Intercompany Transactions

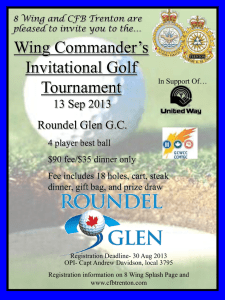

advertisement

Intercompany Transactions • • Very important in Civil Air Patrol financial accounting Very confusing What Are Intercompany Transactions? • • • Transactions between components of an affiliated group filing consolidated financial statements or tax return Civil Air Patrol reports using consolidated financial statements Civil Air Patrol files an annual group Form 990 with the IRS Why Are They Important? • • • Generally Accepted Accounting Principles (GAAP) prohibit generating revenue or expense within a reporting entity through intercompany transactions In CAP, we have lots of intercompany transactions NHQ payments to wings, squadron payments to wings, wing payments to other wings, wing payments to region So You Might Ask • • • Aren’t funds we receive from NHQ for funded missions revenue for our wing since we do receive the money? Aren’t funds we pay to our neighboring wing expense for our wing since we pay them the money? If intercompany revenue and expense is prohibited by GAAP, why do we bother recording those transactions? Posting Intercompany Transactions • Posted to intercompany revenue and expense accounts Intercompany Revenue Accounts • • • • • • • • • • • • • • • • • 6400000 6410000 6410100 6410110 6410120 6410200 6410210 6410220 6410230 6410240 6410290 6413000 6413010 6413020 6413030 6413040 6413090 From Units Below National Headquarters From Regions and Wings From Regions From Regions through NHQ Other Income from Regions From Wings Vehicle Maintenance Mission Reimbursements Aircraft Fuel Membership Dues Miscellaneous From Units Below Wing Conference Encampment Proficiency Flying Aircraft Fuel Miscellaneous Intercompany Expense Accounts 9435000 • 9436000 • 9436010 • 9436020 • 9436030 • 9436040 • 9436090 • 9437000 • 9437010 • 9437020 • 9437030 • 9437040 • 9437090 • Expenditures with Regions Expenditures with Wings Wing Conferences Encampment Proficiency Flying Aircraft Fuel Miscellaneous Expenditures with Units Below Vehicle Maintenance Mission Reimbursements Aircraft Fuel Membership Dues Miscellaneous NHQ Intercompany Accounts 63XXXXX From National Headquarters • 9434XXX Expenditures with NHQ • WFAs are responsible for reconciling all intercompany transactions with NHQ • The KEY to Intercompany Transactions • • If you post revenue to an intercompany revenue account, you or somebody else in CAP must post an equal expense amount to an intercompany expense account Intercompany revenue must equal intercompany expense in CAP in order to be eliminated at year end without a variance Intercompany Transaction Posting The fool proof method of ensuring intercompany transactions remain equal is to create intercompany invoices (income) and intercompany bills (expense) at the same time with the same date. Intercompany Example • • • • • Cheyenne Sq pays an outside vendor $100 for vehicle maintenance WY Wing policy is Wing pays for all corporate vehicle maintenance WY Wing owes Cheyenne Squadron $100 An invoice is prepared with WY Wing as the customer for $100 A bill is prepared with Cheyenne Sq as the vendor for $100 Intercompany Example • • • • • The invoice and bill have the same date The invoice is posted to account 6410210 (From Wings – vehicle maintenance) The bill is posted to account 9437010 (Exp with Units – vehicle maintenance) Intercompany revenue and expense are equal on the same date Payment and receipt of payment will not affect the revenue and expense date Test Your Knowledge • Every Civil Air Patrol Wing must file an annual report with the IRS •FALSE Test Your Knowledge • SM John Smith pays his squadron dues to XYZ Squadron. This is considered an intercompany transaction since John is a member of Civil Air Patrol •FALSE Test Your Knowledge • Regarding the previous question, XYZ Squadron deposits the dues money from John Smith into its squadron WBP sub account. It then uses that money to pay XYZ Wing for corporate vehicle use. The payment to XYZ Wing is an intercompany transaction •TRUE Questions???