Presentation for Australia & NZ

advertisement

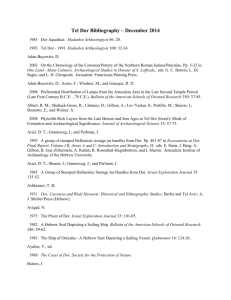

Israel Economy March 2011 Israel- Macro Economic indicators, 2005-2010 Criteria 2005 2006 2007 2008 2009 2010 134.3 146.2 168 202.3 195.4 217* 5.1% 5.7% 5.4% 4.2% 0.8% 4.5%* 23,390 25,080 26,730 27,960 27,930 28,680* Exports of Goods & Services (B$) 57.2 62.5 71.3 81.1 67.7 80.5 Imports of Goods & Services (B$) 57.6 61.7 73.5 84.0 62.9 76 Unemployment Rate (%) 9.0% 8.4% 7.3% 6.1% 7.5% 6.7% Inflation Rate (Year End) 2.4% -0.1% 3.4% 3.8% 3.9% 2.6% Current Account balance (% of GDP) 3.1% 5.1% 2.9% 0.8% 3.9% 3.2%* GDP (B$ -at current market prices) GDP Real Growth rate (%) GDP per Capita (PPP, $) Source: EIU, CBS, Bank of Israel * Forecast **IEICI Forecast GDP Growth (%) Israel 5.7 World Euro area USA 5.4 4.1 3.1 2.7 2 4.5 4.2 3.9 2.8 1.9 2.3 Japan 4.0 3.8 2.9 1.5 0.8 0.4 0 3.8 3.1 2.7 1.9 1.6 2010 2011* 1.6 -1.2 -2.3 -2.6 -4.1 -6.3 2006 Source: EIU 2007 2008 2009 *Forecast Real GDP Growth (annual % of change ,2009) While many OECD countries were severely affected by the global economic crisis, Israel still experienced a positive growth, and only a relatively mild decline in its multi year growth rate. Source: Ministry of Finance Israel’s Credit Ratings Source: Ministry of Finance GDP Quarterly Growth Source: eiu Gross Public Debt (as % of GDP) 100 Since 2003, government debt has been on a consistent downward trend, only interrupted by the extraordinary circumstances surrounding the 2009 global economic crisis 95 90 85 82.6% 80 75.8% 75.2% 77.7% 78.7% 75 74.2% 70.6% 70 66.2% 65 61.5% 60 56.2% 55 50 2006 2007 2008 2009 2010* 2011* 2012* 2013* 2014* 2015* Source: EIU Expenditure on R&D (as % of GDP,2008) Source: Ministry of Finance Unemployment Rate (harmonized, 2009) Source: Ministry of Finance Goods & Services Export Development (Including Diamonds , B $) Services Export Merchandise Export 23.8 25 22 21.1 19.3 17.5 16.0 15.4 12.9 12.2 13.7 8.0 4.6 2.7 6.0 12.7 1980 1990 30.9 27.7 27.2 29.9 2000 2001 2002 2003 19.5 1995 36.3 39.7 43.3 2004 2005 2006 49.8 2007 56.6 2008 51 2009 56 2010 ISRAEL- Goods Export 2010 North America 29% $12.4B Latin America 6% EU 30% (excluding diamonds) Rest of Europe 6% $2.6B $12.7B Asia 20% $8.4B Africa 3% $1.3B Rest of World 6% $2.3B $2.5B A shift from traditional market to Asian markets Exports of Goods by Region (excluding Diamonds) E.U. Asia U.S. Rest Of World 100% 90% 22.0% 22.5% 22.2% 29.7% 28.2% 27.8% 16.3% 14.8% 19.9% 32.1% 34.4% 30.1% 2000 2005 2010 80% 70% 60% 50% 40% 30% 20% 10% 0% Source: Central Bureau of Statistics 13 Israel’s Main Trading Partners 2010 (US$ Billions, excluding diamonds) 5.9 11.7 1.2 0.7 1.7 1.5 1.2 1.8 0.6 Ja pa n 2.0 In di a 1.8 1.8 1.3 Fr an ce 2.4 Tu rk ey d th er la n 1.7 Ne er m an y 1.7 G Ch in a U. S. 1.7 2.1 Ita ly 3.7 U. K. 4.7 Export Import China has become a leading trade partner for Israel Source: Central Bureau of Statistics 14 Israel - Cyprus trade 2003-10 (M$) 881 775 623 567 541 491 153 2005 2006 69 65 32 25 2007 Exports 2008 Imports 44 2009 2010 Israel Exports to Cyprus – main sectors, 2010 SECTOR M$ % change 10/09 % of total Chemicals 669 33% 86% Plastic and Rubber 9.7 0% 1% Machinery & Electrical Eq. 9.2 34% 1% Agriculture 7.6 -14% 1% Wood, furniture etc. 7.5 35% 1% Mining and Quarrying 5.9 -17% 1% Other 66 60% 9% Total Export 755 37% 100% Growth in Export of Goods 2010 (US$ Millions, excluding diamonds) 98% 59% 41% 30% 22% 18% 17% 16% 12% 10% 6% 1% U .S . S. K or ea B el gi u m in Sp a Fr an ce It a ly nd he rla an y N et er m G Tu rk ey l B ra zi a In di U .K . C hi na -1% China, India and Brazil are the most rapidly growing markets for Israeli export Source: Central Bureau of Statistics 14 Export of Goods by Sector 2010 in comparison to 2009 (B$) Industry 2009 2010 % change % of total Hi-Tech Industries 17.9 20.2 12.6% 49.5% Med-Hi Tech Industries 9.7 11.7 20.2% 29% Med-Low Tech Industries 5.4 6.7 25.4% 16.5% Low-Tech Industries 2.0 2.1 6.2% 5% Total (excluding diamonds) 35.0 40.7 16.3% 100% Industry Export Growth, By Sector (M$) 25,000 In the past decade the industrial export was mainly affected by the rapid growth of the Hi-Tech industry 20,000 15,000 10,000 5,000 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Hi-Tech Industries Med-Hi Tech Industries Med-Low Tech Industries Low-Tech Industries Growth of Main Hi-tech sectors, 1995-2010 In the past decade the industrial export was mainly affected by the rapid growth in equipment for control and supervision and Pharmaceutical products Main Hi-tech services sectors, 2002-2010 (m$) 6,000 5,000 4,000 3,000 2,000 1,000 2002 2003 2004 2005 2006 Computer Services 2007 2008 R&D Services 2009 2010 Main Hi-tech sectors TOTAL HIGH- TECH EXPORTS 2010: 25B$ Source: CBS & IEICI Calculations’ excluding R&D Israel’s Free Trade Agreements 1985 USA Egypt 1992 EFTA Jordan 1997 Turkey 1997 Canada 1999 Mexico 2000 European Union QIZ Agreement (Association Agreement) 2007 MERCOSUR* * Member states of the common market of the south, not yet in force 37 Avoidance of Double Taxation Agreements Luxembourg Russia Switzerland Mexico Singapore Thailand Moldova Slovakia The Netherlands Norway Slovenia Turkey Philippines South Africa** Ukraine Portugal * South Korea United Kingdom Poland Spain Uzbekistan Romania Sweden USA * The agreement with Portugal has been recently ratified ** Not yet ratified by South Africa. 39 Cooperation in Industrial R&D Agreements Austria India Belgium Ireland UK Canada Italy USA China Korea Finland Netherlands France Portugal Germany Singapore Hong Kong Sweden Spain 40 Protection of Investment Agreements Albania Croatia Guatemala Argentina Cyprus India Armenia Czech Republic Kazakhstan Azerbaijan El-Salvador Korea Belarus Estonia Latvia Bulgaria Georgia China Germany 41 Protection of Investment Agreements Lithuania South Africa Moldova Thailand Poland Turkey Romania Slovakia Slovenia Turkmenistan Ukraine Uruguay Uzbekistan 42 Israel in Global Perspective Doing Business Index (World Bank)/183 Singapore 1 Hong Kong 2 New Zealand 3 United Kingdom 4 United States 5 Australia Iceland 10 15 France 26 Switzerland 27 Israel 29 Netherlands 30 Austria Cyprus Spain 32 37 49 Italy 80 China 79 Greece Russia India Chad 109 123 134 183 Israel in Global Perspective The Enabling Trade Index- WEF/125 Singapore Hong Kong Denmark Sweden Switzerland New Zealand Australia France Japan Israel S. Korea Cuprus Spain China Italy Greece India Russia Burundi 1 2 3 4 5 10 15 20 25 26 27 31 32 48 51 55 84 114 125 Israel in Global Perspective The Global Competitiveness Index- WEF/139 Switzerland Sweden Singapore United States Germany Canada France S.Korea New Zealand Israel Malaysia China Cyprus Spain Italy India Brazil Russian Federation Greece Chad 1 2 3 4 5 10 15 22 23 24 26 27 40 42 48 51 58 63 83 139 Israel in Global Perspective The Global Competitiveness Index- WEF/133 Israel in Global Perspective The Global Competitiveness Index- WEF/133 Israel in Global Perspective 2010 IMD World competitiveness Yearbook 2010 The institute for Management Development ranked Israel at the 17th Place, Out of 58 countries Israel was ranked 24th at 2009 Israel in Global Perspective 2010 IMD World competitiveness Yearbook 2010 Israel in Global Perspective 2010 IMD World competitiveness Yearbook 2010 Small country - great spirit! Israel's technology advantages: Israel has an entrepreneurial spirit Israel has the mentality of early adopters Israel has a creative fusion between academy and business Israel has a defense technology commercialization Israel has highly skilled workforce Israel has a powerful VC community Israel has investment and R&D incentives Thank you Shauli katznelson Chief Economist shauli@export.gov.il Inflation Rate Worldwide (Annual rate of change in CPI) Source: Ministry of Finance Budget Deficit & General Government Expenditure (as % of GDP) Source: Ministry of Finance