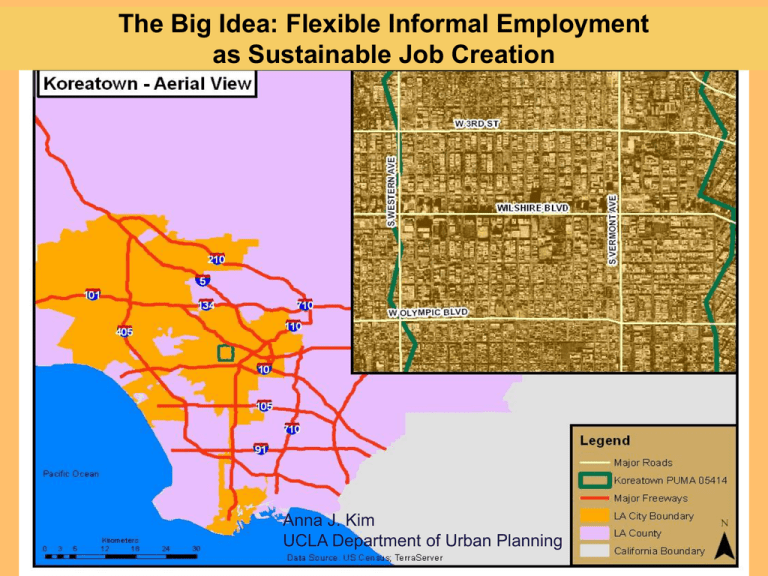

The Big Idea: Flexible Informal Employment

as Sustainable Job Creation

Anna J. Kim

UCLA Department of Urban Planning

How can informal employment

be measured at the local scale?

Proxy indicators in secondary data:

Census SF-1, SF-3; ACS PUMS 2000; 2006-2008

How can informal employment

be counted as job creation?

Interviews with individuals who have participated in the informal

sector, restricted by geography and target group.

Quantitative Proxy Measures

Measuring Informality at the Local Scale

1

Social Compact Model:

Check-cashers, Foreign-born population demographics, Cash utility payments

2

Labor Force Participation:

Employment Status (ESR) vs. Working/Not-working

3

Employer-Reported Employment:

Payroll vs. Self-reported

4

Employment Sector:

Undocumented Workforce as predictor of size of informal labor market

Data Set: Census PUMS (2000, 2006-2008)

Data Set: CA EDD ES-202 (2000, 2006-2008)

Data Set: Current Pop. Survey (2000, 2006-2008)

How are we counting informal

jobs?

By Proxy:

1.Check-cashing businesses and their locations in certain

neighborhoods

The Social Compact model, based on case studies of four

neighborhoods in Chicago, proposes eight proxies as predictors of

informal employment. These include: Percentage of households with no

banking relationships or credit histories; Percentage of utility payments

made in cash; Prevalence of check-casher operations per acre;

Prevalence of check-casher operations per household. (Alderslade,

Talmadge, and Freeman, 2006).

The example of ACE Cash

Express reveals that they

cluster check-cashing

locations in areas of high

poverty – but does this

mean that the money that

changes hands is earned

informally?

In this example, results seem inconclusive as a

predictor of informal economic activity.

Data Source: Geocode of 34 store locations from Acecashexpress.com

So who does Check-Cashing target?

How are we counting informal

jobs?

By Proxy:

2. By residential density of highly immigrant neighborhoods

Marcelli, Pastor and Joassart (1999) propose a computation for

calculating the number of “unauthorized” immigrants, and by extension,

unauthorized immigrant workers in the Latino population using four

main characteristics (years since immigration, years of formal

education, age, and sex) as a predictor of legal status at an accuracy of

about 85%.

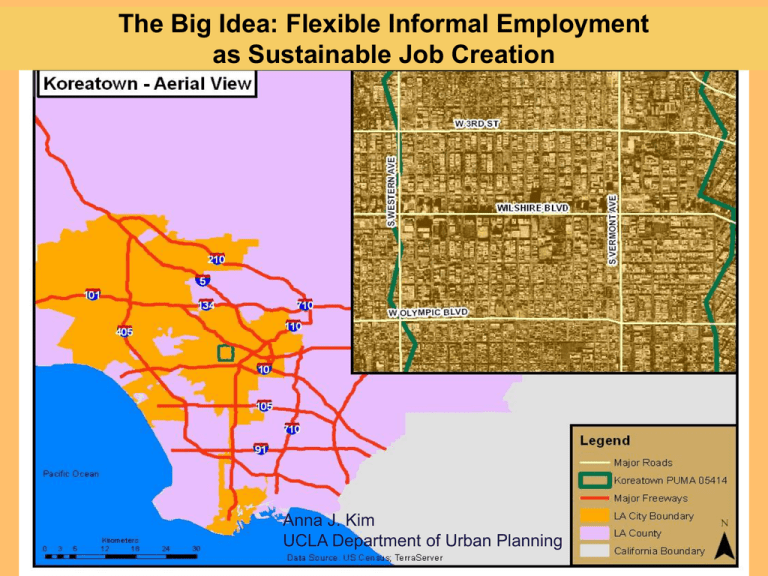

Why is Koreatown important?

Source: US Census, LED on the Map. 2008 QCEW

Koreatown: Population Graphs

The residential population of Koreatown is predominantly foreign-born.

Composed primarily of Korean, Mexican, Salvadorian, and Guatemalan ethnic groups,

in order of size. All groups are mostly Non-English speaking.

Data Set: Census PUMS (2000)

How are we counting informal

jobs?

By Proxy:

3. Discrepancies in Reported Employment

Flaming and Burns (2006) also estimated informal employment by

checking for anomalies between reported employment by workers

versus reported employment by employers. The report estimated that

approximately one third of workers in the Koreatown area work in

informal jobs, and that this “rate of informal employment is twice as

high as the rate found in the City of LA”.

Central City PUMAs: A Comparative Analysis

PUMA

Neighborhood

05414 Koreatown

05412 West Los Angeles

North Los Angeles

05413 (includes Hollywood)

Eastern Los Angeles

05415 (includes Downtown)

05418 South Los Angeles

05703 Long Beach

Immigrant Neighborhoods Look

Different & Work Different

As a Comparison PUMA,

Long Beach PUMA

05703 is markedly

different, not just from

Koreatown but Los

Angeles in general

LA County

Long Beach

Koreatown

Population

10,000,000

130,000

115,000

Mean Wage

$25,000

$34,000

$15,000

ACS Census PUMS 2006-2008

Testing Proxy indicators for informal employment (ACS PUMS 2000)

PUMA

NEIGHBORHOOD

HHLD REPORTED EMPLOYMENT ERROR

05414

Koreatown

10.2%

05412

West Los Angeles

3.1%

05413

North Los Angeles

(includes Hollywood)

2.1%

05415

Eastern Los Angeles

(includes Downtown)

8.5%

05418

South Los Angeles

6.6%

05703

Long Beach

(CSULB area)

0.59%

What Immigrant Workers Have to

Say About Informal Jobs…

Interviews: Sonia

“The main difference in the formal and informal is that if I make $400

informally [a week] I get 400 to take home for me. If I make $400 in

check, then maybe I take home like $375 for real. Out of that $25

goes into paying taxes and I don’t ever see that again. And yet there

are no benefits for me that I can use.”

“We have to support the system, we pay the taxes. It’s what’s right.

You know they always say that the undocumented are taking

advantage of the Medicare or CalWorks and everything, and that

someone else has to support us. But that’s an offense to us because

at the end we are the ones giving, we pay and we don’t get anything

back.”

Interviews: Gloria & John

“Well if we generalize the undocumented

folks yes because of the documentation

you need it [formal work] is harder. But to

my luck I haven’t had a hard time

because of my experience. I have my

own ability and flexibility and dedication

to the work I have.”

“I get paid in cash at my work. The

bosses, a lot of times they don’t ask to

see papers and I know because I check

the ad when it is outside. If it just says

looking for someone to work and doesn’t

mention anything else, no requirements,

I know what that means.”

Flexible, Quasi-Formal,

Transitional Employment

“A long time ago in Koreatown it was always cash. Maybe there were some

who paid people formally but definitely I used to always get paid in cash,

then slowly I noticed they would change it to like a little bit more of check at

a time and then tell me that I’m a “part-time” worker

… and then sometimes there would be inspections from the labor

department at my work because maybe they thought there was something

funny going on. And then the owner would adjust again for a little while and

give me more checks, and then reduce it again and give me cash. There

was a lot of incidences like that.”

… is that they are not very different

from formal jobs.

Why Do Firms Hire Informally?

Flaming and Burns (2006) found that “small businesses are more likely

to hire informally and compensate workers informally,” and that within

the Koreatown area there were higher rates of both self-employment

and small businesses (under 50 employees) than the city of Los

Angeles as a whole.

For a full-time, minimum wage employee in California, an employer pays:

Employer Advantages to Informal / Semi-Formal Job Creation

What could informal job creation

look like, as a policy or program?

1. Lower the risk of participation for undocumented persons

(employees and/or employers) who participate in informal

work “registration program”.

1. Business owners would be exempt from payroll taxes for new

informal employees (as they already are); and workers will

also be exempt from payroll taxes during the informal period

1. A third party agency like non-governmental organizations like

workers centers, workers advocacy groups, workforce

development agencies should maintain the database of

participating firms and employees.

It’s already, almost, being done…

The Big Idea: Flexible Informal Employment

as Sustainable Job Creation

1.

Being able to “count” a hitherto uncounted informal job

raises employment rates and lowers unemployment rates by

adding to the count of jobs and employed persons that

currently exist and lack exact measurement mechanisms.

1.

In the absolute, facilitating informal employment and

lowering the costs of employment creates more

opportunities for work in both the short-term and long-term.