IRS Data Retrieval

advertisement

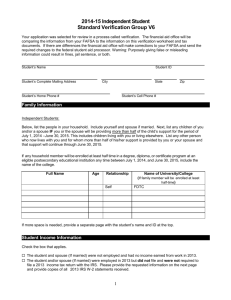

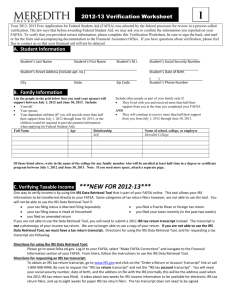

Jim Briggs The Tax Detective Review of Updated Verification Rules Review of IRS Data Retrieval Process Review of IRS Tax Transcripts Q&A IRS Publication 17 – Your Federal Income Tax IRS Publication 970 – Tax Benefits for Education IRS Publication 3 – Armed Forces Tax Guide Changes outlined in DCL Gen 11-13 – 2011 ◦ 30% verification cap eliminated ◦ AGI, Taxes Paid, certain untaxed income considered verified through IRS data retrieval process if no changes made ◦ All families who qualify are encouraged to use IRS data retrieval ◦ Ineligible families and those that refuse are required to provide: IRS Tax Return Transcripts and/or Copies of Foreign Tax Returns Filed a Foreign tax return Married filing separately Change in marital status after 12/31/XX Primary method used by families to verify ◦ ◦ ◦ ◦ ◦ AGI, Tax-Exempt Interest Income Taxes Paid, Education/First Time Home Buyer Credits IRA/Pension - Untaxed Income Families not eligible or did not use IRS Data Retrieval & selected for verification must submit: ◦ IRS Tax Return Transcript and/or ◦ Copy of foreign tax return and/or ◦ In “rare” cases a paper copy of US tax return Must list first name shown on IRS tax return filed Must use EXACT address shown on corresponding tax return Dept of ED and IRS working to make the process more “user friendly” Does Not import “earned income” Automatically adds 15a-15b and 16a-16b as untaxed income Does not add line 25 Currently the IRS data on a tax return may only be imported into ONE FAFSA per award year. This causes issues when: ◦ Parent of dependent student is also a student ◦ Student has siblings who are also filing a FAFSA 02 – The only code that is valid for verification Correcting rollovers on lines 15 or 16 will trigger a change from 02 and require a tax transcript Adding “earned income” data will not change the code from 02. Provided by the IRS free of charge Available for processing by IRS: ◦ 2-3 weeks after filing for E-filed returns ◦ 6-8 weeks after filing for paper filed returns Transcript should arrive within 5-10 business days after it is available for processing Tax Return Transcript – reports what was on Tax Account Transcript – reports changed Record of Account – reports all of the original ORIGINAL tax return (online & phone) data from 1040X or additional 1040 and SOME of the original data. (online & phone) and changed data (4506-T-EZ or 4506) How to obtain a tax transcript: ◦ Online – PREFERRED ◦ Phone – Acceptable ◦ Mail – Acceptable but SLOW ◦ IRS Office Walk-In – Frowned Upon Parent student E-filed – but transcript NOT available. Possible cause: Federal Tax returns filed before the filing deadline with an unpaid balance due are not “processed” by the IRS until the earlier of: ◦ the filing deadline has passed (4-17-2012) or ◦ the tax has been paid IRS URL for Transcripts: ◦ https://sa2.www4.irs.gov/irfof-tra/start.do Must provide: ◦ ◦ ◦ ◦ SSN or ITIN Date of Birth EXACT Street Address as used on tax return Postal Zip Code When a 1040X is filed the family will need to provide: ◦ Tax Return Transcript & ◦ Tax Account Transcript ◦ OR ◦ Record of Account – available only with filing of 4506-T (up to 30 days to receive) NASFAA – Using Federal Tax Returns in Needs Analysis: ◦ Good explanation of 2011 Tax forms, 2012-13 Verification procedures & Tax Return Transcript Decoder USAFUNDS – Excellent explanation of 201213 Verification, 2011 Tax forms and Tax Return Transcript Decoder. 2012-13 is a transition year Dept of ED, IRS, Schools all working together to streamline and simplify verification. 2013-14 should be much more automated and most of the wrinkles should have been ironed out. NCASFAA and Jim Briggs thank you for your participation.