equity ratios or leveraged buyout targets (“due diligence”) 独特机遇 Unique Opportunities • 项目 EB5 Program EB5 – 以能创造职位的投资取得绿卡 Green cards for job-creating investments • 支持艺术产业 Support for the Arts – 冠名赞助高收入媒体场馆会所(有名的建 筑、艺术中心、艺术项目等等) Branding in high-profile media venues (Named buildings, cultural centers, arts programs, etc.) – 减少税额 Reduces taxable income 期待:未来1-3年 What to Expect: Next 1-3 years • 焦点:职位、职位、职位 Focus: Jobs, jobs, jobs • 风险 Risks: – 不稳定的美国经济衰退和通货膨胀 Destabilizing recession and inflation in US – 对中国再次崛起为世界力量的恐惧 Fear of China’s re-emergence as world power – 低利润率 Low profit margins – 先进理念带来的风险 “Bleeding edge” 期待:未来1-3年 What to Expect: Next 1-3 years • 回报 Rewards: – 在美国的立足点 Foothold in US – 汲取经验 Lessons learned – 竞争优势 Competitive edge 期待:未来3-5年 What to Expect: Next 3-5 years • 焦点:提升产量 Focus: Scaling up production • 风险 Risks: – 更多竞争 More competition – 投资回报由于经济衰退或通货膨胀影响 无法达到预期 ROI targets not met due to recession/inflation impacts – 在真实案例基础上对中国持续恐惧 Continued fear of China, now based on real examples 期待:未来3-5年 What to Expect: Next 3-5 years • 回报 Rewards: – 建立市场基地 Market base established – 拥有运营经验的基于美国的团队 US-based team with operational experience 期待:未来5-10年 What to Expect: Next 5-10 years • 焦点:继续扩大规模,新市场协同作用 Focus: Continued scaling up, new market synergies • 风险 Risks: – 更多竞争 More competition – 更多实例鼓吹对中国的恐惧 More examples to perpetuate fear of China – 成为非善意强行接管的目标 Target for hostile takeovers 期待:未来5-10年 What to Expect: Next 5-10 years • 回报 Rewards: – 凭借早期经验及市场情况使投资回报达 到预期 ROI targets met, based on projections calibrated on early years of experience and market development 参考文献 References • An American Open Door? Maximizing the Benefits of Direct Investment from China, Daniel Rosen and Thilo Hanemann, Asia Society, May 4, 2011 • Invest in America Website: http://www.investamerica.gov • Find a local US partner with local government support:http://www.investamerica.gov/static/Invest%20in%20Ame rica%20Contact%20List_Latest_iia_main_001260.pdf • Online Investment Guides: http://www.investamerica.gov/home/iia_main_001157.asp • Intellectual Property references: http://www.uspto.gov/ http://www.stopfakes.gov/events/china_webinar_series.asp • Corporate Taxes http://www.nytimes.com/2011/05/03/business/economy/03rates. html?_r=1&hpw 问题 Questions? elernerlam@palisadesgroup.com