Powerpoint slides

advertisement

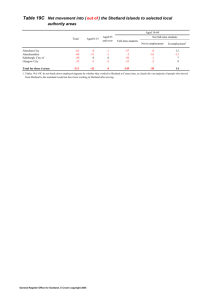

Oil on our doorstep: the Shetland experience Jonathan Wills Sovereign wealth and the defence of the realm If Scotland hadn’t annexed Shetland in 1611 the UK sector would be rather smaller than it is… 1955: Britain claims Rockall • Britain has annexed a rocky islet 300 miles (483km) west of Scotland to stop the Soviets spying on missile tests, the Admiralty has announced. The UK formally claimed uninhabited Rockall, which is just 70ft (21m) high, on 18 September 1955 at 1016 GMT. • Two Royal Marines and a civilian naturalist [James Fisher], led by Royal Navy Lieutenant Commander Desmond Scott, raised a Union flag on the island and cemented a plaque into the rock. [BBC Home Service, 21.09.1955] A diversion to Rockall ..and what if the UK had no claim to Rockall? ...someone in Whitehall had thought of that. The Russians weren’t coming after all, but the oil and gas companies were... • In 1972 the Isle of Rockall Act was passed, which made the rock officially part of Inverness-shire. Shetland, 1972-2013: Lessons from four decades of petro-cohabitation, revenue sharing and environmental protection. KARL, Terry Lynn, 1997, The Paradox of Plenty. University of California Press, London. ISBN 0-520-20772-6. The Paradox of Plenty • Terry Karl said oil and gas developments usually create: 1.Local economic chaos; 2.Mass impoverishment; 3.Arrogant, greedy and often violent elites; 4.Corruption on a large scale; 5.Social and political dislocation; 6.Widespread environmental degradation. Sullom Voe tanker terminal - £1.7bn at 1977 prices Shetland councillors’ aims in 1972: • Plan and control oil developments, so as to avoid local economic chaos and social and political dislocation; • Make sure everyone got a share of the revenues, to avoid mass impoverishment; • Secure long-term benefits for the whole community, rather than the usual short-term boom favouring the wealthy few; • Foster high safety standards, to avoid widespread environmental degradation. (…because there is such a thing as society) The legal basis of prosperity • Political influence – Zetland County Council Act 1974 – Sullom Voe Association Agreement 1975 • Revenue Sharing – Disturbance Agreement 1974 – Shetland Islands Council Charitable Trust 1976 – Port & Harbour Agreement 1978 • Environmental Safeguards – Sullom Voe Oil Spill Advisory Committee; – Shetland Oil Terminal Environmental Advisory Group (SOTEAG); – Vessel Traffic Systems post-1979. Since 1976, Shetland’s council has been: 1. Equal partner in Sullom Voe Association (SVA) with power to block important decisions; 2. Port authority; 3. Owner of Sullom Voe Terminal site (later transferred to Shetland Charitable Trust); 4. Owner of the loading jetties; 5. Employer of salaried pilots; 6. Shareholder/Owner of tug company; 7. Trustee for local public oil revenues; 8. Planning authority; 9. Formerly the environmental regulator (most such functions now with national government agency). Oily money “for a rainy day” Value of Shetland’s ‘oil funds’: • Shetland Charitable Trust: £188.3m stocks & shares + ca. £28m in local property = ca. £216.3m at 26/04/13 • SIC Reserve Fund (from the accumulated profits of the Sullom Voe harbour) = £57.1m at 26/04/13 • Total ‘oil funds’ = £273.4m (i.e. £12,151 per head of population) • NB SIC also has about £133m of reserves in other earmarked funds, some of which originated as income from the oil industry. So the total of local publicly controlled reserve funds is about £406m (£18,062 per head) 1985: £3m Leisure Centre(+£11m pool) 2007: £12m Museum 2012: Cinema & Arts Centre - £13.5m+ But... • You should only spend the income, not the capital; • Buildings have running costs that escalate; • Mr Micawber was right. 1. 2. 3. 4. 5. 6. 7. Political cartography is a messy business Although Terry Karl was right, it doesn’t have to be like that. Most governments are in thrall to the oil and gas industry and will, with rare exceptions, oppose any attempts at local control or revenue sharing. Oil company directors will act in the best interests of their organisation and if you can persuade them that local interests coincide, then they will do deals. When calculating how much oil can be extracted, and how much income you’re likely to get, there are no reliable sources. But you can ‘bet your sweet bippy’ there’s more oil and less local revenue than they tell you. It doesn’t cost a lot, relative to the scale of the oil and gas enterprise, to avoid Terry Karl’s ‘Paradox of Plenty’ and create ‘socialism in one county’. It certainly has no significant effect on the profitability of oil and gas companies. Don’t ever use the deposit account to make good a deficit on the current account. Live within your means. Here Endeth the Lessons