Tax incentives for innovation Presentation R&D Tax relief on the

advertisement

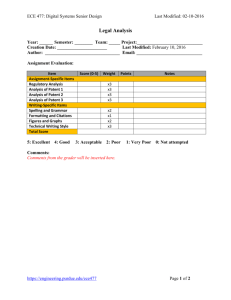

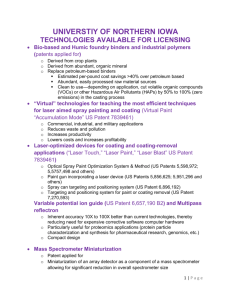

Tax incentives for innovation Presentation R&D Tax relief on the costs of innovation Patent Box Tax relief on the profits of innovation Simon Briton, Clive Owen & Co llp June 2012 R&D tax reliefs What Is R&D? • An advance in science or technology • Science means physical sciences – not social sciences or mathematics • An advance in the global state of knowledge • £10,000 minimum spend • Must own IP resulting from R&D What is the tax break? SMEs • Taxable profits are reduced by 225% of qualifying costs • Eg £10,000 R&D costs reduce tax bill by £4,500* • Sell R&D tax losses to HMRC for 11% • £10,000 R&D costs = £22,500 tax loss = £2,475 cash payment *assuming 20% corporation tax rate 100% R&D capital allowance Capital expenditure Companies carrying on R&D activities R&D superdeduction 175% / 200% / 225% SME Revenue expenditure Grant funded project Large company Surrender loss? 11% R&D superdeduction 130% Qualifying Expenditure • Staff costs – includes pension contributions but not other benefits (e.g company cars) • Software, consumables, heat, light, etc • Subcontractor costs (at 65%) • Payments to clinical trials volunteers • Scientific and technical information services • Ancillary services – e.g. maintaining R&D equipment • Feasibility studies R&D Capital Allowances • R&D tax credits cover expenditure that is revenue for tax purposes • Certain expenditure capitalised for accounting purposes may be treated of revenue for R&D tax credit purposes • Otherwise 100% capital allowances on anything but land • The last tax relief for acquisition of a building Patent Box What is the tax break? • Pay tax at 10% on profits • rather than 20% - 25% • Scheduled to come into force from 1 April 2013 Qualifying Patents • Issued by the Intellectual Property Office (IPO) in the UK and the European Patent Office (EPO) • Also covers Supplementary Protection Certificates, regulatory data protection and plant variety rights • Other EU patents will be brought in • US patents will not Who Is It For? • Companies only (like R&D) • Must hold qualifying patent / exclusive licence • • • • UK / EU / comparable patent (not USA) First commercialised after 29 November 2010 Must have significantly contributed to the R&D Must maintain R&D activity – 75% of entry level R&D for 4 years What Goes Into The Patent Box? • Royalties and licence fees • Proceeds of patent sales • Sale of products including patented parts • Once a patent is granted there is a six year look back in which profits can be brought into the Patent Box Contact details Simon Briton Clive Owen & Co llp Simon.Briton@cliveowen.com 01325 349 700 The things mentioned in this presentation are for general information purposes and are not intended to be taken as advice nor should they be relief on without seeking appropriate professional guidance.