Liberalism, Crises, and Structural Adjustment in

advertisement

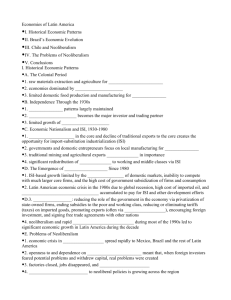

LIBERALISM, CRISES, AND STRUCTURAL ADJUSTMENT IN CHILE 3/15/2010 What is “Liberalism”? Classical Liberalism Political A theory emphasizing individual freedom and equality Policies tied to this idea include freedom of thought and expression, and limitations on government power. Economic A theory that holds that free markets are more efficient than managed ones and thus, in the long run, generate more prosperity The state retains a role in the system as guarantor of rule of law and public goods The state may intervene to correct market inefficiencies Policies tied to this idea include: Free markets tied to property, supply and demand Reduced trade restrictions tied to comparative advantage The state as guarantor: fiscal discipline targeting social goods What is “Liberalism”? Neoliberal Theory The Natural Laws of the Market: the market, once freed of government and social distortions, is a largely selfregulating mechanism and will naturally seek equilibrium. The market is more efficient than the government can be and so should be widely relied upon to provide goods and services. Free flows in cross-border flows of goods, people, and capital increase efficiency and are to be encouraged. What is “Structural Adjustment”? Making fundamental changes to the structures that underpin economic functioning The role of the state Property regime Mode of production The process of moving from one mode of economic organization to another. In practice structural adjustment has been linked to neoliberalism and the Washington Consensus; to forced conditionality What is “Structural Adjustment”?: The Washington Consensus Policy instruments associated with neoliberalism. Reduce fiscal deficits Realign public expenditure priorities Encourage broad but moderate taxation Let the market determine interest rates Achieve a competitive, export-oriented exchange rate Implement free trade policies Encourage FDI Privatize enterprises Deregulate industry Stabilize and enforce property rights Williamson, 1990 What is “Liberalism”? Neoliberal Theory The intentional depression; atomizing Revolutionary intent: Bureaucratic rules distort not only the economy but also individual choices and behavior; neoliberalism would bring greater individual freedom to pursue interests as well as prosperity. Renegotiating the state-society relations changes behavior and, eventually, values Shock Therapy: suddenness and speed of economic shifts impacts the public reaction; quick and sudden transformations facilitate adjustment. Neoliberalism in Chile Pinochet and the Chicago Boys Pinochet was interested in political developments, but had little interest in economics Facing economic crisis in 1973, Pinochet turned to the Chicago Boys and their neoliberal reform agenda Training and travel made them conversant in international financial matters Expertise and self-assuredness in an area in which the military knew very little Technocrats with limited political loyalties They had a plan ready-made, drawn up in the months before the coup Neoliberalism in Chile: The Seven Modernizations A change to a pay your own way system in which quality of life was determined by the individual’s ability to pay. Labor Reform Social Security 1979 Labor Code: Deregulation of the labor market Privatization of pensions and insurance Health Healthcare and cemeteries were privatized Shift control to municipalities Neoliberalism in Chile: The Seven Modernizations Education Change in curriculum Higher education is privatized Shift control to municipalities (1980s) Regional Decentralization Local control was exercised by strongmen appointed by Pinochet Redistricting led to many, small municipalities separated by socioeconomic class Agriculture Justice Neoliberalism in Chile: 1973 - 1980 Deregulation and Privatization 500+ state-owned companies and banks were privatized 1975 Financial Administration Law: The executive has sole authority to propose tax and budgetary legislation Reduced Social Spending By 1980 social spending was half what it had been under Allende Inequality Steadily increasing through the 1970s Average wage plummeted in 1973 and only recovered in the 1990s Today Chile is the 8th most unequal country (tracked by the UN) Neoliberalism in Chile: 1981 - 1982 The 1982 Debt Crisis Decline in imports, GDP, investment, and terms of trade; increase in interest rates Increasing external debt from 40% of GDP in 1979 to 100% in 1983 (with interest payments rising from 3% of GDP to 10%) Corporate Debt Privatization had proceeded on borrowed money Chilean economic elites borrowed money internationally and run up $14 billion in debt Neoliberalism in Chile: 1983 - 1986 State Response to the Debt Crisis Divisions between the technocrats and the businessmen The Chicago Boys lost their jobs; some were investigated for fraud Softening of neoliberalism under Finance Minister Hernán Büchi Re-nationalization of some companies, briefly including banks Rebound in public spending from around 10% of GDP in the 1970s to around 14% in after 1982 Neoliberalism in Chile: 1987 - 1989 Turn towards pragmatic economic policy favoring macroeconomic stability “People’s Capitalism”: continued privatization focuses on small investors and capitalization through stock sales Controlled fiscal expenditures Debt-equity swaps convert external debt into domestic investment Incentives to exports Target social expenditures on the poor Copper Stabilisation Fund, 1987: "The basic idea is to save resources when the price of copper exceeds its long-term level so as to use these savings when copper prices fall below the long-term trend.” (OECD) The economy resumed strong growth in the late 1980s, leading to declining unemployment and increasing average real wages. Neoliberalism in Chile: 1990 through today In 1999 a survey by the UNDP found that “the results indicate the preeminence of two grand themes: the demand for economic security and well-being and the demand for equality” (PNUD 2000, 99) Government guarantees reduce risk and facilitate private investment Transparency and higher accounting standards Adoption of a counter-cyclical policy stance Structural budget surplus rule, 2001: “Estimating revenue based on trend GDP growth, so that expenditure can be calculated on the basis of the government’s capacity to collect taxes over the medium term, rather than on economic conditions each year. …[and] targeting a structural budget surplus of 1% of GDP has allowed for countercyclicality.” (OECD) Public debt-to-GDP ratio fell from 45% in 1990 to 3.8% in 2008 (est.)