background report - Wetlands International

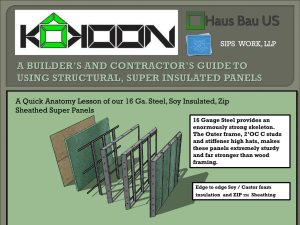

advertisement