Managing the Risks of Business Growth

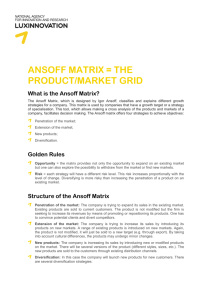

advertisement

SCY Welcomes You To #GuforGrowth Managing the Risks of Business Growth Paul Kelley Phill McTaggart SCY Business Mentors 3 Minute Exercise What are the chief risks your business faces for growth? Market Segmentation and Customer Profiling Paul Kelley Major Risks to Growth Two ways to go out of business fast: Running out of cash Trying to be all things to all people What is Segmentation? A market segment is a cluster of individuals or businesses that share similar characteristics which make them have relatively similar product/ service needs What is Profiling? A customer profile is a way of describing individual customers/clients by using a set of characteristics that can be linked to their predicted buying behaviour. Benefits from both Provides business focus Develops your products/services Informs pricing Directs marketing activities Clarifies true competition Increases sales Market example: websites Blue chips to SME start-ups £99 to £250,000 + Private sector/public sector E-commerce International Design and functionality Market segments should be… Large enough to be profitable Too large = too imprecise Accessible Measurable Stable Methods of profiling : consumers Demographics – age, gender, family Socio economic – income, occupation Geographic – address, region Behavioural – purchase occasion, benefits sought, brand loyalty Methods of profiling : businesses Size – employees, turnover …. Sectors – healthcare, retail, IT …. Geographic – local, regional, national, global Budget size Buying complexity Alchemy - data into gold Data you already hold on customers and their markets Data you could readily capture normal business processes (via orders, contracts, deliveries, etc) Extra data easily captured via normal business processes Additional insights - ask, surveys Learn from the Professionals ‘people who bought this also bought these’ corporate/conferences/breaks/weddings convenience/no frills Exercise List your current top 3-5 market segments Describe your top 3-5 clients by key characteristics …back at the ranch… Dig for gold nuggets – check your own data afresh Think segments, think customer characteristics Identify and target the most attractive. Using Ansoff Matrix To manage risk Phill McTaggart Background Ansoff Matrix represents the different options open to a manager when considering new opportunities for sales growth. Variables in the matrix In terms of the market, managers have two options: Remain in the existing market Enter new ones In terms of the product, the two options are: Selling existing products Developing new ones Exercise On the sheet of paper provided make a list of your existing services/products and which markets you sell these in. Example: An Accountant - Year End Accounts for SMEs - Payroll Services for IT Contractors - Monthly Management Accounts for social enterprises - Companies House Filings for SMEs Exercise List of existing Products/Services & Markets Products/Services to Market Sector Existing PRODUCTS INCREASING RISK New New 1. MARKET PENETRATION Existing Sell more in existing markets INCREASING RISK MARKETS Market Penetration This is the objective of higher market share in existing markets Selling more of the same to the same people Difficult to grow if market is saturated In flat market have to grow by taking business from competition Risks are low but so are prospects of success unless there's strong market growth Market Penetration Strategies Increase usage by existing customers Attract customers away from rivals Encourage greater frequency in transactions by customers Encourage non buyers to buy When to use Market Penetration Strategies When the market is not saturated When there is growth in the market When competitors share is falling When increased volumes can lead to economies of scale When there is scope for selling more to customers Existing PRODUCTS INCREASING RISK New 2. MARKET DEVELOPMENT MARKETS 1. MARKET PENETRATION Sell more in existing markets INCREASING RISK Sell existing products in new markets Existing New Market Development This is the strategy of selling an existing product to new markets. This could involve selling to an overseas market or a new market segment Market development will need changes to distribution channels, pricing and promotion strategy When to use Market Development Strategies When an untapped market has been identified When you have excess capacity When there are attractive channels to access new markets (This is a moderate risk strategy as you already know the product but are unfamiliar with the customers) Existing PRODUCTS INCREASING RISK New New 2. MARKET DEVELOPMENT MARKETS 1. MARKET PENETRATION Existing Sell more in existing markets 3. PRODUCT DEVELOPMENT Sell new products in existing markets INCREASING RISK Sell existing products in new markets Product Development This involves developing new products or services for existing markets This can: Be time consuming Involve an amount of research Require a degree of trialling and testing to ensure the new products/services deliver the expected outcomes or functionality Need revisiting after the initial process (iterative) Product Development Strategies New, innovative products Product improvements (fixes or customer feedback) Product line extensions New products to complement existing products Introduce different quality levels to existing products When to use Product Development Strategies When you have good R&D capabilities When the market is growing When there is rapid change in the market When you can build on existing brands When competitors have better products (New product development can be costly and involves moderate risks for the business) Existing PRODUCTS INCREASING RISK New 2. MARKET DEVELOPMENT 4. DIVERSIFICATION Sell new products in new markets MARKETS 1. MARKET PENETRATION Existing Sell more in existing markets 3. PRODUCT DEVELOPMENT Sell new products in existing markets INCREASING RISK Sell existing products in new markets New Diversification This is the process of selling new products to new customers or new products to new markets. Because there two unknowns this is the most risky of all four strategies. Related Diversification This is where the development remains within the confines of the sector, often harnessing existing product knowledge. This closeness to an existing product/service reduces the risk. (i.e. banks developing insurance products – it is still a financial product) Summary Growth risks can differ substantially The matrix identifies different strategic areas in which your business COULD expand Managers need to then asses the costs, potential gains and risks associated with the other options Using Ansoff You can adopt more than one strategy – perhaps by segment? Keep a balance between the strategies Don't overcommit and try and do all! Exercise Complete an Ansoff Matrix for your organisation Existing PRODUCTS INCREASING RISK New 2. MARKET DEVELOPMENT New 4. DIVERSIFICATION 1. MARKET PENETRATION Existing 3. PRODUCT DEVELOPMENT INCREASING RISK MARKETS Q&A An opportunity to put your questions to the Business Mentors Next Session - 5pm Keynote Speech James Averdieck Founder GÜ Puds Lakehouse, Ron Cooke Hub