The effect of human capital on FDI: A meta-regression

advertisement

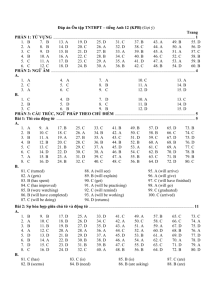

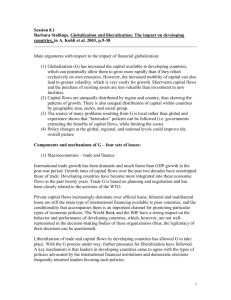

The effect of human capital on FDI: A meta-regression analysis Artane Rizvanolli, AAB-Riinvest University Ancona, 21 May 2010 Contents Introduction: FDI and growth Rationale for MRA Sample MRA model Empirical results Conclusion and further research Introduction: FDI and growth FDI conventionally considered beneficial Especially important for transition economies Technology and know-how transfer (?) Spillovers (?) Hence, overall productivity and growth (?) Need for restructuring and modernisation (at firm and economy level) Limited domestic resources However, are the benefits automatic? The rationale for meta-regression analysis (MRA) • Theory: human capital (HC) attracts FDI – • No consensus in the empirical literature – • Enhancement of productivity, technology adoption and adaption Negative, positive and insignificant results found Potential reasons for the diversity of results? – – Wide range of specifications, HC measures, countries Lack of “universal” relationship between HC and FDI: differences in motivation for FDI, sector of economic activity, etc. The rationale for meta-regression analysis (2) MRA as a means of Quantifying a survey of empirical literature Analysing the sensitivity of results to different study characteristics (!) Identifying and quantifying the “genuine” effect of HC, if present Identifying publication bias (?) Informing the specification of further research on the HC-FDI relationship: which measures? Sample Around 30 regression analyses identified Some excluded EconLit, SSRN, Google Scholar References in papers Measures not convincing/comparable No results reported Only interaction/squared terms Preferred regressions only (?) Sample (2) 28 studies with a total of 231 regressions t-stats range -7.8 - 7.7, with a mean of 0.93 Structure: Developing, transition, mixed, China, developed Mostly secondary and tertiary education measures Majority(static and dynamic) panels Model Linear regression: weighted to give each study the same weight, clustered robust (cluster: study), dependent variables divided by SEpcc Dependent variable: t-statistic of HC variable Moderator variable Description Constant Provides an estimate of publication bias (bias across the whole range of results in the literature) 1/SEpcc SE of the PCC (standardised measure of association) – a precision measure; provides an estimate of the “true” effect in the literature in terms of the PCC FDIFLOW Flow measures for FDI used FDIREL FDI measured relative to population/GDP HCFLOW Flow measures for FDI (enrolment, decision to invest) Model (2) Moderator variable Description LITERACY , PRIMARY, TERTIARY, SECTER, AVGYRED HC measure: Literacy/illiteracy rate, primary education, tertiary education, secondary and tertiary combined, average yrs of education (RC: secondary education) PANEL, DYNAMIC P., QUALITYDV Static panel, dynamic panel, quality dependent variable model (RC: cross-section) DEVELOPED, TRANSITION, MIXED, CHINA Sample according to group of countries (RC: Developing countries) HCCOST If model controls for HC cost HCPROD If model controls for HC productivity PUBYR Year of publication (working paper) MEDIANYR Median year of the period covered in the study NOEXPVAR Number of explanatory variables in the model (includes FEM dummies) ENDOGENEITY If attempts were made to address endogeneity Preliminary results • Bi-variate MRA – • no publication bias OR “genuine effect” Dependent variable Coefficient t-statistic p-value Con 0.60 0.99 0.33 INVSEEpcc 0.04 1.28 0.31 Multi-variate MRA – – Same result as above Full model mis-specified – – Ramsey RESET test : F(3, 205) = 94.52 , Prob > F = Suffers from multicollinearity 0.0000 Preliminary results (2) Testing down: standard procedure in MRA Improves functional form Significantly reduces multicollinearity Some variables highly correlated with INVSEPCC (PERIOD, MEDIANYR, LABCOST, TNOEXPVAR?, EDNOGENITY?, HCSTOCK?) Preliminary results (3) Variable Coefficient p-value Constant -0.014 0.96 INVSEEpcc -0.002 0.96 CROSS 0.127 0.19 QUALDV 0.228 0.00 MIXED 0.091 0.01 DEVELOPED 0.152 0.05 TRANSITION 0.113 0.10 CHINA 0.143 0.00 AVGYRED 0.081 0.13 TERTIARY -0.029 0.41 LABPROD 0.043 0.27 PRIMARY -0.027 0.60 DYNAMIC 0.003 0.89 -0.044 0.25 FDIREL Conclusion and further research Heterogeneity in HC-FDI literature can be explained to a very limited extent (!) Appears to be no genuine effect in the literature: Models not specified correctly? Further research: specify model in accordance with theory human capital variable: level and stock/flow Thank you! Questions & Comments?