Presentation on SMME funding LIMDEV

advertisement

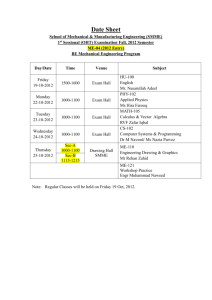

1 Limpopo Economic Development Enterprise EASTEN CAPE DEVELOPMENT CORPORATION – 02 MAY 2011 2 Presentation Outline Purpose of presentation Background Vision Mission Products & Services Targeted Sectors Pricing and Requirements. 3 Purpose of the presentation To highlight the developmental products and services offered by LimDev to SMME’s and Co-operatives within Limpopo Province. 4 Background Mandate of LimDev in terms of the Act (Northern Transvaal Corporations Act, Act No.5 of 1994, Section 4) Encourage Plan Finance Coordinate Promote Carry out development of the Province and its people 5 Our Vision To be the pre-eminent catalyst and partner in economic growth and empowerment in the Limpopo Province. 6 Mission of LimDev Mission TO Establish and advance a sustainable SMME sector through the facilitation and provision of business and investment opportunities Main activities SMME funding and contribution to economic development Providing guarantees and sureties. (subject to Minister’s approval) 7 PRODUCTS & SERVICES SMME Development Finance Project Development and Property Management Mining Development Housing Development finance Passenger Transport. 8 Project Development and Property Management Division LimDev partners with SMME’s on property development. and It also provide rental space for SMME development(Large and Small Industries and Shopping Complexes) 9 Housing Development Finance Risima Housing Finance is a 100% subsidiary of LimDev. It finance Rural and Urban development And It contribute towards SMME development by procuring construction services from building contractors. 10 Mining Development Corridor Mining Resources is a 100% subsidiary of LimDev. And It goes into join-ventures with BBBEE in mining projects 11 Passenger Transport Great North Transport in a 100% subsidiary of LimDev and it provide public transport. and It contribute to SMME development through procurement services. 12 SMME Development Finance LimDev provide developmental finance to SMMe’s, and Providing guarantees and sureties. (subject to Minister’s approval) SMME Development Finance is the core business of LimDev 13 Targeted Sectors Prioritized Manufacturing Mining Tourism Agriculture ( agro-processing ) Construction Retailing Specialized Business Services Personal Services Transport. 14 Types of Financial Products The following are types of financial products available for the SMMEs in the Limpopo: Working Capital Finance Capital Expenditure Finance Start up Capital Finance Equity Capital Finance Bridging Finance 15 Working Capital Finance Purpose Finance working capital requirements Stock and/or working materials Administrative/Operating Expenses Term: 12 -36 months 16 Capital Expenditure Finance Purpose Finance capital expenditure requirements (yellow assets) Equipments and machinery Term: 36- 60 months 17 Start-up Capital Finance Purpose Loan Finance of newly discovered business ideas and opportunities Term Max. of 36-84 months 18 Equity Capital Finance (BEE financing) Purpose Finance purchase of equity/stake in existing businesses Term Build-in exit strategy from beginning. Max. period : 3684 months Conditions: acquire board seats in the project 19 Bridging/Procurement Finance Product Purpose Cover for immediate demand in goods/services Finance for procurement orders and contracts from Government at National, provincial and local level Catering for increased demand during holidays and/or pick periods. Term: 3 months or period of the contract 20 CHARGES Prime-linked interest rate. Thus interest rate is controlled by the risk factor (Min Prime less 3% and Max Prime plus 2%) Admin fee of 1% limited to R2 500.00 (NCR) OR R3 000.00 VAT inclusive depending on the amount . Application fee of R500.00 OR R5 000.00 based on the amount requested. 21 Requirements The business must be registered either as: Sole Proprietorship Partnership Close Corporation Private Company Co-operatives Viable/Bankable Business Plan Securities Deed of Grant / PTO / Title Deed Investments; Insurance Policy (with surrender value) Surety ship 22 Requirements (Cont) Original SA identity document Proof of marital status Proof of residence valuation fee (over R50 000.00) 23 Requirements (Cont) Copy of contract / appointment letter Business Profile Financial statements projections Cash flow projections Work schedule Bank statements (Six month period) Tax clearance certificate Ck documents or memorandum and articles of association 10% own contribution on ordinary business. 24 Summary of SMME’s financed over five year period(2006-2010) NO Period No of SMME’s Finance Value of amount Financed 1 2005/06 262 R56.6 million 2 2006/07 456 R105.8 million 3 2007/08 432 R61.1 million 4 2008/09 88 R19.1 million 5 2009/10 75 R16.5 million 25 RISIMA HOUSING FINANCE NO Period No of Houses Value of amount Financed 1 2005/06 269 R40.4 million 2 2006/07 420 R68.0 million 3 2007/08 357 4 2008/09 5 2009/10 R32.9 million 204 R56.1 million 26 Great North Transport (2006-2010) NO Period No of Passenger transported per annum 1 2005/06 36.0 million 2 2006/07 36.5 million 3 2007/08 36.0 million 4 2008/09 42.2 million 5 2009/10 36.0 million 27 Contact Details Lebowakgomo: Ritavi : Giyani : Thohoyandou : Polokwane : 015-633 4700 015-303 1731 015-812 3111 015-962 4900 015-295 5120 28 THANK YOU 29