EIB EU support to ASEAN

advertisement

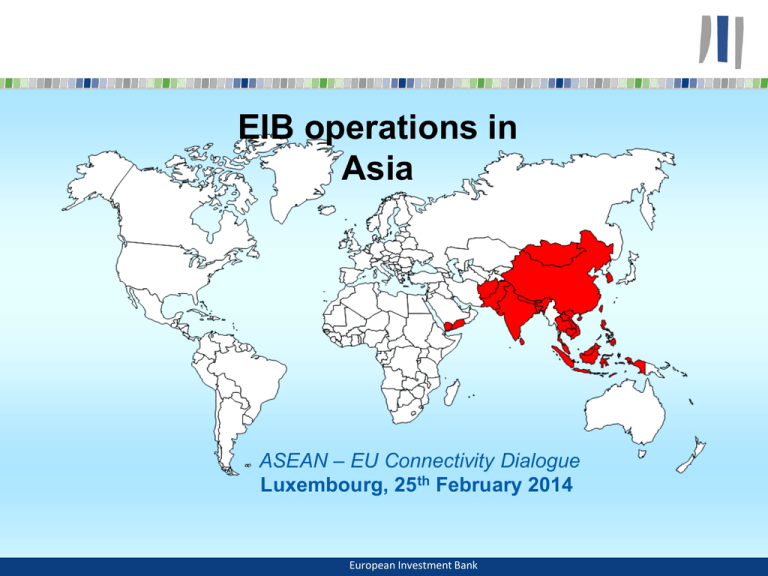

EIB operations in Asia ASEAN – EU Connectivity Dialogue Luxembourg, 25th February 2014 European Investment Bank EIB LENDING IN ASIA AND LATIN AMERICA (ALA) A bit of History … Operations in ALA started in 1993 Until 2006 the remit was to support EU presence through loans to: - Subsidiaries of EU companies - EU/ALA joint ventures - Transfer of EU technology EIB provided long-term financing and political risk guarantee (Risk-Sharing) European Investment Bank 2 EU BENEFICIARIES OF EIB LENDING IN ALA European Investment Bank 3 EIB LENDING IN ALA Evolving objectives … Since 2007: • Support of EU presence • Environmental sustainability From 2011: • Environmental sustainability • Social and economic infrastructure • Local private sector EU Support no longer a sufficient criteria but a desirable side effect European Investment Bank 4 EIB LENDING IN ASIA Asian Countries eligible for EIB financing under the ALA Mandate 22 Eligible countries in Asia Framework Agreements signed with 14 Asian countries. Afghanistan*, Bangladesh, Bhutan*, Brunei*, Cambodia*, China (including Hong Kong and Macao Special Administrative Regions), India, Indonesia, Laos, Malaysia*, Maldives, Mongolia, Nepal, Pakistan, the Philippines, Singapore*, South Korea*, Sri Lanka, Taiwan*, Thailand, Vietnam, Yemen. * No Framework Agreement signed European Investment Bank 5 MAP OF ELIGIBLE COUNTRIES 14 Asian countries with Framework Agreement 8 Asian countries without Framework Agreement European Investment Bank 6 EIB LENDING IN ASIA As of 01.01.2014, the Bank has lent: EUR 5.2 billion via 61 loans in 12 Asian countries 33% to Private and 67% to Public Sector European Investment Bank 7 EIB LENDING IN ASIA Country distribution European Investment Bank 8 EIB LENDING IN ALA Breakdown by Activity Energy 32% Global Loans 9% Water, sewerage 4% Industry 17% Agriculture, Forestry and Fishing 5% Services 0.29% Transports 19% Telecommunication 14% European Investment Bank 9 EIB LENDING IN ASIA IN 2013 In the Year 2013, the Bank has*: • Signed EUR 515.8m – Nepal Tanahu Hydropower project (EUR 53.8m) – Exim Bank of India Climate Change FL (EUR 150m) – Bangladesh Power Energy Efficiency (EUR 82m) – Sri Lanka SME and Green Energy FL (EUR 90m) – Srei Climate Change FL (EUR 40m) – Pakistan Keyal Khwar Hydropower Plant (EUR 100m) • Approved by CA EUR 350m – Dhaka Environmentally Sustainable Water Supply (EUR 100m) – Ireda Renewable Energy and Energy Efficiency FL (EUR 200m) – Ulaanbaatar Water (EUR 50m) * Allocations under already signed framework loans not shown above European Investment Bank 10 EIB LENDING IN ASIA: A LUCRATIVE ACTIVITY Lending in ASIA has proved lucrative: • For the EIB – Very high IRRI – Positive contribution to the Bank’s overheads – Low capital consumption • For EU Companies – Long term funding at AAA conditions – Free political risk guarantee • For the ASIA countries – Employment creation – Transfer of technology – Foreign exchange income – Fiscal inflows European Investment Bank 11 RELEVANCE OF ASIA FOR THE EIB CLIMATE CHANGE ACTION • By 2030 ASIA will emit more than half of the world’s GHG emissions • ASIA includes the most vulnerable areas and the countries with hugest renewable energy and carbon credit potential • The unit cost of reducing GHG emissions in ASIA is much lower than in Europe European Investment Bank 12