Property and Liability Risks

Property Risk, Liability Risk,

Tort System, and Workers’

Compensation

Vickie Bajtelsmit, J.D., Ph.D.

Colorado State University

Outline

Property Risk

Liability Risk

The Tort System

Workers’ Compensation

Property risk

Definition: The risk of theft, loss, or damage to your real or personal property.

Direct versus indirect losses

Examples:

Home burns down

Automobile is damaged is accident

Personal property is stolen from your home

Major Property Insurance

Policies

Homeowners’

Auto Comprehensive

Building and personal property

Business income

Boiler and machinery

Inland marine

Ocean marine

Crime (Employee dishonesty)

Difference in conditions

Homeowners’ Insurance

Standardized and simplified policies

Risk classification and underwriting based on

Location

Construction

Fire protection

Building code adequacy and enforcement

Age

Credit score

Homeowner’s Coverages

Form Type Coverage Under Each Policy

All Policies

HO-3 All-Risk Form

--Personal liability, medical payments for guests, additional living expenses during repair

--Losses due to: fire, lightning, windstorm, hail, explosion, riots, damage from aircraft or vehicles, smoke, vandalism, theft, glass breakage, volcanic eruption,

All perils, including those listed above, except flood, earthquake, war, nuclear accident

HO-4 Renter's Contents

HO-5 Comprehensive Form

HO-6 Condominium

HO-7 Country Home Form

Loss to personal belongings caused by perils listed above.

Similar as HO-3 but includes endorsements for replacement cost coverage on contents and buildings.

Similar to HO-4; covers personal belongings and additions to the living unit.

Covers agricultural buildings and equipment for non-farm businesses

Valuation of recoverable loss

Actual cash value versus replacement cost

Coinsurance clause

Deductibles

Limits and exclusions

Subrogation

Current Issues in Property Insurance:

Catastrophes!

Earthquake, hurricane, flood, wildfire

Do these risks fit the requirements for insurable risks?

Government insurance available (e.g.

National Flood Insurance Program) but many do not buy.

Losses have increased over time due to concentration of population in high risk areas.

Liability Risk

Definition: Risk that you will be responsible for an injury to another person or their property.

Legal Basis (1) The Law of Negligence

Breach of duty to another

Causation of Loss

Legal Basis (2) Strict Liability

Causation of Loss

Types of Liability Exposures

Professional liability

Contractors liability

Employer liability

Product liability

Principal-agent liability

Auto liability

Landlord-tenant liability

Contractual liability

Liability Insurance Policies

Homeowners’

Personal Auto

Commercial Auto

Commercial General Liability (CGL)

Umbrella Liability (business or personal)

Directors and Officers (D&O)

Environmental Impairment Liability (EIL)

Employment Practices Liability

Professional Liability (malpractice)

Errors and omissions (E&O)

Important Concepts in Liability

Insurance

Policy Trigger

Accident

Occurrence vs. Claims Made

Policy Limits

Defense Costs

Underwriting Factors

Moral Hazard

Adverse Selection

Types of Damages

Compensatory Damages

Medical costs

Lost wages

Pain and suffering

Punitive Damages

Auto Insurance Coverages

Liability

Medical payments

Uninsured/underinsured motorist

Personal injury protection (PIP)

Physical damage coverage

Minimum Auto Liability Coverage

Differs by State: Low Relative to

Potential Losses

Auto Insurance Rating

Factors in claim costs by jurisdiction

Accident rate, Small cars, Urbanization,

Medical costs, Auto repair costs, Fraud,

Litigiousness

By person

Driving record, Age, Miles driven, Credit score, Type of vehicle, Marital status,

Gender, Territory

Auto No Fault Laws

Pure versus modified

Verbal thresholds

Dollar thresholds

Add-on laws

Choice systems

Evidence on cost savings

Number of No Fault States Declining

Issues related to the Legal

System

Increased Litigation

Class Actions

Insurer bad faith claims

“New risks”

Escalating jury awards

Non-economic and punitive damages

Insurance fraud

Evaluating the Legal System

Objectives

Compensation of victims

Improved safety

Deterrence

Are these accomplished?

At what cost?

Are the outcomes equitable?

Cost of the U.S. Tort System

Inefficiency of the System: Less than Half the Tort Dollar Goes to Claimants

Administrative

Costs of Settling

Claims 21%

Actual Economic

Losses 22%

Defense Costs

14%

Attorneys Fees

19%

Pain and Suffering

(Non-Economic)

Losses

24%

Source: Tillinghast-Towers Perrin

Factors Driving Tort Costs

Innovative Plaintiff’s Attorneys

Generous Juries and Punitive Damages

More Class Action Law Suits (Product

Liability, Discrimination, Shareholder)

Medical Cost Inflation

Media Coverage

Weak Economy

First Party Bad Faith Claims

Tort Reform Developments

Medical Malpractice Caps on Noneconomic

Damages

Caps on Punitive Damages—What’s Reasonable?

Class Action Reform

Arbitration

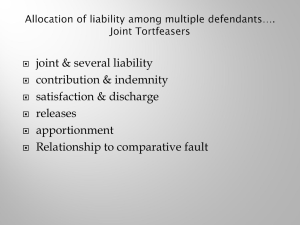

Tort Reform Proposals

Caps on punitive damages

Caps on pain and suffering damages

Attorney fee limits

Arbitration

Limits on class actions

Modifications to Collateral Source Rule

Modifications to Joint & Several Liability

Workers’ Compensation

Workers Compensation

Background

Historically, injured workers had to rely on the law of negligence

Employers were rarely held responsible

Proof of negligence difficult

Defenses available

Currently: No fault (strict liability) system

Wage replacement

Medical benefits

Employer strictly liable for injuries arising out of and in the course of employment

Workers give up the right to bring suit

Problems in Workers Comp

Variation across states

Benefits and utilization

Financing of the system

Litigation (above threshold)

Fraud (by workers,employers,doctors, lawyers, insurers)

Medical Cost Inflation

Cost of dispute resolution

Other Current Issues

Increasing occurrence modern risks such as repetitive motion, mental stress, obesity

Reintegration of veterans

ADA (Americans with Disabilities Act): Must accommodate employees with disabilities

Managed Care

24 hour coverage

Workers’ Comp Summary

Workers’ compensation programs provide a valuable type of insurance for injured workers.

The original trade-off of employer strict liability in return for employees giving up the right to sue is often eroded.

Costs are rising but are a decreasing % of total employee compensation.

Smaller firms feel the cost the most.