Strategic Market Manangement - 7th Edition

The Case of Giordano

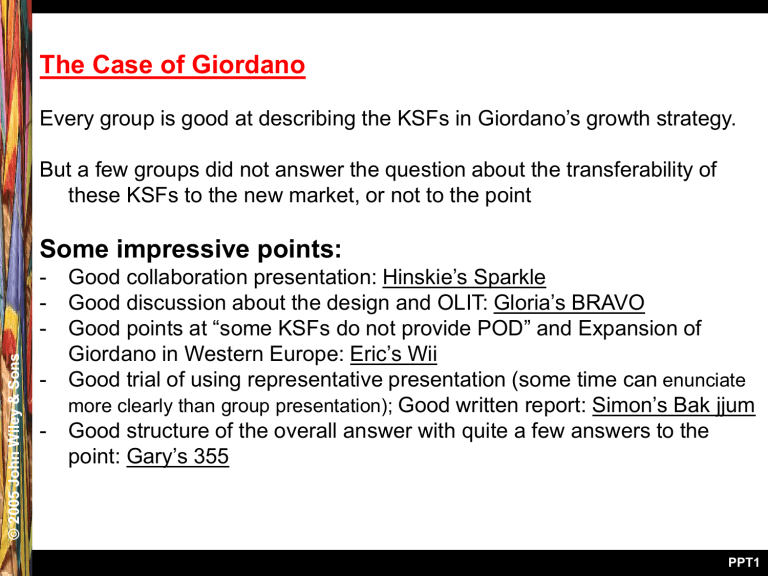

Every group is good at describing the KSFs in Giordano’s growth strategy.

But a few groups did not answer the question about the transferability of these KSFs to the new market, or not to the point

Some impressive points:

Good collaboration presentation: Hinskie’s Sparkle

Good discussion about the design and OLIT: Gloria’s BRAVO

Good points at “some KSFs do not provide POD” and Expansion of

Giordano in Western Europe: Eric’s Wii

Good trial of using representative presentation (some time can enunciate more clearly than group presentation); Good written report: Simon’s Bak jjum

Good structure of the overall answer with quite a few answers to the point: Gary’s 355

PPT1

The Case of Giordano

Performance evaluation: what I gave you higher than what you gave your peers

Flora’s Group “355”

Hinskie’s Group “Sparkle”

Simon’s Group “Bak jjum”

Gloria’s Group “BRAVO”

Eric’s Group “Wii”

2.96

2.72

3.44

3.30

2.57

PPT2

Chapter 14 Setting Priorities for Businesses & Brands

Identifying the business units that are priorities (not priorities) is a key to a successful strategy.

- Priorities: Invest/Grow strategies (chapter10-13)

- Not priorities: Exit/Milk/Hold strategies

1. Business Portfolio

BCG growth-share portfolio model

- GE business position-market attractiveness model

2. An Exit Strategy – Divestment or Liquidation

Motivations

- When to Exit

- Exit Barriers & Biases

3. A Milking Strategy

4. The Brand Portfolio – Brand Consolidation Process

PPT3

1. The Business Portfolio

Portfolio: a collection of investments held by an institution

BCG matrix – Market growth rate vs. Market share

(1) Star – Most important to the business and deserving of any needed investment

(4 growth strategies)

(2) Cash Cows – The source of cash, generating cash flow by reducing investment and operating expenses to a minimum (Milk strategy)

(3) Dogs – Potential cash traps & candidates for liquidation (Exit strategy)

(4) Problem Children (Question Marks) – Have heavy cash needs but will eventually convert into starts (Selective investment strategy)

GE matrix – Market attractiveness vs. Business position

An expansion of the BCG matrix

The advantage is that the dimensions are more comprehensive and detailed

Market attractiveness: a composite measure of the potential for sales and profits in a particular market segment

Business position : the strength of our offering relative to other companies’ products

To invest/grow; To use selective investment; To harvest/divest

PPT4

2. An Exit Strategy (Divestment or Liquidation)

Motivations

(1) A resource drain (not profitable given the investment required)

(2) Not fit with strategic direction (a distraction to the internal culture and the external brand image)

When to exit

(1) Business position (weak)

(2) Market attractiveness (no demand, high price pressure)

(3) Strategic fit (not fit with strategic direction)

Exit Barriers

Termination costs

Impact on the reputation & operation of other company businesses

Exit Biases

(1) Reluctance to give up (e.g., emotional attachment)

(2) Confirmation bias (lead to not objectively evaluate the business)

PPT5

For Discussion

Jack Welch, during his first 4 years as GE’s CEO, divested 117 business units accounting for 20 percent of the corporation’s assets.

What are some of the motivations that led to these divestments?

PPT6

For Discussion

Jack Welch demanded that all business units be one or two in their market.

To leave industries with weak prospects and enter those with better ones.

PPT7

3. A Milk Strategy

A milk or harvest strategy

(1) Minimize (reduce) the expenditures toward the business

(2) Maximize the short-term cash flow

A hold strategy (a variation of milking) – Super for cash cows

(1) Avoid growth-motivated investment

(2) Employ an adequate level of investment to maintain a market position e.g.,

Miller and Bud ( 百威啤酒 )have been milked while resources have gone to Miller Lite and Bud Light;

Kodak for a long time has milked its film business

PPT8

4. The Brand Portfolio

The logic is to categorize brands so that precious brand-building budgets are allocated wisely.

One element of brand strategy is to set priorities within brand portfolio, identifying

(1) The strong strategic brands ( with equity, supporting a sig. business )

(2) Other brand playing worthwhile roles ( supporting a niche or local business )

(3) Brands that should receive no investment ( cash cows )

(4) Brands that should be deleted ( no equity, no potential )

5-step Brand Consolidation Process

(1) Identify the relevant brand set

(2) Brand Assessment

(3) Prioritize the Brands

(4) Develop the revised portfolio strategy

(5) Design and implement the migration strategy

PPT9

4. The Brand Portfolio

For Discussion

How would you determine if a firm has too many brands?

PPT10

4. The Brand Portfolio

For Discussion

How would you determine if a firm has too many brands?

See all P&G’s brands http://www.pg.com/common/product_sitemap.jhtml

You need to determine if every brand has a role that merits investment.

Brands that are basically taking on a descriptive role but are absorbing resources are candidates for downsizing or eliminating.

The brand consolidation process will provide an objective way to evaluate brands.

PPT11

4. The Brand Portfolio

For Discussion

What in your judgment are the key problems or issues in the brand consolidation process?

5-step Brand Consolidation Process

Identify the relevant brand set

Brand Assessment

Prioritize the Brands

Develop the revised portfolio strategy

Design and implement the migration strategy

PPT12

4. The Brand Portfolio

For Discussion

What in your judgment are the key problems or issues in the brand consolidation process?

(1) There are problems in assessing all the brands

Each dimension involves subjectivity: e.g., differentiation, relevance, growth prospects, extendibility and business fit all involve judgment calls.

(2) The determination of the roles

Involves not only strategic judgment but also organizational sensitivities and either a high level of persuasion or power.

(3) Developing the final portfolio and implementing it can be formidable problems.

PPT13

Chapter 15 Organizational Issues

Applying the concepts to specific organizations

Consider several organizations such as:

A professional sports team like the Houston Rocket

A university such as Lingnan

A products company such as GE

A service company such as Bank of East Asia

Four key organizational components:

Structure; System; People; Culture

Main ideas of this chapter:

- A strategy must match with the structure, systems, people and culture of the organization;

- Each organizational component needs to fit with the others;

- If an inconsistency exists, implementation of the strategy will be affected.

PPT14

Chapter 15 Organizational Issues

1. Structure

- defines the lines of authority and communication

- can vary in the degree of centralization

Centralization:

- Maximizes the chances that synergy opportunities will be exploited

- Resources will be allocated wisely

- Cross silo brands can be managed with consistency

- A central brand identity is helpful not only in external communication but also in building a culture

Decentralization: managers are empowered and motivated to innovate, are close to the market and can therefore understand customer needs e.g., GE and Nike have elements of centralization and decentralization:

Facilitative/Consultative/Service provider model is the best course, maybe on a permanent bases.

PPT15

Chapter 15 Organizational Issues

1. Structure (Cont)

- can vary in the formality of communication channels

Functional Structure (silo structure):

Structured according to functional areas

- Silo structure is with high walls built around the departments

- No ability or desire to go between the department

Matrix Structure

Structured according to product lines

- A cross-functional project team, e.g., CFT (Customer Focused Team)

- Utilizes department representatives/agents to connect functional areas to the customers

- Formalize communication between the departments

PPT16

Chapter 15 Organizational Issues

2. Systems

Several management systems are strategically relevant and can influence strategy implementation

1. Information System: providing customer insights, competitive intelligence, and trend analysis, driving innovation and strategy creation and adaptation

2. Measurement & Reward System: drive behavior and thus directly affect strategy implementation; Key measures to evaluate performance (motivate employees to cooperate, communicate and create synergy, reflecting long term perspective)

3. Planning System: A planning template plus creative, out-of-box thinking

PPT17

Chapter 15 Organizational Issues

3. People

- What type of people are needed to make the organization run effectively? What leadership or skill characteristics are most critical?

Strategies require certain types of people:

Functional areas, such as marketing, manufacturing, operations, and finance

- Product or market areas

- New product programs

- Management of particular types of people, a particular type of operation & growth and change

Sourcing:

Insiders: conversant with its culture & systems, have established networks, a

proven track record; too comfortable with the status quo

Outsiders: needed functional expertise, experience, and credibility; don’t know the organization

PPT18

GE’s Jack Welch believes that people are the most important ingredient to success. What are the implications of that belief?

Implications are that the company spends a lot of time and resources on

(1) People evaluation (GE has several meeting during the year on this for top executives)

(2) People training (GE sets the standard for training, Jack Welch spent a night with each class)

(3) Hiring (GE looks for smart, loyal, trustworthy people who share the common vision and goals of the company)

(4) Firing (Welch is famous for his controversial policy of firing the bottom ten percent)

PPT19

Chapter 15 Organizational Issues

4. Culture - Involves three elements

Shared Values

specify what is important

- widely accepted

Norms of Behavior

informal rules that influence decisions and actions throughout an organization;

- suggest what is appropriate and what is not;

- norms encourage behavior consistent with shared values

Symbols and Symbolic Action (c ultures are largely developed & maintained by the use of consistent, visible symbols & symbolic action)

- The founder & original mission (e.g., personality of Richard in Virgin)

- Modern role models help communicate values

- Activities, questions asked routinely, rituals

PPT20

For Discussion

Assume that you are CEO of a company like Leapfrog, which sells entertaining, electronic-based learning devices for customers ranging from infants to high school students.

Describe the culture you would like to develop and maintain.

PPT21

For Discussion

The two dominating values should be education and an electronic game technology culture.

The company should also be one that

- Is fun

- Is intuitive

- Is a learning organization

- Is family oriented

- Consists of risk takers

- Has a strong desire to nurture the next generation

PPT22

Hit Industries e.g., Three different types of firms that compete in hit industries

Hit Industries the goal is to obtain, produce, and exploit a product that will have a relatively short life cycle, e.g., movies, records, fashion, publishing, video games, computer software…

Organizational problems are intense and graphic

PPT23

What are the differences between hit industry roles (an oil industry analogy)?

Drillers – find new ideas/products fast

People: product development people

Structure: flat, loose, no structure

Culture: risk taking, creative, high-energy

System: high bottom-line performance incentives

Pumpers – produce the products/service

People: production control people

Structure: centralized, tight control

Culture: risk-averse, cost oriented, discipline

System: no bottom-line performance incentives

Distributors – marketing & distribution

People: marketing and distribution people

Structure: decentralized, loose control

Culture: promotion oriented

System: some bottom-line performance incentives

An organization starts as a drilling company, then takes the form of either a pumper or a distributor after establishing some products. The 4 components change accordingly.

PPT24

How can a new corporate chief marketing officer (CMO) get traction?

Eight approaches

Get the CEO on Board

Get the right people

Cross-silo teams

Get easy wins

Be facilitator/consultant

Engage the business units

Deliver excellence

Balance central opportunities with local needs

The applicability of the 8 guidelines differ by the context

PPT25