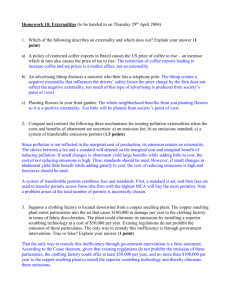

Topic 4:Externalities

advertisement

Topic 4:Externalities Definition of Externality • An externality is an economic cost or benefit that is the by-product of economic activity but that is allacated outside of the market system. • Resources are likely to be misallocated when there is an externality. • There are two types of externalities: negative externality and positive externality. – Negative externalities occur when a cost is generated by the producer of the externality, but because there is no market for the externality, the producer of the externality does not consider the costs that the externality imposed on others. – Positive externalities occur when a benefit is generated by the producer of the externality, but because there is no market for the externality, the producer does not get compensated for the benefit to others and has no incertive to take it into account. External Cost • Scenario [si’neəri:əʊ] – Steel plant dumping waste in a river – The entire steel market effluent [‘eflu:ənt] can be reduced by lowering output (fixed proportions production function) • Scenario – Marginal External Cost (MEC) is the cost imposed on fishermen downstream for each level of production. – Marginal Social Cost (MSC) is MC plus MEC. Price When there are negative externalities, the marginal social cost MSC is higher than the marginal cost. The differences is the marginal external cost MEC. MSC The profit maximizing firm produces at q1 while the efficient output level is q*. Price MSCI MC S = MCI The industry competitive output is Q1 while the efficient level is Q*. Aggregate social cost of negative externality P* P1 P1 MECI MEC D q* q1 Firm output Q* Q1 Industry output • Negative Externalities encourage inefficient firms to remain in the industry and create excessive production in the long run. • Positive Externalities and Inefficiency – Externalities can result in too little production, as can be shown in an example of home repair and landscaping. External Benefits Value When there are positive externalities (the benefits of repairs to neighbors), marginal social benefits MSB are higher than marginal benefits D. MSB D P1 A self-interested home owner invests q1 in repairs. The efficient level of repairs q* is higher. The higher price P1 discourages repair. MC P* Is research and development discouraged by positive externalities? MEB q1 q* Repair Level Public Policy toward Externalities • When large numbers and high transactions costs are invovled, government policy becomes important to internalize an externality. • Internalizing an externality means changing the incentives of the parites involved so that they act as if there is a market for the external cost or benefit. Negative Externalities in a Supply and Demand Framework • The concept of the negative externality can be depicted graphically in a supply and demand framework as shown in figure 4.1. • The externality generates additional opportunity costs that are not included in the supply curve. These costs can be depicted as amount E in the diagram. • The curve S+E includes the entire opportunity cost of production, including the cost of the externality. • Private actions to correct an externality – If only a few people are affected by the externality, then private exchange might correct the problem. – The Coase Theorem states that in the absence of transactions costs, the allocation of resources will be independent of the assignment of property rights. • Ronald Coase. The Problem of Social Cost. 1960 • Corrective taxation of an extenality – If the firms are charged a tax equal to the external cost that they impose on others, then an economically efficient level of output will result. – But there are problems in measuring the cost of the externality, so as to set the tax equal to the marginal cost of the externality. • The first problem is measuring the cost of the externality.( One method might be to take a poll to see how much people would be willing to pay to reduce or eliminate the pollution.) • The next problem is to decide who is responsible for the cost. • What should be taxed? • The external cost is shown as a given amount per unit of production. (figure 4.2, Panel A) • In this case, the only way to reduce the externality is to reduce the amount of production. • But the external cost could be reduced in other ways. Placing a tax on each unit of output would not quite give firms the right incentives. • In panel B, after the corrective tax is placed on the cost of the externality, firms can take action to reduce the amount of pollution they create per unit of production, to lower their tax. • The external cost per unit of production then shifts down from E to E’. Taxation v.s. Regulation • Because it is so difficult to apply a corrective tax on an externality in the real world, governments are more likely to use regulations requiring that certain steps be taken to reduce the externality. • In the short term, a quota might work, but in the long run, the results from a quota and a corrective tax will differ. • taxation versus regulation of an externality(figure 4.3) • The amount of the tax is shown by the entire shaded area, and, as a result, the firm is taking losses. • If each firm is regulated by quotas Q*, they will make above-normal profits, represented by the heavily shaded area. • In the long run, the regulation encourages entry, whereas the optimal tax encourages firms to leave the industry. • the politics of quotas versus taxes – industry representatives will lobby for regulatory solutions – taxpayers can benefit from the tax – which one has more political influence? • Incentive for pollution reduction with regulation versus taxation – incentives involved in regulating pollution are far inferior to those involved in corrective taxation. – however, it is often difficult to apply corrective taxation, and there will be political pressures against it. – regulation may be the second-best solution. Case Study:Standards and Fees • Options for Reducing Emissions to E* – Emission Standard • Set a legal limit on emissions at E* (12) • Enforced by monetary and criminal penalties • Increases the cost of production and the threshold price to enter the industry MSC(marginal social cost, 边际社会成本, 是厂家不会主动考虑的) Dollars per unit of Emissions Standard Fee 3 MCA(marginal cost of abatement, 边际减排成本, 可视为边际排放收益) E* 12 Level of Emissions • Options for Reducing Emissions to E* – Emissions Fee • Charge levied on each unit of emission Dollars per unit of Emissions MSC Cost is less than the fee if emissions were not reduced. So the firm would rather abate than pay the fee. Fee 3 Total Fee of Abatement E* Total Abatement Cost MCA 12 Level of Emissions • Standards Versus Fees – Assumptions • Policymakers have asymmetric [,æsi’metrik , 不对称]information • Administrative costs require the same fee or standard for all firms Fee per Unit of Emissions The impact of a standard of abatement of 7 for both firms is illustrated. Not efficient because MCA2 < MCA1. MCA1 MCA2 If a fee of $3 was imposed, Firm 1 emissions would fall by 6 . Firm 2 emissions would fall by 8. MCA1 = MCA2: efficient solution. 6 The cost minimizing solution would be an abatement of 6 5 for firm 1 and 8 for firm 2 and MCA1= MCA2 = $3. 4 3.75 3 Firm 1’s Increased Abatement Costs 2.50 2 Firm 2’s Reduced Abatement Costs 1 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Level of 14 Emissions • Advantages of Fees – When equal standards must be used, fees achieve the same emission abatement at lower cost. – Fees create an incentive to install equipment that would reduce emissions further. • Are fees always better than standards? C Fee per Unit of 16 Emissions Marginal Social Cost 14 12 Based on incomplete information fee is $7 (12.5% reduction). Emission increases to 11. ABC is the increase in social cost less the decrease in abatement cost. E 10 A D 8 Based on incomplete information standard is 9 (12.5% decrease). ADE < ABC B 6 Marginal Cost of Abatement 4 2 0 2 4 6 8 10 12 14 16 Level of Emissions • Conclusions about Fees vs. Standards – Standards are preferred when MSC is steep and MCA is flat. – Standards (incomplete information) yield more certainty on emission levels and less certainty on the cost of abatement. – Fees have certainty on cost and uncertainty on emissions. – Preferred policy depends on the nature of uncertainty and the slopes of the cost curves. Marketable Pollution Rights • A system of marketable pollution rights – give all existing polluters the right to continue creating the amount of pollution that they currently creat. – firms would not be allowed to increase their level of pollution without buying the right from someone else. – if a firm could find a way to reduce its pollution, it could sell its right to pollute to others. • Drawbacks of marketable pollution rights – must be possible to monitor the amount of pollution created by various contributors – may creat new pollution – need muture markets Case: Emissions Trading and Clean Air • Bubbles – Firm can adjust pollution controls for individual sources of pollutants as long as a total pollutant limit is not exceeded. • Offsets – New emissions must be offset by reducing existing emissions • 2000 offsets since 1979 • Cost of achieving an 85% reduction in hydrocarbon(烃)emissions for DuPont – Three Options • 85% reduction at each source plant (total cost = $105.7 million) • 85% reduction at each plant with internal trading (total cost = $42.6 million) • 85% reduction at all plants with internal and external trading (total cost = $14.6 million) • 1990 Clean Air Act – Since 1990, the cost of the permits has fallen from an expected $300 to below $100. • Causes of the drop in permit prices – More efficient abatement techniques – Price of low sulfur coal has fallen The Optimal Amount of Pollution • Would it be optimal to eliminate all pollution? – the costs of trying to reduce pollution might outweigh the negative effects of the pollution – if pollution is reduced to the point where the marginal cost of doing so is just equal to the marginal benefit of the reduced pollution, some pollution will remain. The Efficient Level of Emissions Dollars per unit of Emissions Assume: 1) Competitive market 2) Output and emissions decisions are independent 3) Profit maximizing output chosen MSC 6 At Eo the marginal cost of abating emissions is greater than the marginal social cost. Why is this more efficient than zero emissions? 4 At E1 the marginal social cost is greater than the marginal benefit. The efficient level of emissions is 12 (E*) where MCA = MSC. 2 MCA E0 0 2 4 6 8 10 E* 12 14 16 E1 18 20 22 24 Level of Emissions 26 Positive Externalities • Positive externalities produce a benefit to others, but this benefit is not allocated within the market(figure 4.4) • Government subsidization – the government compensates the producer for the value of the positive externality – the problem is how to calculate the optimal subsidy, which should be equal to the external benefit