definition - Dawnbreaker

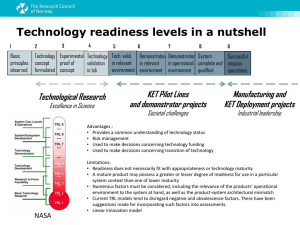

advertisement

Business Readiness Levels [BRL] A measure of risk….. To whom? Why is this important? • Not every SBIR company is looking to become a volume supplier – Some companies may prefer licensing as a commercialization strategy or prefer to outsource production to another entity that manufactures under their label. – NG's BRL model assumes a specific commercialization strategy – i.e. to become a volume manufacturer. Business Models Aligning the readiness levels TRL, MRL, BRL Who should evaluate readiness? • Readiness of any type is best assessed by an independent third party, using a well developed tool • However, it is valuable to apply a tool for self-assessment. Aligning readiness levels • Conceptually, the intent was to establish a metric comparable to the 9 point TRL scale and the 10 point MRL scale • TRLs were first introduced in 1989 by NASA – In 2002 DoD began to focus on TRLs. Understanding the maturity level helps decrease risk and therefore, associated costs Design a parallel BRL tool Intent of BRL • The BRL tool developed by NG is intended to provide an indication of business risk to a government entity that is looking to invest additional funds to facilitate technology deployment. Conceptually • Business Readiness Level refers to those business considerations that have a high probability of affecting the success or failure of a technology transitioning to a government program while adhering to an agreed upon budget and schedule. How is this relevant to you? • It is important to understand how decision makers view your technology and company • It is beneficial to understand perceived weaknesses and what steps you can take to mitigate them. BRL dimensions TWELVE FACTORS Fitness Levels – 10 is best Fitness Factors Commercialization Experience General Management Functional Management Technical Sales & Support Liquidity & Access to Capital Competitive Position Customer Knowledge Customer Commitment Affordability Intellectual Property Management Forecast of Sales Forecast Uncertainty 1 2 3 4 5 6 7 8 9 10 1: Commercialization Experience DEFINITION • The degree to which the management team has successful new product commercialization experience 1: Commercialization Experience Level Description 1 Innovator is developing product in spare time; Innovator has primary employment that does not include development of this product. 2 Innovator has invested significant personal resources in product development 3 Innovator has founded a company to develop the product; Innovator's primary employment is to build the business. 4 If no higher levels apply, then at least the Innovator and/or the General Manager have successful new product commercialization experience with products dissimilar to the product being developed 5 If no higher levels apply, then at least the Innovator and/or the General manager have successful new product commercialization experience with products similar to the product being developed. 6 Business has demonstrated at least one product at TRL 6 or higher. Less than 10% of company revenue is derived from product sales. 7 Business has demonstrated at least one product at TRL 7 of higher. Greater than 10% of company revenue is derived from product sales. 8 Business is an experienced new product developer with at lest one prior significant new product commercialization success. Greater than 25% of company revenue is derived from product sales. 9 Business is a proven new product developer with several new product commercialization successes in the past 5 years. Greater than 50% of company revenue is derived from product sales. 10 Business is a consistently successful new product developer with several new product commercialization successes every year. Greater than 75% of company revenue is derived from product sales. Highest Level Met 1. Commercialization Experience • The degree of experience you have had with commercialization is a reflection of the situations you have encountered and addressed. • Very useful metric for partners, investors, gov • Implications for SBC • If you do not have the management expertise described here, consider Advisory Boards with expertise as an initial risk mitigator • When looking at your technology portfolio, focus on moving at least one compelling opp forward 2: General Management • DEFINITION – The degree to which general management executives/skills are in place at the company 2: General Management Level Description 1 None. 2 Innovator is educating themselves in small business management skills throughout books, classes, or SBA and similar resources. 3 Business operations are managed by an executive whose primary experience is in technology development, not business management; usually the Innovator. 4 Business operations are managed by an executive whose primary skill is in business management, not technology development. 5 General Manager oversees functional managers in at least four key functional areas (R&D, manufacturing, finance, marketing & sales.) 6 General Manager demonstrates commitment to implementing documented processes, best practices, and integrated product teams. A long term strategic business plan is under development. 7 General Manager consistently enforces use of documented processes, best practices, and integrated product teams. A long term strategic business plan is in place. 8 General Manager has experience in leading a business through the commercialization of at least one successful new product. A long term strategic business plan is being executed. 9 General Manager is recognized by industry insiders as a leader in new product development. 10 General Manager is widely recognized as a leader in new product development. Highest Level Met 3. Functional Management DEFINITION • The degree to which functional management (R&D, Manufacturing, Financial, Marketing & Sales) skills/staff are in place at the company. 3: Functional Management Leve l Description 1 None. 2 Functional management is conducted by the Innovator. 3 Functional management is primarily conducted by the Innovator. Some administrative assistance (bookkeeper, office manager) is in place. 4 R&D is managed primarily by the Innovator. Business operations are managed primarily by the General Manager. 5 R&D, Manufacturing, Finance, and Marketing & Sales functions are managed by professionals with training & experience in their respective functions. 6 R&D Management has prior experience in developing technology to at least TRL 6. Manufacturing management has prior experience in at least an MRL 6 capable operation. Project management processes are often used. 7 R&D Management has prior experience in developing technology to at least TRL 7. Manufacturing management has prior experience in at least an MRL 7 capable operation. Project management processes are consistently used. 8 R&D Management has prior experience in developing technology to at least TRL 8. Manufacturing management has prior experience in at least MRL 8 capable operation. Project management processes are of at least mid-level maturity. 9 R&D Management has prior experience in developing technology to at least TRL 9. Manufacturing management has prior experience in at least MRL 9 capable operation. Project management processes are above the middle maturity level, but not necessarily at the highest level. 10 R&D management is widely recognized as an industry leader in new technology development. Manufacturing management has prior leadership experience in at least an MRL 10 capable operation. Project management processes are at or near the highest maturity level. Highest Level Met 4. Technical Sales and Support DEFINITION • The degree to which the company can provide technical sales support to potential customers before the sale, and provide training technical support, warranty, and repair service to customers after the sale 4: Technical Sales & Support Level Description 1 None. 2 None. 3 If needed, technical sales & support are provided by the business Innovator. 4 If needed, technical sales & support are provided by a technologist other than the Innovator. 5 If needed, technical sales & support are provided by the R&D Manager or R&D staff member. 6 Technical sales & support are provided by engineering staff that may have other technical duties as well. Customer satisfaction data is collected. 7 Technical sales & support are provided by full-time technical staff dedicated to these roles. Customer Satisfaction data is consistently collected. 8 Technical sales & support are provided by full-time technical staff dedicated to these roles. Customer Satisfaction data is used for product improvement. 9 Business is recognized as an industry leader in providing technical sales & support. Customer satisfaction data is consistently used for product improvement. 10 Excellent reputation for technical sales & support provides the business with a distinct, sustainable competitive advantage. Customer satisfaction is consistently high. Highest Level Met 5. Liquidity & Access to Capital DEFINITION • The availability of cash to support current operations, The degree to which the company has access to capital sufficient to move the product to the next higher TRL/MRL raise BRL scores, and grow the business. Size of revenue backlog, defined as firm future revenues from signed contracts 5: Liquidity & Access to Capital Level Description 1 Almost no cash or capital are required. 2 Cash and capital are primarily available from the Innovator and their immediate family & friends. 3 Additional cash and capital are primarily available from business lines of credit/secured loans. Use of university, incubator, or other borrowed/rented facilities may be used to preserve capital and cash. No revenue backlog. Risk of critical cash flow shortage is very high. 4 Additional cash and capital are primarily available from government R&D grants/contracts (less than $1M each), angel investors, or potential industrial customers. Revenue backlog small enough that risk of critical cash flow shortage is high. 5 Additional cash and capital are primarily available from venture capital or other 3rd party equity investment, or larger government R&D contracts (greater than $1M each). Revenue backlog large enough that risk of critical cash flow shortage is moderate. 6 Less than 10% of incoming cash is derived from product sales. Revenue backlog and access to credit is large enough that risk of critical cash flow shortage is low. 7 Greater than 10% of incoming cash is derived from product sales. Revenue backlog and access to credit is large enough that risk of critical cash flow shortage is very low. 8 Greater than 25% of incoming cash is derived from product sales. Company has access to adequate amounts of credit for capital investment, and some additional capital is available from re-investment of corporate profits. Adequate amount of operating cash is on hand. 9 Greater than 50% of incoming cash is derived from product sales. Company has access to large amounts of credit for capital investment, and significant additional capital is available from re-investment of corporate profits. Large amount of operating cash is on hand. 10 Greater than 75% of incoming cash is derived from product sales. Most of all required capital is available from reinvestment of corporate profits. Large amount of capital investment cash is on hand. Highest Level Met 6. Competitive Position DEFINITION • The degree to which competition threatens the viability of the product. The full range, from directly competing products, to completely different customer alternatives, should be considered "competition" 6: Competitive Position Level Description 1 Competition holds a dominant market position. Barriers to entry are nearly insurmountable. Potential customers are completely satisfied with an existing product/solution. 2 Competition holds a dominant market position. Barriers to entry are very high. Potential customers are largely satisfied with an existing product/solution. 3 Competition holds a dominant market position. Barriers to entry are high. Potential customers are interested in the price and/or performance improvement potential of the new product. 4 Competition holds a strong market position; top 3 players control at least 80% market share. Barriers to entry are moderate. Potential customers are interested in the price and/or performance improvement potential of the new product. 5 The market includes many competitors, none of which dominates. Barriers to entry are low. The product’s price/performance value is similar to competitive alternatives. 6 The market includes many competitors, none of which dominates. Barriers to entry are low. The product’s price/performance is superior to competition for some applications, but similar or inferior for others. 7 The business is among the top 3 players in the market. The business enjoys moderate barriers to entry from competitors. The product’s price/performance advantage is marginally superior to competition. 8 The business is among the top 2 players in the market. The business enjoys moderate barriers to entry by competitors. The product’s price/performance advantage is clearly superior to the competition. 9 The business is the top player in the market. The business enjoys high barriers to entry by competitors. Alternatively, the product’s price/performance advantage is revolutionary and disruptive in the industry. 10 The company holds a dominant market position. The company enjoys nearly insurmountable barriers to entry by competitors. The new product will deliberately replace the company’s own older products. Highest Level Met 7. Customer Knowledge DEFINITION • The degree to which the company knows its potential customers, customer applications, and all customer requirement for the product. 7: Customer Knowledge Level Description 1 Key customer requirements perceived, but minimal validation of the knowledge conducted. 2 Knowledge of key customer requirements validated by limited secondary research (published journals, trade association studies, industry articles). 3 Knowledge of key customer requirements validated by limited interviews with potential customers or industry experts. 4 Knowledge of key customer requirements validated by significant customer interviews and limited customer evaluation of prototypes that meet TRL 4 criteria. 5 Customer requirements documents sufficient to support TRL 5 testing are in hand. Knowledge of key customer requirements validated by limited customer testing of prototypes that meet TRL 5 criteria. Some secondary requirements may remain invalidated or unknown. 6 Customer requirements documents sufficient to support TRL 6 testing are in hand. Knowledge of key customer requirements validated by customer testing of prototypes that meet TRL 6 criteria. All requirements (including secondary ones) are fully known. 7 Customer requirements documents sufficient to support TRL 7 testing are in hand. Knowledge of all customer requirements validated by customer testing of prototypes that meet TRL 7 criteria. 8 Customer requirements documents sufficient to support TRL 8 testing are in hand. Complete, detailed understanding of customer requirements. Risk of product failure due to a mistaken understanding for requirements is extremely low. 9 Complete, detailed understanding of customer requirements that gives the company a sustainable competitive advantage against all but the other top competitors in the industry. 10 Complete, detailed understanding of customer requirements that gives the company a distinct, sustainable competitive advantage. Knowledge allows successful, accurate anticipation of future requirements. Highest Level Met 8. Customer Commitment KNOWLEDGE • The degree to which customers are committed to expend resources sufficient to move the product to the next higher TRL/MRL. A customer is an organization with authority and funding to buy products in quantity. Organizations/programs whose mission is R&D 9such as DARPA, AFRL, ARL, ONR, the SBIR program) and investors are NOT customers. 8: Customer Commitment Level Description 1 None. 2 None. 3 One or more customers provide informal information to the business on technology evaluation and product requirements. 4 One or more customers commit minor resources (such as brief, simple evaluation & feedback) to assist in moving the product to TRL-4 and/or MRL-4. Customer has resources to assist in achieving the next higher TRL/MRL. 5 One or more customers commit limited resources (such as labor & materials for evaluation & feedback ) to assist in moving the product to TRL-5 and/or MRL-5. Customer has resources to assist in achieving the next higher TRL/MRL. 6 One or more customers commit moderate resources (such as prototype testing) to assist in moving the product to TRL-6 and/or MRL-6. Customer has resources to assist in achieving the next higher TRL/MRL. 7 One or more customers commit substantial resources (such as operational environment testing or cash for R&D) to assist in moving the product to TRL-7 and/or MRL-7. Customer has resources to assist in achieving the next higher TRL/MRL. Customer has urgent and compelling reason (improve competitive position, avoid obsolescence, meet minimum performance requirements ) to adopt the product. 8 One or more customers committed to purchase quantities requiring Low Rate Initial Production. Customers commit to at least half of the resources needed to move from TRL/MRL-7 to TRL-8 and/or MRL-8. 9 One or more customers committed to purchasing quantities requiring full rate production. 10 One or more customers committed to long-term supply agreements that require full rate production. Highest Level Met 9. Affordability DEFINITION • The degree to which the product is affordable to customers, in terms of R&D, acquisition and deployment operation and support, and disposal costs. 9: Affordability Level Description 1 Affordability information is not known. 2 Approximate price and Total Ownership Cost of currently used competing products is known, giving the Innovator meaningful cost targets. 3 Acquisition & deployment costs are higher than alternatives. If Total Ownership Cost is lower than alternatives, customer's payback period is greater than 7 years. 4 Acquisition & deployment costs are higher than alternatives. If Total Ownership Cost is lower than alternatives, customer’s payback period is greater than 3 years. 5 Acq. & dep. Costs are higher than alternatives. Total ownership Cost is lower than alternatives, and the customer’s payback period is less than 3 years. –OR- Acq. & dep costs are lower than alternatives, but Total Ownership Cost is moderately higher. 6 Acquisition & deployment costs are similar to alternatives. Total Ownership Cost is similar to alternatives. 7 Acquisition & deployment costs are similar to alternatives. Total Ownership Cost is lower than alternatives. 8 Acquisition & deployment costs are lower than alternatives. Total Ownership Cost is lower than or similar to alternatives. 9 Acquisition & deployment costs are lower than alternatives. Total Ownership Cost is demonstrably lower than alternatives. 10 Acquisition & deployment costs are much lower than alternatives (including maintaining the currently used product). Total Ownership Cost is low enough to be disruptive to the industry, making all other alternatives obsolete. Highest Level Met 10. Intellectual Property Management DEFINITION • The degree to which the company is able to protect is own intellectual property through use of patents, trademarks, trade secrets, license agreements, or non-disclosure agreements 10: Intellectual Property Management Level Description 1 None. 2 A written plan for protecting intellectual property exists. 3 Business has filed for patent(s) on key intellectual property. A commercialization plan for the IP (use it in-house, license it, or sell it) exists. 4 Key intellectual property is protected by U.S. patents pending an/or trade secrets. Resources for enforcing patents and license & non-disclosure agreements are extremely limited. 5 Key intellectual property is protected by U.S. patents. Resources for enforcing patents and license & non-disclosure agreements are limited. 6 Key intellectual property is protected by U.S. and international patents. Resources for enforcing patents and license & non-disclosure agreements are adequate. 7 Patent position is broad enough to create a strong position in a small niche market. Resources for enforcing patents and license & non-disclosure agreements are adequate. 8 Patent position is broad enough to create a strong position in a niche market. Resources for enforcing patents and license & non-disclosure agreements are more than adequate. 9 Patent position is broad enough to create a leading position in a large market. Resources for enforcing patents are large. Reputation within the industry for enforcing patents and license & nondisclosure agreements is strong. 10 Patent position is broad enough to create a dominant position in a large market. Resources for enforcing patents are intimidating to potential competitors. Reputation for aggressively enforcing patents and license & non-disclosure agreements. Highest Level Met 11. Forecast of Sales DEFINITION • The degree to which expected annual sales of the product will exceed the expected total investment 11: Forecast of Sales Level Description 1 No credible forecast exists. 2 Annual sales to total investment ratio of at least 1.6:1 in 5 years or at least 2:1 in 7 years. (About 10% compound annual rate of return.) 3 Annual sales to total investment ratio of at least 2.5:1 in 5 years or at least 4:1 in 7 Years. (About 20% compound annual rate of return.) 4 Annual sales to total investment ratio of at least 4:1 in 5 years or at least 6:1 in 7 years. (About 30% compound annual rate of return.) 5 Annual sales to total investment ratio of at least 5:1 in 5 years or at least 10:1 in 7 years. (About 40% compound annual rate of return.) 6 Annual sales to total investment ratio of at least 8:1 in 5 years or at least 17:1 in 7 years. (About 50% compound annual rate of return.) 7 Annual sales to total investment ratio of at least 10:1 in 5 years or at least 27:1 in 7 years. (About 60% compound annual rate of return.) 8 Annual sales to total investment ratio of at least 14:1 in 5 years or at least 40:1 in 7 years. (About 70% compound annual rate of return.) 9 Annual sales to total investment ratio of at least 20:1 in 5 years or at least 60:1 in 7 years. (About 80% compound annual rate of return.) 10 Annual sales to total investment ratio of at least 25:1 in 5 years or at least 90:1 in 7 years. (About 90% compound annual rate of return.) Highest Level Met 12. Forecast Uncertainty DEFINITION • The degree of uncertainty that actual sales will meet or exceed the forecast sales. 12: Forecast Uncertainty Level Description 1 No credible forecast exists. 2 Highest. Forecast is based on assumptions only. 3 Extremely high. Forecast is based on assumptions and broad industry data. 4 Very High. Forecast is based on assumptions and loosely targeted industry data. 5 High. Forecast is based on growth models with uncertain validity and well-targeted industry data. 6 Medium – High. Forecast is based on credible sales growth models and well-targeted industry data. Customers have expressed strong interest but made no purchase commitment. 7 Medium. Forecast is based on early sales, credible sales growth models, and reliable industry data. Business has a strong position in a small niche market. 8 Medium – low. Forecast is based on actual sales. Business has a strong position in a niche market. 9 Low. Forecast is based on actual sales and a moderate order backlog. Business is no lower than 3 rd in market share and has sustainable competitive advantage. 10 Extremely low. Forecast is based on actual sales and a large backlog. Business has dominant market share and distinctive sustainable competitive advantages. Highest Level Met