View presentation - Swiss Mining Institute

advertisement

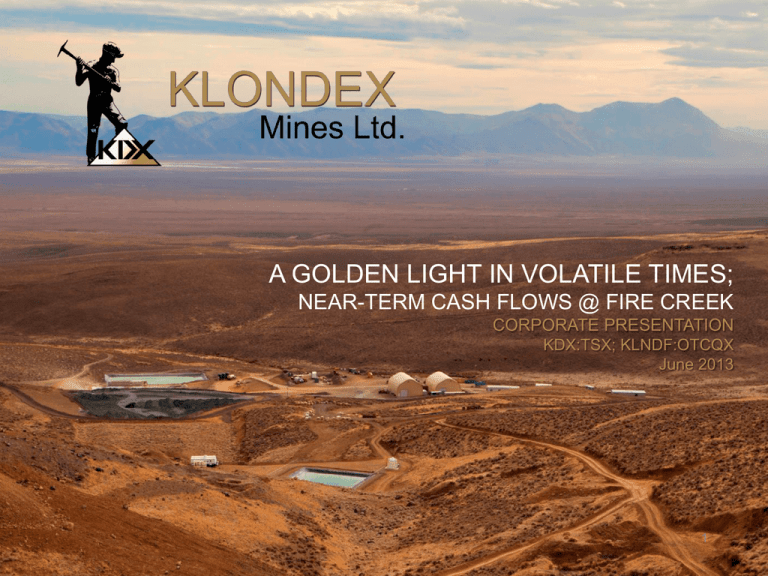

A GOLDEN LIGHT IN VOLATILE TIMES; NEAR-TERM CASH FLOWS @ FIRE CREEK CORPORATE PRESENTATION KDX:TSX; KLNDF:OTCQX June 2013 1 1 FORWARD-LOOKING STATEMENTS Forward-Looking Statements This presentation may include certain statements that may be deemed “forward-looking statements." All statements in this presentation or those made by Klondex management or representatives, other than statements of historical facts, including the likelihood that bulk sampling will generate significant revenues and the possible results of future exploration are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include unsuccessful exploration results, inability to obtain necessary permits and regulatory approvals, changes in metals prices, currency fluctuations, changes in the availability of funding for mineral exploration, unanticipated changes in key management personnel, unavailability of necessary equipment and contractors, and general economic conditions. Mining is an inherently risky business. There is no guarantee that the Company will be able to carry out their work programs or that the results of those work programs will be successful. Accordingly, the actual results may differ materially from those projected in the forwardlooking statements. For more information on the Company and the risks and challenges of their businesses, investors should review the Company filings available at www.sedar.com and www.klondexmines.com. CAUTIONARY NOTE TO U.S. INVESTOR CONCERNING RESOURCES This presentation uses the terms “Indicated and Inferred” resources as defined in accordance with National Instrument 43-101. While such terms are recognized and required by Canadian Securities laws, the United States Securities and Exchange Commission does not recognize them. Under the United States standards, mineralization many not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve calculation is made. “Inferred Resources” have a great amount of uncertainty as to their economic and legal feasibility and readers are cautioned not to assume that all or any part of the inferred resources exists or is economically mineable. 2 MANAGEMENT – OPERATIONS-FOCUSED Paul Huet – President, CEO and Director ● ● ● 25 years high-grade mining experience, particularly in narrow vein gold mining in Nevada Led team taking Hollister Mine to 80k-100k gold equivalent oz/year; Mine Manager of Newmont’s Midas Mine; COO at Premier Gold Extensive experience/knowledge in Mine Operations, Engineering, Geology, Exploration, Permitting and Safety Jorge Avelino – Chief Financial Officer ● ● 25+ years of accounting and financial management experience across range of industries and public companies Public resource company experience since 1986 Mike Doolin – General Manager ● ● ● 25-years with extensive experience in design and permitting of mining projects Substantial experience in milling, metallurgy and assay operation; successfully managed large and small teams on multiple projects Most recently served with Great Basin Gold as Esmeralda Mill Manager Dr. Shuai Chen – Chief Engineer ● ● 17-yrs designing projects, specializing in underground mine design, planning and ground and cost controls in Nevada Previously Chief Engineer for Atna Resources’ Pinson mine, Senior Engineer for Great Basin Gold’s Hollister mine and Senior Mining Engineer for Newmont’s Midas Mine Steve McMillin – Chief Geologist ● ● 25 years experience including grass-roots, near-mine exploration and underground production Previously with US Steel, Newmont Exploration Ltd., Anglo Gold Jerritt Canyon, Queenstake Resources, Midway Gold Sid Tolbert – Mine Superintendent ● ● ● 20 years of mining experience with extensive knowledge in the extraction of narrow, high-grade gold vein systems in Nevada 14 years with Newmont, including Mine Superintendent and Foreman at the Midas Mine and its Vista project at Twin Creeks Extensive knowledge and understanding of underground mining methods, ground conditions, budgets and dilution management Lucy Downer – Environmental Manager ● ● 18 years of environmental experience and has been instrumental in the success of several mining and environmental projects across North America, primarily within Nevada Graduated from Queens University in Ontario with an Engineering: Mining and Mineral Processing degree 3 KLONDEX - HIGHLIGHTS ● ● ● ● ● ● Proven operations-focused management team High-grade gold in safe mining jurisdiction Straightforward and simple deposit Fully-permitted to initiate small scale gold production at Fire Creek in 2013 Low cash costs expected for 2013 trial mining Fire Creek Opportunity for upside: KDX trading at a discount to peers: EV/oz: $33/oz (MI&I) vs. avg. $45/oz Ongoing Milestones: Re-logging core Updated Resource PEA Critical Path to Cash Flows: Final Milling Agreement Vent-raise Access 4 Small-Scale Gold Production from Bulk Sample at Fire Creek Q3 2013 FIRE CREEK - INFRASTRUCTURE ALREADY IN PLACE JERRITT CANYON MILL Strategic location with local infrastructure: ● Located in the heart of Nevada’s gold trends with world-class mines as neighbours At the intersection of Northern Nevada Rift (NNR) & Battle Mountain Trends NNR host to Midas, Hollister, and Fire Creek: narrow vein epithermal gold deposits ● Fire Creek and the Jerritt Canyon Mill accessible via federal and state roads ● Favourable regulatory environment ● 5000 ft+ of underground workings already excavated (ramp, decline and cross cuts) ● Power substation complete and connection to transmission line completed March 2013 Connection to site from substation pending 5 FIRE CREEK - CASH FLOWS EXPECTED 2013 N ● Bulk Sample to begin in Q3 2013 Toll milling and transportation agreement with Veris Gold to Jerritt Canyon Mill, 120 miles NE $112.50/ton milling; $36/ton transportation Joyce Vein Vonnie Vein Toll milling and transportation costs: $148.50/ton ● Start extracting from the Joyce Vein, at crosscut 5400 Joyce Vein (A Vein): 0.9 m @ 95.5 g/t Vonnie Vein (B Vein): 1.5m @ 43.5 g/t ● 2013: deliver ~8,000 ozs AuEq from bulk sample ● Upon completion of updated resource and PEA, projections for 2014 and 2015 targets will be available. ● Initial test-work supports +90% Au recoveries Portal Surge Ponds and Water Treatment Plant Office buildings and core shack 500 ft 1000 ft 6 2013 UNDERGROUND IN-FILL DRILLING PROGRAM N 13 opt Au Target continuity of mineralization to the east ● Drilling on 23m (75ft) spacing ● ~ 9,754m (32,000 ft) of drilling ● Prior surface was drilling on 50m (164ft) spacing ● 16 easterly drill fans, 3 - 4 holes per fan ● East/West drill fan 9 complete; Fan1 assays pending; currently drilling Fan 2 ● Five westerly drill holes in fan 9 to test southern extension of vent raise access UNDER EXPLORED WEST ZONE 0.48 opt Au over 42.8 ft ● Heavy red lines: 2013 u/g infill drill program: ~5 holes per fan ● Heavy black lines, completed 2013 fans, assays pending 7 FIRE CREEK – RESOURCE MODEL ● Current resource of 1.6M ozs Indicated and 458k ozs Inferred, dated May 2011 ● Updated resource estimate targeted mid-2013, by Micon International Will include 240,000 ft of core re-logging & geology review; and an additional 120,000 feet of core drilling Klondex Mines Ltd. ●Source: Technical Report Data as of May 21, 2011; NI 43-101 Compliant Resource Released September 12, 2011 Note: variable Au prices we Metric can selectively mine areas Gold*At Cutoff Grade Gold and remain economic (g/t) Category Tonnes (g/t) (oz) 4.0 Indicated 5,176,050 9.9 1,647,052 4.0 Inferred 1,732,810 8.2 458,084 7.0 Indicated 2,145,283 17.6 1,215,019 7.0 Inferred 555,043 12.5 223,794 * Fire Creek remains economic at lower gold prices Underexplored on strike and at depth 8 MAIN ZONE CONTINUITY, WEST ZONE DISCOVERY Tremendous exploration potential ● Gold resources on less than 7% of the land package ● Main Zone: Underground in-fill drilling Joyce Vein: width and grade increases north from 5400 drift to 5370 drift Joyce Vein: new potential splay before the 5400 drift 496.7 g/t (14.5 opt) Au over 1.82m (6ft) (press release: Jan. 2, 2013) True width at 5370-ACC crosscut estimated at 1.7m (5.5ft) ● West Zone: mineralization discovered by excavating the vent raise access 3.6opt (123.9g/t) Au over 5ft (1.5m) at 528ft –533ft Fan 9: drilling in all 5 holes intercepted gold mineralization ● South Zone: Near Portal discovery (April 2013) 0.53 opt (15.5 g/t) Au over 42.8ft (13m) FC12-029U Exploration drifting at 5370 cross cut in Joyce Vein West Zone: Fan 9 drilling N FIRE CREEK BULK SAMPLE PERMITS ● Issued Permits Secured NDEP 6-month temporary discharge permit: 3/13 BLM permit # N-56088 Amendment allowing NV Energy to connect to offsite substation: 12/12 Class II Air Quality Operating Permit #AP1041-2774 (State): 3/11 & 7/12 Water Pollution Control Permit #NEV2007104 (State): 3/11, 11/11 & 6/12 BLM Notice to Proceed (Fed): 9/10 ● Future Permits Rapid Infiltration Basin (RIB) Permit – in process Geotechnical work begun to complete final RIB design Easements to bring power on site – in process Revised Plan of Operations (BLM) and Water Pollution Control Permit (State) – in process NEPA documentation to expand to full production – initiated 10 KLONDEX ROAD MAP Status Strengthen Board Est. Costs US $M - New CEO and Operations Team Complete - Funding ($23M Equity, $7M Debt) Complete - Infill drilling – underground Ongoing $ 2.9 Mine infrastructure Complete $ 1.0 Examine, re-log core, pictures and metallurgy Complete $ 1.0 Prepare new resource Ongoing $ 0.3 Prepare PEA Ongoing $ 0.3 Vent raise construction Ongoing $ 1.4 Milling agreement Complete - Power line installation Ongoing $ 1.3 Remaining drifting underground Ongoing $ 3.2 Temporary Discharge Permit Complete - Water management (RIB) Ongoing $ 0.8 NEPA documentation to expand to full production Ongoing $ 0.5 Initiate Bulk Sample Total Estimated Costs $12.7 Total Spent to Date $ 6.5 11 2012 Q3 Q4 Q1 ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 2013 Q2 Q3 Q4 Q1 2014 Q2 Q3 Q4 KLONDEX MINES LTD. Board of Directors Larry Phillips, Chairman, Co-founder IAMGold Rodney Cooper, Labrador Iron Mines Jamie Haggarty, JELL Advisors Paul Huet, President and CEO William Matlack, Scarsdale Equities Blair Schultz, K2 and Associates Symbol 52 Week Range Average Volume (3M) TSX: KDX OTCQX: KLNDF C$0.91 to C$1.85 52k Shares Issued and Out 64.4M Fully Diluted 85.7M Market Cap C$87M Enterprise Value C$89M Cash C$7.0M Debt: Long-Term – due Jan 2015 C$8.6M 12 KDX SHARE PRICE PERFORMANCE VS. PEERS 3-mo Average Daily Trading Volume: 69,700 Source: Morningstar.com 13 KLONDEX SPONSORSHIP ● Klondex’s top shareholders include leading resource investors and substantial management ownership. Top Shareholders Coverage Ownership* % FD Outstanding K2 & Associates 11.5M Glenn Pountney Equity Research Analyst 13.4% Casimir Capital Eric Winmill 7.8M 9.1% Mackie Research Capital Barry Allan U.S. Global Investors 4.5M 5.2% MGI Securities Marc Pais William Solloway 3.8M 4.4% GMP Securities Oliver Turner Van Eck Global 3.0M 3.5% PSP-MTL Private Sector Pension 3.0M 3.5% Gold Energy & Tech Stocks Jay Taylor Investors Group 1.8M 2.8% The Mining Speculator Greg McCoach William Matlack, Director 1.4M 1.7% Paul Huet, CEO 1.2M 1.4% Brendan Donohoe 1.1M 1.3% Ownership (%) Mgmt and Insiders Top Shareholders 38M 46.2% Institutional * Includes shares, warrants, options Retail 14 ATTRACTIVE VALUATION VS. JUNIOR GOLD PEERS Klondex sells at a significant discount to its peer group on an EV/resource basis, yet Klondex has: 1. 2. 3. 4. 5. 6. 7. 8. 9. Strong management & Board Funding in place Great location Impressive grade Significant resource Permitting largely in place Direct site grid power imminent Paved road access to toll mill Near-term production from bulk sample EV / MI&I AuEq (Inclusive) • • • • 15 based on MI&I resources, up to May 3, 2013 KDX: Ind. 1.6M oz Au; Inf. 0.4M oz Au. Source: FactSet, Bloomberg, equity research and corporate disclosure Note: Gold equivalent resources and production shown on a precious metals basis only; enterprise value adjusted to exclude minority interest when calculating resource and production valuation multiples CONTACT INFORMATION KDX:TSX KLNDF:OTCQX Klondex Mines Ltd. Suite 600, 595 Howe Street Vancouver, British Columbia V6C 2T5 www.klondexmines.com Paul Huet, President & CEO 807-939-2841 investors@klondexmines.com Alison Tullis, Manager, IR 647-233-4348 atullis@klondexmines.com Investors & Media: David Collins, Toni Trigiani Catalyst Global LLC 212-924-9800 kdx@catalyst-ir.com Fire Creek worker/contractor mine safety board 16