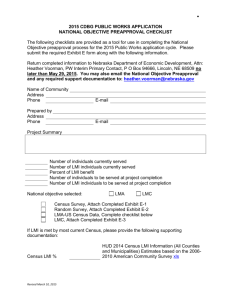

Community Development Block Grant (CDBG)

advertisement

In Order to qualify for CDBG funding a project must meet one of three National Objectives Activities Benefiting Low-Moderate Income Persons/Households To aid in the Prevention/Elimination of Slums & Blight Urgent Need 1. Area Benefit ◦ Census Tract ◦ Survey 2. Limited Clientele ◦ Presumed ◦ Income Eligibility ◦ Nature/Location 3. (1) Those based on area (2) Those serving a limited (3) Those involving housing, Housing ◦ Rehabilitation ◦ New Housing Support/Construction 4. The criteria for how an activity may be considered to benefit L/M income persons are divided into four subcategories: Job Creation/Retention ◦ Job Created/Jobs Retained benefit, clientele, and (4) Those involving employment (jobs). Typical area benefit activities include: • Street-Road Improvements, • Water and Sewer Lines, • Neighborhood Facilities. Census Tract Data The regulations at §570.208(a)(1)(vi) provide that, for purposes of determining whether a particular area contains a sufficient percentage of L/M income persons to qualify an activity under the area benefit criteria, available information from the latest Decennial Census shall be used to the fullest extent feasible. The data shows the number of persons that resided in each such tract/block group at the time of the last census and the percentage of such persons who were L/M income (based on the CDBG definition) at that time. The data contains both the total number of persons in each tract/block group that is to be combined, as well as the number of such persons who are L/M income in each such tract/block group. Thus, it aids in determining whether a particular area benefit activity may be assisted with CDBG funds under the national objective of benefit to L/M income persons. Survey If a grantee has reason to believe that the available census data do not reflect current relative income levels in an area, or where the area does not coincide sufficiently well with census boundaries, HUD will accept information obtained by the grantee from use of a special survey of the residents of the area. Generally, a survey is used to re-compute the percentage of L/M income persons residing in a service area. The survey results may be used to show that the entire area served by the activity exceeds 51% and thus qualify the activity under the L/M income area benefit criteria. Total Families (households) # Responses # Persons # LMI Persons % LMI Persons (must equal 51% or larger) [Note: None responses must be assumed to be above Section 8 income guidelines] PART A. INFORMATION CONTAINED IN YOUR SURVEY 1 Total number of families in target area. 9 2 Total number of families interviewed. 9 3 Total number of LMI families interviewed. 6 4 Total number of persons in LMI families interviewed. 5 Total number of non-LMI families interviewed. 3 6 Total number of persons in non-LMI families interviewed. 8 12 PART B. CALCULATIONS BASED ON DATA CONTAINED IN YOUR SURVEY 7 Average size of the LMI family interviewed. (#4 / #3) 2.00 8 Average size of the non-LMI family interviewed. (#6 / #5) 2.67 9 Proportion of families interviewed that are LMI families. (#3 / #2) 0.67 10 Proportion of families interviewed that are non-LMI families. (#5 / #2) 0.33 11 Estimate number of LMI families in the target area. 6.00 12 Estimate number of non-LMI families in the target area. (#1 * #10) 13 Estimate number of LMI persons in the target area. 14 Estimate number of non-LMI families in the target area. (#8 * #12) 15 Estimate number of persons in the target area. 16 Estimated percentage of LMI persons in the target area. (#13 / #15) (#1 * #9) (#7 * #11) (#13 + #14) 3.00 12.00 8.00 20.00 60.00% A L/M income limited clientele activity is an activity which provides benefits to a specific group of persons rather than everyone in an area generally. It may benefit particular persons without regard to the area in which they reside, or it may be an activity which provides benefit on an area basis but only to a specific group of persons who reside in the area. In either case, at least 51% of the beneficiaries of the activity must be L/M income persons. Presumed To qualify under this subcategory, a limited clientele activity must meet one of the following tests: Exclusively benefit a clientele who are generally presumed by HUD to be principally L/M income persons. The following groups are currently presumed by HUD to be made up principally of L/M income persons: abused children, elderly persons, battered spouses, homeless persons, adults meeting Bureau of Census’ definition of severely disabled persons*, illiterate adults, persons living with AIDS, and migrant farm workers. *Persons are classified as having a severe disability if they: (a) used a wheel-chair or had used another special aid for six months or longer; (b) are unable to perform one or more “functional activities” or need assistance with an “ADL or IADL”; (c) are prevented from working at a job or doing housework; or (d) have a selected condition including autism, cerebral palsy, Alzheimer’s disease, senility or dementia, or mental retardation. Also, persons who are under 65 years of age and who are covered by Medicare or who receive SSI are considered to have a severe disability. Activities that would be expected to qualify under the L/M income Limited Clientele subcategory include: Construction of a senior center, Public services for the homeless, Assistance to L/M income persons developing a microenterprise, Meals on wheels for the elderly, and Construction of job training facilities for severely disabled adults. Income Eligibility Current Section 8 Income Guidelines Altoona Metro Area: FY 2012 Median Family Income: $55,600 ADJUSTED INCOME LIMITS (by household size) Persons 8 Persons 30% Extremely Low 1 Person 2 Persons 3 Persons 4 Persons 5 Persons 6 Persons 7 $11,700 $13,400 $15,500 $16,700 $18,050 $19,400 $20,750 $22,050 50% Low Income $36,700 $19,500 $22,250 $25,050 $27,800 $30,050 $32,250 $34,500 80% Moderate $58,750 $31,150 $35,600 $40,050 $44,500 $48,100 $51,650 $55,200 Housing includes new construction, rehabilitation and delivery costs. Housing rehabilitation includes “handyperson”, paint, smoke detector and lock installation programs as well as water and sewer connections to housing. Construction of Housing: Construction of new housing, including the acquisition of the land on which the housing will be construction. Direct Home Ownership Assistance: Assistance provided to facilitate homeownership may be in the form of subsidizing interest rates and mortgage principal amounts, payment of closing costs and down payment assistance for low-and-moderate income homebuyers, acquiring guarantees for mortgage financing from private financing from private lenders and financing the acquisition by low-and-moderate income persons of housing they already occupy. Rehabilitation; Single Unit Residential: Includes loans and grants for the rehabilitation of privately owned homes. Rehabilitation; Multi-Unit Residential: Includes rehabilitation of buildings with two or more residential units. Public Housing Modernization: Includes the rehabilitation of housing units owned/operated by a public housing authority (PHA) or an Indian housing authority (IHA) Rehabilitation; Other Publicly Owned Residential Buildings: Includes housing that is owned by a public entity other than a PHA or IHA. Energy Efficiency Improvements: Rehabilitation program for the sole purpose of promoting energy efficiency (e.g., a weatherization program). Acquisition for Rehabilitation: When property is acquired in order that it may be rehabilitated for housing. This may be used to reflect the cost of only the acquisition if the rehabilitation costs will be paid from another source or it may also include both the costs of aquistion and rehabilitation if the cost of the rehabilitation is also paid with CDBG. Lead-Based Paint/Lead Hazard Test/Abatement: When the primary goal of a housing rehabilitation activity is for lead-based paint and hazard evaluation and reduction. Residential Historic Preservation: Rehabilitation of historic residential structures. Economic activities designed to create or retain permanent jobs, at least 51 percent of which (computed on a full time equivalent basis) will be made available to or held by LMI persons may qualify under the Job Creation or Retention category of the LMI Benefit national objective. The following requirements must be met for jobs to be considered created or retained. If grantees fund activities that create jobs, there must be documentation indicating that at least 51 percent of the jobs will be held by, or made available to, LMI persons. For funded activities which retain jobs, there must be sufficient information documenting that the jobs would have been lost without the CDBG assistance and that one or both of the following applies to at least 51 percent of the jobs: The job is held by a LMI person; or The job can reasonably be expected to turn over within the following two years and steps will be taken to ensure that the job will be filled by, or made available to, a LMI person. Created or retained jobs are only considered to be available to LMI persons when: (a) Special skills that can only be acquired with substantial training or work experience or education beyond high school are not a prerequisite to fill such jobs, or the business agrees to hire unqualified persons and provide training; and (b) The grantee and the assisted business take actions to ensure that LMI persons receive first consideration for filling such jobs. 1. Area : Boundary Defined/Qualified Economic development activities, such as commercial rehabilitation, which aid in the prevention or elimination of slums or blight in a designated area may qualify under the Area Slum/Blight national objective. In order to qualify under this national objective category, the economic development activity must take place in an area that: 1.) The designated area in which the activity occurs must meet the definition of a slum, blighted, deteriorated or deteriorating area under state or local law; 2.) Additionally, the area must meet either one of the two conditions specified below: 3.) Public improvements throughout the area are in a general state of deterioration; or At least 25 percent of the properties throughout the area exhibit one or more of the following: (a) Physical deterioration of buildings/improvements; (b) Abandonment of properties; (c) Chronic high occupancy turnover rates or chronic high vacancy rates in commercial or industrial buildings; (d) Significant declines in property values or abnormally low property values relative to other areas in the community; or (e) Known or suspected environmental contamination. Documentation must be maintained by the grantee on the boundaries of the area and the conditions that qualified the area at the time of its designation. The designation of an area as slum or blighted must be re-determined every 10 years for continued qualifications. As stated above, qualified activities must address the identified conditions that contributed to the slum and blight. 2. Spot: Acquisition, Relocation, Clearance, Rehabilitation & Historic Preservation When rehabilitation is categorized under the Spot Basis category, it must meet the following requirements: 1. The rehabilitation must eliminate specific conditions of blight or physical decay on a spot basis, i.e., not be located in a designated slum and blight area; and 2. The rehabilitation must be limited to only those conditions that are detrimental to public health and safety. Interim assistance activities may also qualify under the Urgent Needs national objective if the activities are designed to alleviate existing conditions (of recent origin or recent urgency) that the grantee certifies as posing serious and immediate threat to the health or welfare of the community where the grantee is unable to finance the activity on its own and other sources of funds are not available. The following resources are helpful to grantees and subrecipients administering CDBG activities: Community Development Block Grant Program: Guide to National Objectives and Eligible Activities for Entitlement Communities (provided in the Appendix and available through HUD). Some of the resources mentioned as well as other documents and information may be found at the following locations: Community Connections (1-800-998-9999) http://www.comcon.org HUD website http://www.hud.gov CPD home page http://www.hud.gov/cpd/cpdcomde.html CDBG home page http://www.hud.gov/offices/cpd/communitydevelopment/programs/index.cfm CDBG Search Engine http://www.hud.gov/offices/cpd/communitydevelopment/rulesandregs/search.cfm Labor Relations (labor standards http://www.hud.gov/offices/olr/ Income Limits http://www.huduser.org/datasets/il.html Office of Management and Budget (OMB) website http://www.whitehouse.gov/omb/ OMB Circulars on-line http://www.whitehouse.gov/omb/circulars/index.html U.S. Bureau of the Census website http://www.census.gov HUDclips (Regulations and Handbooks) http://www.hudclips.org BOSMAC http://www.hud.gov/offices/cpd/systems/idis/reporting/bosmac/index.cfm General Con Plan http://www.hud.gov/offices/cpd/about/conplan/index.cfm CPMP tool: (consolidated plan mgmt process) http://www.hud.gov/offices/cpd/about/conplan/toolsandguidance/cpmp/index.cfm Relocation and Acquisition http://www.hud.gov/offices/cpd/library/relocation/index.cfm Fair Housing http://www.hud.gov/progdesc/fheoindx.cfm Healthy Homes and Lead Hazard Control http://www.hud.gov/offices/lead/