HRBN Survey

advertisement

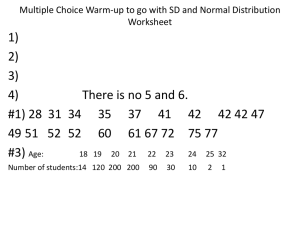

The Human Resources Benchmarking Network An HR Metrics (and) Benchmarking Tool for Municipalities Colin Dawes OMHRA Spring Workshop Guelph, April 2011 Presentation Agenda Introductions/Agenda Benchmarking Concepts HR Metrics for Municipalities The Human Resources Benchmarking Network The Municipal Group in the HRBN Survey • HR Trends in Municipal Government 1998 and 2010 Key Results from the 2010 HRBN Survey Report Applications for HR Metrics • • Training, Technology and the HR Department • Measurement Advice from the HRBN My Second Agenda 1. Remind you about a few things you already know. 2. Measurement and benchmarking concepts and tools you can use to help your organization be more successful – sometimes despite itself. Benchmarking Concepts What is Benchmarking? “Benchmarking is a continuous, systematic tool for measuring and improving the processes, products and services of an organization by comparing them to the very best “like” processes, products and services wherever they may be found.” The Council for Continuous Improvement HR Metrics for Municipalities My Selection Criteria Frequently completed (in the HRBN experience) Simple to understand Avoid duplication Significant Impact – either on HR or the Organization My TOP TEN Indicator Selections (HRBN Survey) 1. External Hire Rate: PFT and Reg. PPT (can be compared to Turnover indicators) 2. 3. 4. 5. Average Time to Fill a Position With an External Hire Number of Non-Management Employees Per Management Employee Extended Health Care Claims Expense Per Participating Employee Paid Sick Hours Per Eligible Employee My TOP TEN Indicator Selections (HRBN Survey) * “Pre-External Intervention” Grievance Rate 7. Workers Compensation Lost Work Hours Rate 8. Modified Work Accommodations Rate 9. HR Technology Indicator 10. Employees Per HR FTE 6. The Human Resources Benchmarking Network What is the HRBN? Cross-Canada network of HR functions primarily from Health Care, Municipal Government and Not-for-Profit employers who complete the HRBN Survey Open to all sectors Current representation in six (6) provinces The Annual Benchmarking Survey Presently fifty-five (55) indicators Balance of “Human Asset” and “Human Resources” indicators Full spectrum of HR function represented More In-depth quantitative analysis possible through demographic breakdowns Electronic Format (Multi-Sheet Excel File) Content determined by input from Network members Sample Survey Indicators External Hire Rate Average Time to Fill Position With External Hire Salary to Operating Expense Ratio Management to Staff Ratio Paid Sick Hours Per Eligible Employee Training and Dev’t Expense Indicator Extended Health Benefit Claims Expense Indicator HR “Admin” Expense to Operating Expense EAP Utilization Rate WCB Lost Time Incident Rate “Final Step” Grievance Resolution Rate HR “Legal Costs” Per Employee Turnover Rate HR “FTE” Indicator “Modified Work” Accommodation Rate HR Technology Indicator HR Training Courses Attendance Indicator Internal Transfers to Total Hires Ratio “Final Step” Grievance Rate Benefits Expenses to Compensation Expense Sample Indicator Definition The Report of the Annual Benchmarking Survey Benchmark statistical data for each indicator (average, percentile, etc.) Note of special statistical relationships if indicated Statistics breakdowns by Province/Sector where justified by sample size Summary table of individual data submissions for the indicator Contact names for Network Survey participants The Report of the Annual Benchmarking Survey Sample Data Table: Paid Sick Hours Per Eligible Employee, HRBN Report The Municipal Group in the HRBN Survey Human Resources Trends in Municipal Government: 1998 to 2010 Trend Setters: Municipal Participants in the 1998 HRBN Survey City of Oshawa City of Toronto Region of Durham Region of Hamilton-Wentworth Region of Niagara Region of Ottawa-Carleton Region of Sudbury Region of Waterloo Some Things Change … Indicator 1998 Survey 2011 Survey Change External Hire Rate 9.9% 16.2% Substantial increase (63.4%) in hiring rates since the late 90s. Dental Expense Per Participating Employee $683 $1,112 A significant increase (63%). Staff Per Management Ratio 19.3 24.8 Not good news for “span of control”. $50.77 $77.43 No surprise here, with the increasingly complex legal environment. $272 $446 64% increase. Reflects increased competition and prices, online solutions. HR Legal Costs Per Employee Employment Advertising Expense Per Hire Some Things Change … A LOT. Indicator 1998 Survey 2011 Survey Change Extended Heath Care Expense Per Participating Employee $854 $2,160 Extended Health care claims – 153% increase in costs (primarily drug-related, increased use of para-medicals, etc.) EAP Utilization Rate 7.2% 15.4% EAP usage becoming more common (115% increase). HR Technology Indicator (showing Ratio 0.375 0.764 Technology has advanced a great deal (107% increase). of points scored to possible points) And Some Things Change Less. Indicator 1998 Survey 2011 Survey Change “All Grievances” Rate 5.4% 5.3% Surprisingly, unions appear to have been upset with employers on a consistent basis for years. WSIB Incidents/ Lost Hours 3.1%/ 3.9 hours 4.3%/ 3.8 hours Less time lost – but more incidents? Lost hours result makes more sense …(Accommodations up slightly 6.6%!) Employees/HR “FTE” 102 100.3 Ontario figures generally unchanged. Sick Pay Expense Indicator 3.3% 3.4% This result, and the next, suggest that we may have reached a “plateau” of sorts. Paid Sick Hours Per Eligible Employee 66.5 69.2 As noted in “Sick Pay Expense”. Survey Demographics – 2010 Survey Municipal group represents 28% of the survey participants (22 in all) and 105,000 employees Many smaller municipalities plus most members of the Regional and Single Tier Municipalities (RSTM) Group RSTM – 12 Other Cities – 6 Towns – 2 Counties - 2 RSTM - Special Indicator Set - 2004 (16 indicators in all) Ontario Municipal CAO’s Benchmarking Initiative (OMBI) and the HRBN HR Group asked to identify HR indicators for OMBI Decision to align indicators to the HRBN Survey (avoid duplication) Four (4) indicators identified: o #T4s per HR staff (Service Level) o HR administration expense per $1000 of municipal operating expenditure (Service Level) o HR services cost per T4 supported (Efficiency) o Turnover Rate (Customer Service) Metrics Challenges in Municipal HR Measurement Complexity/differences in the how and “who” provides HR services to different employee groups Definition of employees … Specific Indicator Challenges o T4 vs. active employee counts o What counts as “HR” o Expenses/internal charges Key Results from the 2010 HRBN Report HRBN #5 – Average Time to Fill a Position Formula: Total, for all External Hires, (Difference Between the “Date the Offer to the New External Hire is Made” and the “Date the Approval to Recruit is Received in HR”, One Year period Statistic Sample Size Survey Health Care Municipal 36 25 10 45.4 16.4 44.6 15.5 47.7 20.8 25th Percentile 23.9 24.4 24. 50th Percentile 44.5 45 48.4 75th Percentile 65.4 65.8 58.8 90th Percentile 77.6 72.9 81.7 Average 10th Percentile NOTE: Permanent, Full-time and Regular Permanent, Part-time Positions take longer to fill - 59 days for the full survey (59 days for the municipal group as well) HRBN #7 – Turnover Rate Employee-count, One Year period Statistic Sample Size Survey Formula: # Separations / # Average Health Care Municipal 66 48 17 11.2% 10.6% 12.4% 10th Percentile 6.9% 7.2% 5.7% 25th Percentile 8.5% 8.8% 7.8% 50th Percentile 11% 10.4% 11.5% 75th Percentile 13.1% 12.5% 15.1% 90th Percentile 15.7% 13.9% 21.2% Average HRBN #4A(1) – Non-Management Employees Per Management Employee Formula: # “Non-Management Employee-count” / # “Management” Employeecount, End of Survey Time Period, One Year period Statistic Sample Size Survey Health Care Municipal 73 55 17 Average 27.6 28.9 24.8 10th Percentile 11.9 16.9 7.8 25th Percentile 19.6 22.0 11.8 50th Percentile 25.7 26.9 23.7 75th Percentile 31.8 32.0 300 90th Percentile 42.0 41.9 39.4 HRBN #15 (A & B) – EAP Indicators (Municipal Sector) Formulas: (A) EAP Cases / Average Eligible Employee-Count (B) EAP Expense / # Employees Eligible to Use the EAP, One Year period Statistic Sample Size (A) EAP Utilization Rate (B) EAP Expense Per Eligible Employee 14 16 Average 15.4% $47.10 10th Percentile 7.8% $26.12 25th Percentile 12.2% $29.34 50th Percentile 15.6% $46.90 75th Percentile 17.9% $53.95 90th Percentile 22.8% $75.50 HRBN #25 – HR Administration Expense Indicator (Municipal Group) Formula: $ HR Administration Expense / $ Operating Expense , One Year period Statistic Sample Size Survey 15 Average 0.6% 10th Percentile 0.4% 25th Percentile 0.5% 50th Percentile 0.6% 75th Percentile 0.6% 90th Percentile 1% HRBN # 1 and #7: Comparison External Hire Rate and Turnover Rates, Municipal Group, 2007-2010 18 16 14 12 External Hire Rate Turnover Rate 10 8 6 4 2 0 2007 2008 2009 2010 HRBN #13: Paid Sick Hours Per Eligible Employee, Health Care and Municipal Groups, 2007-2010 80 78 76 74 72 70 Health Care Municipal 68 66 64 62 60 58 2007 2008 2009 2010 HRBN #9 and #10: Dental Claims and Extended Health Expense Per Employee, Municipal Group, 2007-2010 $2,500 $2,000 EH claims expense per employee Dental claims expense per employee $1,500 $1,000 $500 $0 2007 2008 2009 2010 HRBN #23: Percentage of HR Departments Utilizing Technology, By Technology Type, 2007-2010 100 90 80 70 60 E-Mail Internet HR Intranet HRIS 50 40 30 20 10 0 2007 2008 2009 2010 HRBN #14(C) – Breakdown of Points in Time at Which Grievances were Resolved or Withdrawn in Survey Reporting Period, 2010 (Municipal Group) 8% 19% 46% 28% Prior to "Final Step" Meeting At "Final Step" Meeting Through Third Party Intervention At Arbitration Applications for HR Metrics Applications for HR Metrics Reporting purposes Support HR quality goals Prove/disprove existence of opportunities Demonstrate success/failure of initiatives Illustrate cause/effect relationships Impacting adversarial negotiations or settlement opportunities Create business cases and obtain resources Improve measurement systems Positive reinforcement HRBN #22 – HR Training Course Attendance (Municipal Group) Formula: # Training Course Attendance (Per Category) / # Average Employee-count (or New External Hires in case of Orientation), One Year period Statistic Sample Size Workplace Competency Orientation (of external Hires) Health and Safety Training 16 14 17 Average 81.1% 51.9% 62.8% 25th Percentile 28.3% 16.0% 16.0% 50th Percentile 39.0% 40.5% 26.0% 75th Percentile 110.5% 96.0% 43.0% 90th Percentile 154.5% 107.2% 170.0% HRBN #23: Percentage of HR Departments Utilizing Technology, Municipal Group, By Technology Type, 1998 to 2010 100 E-Mail 90 80 Internet 70 Electronic Forms HRIS 60 50 40 HR Intranet 30 Manager Access HRIS Employee Access HRIS 20 10 0 1998 2010 HRBN #24 - # Employees Per HR “FTE” Formula: # Average Employee-count / # HR “FTE”-count, End of Survey Time Period, One Year period Statistic Sample Size Survey Health Care Municipal 76 53 22 132.1 146.8 100.3 10th Percentile 74.6 78.2 65.9 25th Percentile 91.0 95.1 90.6 50th Percentile 114.8 124.9 104.9 75th Percentile 146.8 185.2 118.9 90th Percentile 220.9 249.9 129.3 Average HRBN #24(B) – HR FTE Detail – Functional Breakdown (Municipal Group) 1998 and 2010 Recruitment Benefits HRIS T&D Workers Comp/H&S Compensation Employee Records Emp/Labour Relations Org. Development Other 2010 1998 0% 50% 100% Trends –Benefits and HRIS, and new HR functions (quality, metrics, etc.), and to a lesser extent, WC/H&S and Recruitment, receive more staff resources now, vs. in 1998. HRBN #24(C) –HR FTE Detail – Organization Level Breakdown (Municipal Group) 1998 and 2010 Executive 2010 Manager Professional/Super visory Administrative Support 1998 0% 50% 100% Trends – There has been a clear trend toward a higher proportion of supervisors, at the expense of both executives and managers, and administrative/clerical positions. HRBN #24(C) –HR FTE Detail – Model of Service Provision Breakdown (Municipal Group) 1998 and 2010 2010 Traditional Designated Client Group Alternative 1998 0% 50% 100% Trends – A change in HR service delivery is definitely indicated, from the traditional (HR as a separate, “expert” dept. with HR specialties serving the organization to a model of HR professionals attached to client groups, with more generalists, and in some cases matrix reporting relationships with Operational departments.) Measurement Advice from the HRBN Don’t take on more measurement than you can handle Focus on objects that are critical success drivers Listen to senior management priorities and educate where possible Balanced Choice of Metrics Simple metrics (in design, in ability to collect data) are more reliable Downside of Simple – inverse relationship simplicity/value Leading vs. lagging where possible Technology will help (if you are lucky enough to have it) But don’t stop with measurement … Numbers are Susceptible to Manipulation! Numbers are Quantitative Portrayals of Real World Situations Numbers are a Means Not an End Any Questions? Colin Dawes Human Resources Benchmarking Network 416-221-0260 colin@hrbn.ca www.hrbn.ca