Controls for Procurement Cards

advertisement

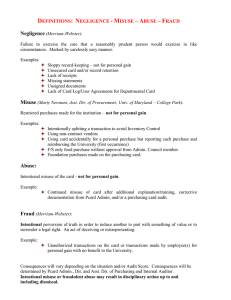

Understanding Commercial Card and the use of Controls Louisiana GFOA Fall Conference October 9, 2014 Rhonda C. Engel, SVP Commercial Card Sales Manager Regions Bank Agenda Introduction Commercial Card Usage Basics and Benefits of a Commercial Card Program Establishing Controls Best Practices Questions and Discussion October 9, 2014 2 Commercial Card Usage October 9, 2014 3 Cities and Counties Usage Source: RPMG Research Corporation, 2014 Purchasing Card Benchmark Survey Results October 9, 2014 4 School Districts Usage Source: RPMG Research Corporation, 2014 Purchasing Card Benchmark Survey Results October 9, 2014 5 Basics and Benefits of a Commercial Card Program October 9, 2014 6 Commercial Card Basics Improving Cash Flow and Reducing Costs Through Payment Methods Wire Fastest Method Most Expensive Check Most Common Labor Intensive ACH Inexpensive Reduced Float Commercial Card Increase Float, Pay Faster October 9, 2014 Earn a Rebate 7 Commercial Card Basics Traditional Plastic Card - Replace the Purchase Order Given to employees to buy goods and services Typically card-present purchase Logged into A/P after posting date (i.e. expense reports) Accounts Payable – Replace the Check Payments made via the Card Program on approved invoices or Purchase Orders Typically card-not-present purchases or Ghost Cards Logged into A/P at the time of invoice or PO approval October 9, 2014 8 Savings and Simplification of Commercial Card Usage Source: RPMG Research Corporation, 2014 Purchasing Card Benchmark Survey Results October 9, 2014 9 Commercial Card Basics Differences between a Commercial Card and a Traditional Credit Card Controls Dollar Limits Merchant Category Blocks Velocity Limits Ghost Card Capability No plastic card issued Enhanced Reporting Online real time information Due in Full Each Month Typically due the 15th of each month Rebate Paid annually October 9, 2014 10 Commercial Card Uses Accounts Payable Replace the check Construction Projects Increase your float Small Dollar / Emergency Purchases Replace purchase orders Capital Expenditures Increase your rebate October 9, 2014 11 Commercial Card Value Proposition Due to the economics of growing costs and reduced revenue, companies have continued to focus on improving cash flow and reducing costs. Authorization Controls Benefit from custom spending controls at the point of sale that are both automated and standardized Float Benefit Increase the potential float on payables Revenue Share Convert your Accounts Payable area into a source of revenue Cost Reduction End-to-end purchasing solution that significantly lowers purchasing transaction costs Data Reporting Automation of data capture, reporting and integration of expenses into existing accounting systems Strategic Sourcing Readily accessible spending data for strategic sourcing and vendor negotiation October 9, 2014 12 Improve Vendor Relations and Cash Flow October 9, 2014 13 Establishing Controls October 9, 2014 14 Program Risks – Fraud, Misuse and Abuse Fraud is the leading concern for Commercial Card issuers and Program Administrators. Account takeover Mail theft Counterfeit Cards Lost / Stolen Cards Mail Order / Telephone Database Hacking Franchise Software Hacking Skimming Sniffing Phishing Other program risks involve Abuse and Misuse: Abuse: Intentionally or unintentionally violating organizational policies and / or procedures for personal gain Misuse: Intentionally or unintentionally violating organizational policies and / or procedures for work related gain October 9, 2014 15 Increased Controls Commercial Card Programs have increased controls that help reduce the potential for fraud. Dollar Limits Monthly, Daily, Weekly and Transaction Velocity Limits Daily and Monthly Supplier Limits Block by Supplier Type (MCC) Reporting Real Time Monitoring of Transactions Additional: October 9, 2014 Employee Card Agreement Employee Misuse Coverage 16 Chip Card Technology Emerging EMV Technologies • EMV-enabled cards -- named for developers Europay, MasterCard and Visa -have an embedded microprocessor chip that encrypts transaction data differently for each purchase. • Some chip cards require a personal identification number (PIN) to complete a transaction, while others only require a signature. • Over 130 countries world-wide use chip technology and it is being adopted as the standard in the U.S. by the end of 2015. October 9, 2014 17 Best Practices October 9, 2014 18 Best Practices Commercial Card Best Practices › A Program Administrator should hold an appropriate position within the organization, have good motivation and people skills and should have access to applicable training to enable them to fulfill the associated responsibilities of managing an efficient program. › Benefit: Minimizes the potential for problems and abuse. October 9, 2014 19 Best Practices › Receive a Commercial Card Program review at least semi-annually from your card provider. The review should focus on previous card use / spend and should identify areas to optimize the program. › Benefit: Validates program integrity and supports the Program Administrator’s oversight of the program. October 9, 2014 20 Best Practices Card Best Practices •Commercial Program Administrators should meet regularly with Management to provide quality updates on program performance and issues. – Benefit: Management is engaged and provides organizational leadership for program direction. › Establish and publish Card program policies and enforce disciplinary actions for card misuse / abuse. › Benefit: Encourages proper stewardship of the card program. October 9, 2014 21 Best Practices Card Best Practices ›Commercial Leverage appropriate controls to effectively manage when, how and where the cards are used (i.e. credit limits, daily limits, merchant controls). › Benefit: Reduces risk of fraud and misuse. Ensures organizational dollars are being used for intended purpose. • Stay up-to-date on industry trends in the commercial payment space. – Benefit: Understanding industry trends will help to optimize your program and identify ‘best practices’. October 9, 2014 22 Revenue Sharing A Commercial Card Program is currently the only payment strategy that offers a Revenue Sharing Opportunity. Earn a percentage on every dollar spent Paid in cash directly to your organization Unencumbered funds Turn Accounts Payable Department into a revenue generator October 9, 2014 23 Stop by and see us at our Booth! Open Discussion / Q&A October 9, 2014 24