presentation file

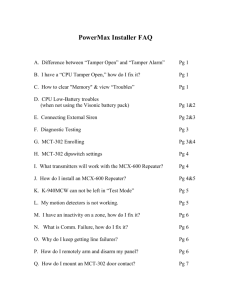

advertisement

Guiding Organizations Through Troubled Times Mark Bonney Board Member Private Investor September 23, 2013 What we will cover Introduction/Background Troubles I have experienced Case Studies Lessons learned Mistakes Guiding Principles Questions Introduction/Background Roles CFO COO Interim CEO Consultant Board Member Mostly in turnaround situations Broad Industry Experience Over 35 years experience in high technology industries: High precision components and assemblies Capital equipment Automotive components Motors and motion control components Optical components and systems Telecommunications equipment Home control semiconductors Petrochemical process equipment Semiconductor capital equipment Direct Marketing Software (SAAS) Personal Drivers Passionate/high energy/hard working/love to learn and teach. Strong desire to understand technology, markets and customers. Customers are key! Decisions driven by facts and data. Integrity and credibility are critical. Strong working relationships inside and outside the company are imperative. Current Roles Board Member of three public companies MRV Telecommunications (MRVC:OTC) [1,2] Sigma Designs (SIGM:NASDAQ) [1,2,3] Zix Corp. (ZIXI:NASDAQ) [1] 1 – Audit; 2 – Compensation; 3 – Nominating and Governance; - Chair Current Roles Philanthropic Boards Community Health Center, Inc. - Board Chair Capuchin Province of St. Mary Types of Troubles I’ve Faced Types of Troubles I’ve Faced Default on debt securities Management “fraud” Loss of major customer Dramatic market contraction Product Failure Law suits (Product liability, patent infringement, shareholder/proxy fights, class action, etc…) CEO’s health issue Owners death Resignation of public accountants A few Case Studies Case Study 1 - Troubles Joined as CFO (Recruited by new CEO) Major issue – a patent suit against a competitor became As a result: management’s total focus for 3 years. 60 R&D projects and no mgt. direction No new products past 4 years Poor IT infrastructure Throwing people at problems Losses Needed cash The street no longer cared Case Study 1 - Actions Met with everyone to openly discuss current situation Developed financial model that would build credibility Sold a product line to raise cash Met with R&D and prioritized 60 projects to 6 Met with Operations to determine priorities Invested in fully integrated IT platform Reduced HC by 30% over two years Managed the litigation process with one dedicated resource Case Study 1 – More Troubles CEO heath issue In the middle of restructuring Met with BOD Day 2 Held Town Hall Day 2 Assured people that we would follow through on the stated strategy and the restructuring to avoid back peddling. Established and communicated the process allowing CEO to recover/rehab and mgt. to know where to go for approvals, etc. CEO back in 5 months; we never missed a beat and the stock price rose 14% during CEO’s absence Case Study 1 – Outcome Small Public Company – too small; very broken Sold product line – Raised Cash FIX Business Process Redesign, new IT structure, reduced HC 30% - returned the company to profitability by end year 2. RE-MARGIN Pruned product line, increased GM 10 pts. by year 3. Pruned R&D projects from 60 to 6 Secondary offering – raised significant cash GROW Launched 4 new products, acquired 4 businesses Grew the core business to $80MM and the company to $100MM (23% EBIT) in five years. Stock price grew from $1.67 to $38.50 (post-splits) What about the lawsuit? Won a judgment 6 years after launching the suit Defendant appealed Company prevailed; awarded $1.0M 2 years after the appeal Litigation Lesson Learned Company spent nearly $3M on the litigation Distraction was more costly Lessons: Your case is not as strong as you think Their case is not as weak as you think Courts don’t like to award big wins Patent litigation often detracts much more value than you can possibly be awarded especially troublesome for SMB’s Case Study 2 - Troubles Hired as COO to transform the company Issues: Holding Company structure Weak divisional leadership No new products in several years Stagnant sales and profits Needed cash to transform the company Case Study 2 - Actions Actions: Met with CEO and the Board - Not a quick fix, requires a 3 year implementation, secured buy-in Met with management and employees at every division every month Determined where divisions could work together Sold the best performing division to raise cash Changed 5 of 7 GM’s Implemented Lean Principles Consolidated and closed a high cost business unit Redirected a new product to focus on a high growth market Case Study 2 - Outcome $100MM Multi-divisional Technology Company Identified core competencies, sold best performing business – raised cash FIX Restructured leadership team, implemented Lean, closed high cost business, increased GM 7 pts., returned company RE-MARGIN to profitability, cash flow positive year 2. Launched new venture, acquired company introduced four, high margin, products in year two. GROW Company initially Shrunk to $85MM by design then grew back to >$140MM Share price rose from $15.00 to $70.00. Sold to a strategic buyer for $64.00/share. Case Study 3 - Troubles Small public company in the security products field FIX RE-MARGIN GROW Joined as CFO. Restructured operations, Closed two facilities and relocated to one modern facility – retained or found jobs for all employees. Used ISO and SOX processes to drive process improvements and streamline closing process, staff and order to cash processes. Gross margins increased 12 pts. in 3 years driving consistent profitability and cash flow. Introduced new product and doubled revenues in 2 years. On track for doubling again in 2 years. Case Study 3 - Troubles Customer reports product failures on our new product Immediately notified our manufacturing partner of the issue and created a cross company task force to develop a solution Pulled together a team of experts; bought equipment to test our product under every conceivable set of environmental conditions CEO traveled to every region of the world to ease fears Our data and customer data indicated the failure rate averaged 1 failure in 10 million uses Three months later, despite the data, customer cancels orders and threatens litigation Product development discovered a solution; New product introduced within 5 months of first notice, eliminated the issue completely Signed a new customer and renewed a second Litigation threat is lifted, customer agrees to pay for certain inventory….crisis averted! Case Study 3 – More Trouble Issues: Actions: Share price declined >30%. Activist shareholder demands replacement of board Negotiated a settlement - board increased by 3 activist appointees. Led the Company through an auction process Result: Fixed the product issues. Sales more than doubled to $30MM. Sold to a strategic buyer -- nearly a 1000% return for shareholders. Case Study 4 - Troubles Distributer of Books, Movies and Music Hired as CFO by new CEO Issues: Introduction of the iPod iPad causing erosion in Book market DVD sales shrinking fast Company nearly out of cash High cost business model and infrastructure Case Study 4 - Actions Met with everyone that knew the business, what had been done before? What should we try now? Took control of everything affecting cash Implemented Policy and Governance improvements…know what we are doing. Direct marketing is all about analysis and testing…Restructured Financial and Marketing Analysis operations. Changed the payments model to credit card…immediate cash. Implemented a major restructuring. Closed two facilities, sublet 200,000 sq ft. Exited the music biz Stopped the bleeding Case Study 4 - Outcome FIX RE-MARGIN GROW – Not this time Stopped the bleeding – cash at $60M within 9 months. Restructuring yielded > $25M annual savings. Changed the payments model to all credit card…immediate cash. Sublet 200,000 sq ft. – generated nearly $2M annual rent. Outsourced non-strategic activities saving > $10M annually. Worked with Marketing to optimize mail dates, drive revenue and cash. Increased gross margins by 4 pts. to drive profitability and cash flow. More troubles: Customer acquisition couldn’t outpace attrition without greater investment IT systems were fixable and were key to growth but PE wouldn’t write the check Found an equity partner and Owners exited…6x return on investment….and I exited too. Case Study 5 - Troubles $80M profitable business Owner dies without a spouse or a will Two sons in business want out; one not in wants in IRS claims business is worth >$120M Requires ≈$80M immediate cash to buy out sons and pay estate taxes Bank lines are exceeded without this requirement CFO Fired Case Study 5 – Action Plan Asked by auditors to see what I could do Met with CEO and his team I agreed to become acting CFO for four months and: Get the IRS and CT DRS off their backs Get the bank off their backs Higher a permanent CFO Case Study 5 – Actions/Results Actions/Results: Step 1: Negotiated the business valuation from >$100M to $60M; Tax drops to $30M from >$60M Step 2: IRS agreed to 10 year payment plan with a one year moratorium. Paid State Tax in full Step 3: Negotiated new term loan and bank lines with existing bank Step 4: Hired a new CFO started 4 months to the day after I arrived….still there 10 years later Company received a clean opinion that year CEO able to keep the business in the family Lessons Learned Lessons Learned In a crisis, time is not on your side Ask “what’s the worst that can happen” Important to differentiate between a crisis and a CRISIS, amount of time to fix is very different Plan for worst but develop all possibilities Fully develop alternatives I use a Fix, Re-Margin and Grow model Communicate the possible outcomes Create an atmosphere of confidence Find out who can really help you Lessons Learned Know who you can count on and rely on them Act decisively Adjust rapidly and own the changes Communicate often and directly with the board, employees, customers, analysts, etc. Use your learning in future situations Teach through examples, stories convince Major mistakes Impatience while learning Firing too fast Firing too slow Not respecting history Giving history to much credence Over-achieving Under communicating Over communicating (not quantity but content) Not believing in a potential outcome Not managing expectations upward Guiding Principles People will watch your every move! Be respectful of everyone. Work harder than anyone. Be visible. Be accessible. Talk with people about their lives not just their work. Communicate and cascade appropriately. Expression needs to match words. Base decisions on facts and data. Guiding Principles Cont’d When you know what to do “do it”. Good results come from your team’s efforts. Bad results come from bad decisions…don’t be afraid to say that you made a mistake…makes you human…earns respect. Managing up is as important as managing across and down. It’s not “just business”. It is about people and the relationships that you form and maintain that will define you. Trust your gut, enjoy the ride and have fun. Questions