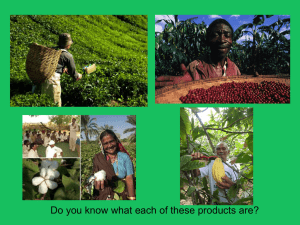

Tanzania coffee Sector Strategy Presentation AFCA 2013

advertisement

Tanzania Coffee Industry Development Strategy (2011-2021) PRESENTATION ; AT AFCA 2013 KAMPALA ADOLPH A. KUMBURU TANZANIA COFFEE BOARD Coffee growing regions in tanzania FUNCTIONS OF THE TANZANIA COFFEE BOARD Tanzania Coffee Board (TCB) is a government institution established by Act no. 23 of the parliament in 2001 The TCB has two Basic functions: Promotion Advisory Representation Information disemmination Regulatory Supervisory Monitoring Co-ordination CONTENTS Why sector strategy? Strategy participatory development process The strategy: logic of intervention Quantitative objectives Four strategic thrusts to reach the objective Problem analysis Intervention Strategy Impact scenario (summary) Why sector strategy? Problem oriented (not program oriented – every organization tends to follow their own agendas) Allow to bring sustainable « sector change » (unlike individual action tackling problems in a single dimension) Bring under the same « roof » actors of very different natures unlikely to cooperate otherwise (private, public, research etc.) Strategy participatory development process National Coffee Conference decides to develop a coffee sector strategy (December 2009) National and local consultation with all actors of the value chain (TFC meetings + 8 zonal meetings gathering about 600 stakeholders from 28 districts) First draft validated by NCC in May 2011 Presentation/Adoption of the document by Government May 2012 Implementation Key principles observed when developping the strategy Process vs. Output -> bringing people together is as important as the final product Being pragmatic (vs.wishlist) -> need to be both ambitious and realistic Linking with future implementation -> concrete actions and implementation plan The strategy: logic of intervention The strategy VISION “The Tanzanian coffee industry aims to build a long term sustainable and profitable coffee industry to all stakeholders, producing internationally recognized high quality Arabica and Robusta coffees and making a significant contribution to macro-economic stability, poverty reduction and improved Tanzanian livelihoods.” OBJECTIVE “To increase national coffee production and quality so as to improve incomes for the entire value chain, particularly coffee farmers.” Quantitative objectives Increased annual clean coffee production from the present average of 50,000 tons to at least 80,000 tons by year 2016 and 100,000 tons by year 2021 Improved coffee quality demonstrated by an increase in the share of coffee sold with price premiums on export markets, from the present 35% of the total volume to at least 70% by year 2021 Farmers’ share of the net FOB price on coffee exports is improved to reach at least 75% by year 2021 Four strategic thrusts to reach the objective Strategic thrust 1: Increase coffee productivity and overall production Indicators of success Average coffee yield at the national level increases to reach at least 450 kgs of clean coffee per hectare by year 2021 (+100% increase) At least 10,000 hectares of new coffee farms are planted by year 2021 Problem analysis Main problem of Tanzania is low yields, about 225 kgs of clean coffee per hectare as an average Robusta = 500 kgs/ha (Vietnam produces 5 times more) Arabica= 170 kgs/ha (Brazil produces 7 times more) At this level of productivity coffee farming cannot be profitable, currently Tanzania coffee production is not economically sustainable Gap analyis: what is already being done? What is missing? TaCRI has already a theoretical capacity of maximum 15 M. improved seedlings per year How to link with on farm replanting and efficient nursery management? (Survival rate) For dissemination of GAP and sustainable coffee production, possibility to capitalize on successes from NGO projects and upscale their approach (Technoserve, Neumann, Sustainable Harvest etc…) ST1: Intervention Strategy Increased production +50 000 t Strategy Objectives Indicators Programs/ Activities Rejuvenation of 10 M. coffee trees (replanting) Increased productivity (+100%) Increased area (+ 10 000 ha) Dissemination of Good Agricultural Practices Inputs (possible incentives to rejuvenation) Four strategic thrusts to reach the objective Strategic thrust 2: Improve efficiency of the value chain Indicators of success By 2016 the Average share of transaction costs from Farm-gate to FOB is reduced from the current 35% to 25% By 2016 the average time needed to move the coffee form farm-gate to FOB is reduced from the current average 3 months to 2 months Problem analysis Tanzania coffee value chain currently suffers from: Loss of value (internal marketing, transport, unecessary intermediaries, taxation, hassles, some poorly managed cooperatives,repeated grading/sorting/bulking , sisal bags etc.) Slow transfer of coffee from one stage to another (high cost of capital financing, price risk, quality deterioration, loss of opportunities on international markets) -> It is always the farmer who ultimately pays for transaction costs Gap analyis: What is already being done? What is missing? Consultation organized by government / TCB Recent evolutions in regulations and taxation framework at national level Some improvements at district level -> How to mainstream these initiatives into an overall coherent and enabling regulatory framework ST2: Intervention Strategy Increased FG price to 75% of FOB Strategy Objectives Indicators Programs/ Activities Attractive regulatory framework Rejuvenation of 10 M. coffee trees (replanting) Increased speed of coffee flow Improved internal marketing Increased transparency/g overnance (price information etc.) Four strategic thrusts to reach the objective Strategic thrust 3: Support overall coffee quality improvement Indicators of success By 2021 a minimum of 70% of the coffee produced in Tanzania is of grade 1-7 By 2021 a minimum of 75% of the Arabica coffee produced in Tanzania is processed through CPU Problem analysis Sundried coffee or hand pulped coffee are not necessarily inferior to CPU washed Management of the process is however much more complicated and requires delicate care and know how In Tanzania, about 90% of the coffee is currently home processed (Hans R. Neumann Stiftung) Inconsistent and heterogeneous quality because of deficient post harvest practices Tanzanian coffees used in blends rather than single origin coffees. Gap analyis: What is already being done? What is missing? Existing CPUs throughout the country (about 10% of the production is fully washed) Some CPUs could be rehabilitated Possibility to capitalize on work done by private sector and NGO projects(Sustainable Harvest, Neumann, Technoserve) -> How to effectively create incentive for farmers to improve harvest / post- harvest practices? -> How to upgrade the national CPU capacity in a sustainable manner (no CPUs abandonned after a few years) ST3: Intervention Strategy Price premiums for 70% of the coffee produced Strategy Objectives Indicators Programs/ Activities 70% of the coffee is of grades 1-7 Improve overall harvest / post harvest practices (Training) Improve Robusta quality and promote mobile hulling 75% of the Arabica is processed through CPU Build/rehabilitate 300 CPUs Four strategic thrusts to reach the objective Strategic thrust 4: Support the promotion of Tanzanian coffees abroad and explore new market opportunities including sustainable coffees Indicators of success By 2021 a minimum of 50% of the coffee produced in Tanzania is “sustainable” (UTZ, 4C, FLO, Rainforest, Organic) By 2021 domestic consumption is increased in Tanzania and reaches at least 10% of the production Problem analysis Need to mainstream sustainability issues in general coffee practices Sustainable coffee represent also a growing market and large players are committing to source almost exclusively from sustainable producers Generally, external marketing need to take into account the growth on emerging markets and the « branding » aspect of Tanzanian coffee Possible development of domestic market Sustainability Not only certifications/verifications/code of conduct Start with GAP -> who pays the cost? -> will there be premiums? -> what certifications/verifications/code of conduct should be promoted? Gap analyis: What is already being done? What is missing? Sustainability: UTZ mainly with large estates Sustainability: Some initiatives for GAP (NGOs) External marketing: mainly private sector but as well TCB (EAFCA, other forums) -> No clear indications on which certification/verification/code of conduct promoting nationally -> Should Tanzania be developped as a « brand » or is something that comes in an organic manner? ST4: Intervention Strategy promotion abroad and explore new markets including sustainable coffees Strategy Objectives Indicators Programs/ Activities 50% of the coffee produced in Tanzania is “sustainable” (UTZ, 4C, FLO, Rainforest, Organic) Develop Tanzania Brand and promote Tanzania’s origin on export markets Adherence to environmental and social responsibility standards Domestic consumption increased to at least 10% of the production Promote domestic consumption and production of roasted and ground coffees Impact scenario (summary) If the coffee strategy is implemented: Additional revenues of at least +150 M. $US per year (+223 M. $US at current price) 250 M. $US generated annually by the coffee industry (335 M. $US at current price) 75% redistributed to coffee farmers. It will almost double (+95% increase) the coffee incomes for 400,000 households -> Reduction of poverty and sustainable capacity for self improvement of the coffee industry AHSANTE SANA PRESENTATION BY TANZANIA COFFEE BOARD Contact: DIRECTOR GENERAL P.O Box 732, MOSHI info@coffeeboard.or.tz www.coffeeboard.or.tz