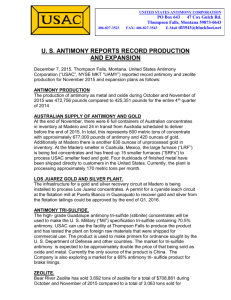

usac corporate profile

advertisement

U.S. ANTIMONY CORPORATION JOHN LAWRENCE, CEO GHS July 19, 2011 1 USAC CORPORATE PROFILE • USAC is a rapidly growing natural resource company with three products: antimony, precious metals (silver and gold) and zeolite. • USAC produces antimony metal and tri-oxide at its Montana and Mexico smelters • USAC obtains antimony raw materials from its own mines and mill, plus other mines and smelters in Canada, Mexico, and Europe. • USAC uses proprietary metallurgical processes to recover precious metals from antimony raw materials • USAC sold 1,679,041 pounds of antimony at an average sales price of $3.67 per pound in 2010 • USAC will mine antimony and silver at its Los Juarez property in Queretaro, Mexico • USAC subsidiary Bear River Zeolite mines natural zeolite near Preston, Idaho; 15,318 tons of zeolite were sold at an average sales price of $157.72 per ton in 2010 USAC SMELTER AND CORPORATE OFFICES 47 Cox Gulch Road Thompson Falls, MT 59873 Phone: 406-827-3523 Fax: 406-827-3543 Email: tfl3543@blackfoot.net www.usantimony.com www.bearriverzeolite.com USAC reported a profit of $805,213 on revenues of $9,073,324 in 2010 GHS July 19, 2011 2 USAC ANNUAL TOTAL SALES ANTIMONY METAL AVERAGE PRICE/TON $10,000,000 $18,000 USAC $9,000,000 BRZ $16,000 $8,000,000 $14,000 $7,000,000 $12,000 $6,000,000 $10,000 $5,000,000 $8,000 $4,000,000 $6,000 $3,000,000 $4,000 $2,000,000 $2,000 $1,000,000 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2010 2009 2008 2007 2006 2005 GHS July 19, 2011 $0 2004 $0 3 ANTIMONY • USAC mines, mills, and smelts antimony ores • Antimony is a strategic metal accounting for 68% of USAC 2010 revenues - Antimony uses: Metal – automotive bearings, ordinance, storage batteries Oxide – fame retardant, ceramics, catalysts - Substitutes for antimony oxide flame retardants are less economic and do not perform as well • Demand is strong $7,000,000.00 $6,000,000.00 $5,000,000.00 $4,000,000.00 $3,000,000.00 $2,000,000.00 $1,000,000.00 $- 2010 2009 2008 2007 2006 2005 2004 • USAC’s proprietary metallurgy recovers precious metals from antimony and removes impurities such as lead and bismuth USAC ANTIMONY & PRECIOUS METALS ANNUAL REVENUES • China currently produces 92% of 350 million pound world market - China’s resources are reportedly disappearing USAC IS ONLY FULLY-INTEGRATED ANTIMONY PRODUCER OUTSIDE OF CHINA GHS July 19, 2011 4 ANTIMONY: MEXICO MINING PROPERTIES • LOS JUAREZ ANTIMONY, SILVER AND GOLD DEPOSIT – QUERETARO, MX - Recently expanded to 3000 hectares - Possibly bulk minable by open pit methods - Estimated initial recoveries 80-85% - Operations to commence Q3 2011 Los Juarez property • SOYATAL MINING DISTRICT – QUERETARO, MX - Supply Agreement on 283 hectares - Soyatal was the third largest producer of antimony in Mexico - Hand sorted rock and mill feed now being purchased Mining operations at Soyatal Mining District GHS July 19, 2011 5 ANTIMONY: MEXICO MILL AND SMELTER • FLOTATION MILL – CORRAL BLANCO, GUANAJUATO, MX - Capacity of 150 metric tons per day - Will process rock from Los Juarez, Soyatal and other properties - Will produce 50-60% antimony concentrates with silver and gold - Operation to begin 3Q 2011 Corral Blanco Flotation Mill • ANTIMONY SMELTER – MADERO, COAHUILA, MX - Smelter operations began in 2010 - Feed capacity over 250 metric tons per month (approximately 300,000 pounds of antimony metal content) - Property convenient to major rail line - Highway access to Gulf of Mexico, Pacific Ocean and United States Madero Smelter GHS July 19, 2011 6 ANTIMONY PRODUCTION FLOW DIAGRAM FOR ANTIMONY (Sb), SILVER (Ag) & GOLD (Au) PRODUCTION USAMSA Raw Materials Mines Worldwide Los Juarez, Soyatal, MX 1-15% Sb plus Ag & Au USAMSA Flotation Mill Corral Blanco, MX ANTIMONY METAL Concentrate 50-60% Sb 150-300 opt Ag, 1-5 opt Au USAMSA Sulfide and Oxide Smelter Madero, Coahuila, MX Sb Metal with Ag & Au Sb2O3 (Sb Oxide) USAC Oxide Smelter Thompson Falls, Montana, USA ANTIMONY OXIDE Sb Metal Sb2O3 (Sb Oxide) Sb Metal “Finished” Sb2O3 (Sb Oxide) Na SbO3 (Sodium Antimonate) Ag & Au (Silver & Gold) MARKET GHS July 19, 2011 7 USAC PLANT LOCATIONS USA GHS July 19, 2011 MEXICO 8 PRECIOUS METALS (SILVER AND GOLD) • USAC uses proprietary metallurgy to recover precious metals from antimony ore USAC Precious Metal Sales $600,000 • Silver and gold are by-products of USAC antimony ore smelting $500,000 • Precious metals accounted for 5% of USAC 2010 revenues $300,000 • 2009 and 2010 precious metal revenues included a discount of 25% on silver and 40% on gold from independent smelter GHS July 19, 2011 $400,000 $200,000 $100,000 $0 2009 2010 9 ZEOLITE – BEAR RIVER ZEOLITE (“BRZ”) • USAC wholly owned subsidiary near Preston, ID • BRZ mines, mills and sells natural zeolite • BRZ zeolite sales accounted for 27% of USAC 2010 revenues • Zeolite is an industrial mineral that is a natural cation exchange agent $3,000,000.00 $2,500,000.00 $2,000,000.00 $1,500,000.00 $1,000,000.00 $500,000.00 $- 2010 2009 2008 2007 2006 2005 2004 • BRZ zeolite applications : Animal and Agriculture: feed, flow agent, hogs, horses, odor control, pellet binder, poultry, ruminants Air Filtration: ammonia, blasting, odor control Aquaculture: ammonium control, decorative Concrete and Pozzolan Remediation: nuclear, oil spills on water, floor spills, toxic waste Soil: soil amendment, golf and turf, for high salinity soils Water: cation removal, drinking water filtration, swimming pools, waste water treatment, water filtration Retail: algae eater, decorative, floor spill, deodorizer, horse stall freshener, kitty litter, soil amendment BRZ REVENUES • Demand is strong GHS July 19, 2011 10 BEAR RIVER ZEOLITE BRZ pit near Preston, ID BRZ plant near, operating since 2004 Strontium 90 Plume - Selected by Department of Energy to remediate West Valley, New York Strontium 90 nuclear plant leak (almost 100% removal of Strontium 90) - Currently being tested by TEPCO to help remediate Fukujima nuclear disaster West Valley Demonstration Project GHS July 19, 2011 11 MARKET PROFILE • SYMBOL: UAMY.bb (to apply for AMEX listing) Q1 2011 (UNAUDITED) • MARKET CAP $240 million • SHARES OUTSTANDING (FD): 60 million • Q1 2011 PRICE RANGE: $.32 - $4.10 • AVERAGE DAILY VOLUME: 140,000 • SHARE OWNERSHIP: - Officers/Directors - 5% Holder - Institutions (est.) GHS July 19, 2011 11.0 million 3.9 million 10.0 million Cash Working Capital Total Debt $1,543,176 1,846,494 142,150 Stockholder’s Equity $5,739,884 18% 6% 16% 12 U.S. ANTIMONY CORPORATION UAMY.BB GHS July 19, 2011 13 MANAGEMENT and BOARD CORPORATE MANAGEMENT, THOMPSON FALLS, MT John Lawrence: President and CEO - Antimony expert. Skilled geologist, metallurgist, chemist, mill and mining expert Dan Parks: CFO - Former Coopers and Lybrand partner for mining companies Matt Keane: Director Sales John Lawrence, working CEO Russell Lawrence: COO Mexico operations NEW BOARD DIRECTOR Hart W. Baitis – Former CEO of two Minorco U.S. subsidiaries. Mining expert on a global basis. PhD Geology. GHS July 19, 2011 14 USAC ANTIMONY PRODUCTION CURRENTLY “SOLD OUT” • USAC expanding to service its total antimony demand • Major U.S. industrial corporation recently issued large multi-year purchase order to USAC • Chinese imports of antimony concentrates up 66% January to May 2011 GOAL: REPLACE CHINA’S FADING INDUSTRY DOMINATION GHS July 19, 2011 15 WHY OWN USAC NOW? 1. USAC REVENUES EXPANDING RAPIDLY WITH MEXICO MINES AND MILL 2. USAC EXPANDING WORLDWIDE SOURCES OF RAW MATERIALS 3. APPLICATION FOR AMEX LISTING PLANNED FOR Q3 2011 GHS July 19, 2011 16 FORWARD LOOKING STATEMENTS This presentation includes certain “forward-looking statements” or “forward-looking information”. All statements of historical fact, included in this presentation are forward-looking statements that involve risks and uncertainties. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intends”, “continue”, “budget”, “estimate”, “forecast”, “may”, “will”, “schedule”, and similar expressions identify forward-looking statements. Forward-looking statements include, among other things, statements regarding targets, estimates and assumptions in respect of antimony, zeolite, gold and silver and gold equivalent production and prices, cash and operating costs, results and capital expenditures, mineral reserves and mineral resources and anticipated grades, recovery rates, future financial or operating performances, margins, operating and exploration expenditures, costs and timing of the development of new deposits, costs and timing of construction, costs and timing of future exploration and reclamation expenses, anticipated 2011 results, our ability to fully fund our business model, including our capital and exploration program, internally, anticipated 2011 year-end interim and annual gold and silver production and the cash and operating costs associated with the same, the ability to achieve productivity and operational efficiencies, the ability to achieve cash flow margin improvements, the ability to develop and put into production our exploration targets and the timing of each thereof. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by United States Antimony Corporation, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Important factors that could cause actual results to differ materially from United States Antimony Corporation expectations include, among others, risks related to international operations, the actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, future prices of antimony, zeolite, silver and gold, known and unknown uncertainties and risks relating to additional funding requirements, reserve and resource estimates, hedging activities, development and operating risks, illegal miners, uninsurable risks, competition, limited mining operations, production risks, environmental regulation and liability, government regulation, currency fluctuations, recent losses and write-downs, dependence on key employees, possible variations of ore grade or recovery rates, failure of plant, equipment or process to operate as anticipated, or accidents. Although United States Antimony has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are not guarantees of future performance. Accordingly, readers should not place undue reliance on forward-looking statements. GHS July 19, 2011 17