The land registration system in Italy – Principles, organization and

advertisement

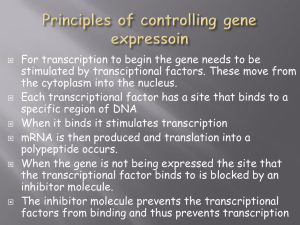

The Land Registration System in Italy Principles, organization and evolution Aldo de Luca Central Director Land Registration and Legal Affairs Rome, November 20th 2014 The principle of real consent: a dogma difficult to be overtaken The civil law principle that applies to immovable transactions is known as «principle of real consent» and is provided by art. 1376 of the current Italian Civil Code, inspired by the Code Napoléon. This principle, which affirms the primacy of the individual against the feudal domain, led to the assertion of a private will, consolidated in the agreement, capable on its own of producing effects not only between the parties but also “erga omnes”. In Italy, as in the other countries of Napoleonic law, the principle of “real consent", incorporated by the Civil Code of 1865 in the category of the “real effects contract”, was balanced by a system of rules for the transcription of real estate transactions, inspired by the French law of 1855. Principles The fundamental principles that inspired the Italian system of transcription are totally opposed to those that govern the Germanic systems of “Title Registration" (“Grundbuch” in Austria and Germany). The process of transcription is more agile and quick than the “Title Registration” process and this depends on the following circumstances: • Transcription has no probative value; therefore the work and responsibility of the Registrar (Conservatore) does not extend to the examination of the validity and substantial efficacy of the title; • Transcription does not constitute the real effect - acquisition of ownership - having mainly declarative effects. To avoid the danger of huge gaps in the registers, the Italian legislator provided some measures: • • • the obligation for the notary, who received or authenticated the deed, to apply for transcription in the shortest time possible (art. 2671 Civil Code) the widespread legitimation to apply for transcription, irrespective of the existence of a legitimate interest (art. 2658 and 2659 Civil Code) the introduction of the continuity principle, regulated by art. 2650 of the Civil Code 1. Continuity of transcriptions The introduction of the continuity principle is the breaking point with respect to the original model of register of deeds: (art. 2650 of the Civil Code) "Where [...] a deed of acquisition is subject to transcription, the following transcriptions or inscriptions against the acquirer will have no effect if the previous acquisition deed has not been transcribed. Once the previous acquisition is transcribed, the following transcriptions or inscriptions will produce effects according to their respective order, except for what is provided in art. 2644 ". 2. Declaratory function of transcription The transcription of a deed in the Register fulfils a declaratory function in respect of the “exceptionability” principle (art. 2644 Civil Code, in relation to the articles 2643 and 2645) This is the tipical effect of transcription The “exceptionability” principle represents a sort of limitation to the principle of the “real consent” provided by art. 1376 of the Italian Civil Code, to the extent that transcription ends up by also having a discriminatory function between conflicting real rights coming from the same assignor. This effect can be clearly understood when the first who transcribes is also the first who acquired the right 1° 2° 1° The case is different when the second acquirer transcribes first: in this case transcription plays a role, rather than declarative, “constitutive” because the transmission of the right without transcription doesn’t produce any real effect, nor between the parties (as acquiring a non domino) nor erga omnes. The second acquirer transcribes first 1° 1° 2° 2° 3. Further effects Constitutive efficacy was attributed to the case when the fulfillment of the formality completes the acquisition: • foreclosure, ex art. 555 of Civil Procedure Code • conservative seizure, ex art. 679 of Civil Procedure Code have been inserted by the doctrine in this category. Transcription plays, in the cases covered by Art. 2652 (transcription of legal claims) a reservation function for the effects of the judicial decision that is going to be issued: deeds transcribed and inscribed against the respondent during the course of judicial proceedings will be unenforceable to the victorious claimant. A further hypothesis of transcription with reservation efficacy is the transcription of the preliminary contract, regulated by art. 2645 bis The Land Registry Organization Land Registries can be defined as an unicum of registries and deeds • stored and preserved by the Registrar, as provided by art. 2679 of the Civil Code and • properly ordered to be made available to the public for consultations and copies and issue of certificates Complementary Registries Book of surnames and Table of surnames Repertories Registries provided by the Civil Code General Order Register Special Registries of Transcriptions, Inscriptions and Annotations The tecnological evolution of Land Registration services Notaries’ duties in the civil and fiscal field after the conclusion of a real estate contract. Land Registry exceptionability Deed Changing the holder in cadastre Registrar’s and Cadastral offices Cadastre Tax Office Taxes payment Tax Office Before Automation... NOTATION Court DEED The legal bases of the land services automation were provided by the Law n. 52 of the 27 February 1985 The automation process was carried out in steps In the 8o’s: In the 9o’s: The model had to be submitted in a device fit for computer processing The model for entering notations had been mechanized Searches via internet started 2000 The single on line model 2012: The on line deed Since the 80’s: Notation in paper format, electronically transmitted by an operator, to the central system Notation Since the 90’s: Notation are submitted in a device fit for computer processing and Searches are made via internet 2000: telematics single model Cadastre Land Registry Notary SISTER MUI Bank 2012: DEEDS in Digital Format Land Registry Cadastre results of formalities processing Ufficio delle Entrate SISTER platform Single model Payments details Notary Electronic deed In XML format Deed 1 Electronic connection Electronic document in XML format RNI National interbank network Deed 2 Deed n Receipt Digital signature Bank Electronic Land Registries Evolution lines Digital preservation Deeds submitted in digital format are kept in accordance with the Digital Administration Code (CAD) Land Registries are constituted in electronic format The DPCM, to which art. 40 of the Digital Administration Code refers, will establish the date from which all registries in electronic format will have full legal value instead of paper ones Electronic Land Registries The computerization of paper deeds In order to preserve from decay our current paper archives, a project is in progress to computerize the old search registries and to put in digital format the names of the subjects included in them. At the completion of this project, searches will be done totally on line, irrespective of the interested period The integration between the two databases, cadastre and land registries The A.I.I is a new integrated information infrastructure that, in compliance with the current legislation, uses and integrates data managed by the Agency (cadastral and land registries), created and originally maintained separately. Its goal is to certify, for fiscal purposes, the situation of the integration between the two data bases, aiming at identifying, for each real estate unit, the person holder of real estate rights. Integrated real estate register Real estate taxpayer 1. 2. Owners Holders Cadastre Cartography Declarations by private parties Deeds to update rights Land Registries 1. 2. Titles Notes OMI The project called “Register of Holders” is operating within the described scheme, to create the data base of “Real estate taxpayers”, strictly linked with two other databases: - the land registries, including deeds creating, modifying or transferring real estate rights; - the tax register, that focuses the issue from the taxation point of view. The measure of the integration level between the cadastral and land registries data bases, only possible for the computerized period, has recently showed that the univocal correspondence exists only for 44% of buildings and 30% of land. As a consequence, this project aims at identifying for fiscal purposes the “holders” of real estate rights related to each property registered at the Cadastre, through: • the deeds maintained in the land registries; • the declaration made by the interested parties to register the property at the cadastre. In conclusion, our system has taken two directions: 1. Computerization, since 1986, has made possible an easier and quick access to the registry and a higher level of security and precision in achieving the effects of publicity, with advantages not only for its users, but also for people that must rely on the registry efficiency. 2. The integration between cadastral and land registries data bases, through which it will become possible to create a relation between the real estate data included in the legal deeds and the holders. These evolutions don’t make the system similar to a title one, based on real folio principle, nor modify the transcription scheme, that remains anchored to its tradition and principles. Thank you for your kind attention