Business methodologies and corporate quantitative

advertisement

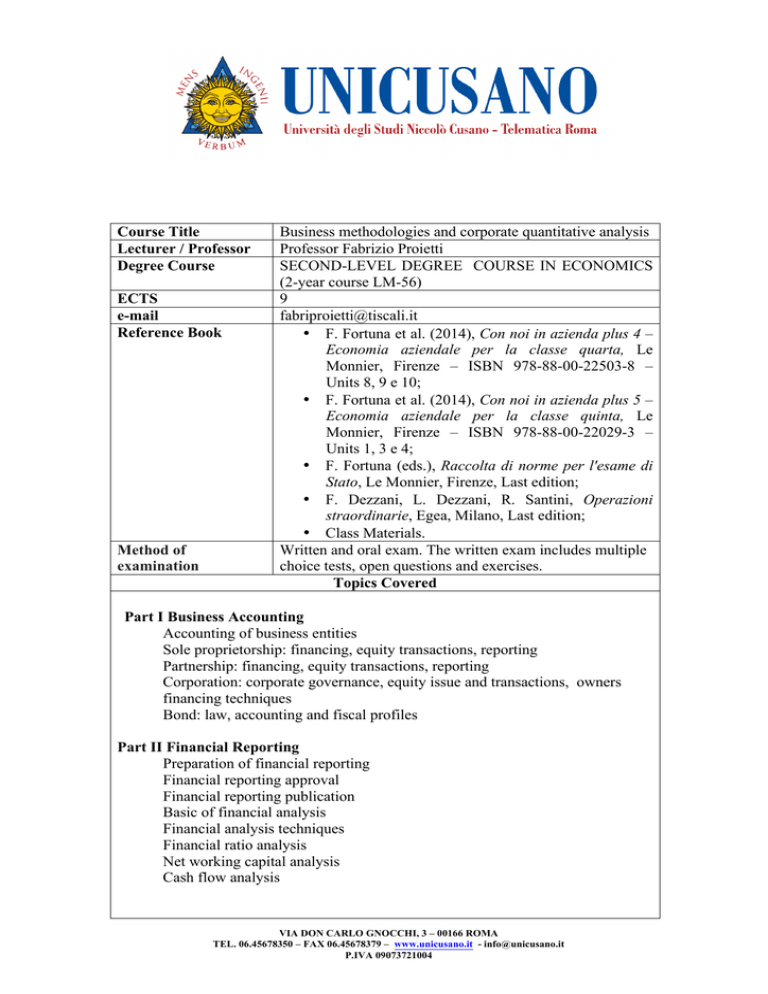

Course Title Lecturer / Professor Degree Course ECTS e-mail Reference Book Method of examination Business methodologies and corporate quantitative analysis Professor Fabrizio Proietti SECOND-LEVEL DEGREE COURSE IN ECONOMICS (2-year course LM-56) 9 fabriproietti@tiscali.it • F. Fortuna et al. (2014), Con noi in azienda plus 4 – Economia aziendale per la classe quarta, Le Monnier, Firenze – ISBN 978-88-00-22503-8 – Units 8, 9 e 10; • F. Fortuna et al. (2014), Con noi in azienda plus 5 – Economia aziendale per la classe quinta, Le Monnier, Firenze – ISBN 978-88-00-22029-3 – Units 1, 3 e 4; • F. Fortuna (eds.), Raccolta di norme per l'esame di Stato, Le Monnier, Firenze, Last edition; • F. Dezzani, L. Dezzani, R. Santini, Operazioni straordinarie, Egea, Milano, Last edition; • Class Materials. Written and oral exam. The written exam includes multiple choice tests, open questions and exercises. Topics Covered Part I Business Accounting Accounting of business entities Sole proprietorship: financing, equity transactions, reporting Partnership: financing, equity transactions, reporting Corporation: corporate governance, equity issue and transactions, owners financing techniques Bond: law, accounting and fiscal profiles Part II Financial Reporting Preparation of financial reporting Financial reporting approval Financial reporting publication Basic of financial analysis Financial analysis techniques Financial ratio analysis Net working capital analysis Cash flow analysis VIA DON CARLO GNOCCHI, 3 – 00166 ROMA TEL. 06.45678350 – FAX 06.45678379 – www.unicusano.it - info@unicusano.it P.IVA 09073721004 Part III Fiscal Issues Basic of business taxation Italian fiscal regulation Corporate income tax (/IRES) Requirements, taxable subjects, determination of the tax base General principles for the determination of business income Positive and negative components of income: convergences and divergences between civil and tax assessments The Regional Business Tax (IRAP) Taxable income and tax rate Provisions of the Italy’s Income Tax Consolidated Text (Testo Unico delle Imposte sui Redditi – TUIR) Part IV Managerial Control Basic of managerial accounting Cost classification and analysis Cost-volume-profit analysis Cost configuration and allocation Full costing and direct costing Activity Based Costing Part V Extraordinary transactions Basic of extraordinary transactions and items. Valuation appraisals and capital-value configurations Sell-offs and spin-offs Mergers and acquisition Demergers Transformations Liquidations Course Objectives This course provides an advanced analysis to selected issues in business accounting, financial reporting, financial analysis, corporate taxation, managerial accounting and extraordinary transactions. Primary areas of study include the preparation and analysis of financial statements, the calculation of corporate income taxes, the cost analysis and the preparation of extraordinary transactions. After this course, students should be able to understand the accountants’ work, interpret and analyse the financial reports of listed and non listed companies in general, build a planning and control system for business entities and prepare extraordinary transactions. VIA DON CARLO GNOCCHI, 3 – 00166 ROMA TEL. 06.45678350 – FAX 06.45678379 – www.unicusano.it - info@unicusano.it P.IVA 09073721004 Expected Results The expected results are: • To prepare financial statements • To interpret information contained in published financial statements; • To analyse financial reporting using financial analysis techniques; • To calculate corporate income taxes; • To construct a planning and control system; and • To prepare extraordinary transactions. VIA DON CARLO GNOCCHI, 3 – 00166 ROMA TEL. 06.45678350 – FAX 06.45678379 – www.unicusano.it - info@unicusano.it P.IVA 09073721004