AptarGroup Inc

advertisement

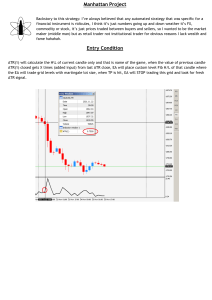

AptarGroup, Inc. Presented March 14th, 2013 To The RCMP Class For Illustrative Purposes Patrick O’Donnell (Originally authored by: Kaidi Wang, Brian Mulvihill, Hitesh Setpal, Harout Sahakian, and Patcick O’Donnell) Report and Analysis completed Jan 7, 2012 for CFA Institute Research Challenge Business Description • AptarGroup is a leading supplier of innovative dispensing systems for consumer products. The company began its operations in the 1940’s and expanded over the years through acquisitions. In 1992, the company incorporated and changed its name to AptarGroup Inc. • Aptar operations are divided into three segments: Beauty + Home, Pharma, and Food + Beverage. – Service clients need for “differentiated packaging” – Engineers/Manufactures product packaging • Ranked either 1 or 2 in market share within particular packaging operation • Significant Economies of Scale versus Competitors. • Operates in a mature industry Aptar Products Macroeconomic Review – APTAR IS A GLOBAL COMPANY Source: Aptar CFAI Research Challenge Presentation Macroeconomic Review • IBIS Growth Estimates: • US GDP: will grow 1.41% in 2013 and 3 to 4% from 2014 to 2017. • EU GDP: will grow 0.1% in 2011. and 2.4% from 2014 – 2017. • World GDP: is project to grow, census shows a global growth rate of 7.58% - Primarily lead by BRIC nations. • Other Macroeconomic factors that have a significant impact on Aptar: price of oil commodity/plastic resign, employment trends, discretionary income figures. Industry: Plastics Packaging (NACIS 32619) (Source: IBISWorld Market Data) Industry: Five Force Analysis Source: Market Line – Plastics Packaging Industry Report Industry: Where Does the Plastic Go? (Source: IBISWorld Market Data) Industry: Plastic Packaging vs Manufacturing as a whole (Source: IBISWorld Market Data) Industry: Capital Intensity Source: IBISWorld Market Data ATR –Stock Market Prospects (Reference Date: March 13, 2013) • Ticker: ATR • Stock Classification: Value • Share Price: 55.33 • Dividend (Yield): 1.00 (1.8%) • P/E (TTM): 23.25 • P/E (Future):17.79 • EPS (TTM) 2.38 • EPS (Future) 2.77 ATR Market Prospects vs Competitors (1 year) (Source: YahooFinance.com: ATR) ATR Market Prospects vs Competitors (5 year) (Source: YahooFinance.com: ATR) ATR Return– 1 year vs S&P (Source: YahooFinance.com: ATR) ATR Return– 5 year vs S&P (Source: YahooFinance.com: ATR) The “Aptar” Business • Packaging – Primarily with the use of plastic (naphtha, a main raw ingredient of plastic is a derivative of the oil commodity) • Revenue Breakdown: – Beauty and Home: 63% of total sales – Pharama: 24% of total sales – Food and Beverage: 13% of total sales • The company reports that it has over 5,000 customers – none of which contribute more than 6% to revenues. Who Buys Aptar Products? Source: Aptar CFAI Research Challenge Presentation Update: Last Earnings Report (Q4) • Gross margin is 31.8%, while operating margin is 11.3% and net margin is 7.0%. • Continuing negotiations with European Labor Unions (settlement for union wage curtailment) • Company reporting 4 different insider sales of 35K shares of stock Financial Analysis • Management Plans: • Expand Sales into Asian Regions • Increase CAPEX expenditures into fastest growing segment – Pharmaceuticals • Cost Cut – Close European operations – Increase operations in South America (cheaper labor) – OVERALL: Reduction of long term variable costs by increasing short term variable and fixed costs. Application of Financial Tools • See Excel Workbook • Discount Rate: 10.8% • Growth Rate: 6.8% • Share Value: $49.24 Implications for RCMP • A Stable Value Investment: HOWEVER SOMETHING TO CONSIDER: From an investor’s standpoint, the stock presents a diversification attribute toward a portfolio. There may be a concern that the company has “over-diversified,” due to their geographical expansion, large client base, and exposure to almost all sectors of the economy (food, pharma, home, etc.), to a point where it can only be considered a value stock without any potential for significant growth Recommendation • Hold/ Weak Sale • Place on Watch List • Significant future events that may trigger reconsideration for RCMP: – After the company is able to settle severance/liability claims in European operations – After sales numbers come out in China – After corporation has expanded South American influence